UPDATE: Anglo Nears $630 Million Deal For Mozambique Coal Asset-Source

12 December 2011 - 1:18PM

Dow Jones News

Anglo American PLC (AAL.LN) is close to a US$630 million deal to

acquire a controlling interest in a large undeveloped steelmaking

coal deposit in Mozambique from the Talbot Group, a person familiar

with the matter said Monday.

London-listed Anglo is in late-stage talks to acquire the 58.9%

stake in the Revuboe River coking coal deposit from the Talbot

Group, with parties needing to resolve issues including the award

of a mining license by the Mozambique government, the person

said.

Talbot Group is selling all its assets, including the stake in

Revuboe, following the death of founder Ken Talbot in an air crash

in Africa last year.

Consolidation in coal mining is intensifying globally, as major

miners seek exposure to large deposits that can be developed for

export to rapidly industrializing countries in Asia, including

China and India. In the latest major deal Monday, Whitehaven Coal

Ltd. (WHC.AU) said it has agreed a nearly A$3 billion (US$3.1

billion) deal to acquire fellow mid-tier Australian coal miner

Aston Resources Ltd. (AZT.AU) and a smaller coal prospector.

Coking coal is far more scarce than thermal coal, and commands

nearly double the price on global markets even though there isn't

much difference between mining costs. High-quality coking coal

deposits are mostly confined to a few regions of Australia,

Colombia, North America, Russia, Mongolia and Mozambique.

Revuboe is a 1.4 billion metric ton coking and thermal coal

deposit in the fast-growing Tete coal province in central-western

Mozambique. The joint venture, which includes Japan's Nippon Steel

Corp. (5401.TO) and South Korea's Posco (005490.SE), hopes to start

production of up to 17 million tons of coking and thermal coal from

September 2013.

The joint venture partners are likely to give the deal their

blessing as they want a miner with the ability to develop the

deposit quickly, especially given the logistical constraints in

Mozambique such as port and rail access, another person familiar

with the deal said.

A successful deal would mean most of Mozambique's largest coal

deposits will now be controlled by mining heavyweights, including

Rio Tinto PLC (RIO), which acquired Riversdale Mining Ltd. for

nearly A$4 billion earlier this year, and Brazil's Vale SA

(VALE).

Anglo spokeswoman Jacqui Strambi declined to comment, while the

Talbot Group couldn't immediately be reached for comment.

-By David Winning, Dow Jones Newswires; +61-2-82724688;

david.winning@dowjones.com

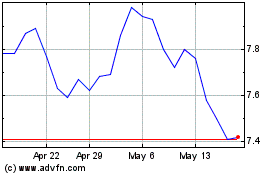

Whitehaven Coal (ASX:WHC)

Historical Stock Chart

From Apr 2024 to May 2024

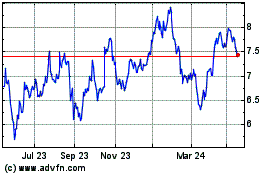

Whitehaven Coal (ASX:WHC)

Historical Stock Chart

From May 2023 to May 2024