Can BSV Hold Its New 2023 Peak? Analysts Watch As Trading Volume Explodes

30 December 2023 - 12:00AM

NEWSBTC

The Bitcoin Cash (BCH) blockchain’s hard fork, BSV, has been making

record-breaking gains. With a price surge of more than 70% as of

this writing, the cryptocurrency hit $84.8, a level not seen since

April 2022. The spike may be attributed to the prevailing

optimistic market sentiment, however there are other factors at

play for Bitcoin SV. Related Reading: MATIC Blasts Off: 20% Surge

As Polygon Trading Volume Hits Records BSV’s Surge: South Korea

Dominates With this latest surge, BSV’s monthly gains have

surpassed 82%, and its trading volume has risen noticeably to over

$770 million. This rise appears to be influenced by the

persistently optimistic market sentiment in the larger

cryptocurrency market, with South Korean investors especially

playing a significant role. BSV price at $88.43. Source: Coingecko

Upbit, a well-known cryptocurrency exchange in South Korea, was

responsible for $515 million worth of BSV trades in the last day,

according to CoinGecko data. With more than 67% of the transaction

volume, it commands a huge proportion. This suggests that South

Korean investors are interested in BSV. At the time of writing,

Bithumb, another well-known cryptocurrency trading platform in

Asia, accounted for about 5% of all trades in the asset. By itself,

South Korean cryptocurrency traders accounted for more than 75% of

BSV’s entire trading volume on the previous day. BSV market cap

currently at $1.714 billion. Chart: TradingView.com In 2018, Craig

Wright initiated the creation of BSV by implementing a hard fork of

BCH, which itself had undergone a hard fork from the original BTC

chain in August 2017. Nevertheless, the asset has sparked

significant debate as its originator asserts to be the true Satoshi

Nakamoto, yet fails to provide definitive proof. BSV Surges 80%

Amidst ETF Anticipation The market’s widespread excitement around

the potential approval of a spot Bitcoin exchange-traded fund (ETF)

in the US is one factor contributing to the rising value of BSV. As

a result, throughout the last 30 days, the value of the Bitcoin

fork has increased by nearly 80%. BSV price action in the last

week. Source: Coingecko To stop illicit activity in the space,

South Korea recently made the decision to create a framework for

crypto regulations. Furthermore, a December 27 update disclosed

that the nation has mandated public officials to disclose their

cryptocurrency holdings, marking a noteworthy advancement in the

regulation of the space. Given the sense of security that comes

with operating in a regulated industry, investors may have taken

notice of these developments. Related Reading: Axie Infinity

Springs Back To Life With Surprise 35% Rally – Details Meanwhile,

BSV is still down 82.29% from its all-time high in 2020, when it

was among the largest cryptocurrencies by market capitalization,

despite the coin’s recent price increase. Often referred to as

“Satoshi’s Vision” for Bitcoin, BSV experienced a little decline in

its market value following a Coinbase statement. The top US

cryptocurrency exchange said that, as of January 9, 2024, it will

no longer support Bitcoin SV. In October of last year, BSV was the

victim of an empty block mining attack. An empty block attack

occurs when miners consciously choose to omit transactions from the

blocks they verify, slowing down the network for users in the

process. Featured image from Shutterstock

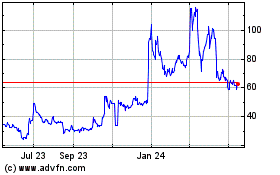

Bitcoin SV (COIN:BSVUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

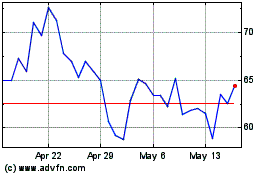

Bitcoin SV (COIN:BSVUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024