80% of companies are investing in AI to improve cash flow despite budget cuts

18 December 2024 - 1:30AM

UK Regulatory

80% of companies are investing in AI to improve cash flow despite

budget cuts

"Cash Maturity 2024" Study by Sidetrade and PwC

France and Maghreb, reveals that the integration of smart

automation, generative AI, and internal upskilling are driving

efficiency gains, while companies shift from outsourcing to

cultivating in-house talent with essential tech and leadership

skills.

In collaboration with consulting and audit

firm PwC France and

Maghreb, Sidetrade,

the global leader in AI-powered Order-to-Cash applications,

reveals a significant shift in investment and renewed boldness

within the finance function, driven by a sharpened emphasis in 2024

on cash flow generation and EBITDA preservation amid a challenging

economic landscape.

"Cash Maturity 2024"

by Sidetrade and PwC provides a perspective on finance

transformation trends across Europe, revealing how companies are

rethinking Order-to-Cash strategies amid significant interest rates

and tighter credit conditions. Now in its second year, the report

shows businesses adopting generative AI and cultivating in-house

talent to build finance functions that drive measurable

value.

The study serves as a guide for finance leaders to assess

their cash maturity and take proactive steps to optimize their

finance functions. As finance departments continue to evolve into

dynamic, value-generating units, the road to success lies in

embracing change, setting clear priorities, and making bold,

informed choices in the face of economic uncertainty.

The complete Cash Maturity 2024 study can be accessed

here.

Arthur Wastyn, Partner PwC

France and Maghreb commented: "Through

technology - AI and process automation primarily - companies

are now embracing a more systematic and ambitious transformation of

their Order-to-Cash processes, moving beyond the

aspirations of 2023. Yet, the success and sustainability of this

transformation depend not only on technological foundations but,

above all, on identifying bold, visionary leaders able to deliver

complex projects in a volatile

environment."

Key findings of

"Cash Maturity 2024"

- Even as budget increases shrink, down 30% from 2023, finance

leaders are pressing ahead with transformation efforts; 87% are

actively engaged in projects for 2024 (compared to 59% in 2023),

with nearly all of these active projects (98%) making optimized

Order-to-Cash (O2C) processes a focal point of their investments.

This push aligns with a 79% increase in priority for initiatives

targeting cash flow acceleration and EBITDA growth which is

critical as businesses navigate rising interest rates and

constrained credit conditions.

- Generative AI has emerged as a high priority within this

transformation landscape. Over 80% of companies are investing in

it, despite financial constraints, placing it just behind ERP

systems in deployment plans. Yet, with more than 55% of O2C tasks

still handled manually, many companies are recognizing the need to

automate these processes. In fact, three-quarters of respondents

are planning significant automation upgrades over the next 18

months, seeking to boost productivity and cash flow

efficiency.

- Accompanying these technological moves is a notable pivot in HR

strategy within finance teams. Rather than outsourcing, companies

are emphasizing internal upskilling, addressing the rising demand

for technical, analytical, and leadership skills. This year, 50% of

respondents report prioritizing talent development—up from 27% in

2023—reflecting a substantial commitment to building both the hard

and soft skills essential for today’s finance strategy.

Jean-Claude Charpenet, Sidetrade

Partner added: “In today’s climate, budget

limitations aren’t slowing down investment in

generative AI – in fact most

business leaders see it as essential

to drive Order-to-Cash transformation. For today’s CFOs,

smart technology isn’t just

about productivity; it’s a strategic

move to stabilize cash flow and protect EBITDA. Finance

transformation is now a must, fueling

growth and resilience in a market that demands agility. The

real challenge is no longer ‘if’ but deciding

‘how fast’ and ‘where to

focus’.”

Methodology

"Cash Maturity 2024" was co-authored by

PwC and Sidetrade between Q2 - Q3

FY24.

The research encompassed responses from a sample of 180

companies across a range of industries and represented a diverse

spectrum of functions, including CEO, CFO and Financial

Manager.

To ensure the robustness of our findings, it intentionally

designed the survey sample to be highly heterogeneous, encompassing

companies of varying sizes, from Small and Medium-sized Enterprises

(SMEs) to large corporations, and spanning across a multitude of

industry sectors.

This methodological approach was undertaken to provide a

comprehensive and representative analysis of the finance

transformation landscape, offering insights that cater to a wide

range of organizations.

PwC France and

North Africa contact

Priscille Holler

00 33 07 87 93 40

38

priscille.holler@pwc.com

About PwC France and Maghreb

In France and the Maghreb, PwC provides consulting and audit

services, as well as tax and legal expertise, with the strategic

ambition of being the benchmark in trust and business

transformation industry-wide. More than 6,750 people work in PwC’s

entities in France and the Maghreb, sharing their expertise across

an international network of more than 364,000 people in 151

countries. For more information, visit www.pwc.fr.

Sidetrade contact

Becca

Parlby

00 44 7824 5055

84

bparlby@sidetrade.com

About Sidetrade

Sidetrade (Euronext Growth: ALBFR.PA) provides a SaaS platform

dedicated to securing and accelerating cash flow. Sidetrade’s

next-generation AI, nicknamed Aimie, analyzes $6.1 trillion worth

of B2B payment transactions daily in the Sidetrade Cloud to predict

customer payment behavior and the attrition risk of more than 38

million buyers worldwide. Aimie recommends the best operational

strategies, intelligently automates actions on the entire

Order-to-Cash process, and dematerializes customer transactions to

enhance productivity, performance, and working capital

improvements.

Sidetrade has a global reach, with 315+ talented employees based in

Paris, London, Birmingham, Dublin, Houston, and Calgary, serving

global businesses in more than 85 countries. Amongst them: Bidcorp,

Biffa, Bunzl, Engie, Expedia, Inmarsat, KPMG, Lafarge, Manpower,

Opentext, Page, Randstad, Saint-Gobain, Securitas, Sodexo, Tech

Data, UGI, Veolia.

Sidetrade is a participant of the United Nations Global Compact and

adheres to its principles-based approach to responsible business.

For further information, visit us at www.sidetrade.com and follow

@Aimie on LinkedIn.

In the event of any discrepancy between the French and English

versions of this press release, only the English version is to be

taken into account.

- 80% of companies are investing in AI to improve cash flow

despite budget cuts

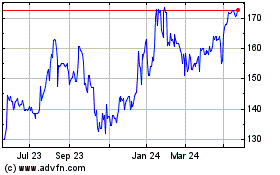

SideTrade (EU:ALBFR)

Historical Stock Chart

From Dec 2024 to Jan 2025

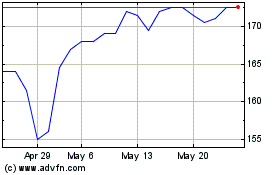

SideTrade (EU:ALBFR)

Historical Stock Chart

From Jan 2024 to Jan 2025