Renold PLC AGM Trading Update (3261L)

05 September 2023 - 4:00PM

UK Regulatory

TIDMRNO

RNS Number : 3261L

Renold PLC

05 September 2023

5 September 2023

Renold plc

("Renold", the "Company" or the "Group")

AGM Trading Update

Renold, a leading international supplier of industrial chains

and related power transmission products, is pleased to provide a

trading update covering the four months ended 31 July 2023 (the

"Period") ahead of the Company's annual general meeting being held

at 11.00 a.m. today.

The Board is pleased to report that the Group's financial

performance in the first four months of the new financial year has

been strong. Group revenue for the Period was GBP85.1m (FY23

equivalent GBP73.0m), a year-on-year increase of 16.6% at reported

rates and 18.7% at constant exchange rates. Within this, YUK S.A.

("YUK"), acquired in August 2022, contributed GBP5.4m.

Order intake for the Period was GBP74.2m, a decrease of 2.7%

(FY23 equivalent GBP76.3m), or a 1.0% decrease at constant exchange

rates. YUK contributed GBP4.9m to order intake in the Period. The

order book as at 31 July 2023 of GBP86.0m remains higher than

historic levels. However there has been a normalisation of order

intake following an improvement in global supply chains, with

improvements to delivery times, allowing customers to reduce

forward order placement as certainty of deliveries increase,

leading to a reduction and shortening of the order book. The order

book at 31 July 2023 represents a decrease of 13.6% over the record

high position at the end of the previous financial year.

On the 1 September 2023, the Group acquired the trading assets

of Davidson Chain PTY ("Davidson"), based in Melbourne, Australia,

enlarging our already strong Australian Chain business by 26%. The

Davidson acquisition demonstrates further strategic momentum,

supplementing organic growth through high quality bolt-on

acquisitions which can expand our geographic presence, grow our

product offering and strengthen our market position in key end

markets.

Net debt as at 31 July 2023 was GBP23.3m (representing 0.6x

EBITDA(1) ), a reduction of GBP6.5m (21.8%) from GBP29.8m as at 31

March 2023, reflecting the strong underlying cash generation of the

business during the Period. Net debt at the half year (period

ending 30 September 2023) is expected to increase, following the

payment of GBP1.7m of deferred consideration relating to the YUK

acquisition and the purchase consideration of GBP3.1m (AU$6.0m) for

Davidson. Additionally, the Group will bring forward the payment of

the H2 pension contribution of approximately GBP2.6m, which enables

efficiency gains in the investment portfolio .

Global markets continue to be uncertain, with ongoing labour

cost inflation and material costs remaining high when compared to

historic levels. Whilst there is a normalisation of demand in some

of the Group's end markets, the Group retains strong order books

which remain high by historical standards, despite a shortening of

lead times, reducing the overall quantum.

As a result of the continued positive trading momentum, and an

increase in activity from the recently announced Davidson

acquisition, the Board now anticipates achieving results for the

year ending 31 March 2024, higher than previously expected.

(1) Calculated as Net debt as at 31 July 2023/ Ebitda for the

preceding 12 months taken from the Group management accounts.

ENQUIRIES:

Renold plc IFC Advisory Limited

Robert Purcell, Chief Executive Tim Metcalfe

Jim Haughey, Group Finance Director Graham Herring

0161 498 4500 020 3934 6630

Nominated Adviser and Joint Joint Broker

Broker

Peel Hunt LLP FinnCap Limited

Mike Bell Ed Frisby / Tim Harper (Corporate

Finance)

Ed Allsopp Andrew Burdis / Harriet Ward

(ECM)

020 7418 8900 020 7220 0500

NOTES FOR EDITORS

Renold is a global leader in the manufacture of industrial

chains and also manufactures a range of torque transmission

products which are sold throughout the world to a broad range of

original equipment manufacturers and distributors. The Company has

a well-deserved reputation for quality that is recognised

worldwide. Its products are used in a wide variety of industries

including manufacturing, transportation, energy, steel and

mining.

Further information about Renold can be found on the website at:

www.renold.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUPUWABUPWGAC

(END) Dow Jones Newswires

September 05, 2023 02:00 ET (06:00 GMT)

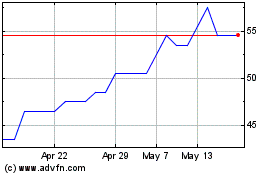

Renold (AQSE:RNO.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Renold (AQSE:RNO.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024