Most Asian Stock Markets Fall Amid Renewed Weakness in Oil

04 May 2016 - 2:30PM

Dow Jones News

Most shares in Asia were back in the red Wednesday with

Australia slipping below breaking even for the year amid a renewed

fall in oil prices and a nearly 10% plunge in shares of

Anglo-Australian BHP Billiton Ltd.

The S&P/ASX 200 was down 1.2%, giving back some of its gains

from yesterday when Australia's central bank cut interest rates.

The benchmark, heavy on energy shares, is now close to flat for the

year, after breaking into positive territory for the first time

this year yesterday.

Heavy decliners Wednesday included BHP Billiton, which tumbled

9.6% in Sydney. That followed Brazilian federal prosecutors filing

a civil lawsuit Tuesday that demands mining companies—BHP Billiton,

Brazil's Vale SA, and their joint-venture Samarco Mineraç ã o—shell

out up to $43.55 billion for cleanup and remediation related to a

catastrophic dam failure last year.

Losses elsewhere in Asia included a 1.3% decline in the Hang

Seng Index, also weighed down by the energy sector. South Korea's

Kospi was down 0.6%. The Shanghai Composite Index slipped 0.4%.

"The street is back again to focusing on low global growth and

looking at the crude price as a barometer here," said Gavin Parry,

managing director at Parry International Trading Ltd.

The weakness reflects how shaky the region's rally has been

since mid-February, as global growth fears simmer in the

background. Meanwhile, Japan's stock market, which tumbled for two

sessions before closing for a three-day holiday, reopens Friday.

That market has been especially volatile, as investors try to gauge

the Bank of Japan, which last Thursday left monetary policy

unchanged.

Pressuring Japanese shares is the yen, which has been at its

strongest levels since October 2014. A strong currency at home

generally hurts exporting companies by making their goods less

competitive and eroding their repatriated earnings.

"Increasing [currency] volatility resulting from central bank

policies is transmitting waves of uncertainty through global

markets," said Margaret Yang, market strategist with CMC Markets.

"A stronger yen will probably continue to blacken the outlook for

Japanese equity markets."

During Asian overnight hours, U.S. crude oil prices declined,

bringing its losses in three sessions to more than 5%. That sent

U.S. stock indexes lower.

By early Wednesday in Asia, the fall was also weighing

here—energy shares fell almost 4% in Australia and 2.9% in Hong

Kong. Shares of Rio Tinto Ltd. and Fortescue Metals Group Ltd. were

6% and 4.2% lower, respectively.

In Australia, shares are close to joining benchmarks in Korea

and a number of Southeast Asian countries in positive territory for

the year, although steep declines remain in the region, with

Shanghai stocks still off 15% since the beginning of the year.

Ric Spooner, CMC Markets chief market strategist, said that

"traders are becoming concerned about the possibility that the next

volatile market swing, in this case downward, may not be too far

away."

Losses in BHP in Sydney follow a 5% plunge for the firm's London

listing overnight.

In currencies, the Australian dollar, which reached its weakest

level against the U.S. dollar in more than a month after the

central bank's rate cut, was last rebounding by 0.3% in early Asian

trading.

Paul Kiernan contributed to this article.

Write to Chao Deng at Chao.Deng@wsj.com

(END) Dow Jones Newswires

May 04, 2016 00:15 ET (04:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

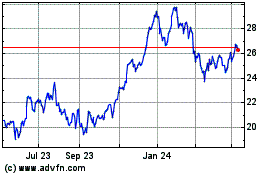

Fortescue (ASX:FMG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Fortescue (ASX:FMG)

Historical Stock Chart

From Dec 2023 to Dec 2024