Sidetrade: Outstanding 26% growth in Revenue for 2024

Solid Q4 2024: subscription bookings up

33%

New record for bookings, year-over-year

Strong revenue growth in 2024, up 26%,

with SaaS subscriptions up 22%

-

Consolidated expansion in Europe with the acquisition of

SHS Viveon

-

Revenue up 36% in the United States

-

65% of revenue in international markets

Sidetrade rises to the Top 15% in

EcoVadis ratings

Sidetrade, the global

leader in AI-powered Order-to-Cash applications,

announces 26% revenue growth for the 2024 fiscal

year.

Olivier Novasque, CEO of Sidetrade,

commented:

“Following a downturn in the third quarter, we

finished the year with a return to dynamic growth for

fourth-quarter bookings, posting slightly more than €2 million

in new annual recurring revenue (ARR), significantly up by 33%

year-over-year. Except for Q3, we successfully aligned three out of

four quarters throughout the year, with slightly over

€2 million in new ARR per quarter. As a result, we achieved a

new annual record for bookings. Figures aside, this dynamic

confirms three structural trends that will propel Sidetrade’s

trajectory in the months and years ahead. 1/ Our

technological lead in AI, now boosted by generative AI

capabilities, positions us to secure very large global

accounts. 2/ Sidetrade is firmly establishing

itself as the go-to partner for multinational

companies, with a 44% growth in subscriptions from

companies with revenue exceeding €2.5 billion and nearly 80%

of total subscription revenue coming from those generating over

€1 billion. 3/ The United States is

and will continue to act as a vigorous growth driver for the

Group, registering nearly half of the year’s bookings

(46%) and with impressive revenue growth (+36%).

To this end, and in anticipation of the expected market environment

on both sides of the Atlantic, we decided to focus most of our

business investments for 2025 on North America, where we see

considerable growth potential. 2024 heralded a milestone in our

development, buoyed by a promising start in generative AI-powered

Order-to-Cash applications, not to mention our stronger leader

position in Europe following the acquisition of SHS Viveon, and

lastly, a marked acceleration in our US expansion. Looking

ahead to 2025 and beyond, Sidetrade is on track to deliver another

year of growth and profitability.”

Solid Q4 2024: subscription bookings up

33%

Sidetrade ended Q4 2024 with bookings of €2.08 million

in new ARR, a substantial increase of 33%

versus €1.56 million in the same period last year. Parallel to

this, services bookings, with almost all invoiced

within 12 months of their signing, totaled

€1.72 million, up 29% on the

same period the previous year (€1.33 million).

Overall, new Annual Contract Value (ACV) –

combining new yearly subscriptions and related services – totaled

€3.8 million, representing a sustained increase of 31%

versus €2.89 million in Q4 2023.

New record for bookings, year-over-year

(ACV up 13%)

Despite a sharp decline in Q3 2024, Sidetrade succeeded in setting

a new full-year record for bookings, both in terms of total new

subscriptions and related services. For the fiscal year

2024, new contracts amounted to €6.53 million

in subscriptions in new ARR, up 6% from the

€6.18 million reported in 2023, with services bookings

of €6.2 million, i.e., growth of 21% versus the

€5.1 million recorded in the previous fiscal year.

On balance, new ACV totaled a

never-before-seen €12.73 million, compared to

€11.30 million year-over-year (+13%).

The United States played its

full role as a growth driver, with a 36% increase

in subscription bookings, accounting for

46% of the total. In addition, the Northern Europe

region – mainly driven by the United Kingdom – kick-started a

positive upturn with €0.74 million in subscriptions for 2024,

representing a 20% increase on 2023 and indicating potential for

further growth in 2025.

In the 2024 fiscal year, bookings in

subscriptions by new customers (“New

Business”) accounted for 63% of the

total, while 18% of total bookings were

driven by Cross-selling for new entities within a

Group. Lastly, Upselling of additional modules to

existing customers represented the remaining 19% of

bookings.

Strong revenue growth in 2024, up 26%,

with SaaS subscriptions up 22%

Sidetrade

(€m) |

2024 |

2023 |

Change |

|

SaaS subscriptions |

45.5 (1) |

37.3 |

+22% |

|

Revenue |

55.0 (2) |

43.7 |

+26% |

(1) includes €3.0m in recurring revenue from SHS

Viveon

(2) includes €4.4m in revenue from SHS Viveon

In 2024, Sidetrade achieved

annual revenue of

€55.0 million, representing a

year-over-year increase of 26% and up 16%

on a comparable basis (excluding the acquisition

of SHS Viveon completed in June 2024), which is

underpinned by solid internal momentum. These outstanding results

are due to several factors:

Excluding the contribution of SHS Viveon,

Sidetrade expertly demonstrated its ability to sustain growth.

Total Company revenue (excluding the acquisition) increased by

16%, while SaaS subscriptions were up by a

sizeable 15%. In particular, this performance was

bolstered by a record first-half for bookings. In

parallel, the Group’s Services business achieved remarkable

growth of 24%, notably thanks to deployment projects

signed worldwide.

