MARKET COMMENT: S&P/ASX 200 Off 0.6%;US Econ Data Jolt Cyclicals

04 April 2013 - 11:43AM

Dow Jones News

0013 GMT [Dow Jones] Australia's S&P/ASX 200 falls 0.6% to

4926 as disappointing U.S. private sector jobs data and commodity

price falls jolt cyclicals, with BHP (BHP.AU), Rio Tinto (RIO.AU)

Origin Energy (ORG.AU), and Newcrest (NCM.AU) down 0.9%-3.3%. Banks

are mostly weak, with NAB (NAB.AU) off 0.5%. "There's no hurry to

buy," says CMC Markets chief strategist Michael McCarthy. "If we

hold above 4928, there would be some reason for expecting a bit of

a bounce, but a close below that level could trigger a slide to

4700 in the short term." While the focus has shifted from the

Cypriot bank crisis to disappointing U.S. economic data, McCarthy

says equity markets are simply overextended. "There's been a lack

of fresh buying, so a pullback is inevitable," he says. "Markets

ran ahead of the U.S. economic recovery, which is likely to remain

slow and patchy." While April is normally a strong month, McCarthy

feels equities have seen an early "seasonal peak". Domestic retail

sales and building approvals data are due at 0030 and the outcome

of the BOJ's board meeting is due before the ECB meeting later

Thursday. Gains are mostly limited to defensives, with Woolworths

(WOW.AU), Westfield (WDC.AU), Amcor (AMC.AU) and Transurban

(TCL.AU) up 0.2%-1.1%. (david.rogers1@wsj.com)

Contact us in Singapore. 65 64154 140; MarketTalk@dowjones.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

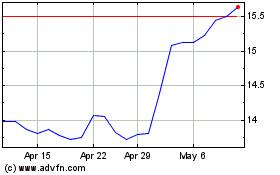

Amcor (ASX:AMC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Amcor (ASX:AMC)

Historical Stock Chart

From Jan 2024 to Jan 2025

Real-Time news about Amcor PLC (Australian Stock Exchange): 0 recent articles

More Amcor News Articles