Santiment Reveals Best Altcoins Currently In “Opportunity Zone”

21 March 2024 - 5:00AM

NEWSBTC

The on-chain analytics firm Santiment has revealed the altcoins

that have recently surged into the mid-term “opportunity zone.”

These Altcoins May Be More Likely To See Rebounds In a new post on

X, Santiment has discussed what the various altcoins in the market

are looking like from the perspective of the MVRV. The “Market

Value To Realized Value” (MVRV) refers to an indicator that keeps

track of the ratio between the Bitcoin market cap and the realized

cap. The realized cap here is a capitalization model for BTC that

measures the total sum of capital that the investors have used to

purchase their coins. As such, the MVRV tells us about how the

value that the investors are holding right now (the market cap)

compares against this initial investment. Related Reading: Bitcoin

Plunges Under $63,000, Here’s Where Next On-Chain Support Is

Historically, the more profits the investors have held (that is,

the higher the market cap has been compared to the realized cap),

the more likely tops have been to occur. This is naturally because

investors become more likely to give in to the allure of

profit-taking the higher their gains get. On the other hand,

cryptocurrencies have been probable to see rebounds when holders’

returns have dropped into the negative territory. In these

conditions, there aren’t many profit-takers left, so selling

pressure begins to run out. Based on these facts, Santiment has

come up with an “Opportunity & Danger Zone Model” that uses the

MVRV’s divergence from the norm on various timeframes to determine

if an asset is providing a potential window for selling or buying

right now. Below is the chart shared by the on-chain analytics firm

that reveals what this model is saying for altcoins around the

sector: Looks like some of the coins are approaching the

opportunity zone | Source: Santiment on X From the graph, it’s

visible that a lot of coins are still inside the overbought

territory, but several altcoins have managed to sneak into the

mid-term opportunity zone following the recent market downturn led

by Bitcoin’s plunge. “This zone gets breached when an asset’s

30-day, 90-day, and 365-day average wallet returns are combining to

be in negative territory,” explains Santiment. It should be noted,

though, that while mid-term returns are red for these coins, they

are still not yet inside the buy zone proper. “In a zero sum game

like crypto, projects with minimal returns compared to the rest of

the sector have a higher probability of a more efficient rebound

for those who are willing to #buythedip on projects traders are in

the most pain on,” notes the analytics firm. Related Reading:

Bitcoin Has Undergone This Bearish Structure Change, Analyst

Explains According to Santiment, some of the best altcoin

candidates who are inside the mid-term opportunity zone include

Lido DAO (LDO), Synthetix (SNX), Storj (STORJ), and OMG Network

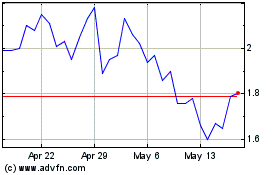

(OMG). LDO Price Lido DAO has had a bad time recently as its price

has gone down more than 31% over the past week. With these red

returns, it’s no wonder that the coin is becoming underbought on

the MVRV. The price of the altcoin appears to have plunged down in

the last few days | Source: LDOUSD on TradingView Featured image

from Shutterstock.com, Santiment.net, chart from TradingView.com

Lido DAO Token (COIN:LDOUSD)

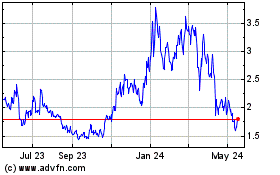

Historical Stock Chart

From Oct 2024 to Nov 2024

Lido DAO Token (COIN:LDOUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024