UniCredit to Sell Ukrainian Unit to Alfa Group

12 January 2016 - 7:33AM

Dow Jones News

By Giovanni Legorano

MILAN--- UniCredit SpA said Monday that it reached an agreement

to sell its Ukrainian unit, Ukrsotsbank, to Alfa Group's ABH

Holdings SA, in a transaction likely to cost the bank about EUR852

million ($930.8 million).

The Italian bank said the deal reached will lead to a charge of

roughly EUR200 million the bank will book in its earnings for the

fourth quarter of last year, as a net result of the sale.

UniCredit said it would also be hit by a foreign-exchange charge

once the deal is closed of around EUR652 million because of the

depreciation of the Ukrainian currency. The bank said it expects to

close the deal this year, after obtaining regulatory approvals.

The charges won't affect the bank's capital position, as they

will have a neutral effect on UniCredit's common equity Tier 1

ratio--a measure of banks' capital solidity--because of the

reduction in the lender's risk-weighted assets.

In the transaction, UniCredit said it would contribute its

exposure in Ukrsotsbank to ABH Holdings in exchange for new shares

representing a 9.9% stake in ABH Holdings after the

transaction.

The sale of Ukrsotsbank is part of UniCredit's strategic plan

aimed at avoiding raising fresh capital by cutting costs and

shedding noncore assets.

Under the plan, UniCredit is targeting a net profit of EUR5.3

billion in 2018 and a common-equity Tier 1 capital ratio of

12.6%.

To achieve these targets, it said it would cut as many as 18,200

jobs. About 6,000 cuts will come from the sale of Ukrsotsbank and

the planned tie-up of its asset manager Pioneer and Santander Asset

Management.

Write to Giovanni Legorano at giovanni.legorano@wsj.com

(END) Dow Jones Newswires

January 11, 2016 15:18 ET (20:18 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

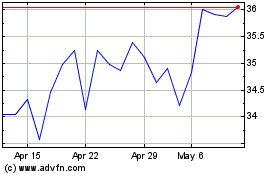

Unicredit (BIT:UCG)

Historical Stock Chart

From Apr 2024 to May 2024

Unicredit (BIT:UCG)

Historical Stock Chart

From May 2023 to May 2024