Bitcoin Will Test ATH Once It Breaks This Strong Supply Zone – Details

22 December 2024 - 8:00AM

NEWSBTC

Bitcoin is currently trading at $97,600, following a sharp dip from

its all-time high and a modest recovery from the critical $92,000

support level. This recent price movement highlights the market’s

ongoing volatility as investors grapple with shifting sentiment and

technical levels. Despite the rebound, Bitcoin now faces a

significant challenge in sustaining its upward momentum. Related

Reading: XRP Whales Loading Up – Data Reveals Buying Activity

Analyst Ali Martinez shared compelling data revealing that Bitcoin

encounters a massive resistance zone between $97,500 and $99,800.

This “brick wall” is fortified by the activity of 924,000 wallets,

which collectively purchased over 1.19 million BTC in this range.

Such strong on-chain resistance could hinder BTC’s ability to

reclaim the psychological $100,000 level in the near term. This

critical area will likely determine Bitcoin’s next move.

Successfully breaking through this zone could pave the way for

another rally, while failure to do so might lead to heightened

selling pressure and a retest of lower support levels. As the

market watches this pivotal phase unfolds, all eyes remain on key

technical and on-chain signals to gauge whether Bitcoin’s recovery

is sustainable or if a larger correction looms ahead. Bitcoin

Holding Strong Bitcoin has experienced intense price swings over

the past few days, with a 15% correction followed by a swift 6%

bounce in under three days. This rapid movement highlights the

serious volatility gripping the market, with Bitcoin mirroring the

broader uncertainty. Despite the turbulence, there is growing

optimism among analysts regarding Bitcoin’s outlook, as its

recovery from aggressive selling pressure yesterday took only a few

hours. Martinez shared key insights on X, shedding light on a

significant resistance zone that Bitcoin must overcome to regain

momentum. According to Martinez, Bitcoin faces a “brick wall”

between $97,500 and $99,800. This range is fortified by 924,000

wallets that collectively purchased over 1.19 million BTC within

these levels. This substantial cluster of on-chain resistance could

act as a barrier to Bitcoin’s upward trajectory. Related Reading:

Bitcoin Data Reveals No Significant Panic Selling In The Market –

Shakeout Or Trend Shift? If Bitcoin can manage to break above this

critical resistance zone, it could open the door to new all-time

highs. However, failure to surpass this range may lead to increased

selling pressure and further consolidation below the $100,000 mark.

For now, Bitcoin remains resilient, holding its ground amid market

volatility, with many analysts cautiously optimistic about its

potential for another rally. Technical Analysis Bitcoin is

currently trading at $98,200, showing a strong recovery from the

$92,000 mark, which has proven to be a significant demand level.

This reaction from $92K signals strength in Bitcoin’s price action,

indicating the potential for bullish momentum in the weeks ahead.

If BTC manages to push above the critical $100,000 level in the

coming days, it could trigger a massive surge, potentially driving

the price to new all-time highs. This psychological and technical

milestone is expected to ignite a wave of buying pressure as

investors and traders anticipate the next leg of the rally.

However, the market remains uncertain, and the possibility of

Bitcoin entering a sideways consolidation phase cannot be ruled

out. In this scenario, BTC could remain range-bound between its

all-time highs and local lows, reflecting a period of accumulation

as the market recalibrates after recent volatility. Related

Reading: On-Chain Metrics Reveal Cardano Whales Are ‘Buying The

Dip’ – Details For now, the $92,000 mark has provided a strong

foundation for Bitcoin, and all eyes are on the $100,000 level as

the next major test. Whether BTC breaks out or consolidates, its

current resilience suggests that Bitcoin remains poised for

significant moves in the near term. Featured image from Dall-E,

chart from TradingView

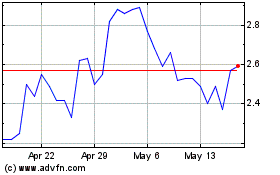

Optimism (COIN:OPUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Optimism (COIN:OPUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024