Piedmont Lithium Inc. (“Piedmont” or the “Company”) (NASDAQ:

PLL; ASX: PLL), a leading, diversified developer of lithium

resources required to enable the U.S. electric vehicle supply

chain, is pleased to announce the results of its annual meeting of

shareholders held virtually on February 3, 2022 (the

“Meeting“), at which the shareholders approved all motions

put forward by the Company.

A total of 8,520,938 votes were cast in connection with the

Company’s proxy, representing 53.69% of the issued and outstanding

common shares of the Company.

All resolutions, as outlined in the Company’s proxy statement

dated November 30, 2021, available on the Company’s website and at:

Form DEF 14A (dd7pmep5szm19.cloudfront.net) were approved by the

requisite majority of votes cast at the Meeting. The number of

directors is fixed at 6. The two director nominees named in the

Proxy Statement were elected to serve until the 2024 Annual Meeting

of Stockholders or until their successors are duly elected and

qualified.

The other seven resolutions, the appointment of the Auditors,

the issuance of stock options to Mr. Keith Phillips under the

Company’s Stock Plan, and the issuance of restricted stock units to

Mr. Jeff Armstrong, Mr. Keith Phillips, Mr. Todd Hannigan, Mr.

Jorge Beristain, Mr. Claude Demby, and Ms. Susan Jones under the

Company’s Stock Plan, also passed at the meeting. Details of voting

are provided in the tables that follow:

PROPOSAL 1: Election of two

(2) Class I director nominees to serve until the 2024 Annual

Meeting of Stockholders and until their successors are duly elected

and qualified:

NOMINEE

FOR

WITHHOLD

Mr. Keith Phillips

4,080,447

466,300

Mr. Todd Hannigan

4,020,943

525,804

PROPOSAL 2: Ratification of

the selection of Deloitte & Touche LLP as the Company’s

independent registered public accounting firm for the year ending

June 30, 2022:

FOR

AGAINST

ABSTAIN

7,995,679

100,008

425,251

PROPOSAL 3: Approval to

issue 10,786 stock options to Mr. Keith Phillips and/or his nominee

under the Company’s Stock Plan:

FOR

AGAINST

ABSTAIN

2,789,952

1,272,986

483,809

PROPOSAL 4: Approval to

issue 5,344 restricted stock units to Mr. Keith Phillips and/or his

nominee under the Company’s Stock Plan:

FOR

AGAINST

ABSTAIN

3,392,760

668,728

485,259

PROPOSAL 5: Approval to

issue 1,796 restricted stock units to Mr. Jeff Armstrong and/or his

nominee under the Company’s Stock Plan:

FOR

AGAINST

ABSTAIN

2,892,549

1,171,544

482,654

PROPOSAL 6: Approval to

issue 1,197 restricted stock units to Mr. Jorge Beristain and/or

his nominee under the Company’s Stock Plan:

FOR

AGAINST

ABSTAIN

2,889,924

1,172,087

484,736

PROPOSAL 7: Approval to

issue 1,197 restricted stock units to Mr. Todd Hannigan and/or his

nominee under the Company’s Stock Plan:

FOR

AGAINST

ABSTAIN

2,891,059

1,170,771

484,917

PROPOSAL 8: Approval to

issue 1,197 restricted stock units to Mr. Claude Demby and/or his

nominee under the Company’s Stock Plan:

FOR

AGAINST

ABSTAIN

2,891,627

1,171,156

483,964

PROPOSAL 9: Approval to

issue 1,197 restricted stock units to Ms. Susan Jones and/or her

nominee under the Company’s Stock Plan:

FOR

AGAINST

ABSTAIN

2,895,108

1,167,384

484,255

A replay of the Meeting is available on the Company’s website

and at: www.virtualshareholdermeeting.com/PLL2022.

About Piedmont Lithium

Piedmont Lithium (Nasdaq:PLL; ASX:PLL) is developing a

world-class, multi-asset, integrated lithium business focused on

enabling the transition to a net zero world and the creation of a

clean energy economy in North America. The centerpiece of our

operations, Carolina Lithium, is located in the renowned Carolina

Tin-Spodumene Belt of North Carolina. Combining our U.S. assets

with equally strategic and in-demand mineral resources, and

production assets in Quebec and Ghana, positions us to be one of

the largest, lowest cost, most sustainable producers of

battery-grade lithium hydroxide in the world. We will also be the

most strategically located to best serve the fast-growing North

American electric vehicle supply chain. The unique geology,

geography and proximity of our resources, production operations and

customer base, will allow us to deliver valuable continuity of

supply of a high-quality, sustainably produced lithium hydroxide

from spodumene concentrate, preferred by most EV manufacturers. Our

diversified operations will enable us to play a pivotal role in

supporting America’s move toward decarbonization and the

electrification of transportation and energy storage. For more

information, visit www.piedmontlithium.com.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of or as described in securities legislation in the

