Bitcoin Price Soars, Smashing Through $45,000 On The Back Of Two Key Factors

09 February 2024 - 6:30AM

NEWSBTC

In the past 14 days, the Bitcoin price has displayed a significant

uptrend of 14.5%, signaling a resurgence in bullish sentiment. This

rally comes as Bitcoin spot exchange-traded funds (ETFs) have been

trading for nearly a month, with the market already factoring in

this development. As a result, Bitcoin is back on its natural

course, gaining momentum ahead of the scheduled halving in April.

Currently, Bitcoin has not only regained its bullish momentum after

a brief dip to the $38,500 level but has also surpassed the $45,300

mark. It now edges closer to its 25-month high of $49,000, with the

$50,000 milestone within reach. Achieving this level would

significantly narrow the gap between the current price and

Bitcoin’s all-time high (ATH) of $69,000. However, what are the

main catalysts behind this uptrend, and how far can the Bitcoin

price climb? Reduction Of GBTC Flows And Net Positive BTC Spot ETF

Inflows According to the latest analysis by QCP Capital, two key

factors are driving Bitcoin’s upward trajectory: Daily

outflows from the Grayscale Bitcoin Trust (GBTC) have decreased

from $500-600 million to $100-200 million. Simultaneously, total

inflows across all Bitcoin ETFs are now positive. This shift

in the GBTC flows, and the emergence of net positive BTC spot ETF

inflows contribute to the current bullish trend, according to the

crypto trading firm’s analysis Related Reading: Ethereum Breaks

Above $2,400: This Metric Points To Further Upside Additionally,

notable price movements have been observed around “spot ETF

fixings.” Between 3-4 pm EST, QCP has recorded that the Bitcoin

price tends to tick higher, possibly due to the one-hour

observation window used by the BlackRock ETF (IBIT) to calculate

its Net Asset Value (NAV). Conversely, downward pressure is

typically observed after 4 pm EST as GBTC employs a point fix,

leading market makers to sell around and after the fix. Strong

Performance In US Equities Despite the Federal Reserve’s hawkish

stance and higher US yields driven by robust February Non-Farm

Payroll data (353k actual vs. 180k expected), US equities continue

outperforming. Companies like NVDA and META have rallied due

to strong earnings and positive headlines. Underallocated investors

will likely continue buying any equities dips as they chase

returns. According to the analysis, this bullish sentiment is

expected to “spill” over into BTC and Ethereum (ETH), further

fueled by the upcoming BTC halving and the ETH spot ETF narratives.

Ultimately, the trading firm assesses significant interest in

accumulators, which enable investors to purchase Bitcoin or ETH at

a “substantial discount” to the current spot price. This strategy

is believed to present an attractive opportunity for bullish

investors looking to build long positions throughout the year.

Bitcoin Price Faces Strong Barriers On Its Way To $50,000 Despite

the uptrend, notable resistance levels could impede further upward

movement and potentially lead to a consolidation phase for

Bitcoin. To assess the nearest-term resistances accurately,

the 1-hour chart indicates potential price paths for Bitcoin in the

coming days if these bearish thresholds are breached. In the

immediate time frame, the $45,500 level emerges as Bitcoin’s next

resistance level. This level previously marked a correction in the

Bitcoin price shortly after the introduction of ETF trading.

Subsequently, the next target would be the $46,600 level if the

immediate resistance at $45,500 is surpassed. However, while these

two thresholds may present challenges, no significant resistance

levels are evident on Bitcoin’s hourly chart until the $48,500

level. This particular level represents the final hurdle for

Bitcoin before reclaiming its previous high reached on January 11,

immediately following the approval of ETFs by the US Securities and

Exchange Commission (SEC). Related Reading: Shiba Inu Price Breaks

2-Month Downtrend, Eyes New Peaks Considering the combined factors

of Grayscale’s reduced sell-off and the overall performance of the

equity market, alongside renewed investor sentiment, Bitcoin could

potentially surge to previous highs and even surpass them, marking

new highs since the end of the crypto winter. The key factor

to be seen is how Bitcoin’s price will respond when encountering

these highlighted resistance walls and whether the buying pressure

will be sufficient to propel Bitcoin back on track toward the

bullish momentum observed at the beginning of 2024. Featured image

from Shutterstock, chart from TradingView.com

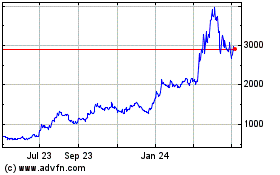

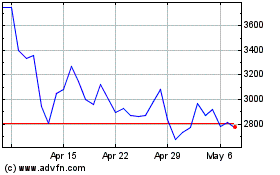

Maker (COIN:MKRUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Maker (COIN:MKRUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024