MARKET COMMENT: S&P/ASX 200 Likely Balanced by Fading Risk Aversion, Ex-Divs

02 September 2013 - 10:26AM

Dow Jones News

2355 GMT [Dow Jones] Australia's S&P/ASX 200 is likely to be

influenced Monday by ex-dividend movements in stocks including BHP

(BHP.AU), AMP (AMP.AU) and Fortescue (FMG.AU), reduced risk

aversion after U.S. President Obama's decision to seek

congressional authorization for any use of military force in Syria,

and China's stronger-than-expected official manufacturing PMI data.

Still, activity will be subdued given the U.S. Labor Day holiday

weekend. Reflecting reduced risk aversion in global markets, spot

gold has fallen about 0.9% to US$1394.80 and Nymex crude is down

around 0.5% versus New York closing levels. Ex-dividend movements

are worth about 13 index points, or 0.3%, although BHP and

Fortescue may carry some of their dividend after China's PMI rose

to 51 vs 50.6 expected. BHP ADRs closed at A$35.43, down about 0.9%

versus Friday's local close, as spot iron ore fell 0.4% on Friday

and the S&P 500 declined 0.3%. Domestic building approvals,

inventories and company profits data are due at 0130 GMT. Index

last 5135.0. (david.rogers1@wsj.com)

Write to Shani Raja at shani.raja@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

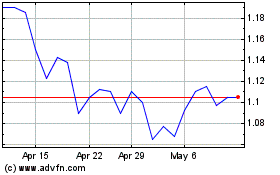

AMP (ASX:AMP)

Historical Stock Chart

From Dec 2024 to Jan 2025

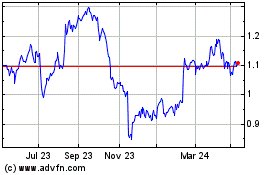

AMP (ASX:AMP)

Historical Stock Chart

From Jan 2024 to Jan 2025

Real-Time news about AMP Limited (Australian Stock Exchange): 0 recent articles

More Amp News Articles