Polkadot (DOT) Seen Reversing Losses With 116% Rally To $10 – Analyst

13 August 2024 - 7:30AM

NEWSBTC

Polkadot token DOT has indeed been hot on the cryptocurrency market

throughout the week, appreciating over 21%. Despite the gains

bringing further enthusiasm among the investors, the token pressed

on higher and continues to trade at $4.65 with a market

capitalization of more than $6.6 billion. Now ranking 17th in the

largest cryptocurrencies, investors and DOT aficionados cannot stop

wondering if it can sustain its momentum. Related Reading: Solana

Rockets Up 23% As Developments Spark Investor Interest Something is

literally now hyping in the air, particularly after the analysis of

the popular crypto analyst known as “Zayk Charts.” The analyst

observed a falling wedge pattern on the 2-day chart for DOT/USDT,

and it could truly be a game-changer. $DOT Falling Wedge Formation

in 2D Timeframe✅ Incase of Breakout,Next Target wil be $10📈#DOT

#DOTUSDT #Polkadot #Crypto pic.twitter.com/xgqyjAN4ul — ZAYK Charts

(@ZAYKCharts) August 11, 2024 This is usually a bullish sign and

gets more than 70% ripeness for triggering a trend reversal of the

negative variety. If DOT breaks out of this wedge, Zayk Charts

predicts it could shoot straight up and target a price as high as

$10. Polkadot ‘Greed’ Factor While the technical analysis looks

good for DOT, when we overlay the sentiment, it only makes things

more complex. Polkadot’s Fear and Greed Index recently shifted into

a “Greed” phase. What does it mean? In plain words, investors are

getting excited—maybe a little too excited. The “Greed” phase

usually means that it is creating an irrational stage in bullish

investors’ minds, where they just think prices are to go up and

never go down. While being great for short-term gains, there’s a

catch. Too much greed inflates prices higher than they are truly

worth, hence creating a bubble. While the “Greed” period, of

course, introduces on the radar screen strong market performance,

it also carries with it red flags toward a possible market

correction. In short, would we have to face a bubble, or is it just

the beginning of an upward long-term trend? Technical Analysis:

Falling Wedge And Breakout Potential Back to the technical front.

The falling wedge pattern is very important, and Zayk Charts marks

it accordingly. Technically, this pattern is known to be a bullish

reversal pattern. It forms when the price of a coin trades lower

but with the rate of decline decreasing, which then results in the

formation of a converging trend line. A breakout from this pattern

usually results in a massive price increase. Breaking out of this

wedge could be the key to $10 for DOT, which means a 116% increase

for the altcoin. That would be a huge comeback for the

cryptocurrency, a move that would easily regain investors’

confidence and re-cement Polkadot’s status as a force to reckon

within the market. Like any other prediction done in the highly

unpredictable world of crypto, however, this also comes with no

guarantees. Related Reading: Fantom (FTM) Poised For Massive Bull

Run, Analyst’s 234% Rally Prediction Raises Eyebrows Price Forecast

And Investor Outlook On a broader perspective, DOT still hovers

with very positive sentiments. According to data from CoinCheckup,

the DOT token is poised for an upsurge in strength. The platform

gave a forecast that, in the coming three months, it would climb up

by 245%. Should such an event ensue, this would be a massive

comeback for the token. But that’s not all. In the coming six

months, Polkadot is projected to climb 180%, and in a one-year time

span, it is expected to rise 166%. Featured image from Host

Merchant Services, chart from TradingView

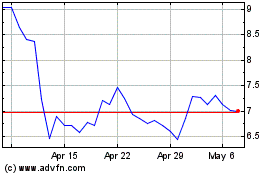

Polkadot (COIN:DOTUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Polkadot (COIN:DOTUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024