Rio Tinto Notches 1Q Iron-Ore Export Record, Cuts Fiscal Year Copper Output Estimate -- Update

20 April 2023 - 9:58AM

Dow Jones News

By Rhiannon Hoyle

Rio Tinto PLC reported record first-quarter iron-ore shipments

from its mammoth Australian mining operations, but downgraded its

full-year copper-production estimate, citing a conveyor outage at

its Kennecott mine near Salt Lake City, Utah.

The company also said it is reviewing the budget and schedule

for a project at its Rincon lithium development in Argentina due to

searing local inflation and rising equipment costs.

The world's second-biggest miner by market value on Thursday

said it shipped 82.5 million metric tons of iron ore from its mines

in Australia's Pilbara region in the three months through March, up

16% on the same period a year ago. Rio Tinto's iron-ore mining

operations there are the biggest in the world, alongside a network

of mines run by rival Vale SA in Brazil.

Output from its iron-ore pits was 11% higher than the year-prior

level and exports were boosted by a drawdown of stockpiles, the

company said.

Rio Tinto said it also produced 145,000 metric tons of mined

copper in the quarter, in line with the same period of 2022.

However, the miner cut its full-year copper-production estimate due

to disruptions at Kennecott, as well as geotechnical challenges in

the pit of the Escondida mine in northern Chile.

Rio Tinto now expects to report between 590,000 and 640,000 tons

of mined-copper production in 2023, from 650,000 to 710,000 tons

previously.

Output at the Kennecott mine was 36% lower year-on-year because

of the problems with a conveyor belt that links the mine to a

concentrator. The area also experienced record snowfall -- twice

the historical Utah average, the company said.

The concentrator is expected to operate at reduced rates until

the third quarter, with Rio Tinto planning to truck ore while it

sources replacement motors for the conveyor. The miner kept copper

unit-cost guidance unchanged.

At the Rincon lithium project in Argentina, development of a

lithium-carbonate starter plant is ongoing, the company said.

However, it is reviewing its $140 million estimate and schedule for

the plant in response to surging inflation.

"Detailed studies for the full-scale operation are ongoing, and

the exploration campaign progressed to further understand Rincon's

basin and brine reservoir," the miner said.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

April 19, 2023 19:43 ET (23:43 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

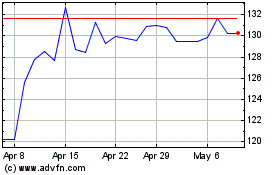

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Nov 2024 to Dec 2024

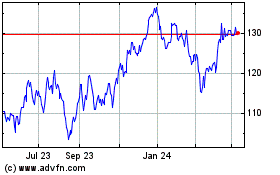

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Dec 2023 to Dec 2024