Huobi Global Faces Risks As Investments In stUSDT Surge To $1.8 Billion

21 September 2023 - 8:00AM

NEWSBTC

Huobi Global, a prominent cryptocurrency exchange, is at risk as

investments in the staked USDT (stUSDT) project soar to $1.8

billion. The project, spearheaded by crypto entrepreneur Justin

Sun, promises 5% returns tied to low-risk securities like

government bonds. However, according to a Bloomberg report,

Huobi’s heavy involvement in the project raises concerns about the

exchange’s ability to manage sudden outflows of funds and the

transparency of its reserves. Huobi’s Association With stUSDT

Sparks Concerns And Triggers Institutional Withdrawals Per the

report, Huobi’s close association with the stUSDT project has led

to a significant transformation in the exchange’s crypto

reserves. Altering by this shift and the lack of transparency

surrounding stUSDT, institutional traders have withdrawn a

substantial portion of their crypto holdings from Huobi.

Related Reading: Bitcoin May Not See Lasting Bullish Momentum Until

This Happens This withdrawal trend highlights the potential risks

of Huobi’s concentration on the stUSDT platform. Notably,

blockchain research firms have expressed concerns about the

relative lack of transparency surrounding the stUSDT project. The

absence of comprehensive information about its investments raises

questions about the source and sustainability of the advertised

4.2% yield. Huobi’s reliance on the project exposes the

exchange to problems that may arise within stUSDT, further

magnifying its potential vulnerabilities. As investments in stUSDT

have grown, Huobi’s Tether (USDT) reserves have plummeted, raising

further concerns. While Huobi maintains that stUSDT is a separate

project not overseen by the exchange, the heavy concentration of

stUSDT in its reserves implies that Huobi’s fortunes are closely

linked to the success or failure of the project. The

dominance of tokens associated with Justin Sun, such as TRON (TRX)

and Huobi Token (HT), in Huobi’s reserves adds another risk layer,

as market participants could perceive it as a higher exchange risk.

Huobi Global’s Average Daily Trading Volume Plummets Institutional

clients, including crypto funds and market makers, have expressed

concerns about the dominance of stUSDT and other tokens associated

with Justin Sun in Huobi’s reserves. According to Bloomberg,

these clients have withdrawn a significant portion of their digital

assets from the exchange shortly after the launch of the staked

Tether project. This departure from Huobi has contributed to a

decline in the exchange’s average daily trading volume. The stUSDT

project’s rapid growth and lack of transparency raise questions

about its underlying investments and the sustainability of its

returns. Investors and industry experts emphasize the importance of

increased transparency and oversight to understand the sources of

yield and mitigate potential risks. Per the report, the project’s

management team intends to engage a reputable third-party

verification entity to enhance community oversight. However,

further details about the project’s structure and employees remain

scarce. Related Reading: Bitcoin Bulls Could Buck Downtrend With

Move To $42,000 What is certain is that Huobi Global’s involvement

in the stUSDT project has significantly impacted the composition of

its reserves, raising concerns among institutional traders and

industry experts. The heavy concentration of stUSDT, TRX, and

HT tokens in Huobi’s reserves and the lack of transparency

surrounding the project pose potential risks to the exchange’s

financial stability. To alleviate these concerns, greater

transparency and oversight are essential, ensuring the

sustainability and credibility of the stUSDT project and Huobi’s

operations in the evolving crypto landscape. Featured image from

iStock, chart from TradingView.com

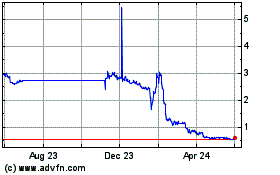

Huobi Token (COIN:HTUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Huobi Token (COIN:HTUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025

Real-Time news about Huobi Token (Cryptocurrency): 0 recent articles

More Huobi Token News Articles