Italian Bank Shares Plunge on Windfall Tax

08 August 2023 - 6:37PM

Dow Jones News

By Adria Calatayud and Cecilia Butini

Shares in Italian banks fell sharply Tuesday, and dragged down

European peers, after the Italian government approved a windfall

tax on their profits limited to 2023.

At 0803 GMT, shares in Intesa Sanpaolo and UniCredit dropped

6.8% and 5.2%, respectively. Smaller banks Banco BPM, BPER Banca

and Banca Monte dei Paschi di Siena all fell more than 6%. Most

European banks traded lower, and the Stoxx Europe 600 Banks index

was down 1.5%.

Italy's cabinet approved a proposal to introduce a tax on banks'

profits that will apply only in 2023, Deputy Prime Minister and

Infrastructure Minister Matteo Salvini said at a press conference

Monday. The tax will amount to 40% of what Salvini called banks'

extra profits and will result in tax income of "a few billion"

euros, he said.

The measure aims to aid mortgage payments and tax cuts, the

Italian deputy prime minister said.

"While the cost of money has increased and even doubled for

families and businesses, what account holders earn hasn't doubled,"

Salvini said.

The move comes after Italian lenders in recent weeks reported

strong quarterly results. Intesa and UniCredit both raised their

expectations for 2023 after second-quarter earnings topped

forecasts.

Analysts at Citi said in a research note that the decision came

as a surprise and is substantially negative for Italian banks. The

tax could hit Italian banks' earnings by around 19% and reduce

their book value by around 3%, Citi analysts estimated.

"Smaller players with higher reliance on [net interest income],

and showing stronger growth are in our view the banks with the

highest impact," the Citi analysts said.

Write to Adria Calatayud at adria.calatayud@dowjones.com and to

Cecilia Butini at cecilia.butini@wsj.com

(END) Dow Jones Newswires

August 08, 2023 04:22 ET (08:22 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

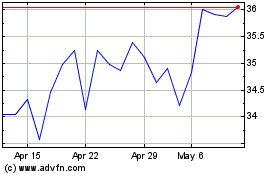

Unicredit (BIT:UCG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Unicredit (BIT:UCG)

Historical Stock Chart

From Dec 2023 to Dec 2024