Australia Stocks Remain Jittery

28 June 2016 - 5:39PM

Dow Jones News

By Robb M. Stewart

MELBOURNE--Shares in Australia were again under pressure

Tuesday, closing at a fresh two-month low in the wake of Britain's

vote to leave the European Union.

Markets globally remain jittery, with investors unsure how to

position following the U.K. referendum. Still, the Australian

market managed to pare back its worst levels of the day as major

banks crept higher.

Surrendering a modest recovery Monday on the heels of Friday's

steep dive, the S&P/ASX 200 shed 33.9 points, or 0.7%, to

finish at 5103.3. Most industry sectors were in the red, led by

energy and materials stocks.

"While the major implication for both the U.K. and Europe

appears to be lower growth, the likely torturous process to leave

the union could sabotage markets for weeks or months," said Michael

McCarthy, chief market strategist at CMC Markets.

Investors continued to sell down shares of companies with

sizeable exposure to the U.K., including the local stock of British

bank CYBG, which was spun off by National Australia Bank in

February. It fell another 0.7% to A$4.11 to bring its tumble over

the last three sessions to 26%.

Asset managers BT Investment Management and Henderson Group also

continued to be targeted, losing 1.7% and 1.3%, respectively. And

QBE Insurance was knocked back another 1.6% to A$10.07, bringing

the three-day retreat to 14%.

There was some relief for investment bank and asset manager

Macquarie, which rebounded 1.4% to A$67.91 after strong selling the

past two sessions.

And the country's largest banks notched gains, led by Westpac

and National Australia Bank, which were both up 0.5%. Commonwealth

Bank of Australia rose 0.4%, while Australia & New Zealand

Banking nudged up 0.1%.

Morningstar in a note to clients said the big banks were well

placed to manage increased risks from the U.K. vote, including

being able to handle higher funding costs and increased volatility

that has impacted financial markets.

Among energy stocks, Woodside Petroleum and Oil Search slipped

0.3% and 0.6%, respectively, and Santos dropped 2.6% to A$4.54

after oil prices had their largest back-to-back percentage losses

since February in overnight trading.

BHP Billiton eased 0.3% to A$18.03, iron-ore miner Fortescue

Metals Group declined 3.7% to A$3.40 and gold producer Newcrest

Mining was 2.7% lower at A$23.55. Rio Tinto, meanwhile, was lifted

0.35 to A$44.20.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

June 28, 2016 03:24 ET (07:24 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

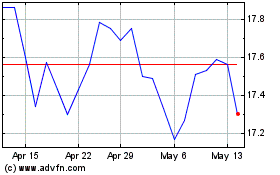

QBE Insurance (ASX:QBE)

Historical Stock Chart

From Nov 2024 to Dec 2024

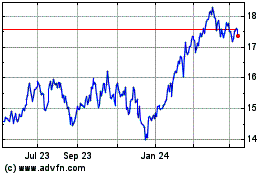

QBE Insurance (ASX:QBE)

Historical Stock Chart

From Dec 2023 to Dec 2024