UNI Bullish Rebound Signals Upsurge, Targets $8.7 Resistance Ahead

02 October 2024 - 9:30PM

NEWSBTC

UNI is making a strong comeback as bullish momentum pushes the

token toward the critical $8.7 resistance level. After bouncing

back from a recent low of $6.7, market enthusiasm is building, and

traders are watching closely for a potential breakout. With

buying pressure increasing and sentiment turning positive, UNI’s

rally could gain further upward traction if it manages to overcome

this key barrier, signaling a renewed bullish trend and paving the

way for additional price advances. The aim of this article is to

analyze UNI’s recent price rebound and its potential to break

through the $8.7 resistance level. By examining key technical

indicators and market sentiment, the article seeks to provide

insights into whether its current upward momentum can be sustained,

and what traders should expect if the token successfully breaches

this critical price point. Market Sentiment Shifts: Bulls Back In

Control Following the bullish comeback at $6.7, UNI’s price on the

4-hour chart has continued to gain strength to surge toward the

$8.7 resistance level. UNI is also trading above the 100-day Simple

Moving Average (SMA), suggesting a positive upward trend that could

lead to a potential breakout. An analysis of the 4-hour Relative

Strength Index (RSI) shows that the signal line is currently at

45%, climbing from the oversold zone and approaching the 50%

threshold. This upward movement indicates that selling pressure is

easing, and buyers are beginning to regain control. As the RSI

moves closer to 50%, this shows a potential shift toward more

balanced market conditions, with the possibility of a bullish

reversal if the pressure continues. Related Reading: Uniswap Price

on the Rise: UNI Eyes Set on Further Gains Furthermore, on the

daily chart, UNI is exhibiting strong upward momentum, marked by a

bullish candlestick formation following its successful rebound. The

price is now attempting to break above the 100-day SMA, a critical

resistance level that could solidify the rising trend. A sustained

move above the 100-day SMA would reinforce market confidence,

signaling increased buying pressure and the potential for more

price appreciation. Finally, on the 1-day chart, a detailed

examination of the RSI formation indicates that UNI may maintain

its optimistic trajectory as the indicator’s signal line is rising

again, positioned at 55% after dropping to the 50% threshold,

suggesting a sustained upward outlook. Potential Scenarios: What

Happens If UNI Breaches $8.7? If UNI manages to break through the

$8.7 resistance level, it could ignite a price surge, propelling it

toward the $10.3 mark. A successful breakout above this critical

level is likely to draw in more buyers, pushing UNI closer to its

next resistance target of $11.8 and beyond. Related Reading:

Uniswap Price (UNI) Pumps 20%: Is This the Start of a Major Rally?

Nevertheless, if UNI fails to maintain this strength and breaks

below the $8.7 resistance level, it might result in a pullback,

with the price sliding back toward the $8.7 support zone. A

breakdown below this level could lead to further losses,

potentially targeting lower support areas. Such a move would signal

weakening optimistic sentiment, raising concerns of a more extended

bearish trend and prompting traders to brace for additional

downside risks. Featured image from Adobe Stock, chart from

Tradingview.com

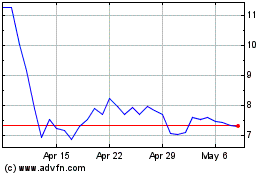

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024