Campari Shares Fall After New Share, Convertible Bond Issue

10 January 2024 - 9:25PM

Dow Jones News

By Andrea Figueras

Shares in Davide Campari-Milano dropped after the company said

it raised 1.2 billion euros ($1.31 billion) through a discounted

share offering and an issue of convertible bonds.

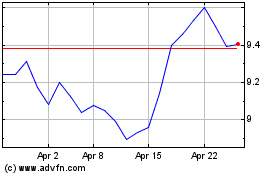

At 0945 GMT shares were down 5.3% at EUR9.40.

The Italian distiller said new shares, which represent 5.6% of

its issued and outstanding ordinary share capital, were placed at

EUR9.33 each, down from the closing share price on Tuesday of

EUR9.93.

The company aims to use proceeds to fund its planned acquisition

of Beam Holding France, which owns Courvoisier cognac, for up to

$1.32 billion, it said.

"According to our calculations, the acquisition in the short

term would have brought leverage close to the levels that

management considers as a ceiling," Equita analyst Paola Carboni

said in a research note.

With the measure, Campari could gain financial flexibility and

pave the way for any possible new acquisition, the analyst

said.

Write to Andrea Figueras at andrea.figueras@wsj.com

(END) Dow Jones Newswires

January 10, 2024 05:10 ET (10:10 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

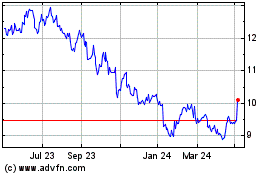

Davide Campari (BIT:CPR)

Historical Stock Chart

From Dec 2024 to Jan 2025

Davide Campari (BIT:CPR)

Historical Stock Chart

From Jan 2024 to Jan 2025