Bitcoin Price Plummets Below $40,000 As Crypto Market Tallies $440 Million In Liquidations

12 April 2022 - 4:21PM

NEWSBTC

Bitcoin fell 15% in the last 24 hours, plunging below $40,000 for

the first time since middle of March. Meanwhile, Ethereum was down

14%, retreating below the $3,000 level for the first time since

March 22. BTC was trading at $39,783 at the time of writing, while

Ether (ETH) fell to $2,978.54, according to Coingecko data.

Investors are weighing the prospects of rising interest rates,

skyrocketing inflation, and global commerce being disrupted as a

result of Russia’s attack on Ukraine, among other factors.

Suggested Reading | What’s Next For Bitcoin As Prices Encounter

Difficulty Reclaiming $43,000? Bitcoin Retreats To Monthly Low

Faced with the threat of further rate hikes by the US Federal

Reserve, Bitcoin, along with stocks, is sliding to a monthly low.

Hundreds of millions of dollars worth of liquidations have occurred

as a result. Market experts believe that the central bank’s balance

sheet reductions are exerting downward pressure on stocks and risk

assets, with Bitcoin potentially losing allure. Decentrader

co-founder filbfilb concurred with these severe headwinds, stating

that the Fed’s action will have an effect on the BTC price trend

“for months to come.” Lesser Exposure To Speculative Assets

Investors appear to be decreasing their exposure to speculative

assets, such as stocks and cryptocurrencies, in response to fears

about inflation and slowing economic development. Additionally, the

10-year Treasury yield increased to a fresh three-year high of

2.77% on Tuesday, lowering the present value of high-priced

technology equities. Bitcoin, which has generally been reasonably

connected with the pricing of other cryptocurrencies, has recently

become more correlated with stock prices. BTC total market cap at

$765.42 billion on the weekend chart | Source: TradingView.com

Suggested Reading | Price Of Bitcoin Retreats Under $42,000 As

Enthusiasm From Miami Event Fizzles Last month, the cryptocurrency

asset’s price correlation with the S&P 500 reached 0.50, with

-1 indicating that they move in complete opposition to one another

and 1 indicating that they move in perfect sync. According to

Arcane Research data, it was the highest rate since October 2020.

Nydig, a Bitcoin-focused asset manager, noted in a note to

investors: “Bitcoin investors continue to be concerned about rising

interest rates and the prospect of tighter monetary conditions.”

Looming Crypto Meltdown On Sunday, BitMEX founder Arthur Hayes

warned of a “coming crypto carnage” and projected that both Bitcoin

and Ether would continue to plummet far further. The billionaire

investment banker-turned-crypto mogul predicted that Bitcoin and

Ether will “bottom well before the Fed moves” and reverses course

on its tightening policies. Hayes anticipated that the two leading

cryptocurrencies would touch the $30,000 and $2,500 levels by the

end of June. Within 24 hours, Coinglass reports that roughly $440

million has been liquidated across the broader crypto market. This

totals over 140,000 trades, one of which resulted in a $10 million

loss on a single trade. Featured image from Medium, chart from

TradingView.com

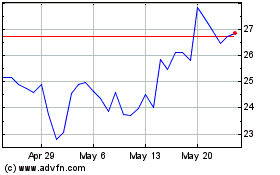

ENTRADE (COIN:ENTRUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

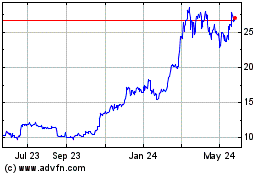

ENTRADE (COIN:ENTRUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025

Real-Time news about ENTRADE (Cryptocurrency): 0 recent articles

More ENTRADE News Articles