By Eric Sylvers in Milan and Matthew Dalton in Paris

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 13, 2020).

The coronavirus crisis is widening the gap between the haves and

the have-nots of the luxury goods industry.

Virtually all luxury brands suffered revenue drops of more than

20% in the first half as boutiques were closed for months and

big-spending shoppers couldn't travel. But the industry's biggest

brands -- Louis Vuitton, Dior, Hermès and some others -- have held

up better than the industry as a whole and taken market share in

the crisis.

At the same time, midsize Italian luxury-goods companies

Salvatore Ferragamo SpA and Tod's SpA have sputtered compared with

their bigger competitors. Their brands were already suffering

before the pandemic, hampered by lack of investment in digital

marketing and e-commerce, a weakness that left them particularly

susceptible when pandemic lockdowns made online operations the only

way to connect with customers.

Analysts say the damage caused by the pandemic, coming after

years of declining results for Tod's and Ferragamo, could raise

pressure on the companies to seek outside investment or sell

themselves to one of the industry's conglomerates: LVMH Moët

Hennessy Louis Vuitton SE, Kering SA, Compagnie Financière

Richemont SA or Capri Holdings Ltd. The giants control much of

Italian luxury-goods production, including Gucci, Fendi, Bottega

Veneta and Versace.

"The trends that we observed before the crisis -- the fact that

the bigger brands outperformed the smaller -- continued and

accelerated," said Anne Le Borgne, who manages a luxury and

lifestyle investment fund with CPR Asset Management in Paris. "For

the sector, this could accelerate consolidation."

Tod's majority owner, Diego Della Valle, has repeatedly said he

is committed to the brand, and he has increased his controlling

stake over the past several years to 81%. Last month he reiterated

that he has no intention of selling Tod's. Mr. Della Valle has in

the past considered selling one of Tod's smaller brands, such as

luxury sneaker label Hogan, a person familiar with the matter

said.

Florence-based Ferragamo, which is still owned by the family

that founded the company almost a century ago, also says it isn't

for sale. But the rehiring during the pandemic of a former longtime

Ferragamo chief executive as executive deputy chairman led to a 15%

jump in the share price amid speculation the company might be sold.

The Ferragamo family is often seen as an obstacle to efforts to

refurbish the brand, known for its Vara pumps and handbags.

Ferragamo's revenue plunged 60% in the second quarter, one of

the biggest drops of any large luxury company. In the first half,

revenue fell 47%, compared with 27% for LVMH, which owns Louis

Vuitton and Dior, and 30% for Kering, owner of Gucci and Saint

Laurent. The two conglomerates reported steep drops in earnings,

but remained profitable. Ferragamo will report complete first half

results in September, with analysts expecting a loss. The company

said revenue improved in all markets in July, the first month of

the current quarter.

Tod's, which reports first-half results on Sept. 8, could book

an EUR80 million ($94.4 million) loss in the period, according to

investment bank Equita.

The challenges facing the two companies predate the arrival of

the coronavirus. Tod's has had trouble connecting with younger

consumers, and both have lagged behind in online sales.

Due to a surge during the coronavirus lockdown, Ferragamo and

Tod's this year will get about 10% of sales through e-commerce,

according to Flavio Cereda, an analyst with investment bank

Jefferies. That remains below the industry average of around 15%,

which also grew during the lockdown, he said.

Paris-based LVMH and Kering have so far fared better during the

pandemic. LVMH has been able to lean on the strong momentum of its

biggest brands, Louis Vuitton and Dior, both of which have

well-developed e-commerce operations that have been able to offset

much of the hit from closing physical stores across China and the

West.

Momentum at Gucci, Kering's biggest brand, had already begun to

slow before the pandemic. But Kering also owns two of the

fastest-growing brands in the industry, Bottega Veneta and

Balenciaga, and the group has extensive e-commerce operations.

The gap between industry leaders and some independent Italian

brands shows how those that neglected their digital operations

before the pandemic are struggling to catch up now.

The well-developed e-commerce operations of LVMH and Kering

brands helped them to satisfy demand even during the height of

lockdowns, when the industry was forced to shut bricks-and-mortar

stores. Both groups have also devoted significant resources during

the pandemic to cultivating top-spending clients even if they were

unable to shop physically in boutiques.

"As we move past the pandemic's initial shock, we are seeing

consumer confidence begin to return, with many customers now

shopping online for the first time," said Chris Morton, CEO of

Lyst, which ranks the fashion industry's hottest brands and

products by tracking the behavior of more than 9 million online

shoppers.

Ferragamo launched a refurbished website and e-commerce shop

during Italy's lockdown that the company says have resulted in more

traffic and online sales. But neither Ferragamo nor Tod's are in

the top 20 of the most recent quarterly Lyst Index, which is led by

Nike and includes Italian luxury brands such as Gucci, Fendi and

Bottega Veneta that are owned by one of the conglomerates.

Write to Eric Sylvers at eric.sylvers@wsj.com and Matthew Dalton

at Matthew.Dalton@wsj.com

(END) Dow Jones Newswires

August 13, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

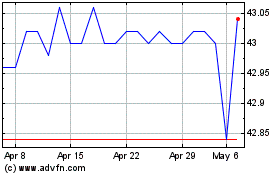

Tod`s (BIT:TOD)

Historical Stock Chart

From Oct 2024 to Nov 2024

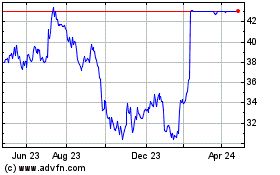

Tod`s (BIT:TOD)

Historical Stock Chart

From Nov 2023 to Nov 2024