United States and Australia, including statements regarding

exploration, development, and construction activities; current

plans for Piedmont’s mineral and chemical processing projects;

strategy; and expectations regarding permitting. Such

forward-looking statements involve substantial and known and

unknown risks, uncertainties, and other risk factors, many of which

are beyond our control, and which may cause actual timing of

events, results, performance or achievements and other factors to

be materially different from the future timing of events, results,

performance, or achievements expressed or implied by the

forward-looking statements. Such risk factors include, among

others: (i) that Piedmont will be unable to commercially extract

mineral deposits, (ii) that Piedmont’s properties may not contain

expected reserves, (iii) risks and hazards inherent in the mining

business (including risks inherent in exploring, developing,

constructing and operating mining projects, environmental hazards,

industrial accidents, weather or geologically related conditions),

(iv) uncertainty about Piedmont’s ability to obtain required

capital to execute its business plan, (v) Piedmont’s ability to

hire and retain required personnel, (vi) changes in the market

prices of lithium and lithium products, (vii) changes in technology

or the development of substitute products, (viii) the uncertainties

inherent in exploratory, developmental and production activities,

including risks relating to permitting, zoning and regulatory

delays related to our projects as well as the projects of our

partners in Quebec and Ghana, (ix) uncertainties inherent in the

estimation of lithium resources, (x) risks related to competition,

(xi) risks related to the information, data and projections related

to Sayona Quebec and Atlantic Lithium, (xii) occurrences and

outcomes of claims, litigation and regulatory actions,

investigations and proceedings, (xiii) risks regarding our ability

to achieve profitability, enter into and deliver product under

supply agreements on favorable terms, our ability to obtain

sufficient financing to develop and construct our projects, our

ability to comply with governmental regulations and our ability to

obtain necessary permits, and (xiv) other uncertainties and risk

factors set out in filings made from time to time with the U.S.

Securities and Exchange Commission (“SEC”) and the Australian

Securities Exchange, including Piedmont’s most recent filings with

the SEC. The forward-looking statements, projections and estimates

are given only as of the date of this presentation and actual

events, results, performance, and achievements could vary

significantly from the forward-looking statements, projections and

estimates presented in this presentation. Readers are cautioned not

to put undue reliance on forward-looking statements. Piedmont

disclaims any intent or obligation to update publicly such

forward-looking statements, projections, and estimates, whether as

a result of new information, future events or otherwise.

Additionally, Piedmont, except as required by applicable law,

undertakes no obligation to comment on analyses, expectations or

statements made by third parties in respect of Piedmont, its

financial or operating results or its securities.

This announcement has been authorized for release by the

Company’s President & CEO, Keith D. Phillips.

Appendix - Results of Annual Meeting of Shareholders

Piedmont Lithium Inc. Annual General Meeting – 3 February

2022

The following information is provided in accordance with ASX

Listing Rule 3.13.2:

Resolution

Number of Proxy Votes

Number of Votes cast on the

Poll

Result

For

Against

Abstain

Proxy's discretion

For

Against

Abstain

1.1 Election of Mr Keith Phillips

4,080,447

N/A

466,300

-

4,080,447

N/A

466,300

Vote carried by poll

1.2 Election of Mr Todd Hannigan

4,020,943

N/A

525,804

-

4,020,943

N/A

525,804

Vote carried by poll

2. Ratification of Auditor Selection

7,995,679

100,008

425,521

-

7,995,679

100,008

425,521

Vote carried by poll

3. Approval to issue stock options – Mr

Keith Phillips

2,789,952

1,272,986

483,809

-

2,789,952

1,272,986

483,809

Vote carried by poll

4. Approval to issue restricted stock

units – Mr Keith Phillips

3,392,760

668,728

485,259

-

3,392,760

668,728

485,259

Vote carried by poll

5. Approval to issue restricted stock

units – Mr Jeff Armstrong

2,892,549

1,171,087

482,654

-

2,892,549

1,171,087

482,654

Vote carried by poll

6. Approval to issue restricted stock

units – Mr Jorge Beristain

2,889,924

1,172,087

484,736

-

2,889,924

1,172,087

484,736

Vote carried by poll

7. Approval to issue restricted stock

units – Mr Todd Hannigan

2,891,059

1,170,771

484,917

-

2,891,059

1,170,771

484,917

Vote carried by poll

8. Approval to issue restricted stock

units – Mr Claude Demby

2,891,627

1,171,156

483,964

-

2,891,627

1,171,156

483,964

Vote carried by poll

9. Approval to issue restricted stock

units – Ms Susan Jones

2,895,108

1,167,384

484,255

-

2,895,108

1,167,384

484,255

Vote carried by poll

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220209005359/en/

Keith Phillips President & CEO T: +1 973 809 0505 E:

kphillips@piedmontlithium.com Brian Risinger VP - Investor

Relations and Corporate Communications T: +1 704 910 9688 E:

brisinger@piedmontlithium.com

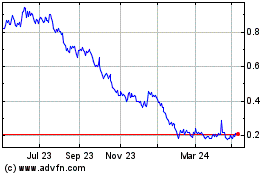

Piedmont Lithium (ASX:PLL)

Historical Stock Chart

From Oct 2024 to Nov 2024

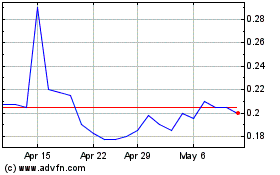

Piedmont Lithium (ASX:PLL)

Historical Stock Chart

From Nov 2023 to Nov 2024