Malaysia's Vulnerability Exposed by Dollar's Ascent

16 December 2016 - 10:49AM

Dow Jones News

By Rachel Rosenthal

Malaysia has been one of Asia's worst-hit economies amid the

continued climb of U.S. interest rates and the dollar.

Foreign investors sold $5.3 billion of Malaysian stocks and

bonds in November, the largest monthly outflow since September

2011, according to ANZ Bank. That is almost a quarter of the $22.1

billion pulled from emerging markets in the region, excluding

China.

The bulk of the selling was in Malaysia's bond market. The $4.5

billion of bonds sold by foreigners in November, in ringgit terms,

marks the biggest monthly debt outflow on record, according to

ANZ.

The ringgit was one of Asia's worst-performing currencies in the

aftermath of the U.S. election, and Malaysia's central bank has

been tapping the country's already low level of reserves to support

it. Last month, Bank Negara clamped down on offshore currency

speculators, a worrying echo of its maneuvers to stem capital

outflows during the Asian financial crisis of the late 1990s.

Despite the government's various attempts to support the

currency, the ringgit has lost 6.5% of its value against the

greenback since the U.S. election, hitting a nearly 19-year low on

Nov. 30. On Thursday, the currency weakened 0.9%, following the

Federal Reserve's announcement of its first rate increase in

2016.

Malaysia's Achilles' heel is the high level of foreign ownership

of its government bonds. Foreign money is flighty, a factor that

can accelerate a liquidity crunch during times of stress. While the

latest rash of selling slashed the proportion of foreign ownership

to 48% in November from 52% a month earlier, the percentage is

still very high for an emerging market.

Carolyn Cui contributed to this article

Write to Rachel Rosenthal at Rachel.Rosenthal@wsj.com

(END) Dow Jones Newswires

December 15, 2016 18:34 ET (23:34 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

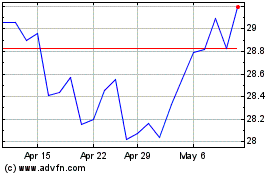

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Nov 2024 to Dec 2024

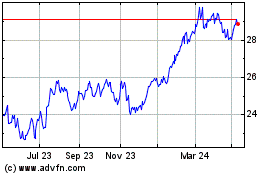

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Dec 2023 to Dec 2024