-

Strategic acquisition of SHS Viveon

Following its consolidation on July 1,

2024, SHS Viveon delivered revenue of

€4.4 million, serving to

accelerate Sidetrade’s growth momentum. Fully consolidated in the

DACH region (Germany, Austria, Switzerland and eastern European

countries), SHS Viveon’s business accounted for 15% of the

Company’s total revenue in H2 2024. This new geography is

now an established growth driver for the Group.

-

A fast-expanding global presence (65% of

revenue)

Sidetrade is extending its foothold worldwide,

which validates international expansion as one of its strategic

pillars. The consolidation of SHS Viveon has propelled the share of

revenue generated outside France to 65%, a

significant development testifying to the Group’s successful

expansion.

What’s more, with 70% of its workforce based

abroad, Sidetrade has proven its ability in expanding in

global markets while upholding close ties with local customers,

fostering trust and effectiveness.

-

Remarkable performance in North America

(+36%)

Of all the Group’s geographies, North America

posted the strongest growth for 2024, up 36% and accounting

for €16.6 million in annual revenue. This strategic market

will continue to play an important role in fulfilling Sidetrade’s

ambitions for development.

Rise in subscriptions from

multinationals: a growth driver for Sidetrade

Analysis of Sidetrade’s customer profiles, which is enhanced by the

consolidation of SHS Viveon, is underpinned by impressive growth of

44% in subscriptions with multinationals generating

€2.5 billion-plus

revenue. These contracts now account for 50% of

Sidetrade’s total subscriptions, proving critical to the

Company’s development strategy.

More generally, subscriptions with

multinationals achieving

€1.0 billion-plus revenue

now represent 79% of the total portfolio, cementing

Sidetrade’s strengthened position as the partner of choice among

large corporations.

The acquisition of SHS Viveon substantially

contributed to this performance, providing an established portfolio

of key accounts and widening the scope for Sidetrade with major

companies in the DACH region. With this expanded customer base,

Sidetrade is firmly positioned to sustain demand and fully

capitalize on these new opportunities over the next few

quarters.

It should be noted that all multi-year

Sidetrade contracts are routinely indexed to inflation

(the Syntec for Southern Europe, the UK CPI for Northern Europe and

the US CPI for the United States). This measure alters the total

price of SaaS subscriptions each year by reference to changes in

these price indices, without the need for contract renewals.

Sidetrade rises to the Top 15% in

EcoVadis ratings

2024 marked a new milestone for Sidetrade in

terms of social and environmental performance as the Group was

awarded a Silver medal from EcoVadis. As a result, the Company now

ranks among the top 15% rated within its industry.

With a score of 70/100 – an improvement from

2023 – this medal recognizes the Group’s efforts to shrink its

energy footprint while optimizing infrastructure. This success

reaffirms Sidetrade’s status as a responsible partner in the

transition towards a sustainable economy.

Sidetrade looks ahead to the fiscal year

2025 with confidence and a clear vision, and has the resources to

fulfill its ambitions.

Next financial

announcement

Annual Results for 2024: March 26, 2025 (after the stock market

closes)

Investor

relations

Christelle Dhrif

00 33 6 10 46 72

00

cdhrif@sidetrade.com

About

Sidetrade

(www.sidetrade.com)

Sidetrade (Euronext Growth: ALBFR.PA) provides a SaaS platform

designed to revolutionize how cash flow is secured and accelerated.

Leveraging its next-generation AI, nicknamed Aimie, Sidetrade

analyzes $6.1 trillion worth of B2B payment transactions daily in

its Cloud, thereby anticipating customer payment behavior and the

attrition risk of more than 38 million buyers worldwide. Aimie

recommends the best operational strategies, dematerializes and

intelligently automates Order-to-Cash processes to enhance

productivity, results and working capital across organizations.

Sidetrade has a global reach, with 400+ talented employees based in

Europe, the United States and Canada, serving global businesses in

more than 85 countries. Amongst them: Bidcorp, Biffa, Bunzl, Engie,

Expedia, Inmarsat, KPMG, Lafarge, Manpower, Opentext, Page,

Randstad, Saint-Gobain,

Securitas, Sodexo, Tech Data, UGI, and Veolia. Sidetrade is a

participant of the United Nations Global Compact, adhering to its

principles-based approach to responsible business.

For further information, visit us at www.sidetrade.com and

follow @Sidetrade on LinkedIn.

In the event of any discrepancy between the French and English

versions of this press release, only the French version is to be

taken into account.

- Sidetrade: Outstanding 26% growth in Revenue for 2024

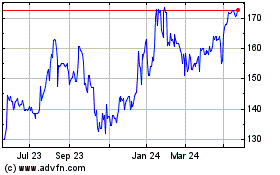

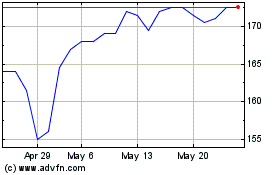

SideTrade (EU:ALBFR)

Historical Stock Chart

From Dec 2024 to Jan 2025

SideTrade (EU:ALBFR)

Historical Stock Chart

From Jan 2024 to Jan 2025