- The funds raised represent 110% of the Initial Offer; the

net amount of €14.9 million will contribute to the Company's

short-term financing

- Together, demand and underwriting and guarantee commitments

reached €18.8 million and were allocated as follows:

- €9.2 million as part of the global offering, including €7.8

million in subscription commitments (100% allocation) and €1.4

million in guarantee commitments (24% allocation), representing 56%

of the Offer

- €7.3 million as part of the public offering, i.e. a 100%

allocation, representing 44% of the Offer

- After the Offer, the Company's 12-month financing need

amounts to c. €50 million (with a cash runway to end-February

2024), which could be reduced to €35 million (with a cash runway to

mid-May 2024) in the case of a definitive agreement with the

EIB1

Regulatory News:

NOT FOR DISTRIBUTION IN THE UNITED STATES OF

AMERICA, CANADA, AUSTRALIA OR JAPAN

CARMAT (FR0010907956, ALCAR), designer and developer of the

world’s most advanced total artificial heart, aiming to provide a

therapeutic alternative for people suffering from advanced

biventricular heart failure (the “Company” or

“CARMAT”), announces the completion of its capital increase

by way of a public offering without preferential subscription

rights for a total gross amount of €16.5 million, including the

partial exercise of the overallotment option granted by the Company

to the Lead Manager and Bookrunner, for a gross amount of €1.5

million.

Stéphane Piat, Chief Executive Officer of CARMAT, said:

"I would like to thank all investors, both historical and new,

individual and institutional, who have contributed to the success

of this capital increase, and thus demonstrated their confidence in

the development of our Company. The funds raised will, in the

coming weeks and months, enable us to build on the sales momentum

initiated in the fourth quarter of 2023. More and more patients

will thus be able to benefit from our unique therapy. We are more

than ever determined to move forward and make Aeson® a reference

therapy in the treatment of advanced biventricular heart

failure."

Use of proceeds of the Offering

The Company plans to use the funds raised to strengthen its

equity and finance its short-term working capital requirements; and

in particular to continue the development of its production and

sales, as well as its EFICAS clinical trial in France.

Following this capital increase, the Company estimates its

financing needs for the next 12 months at about €50 or €35

million2, depending on the outcome of its ongoing discussions with

its financial creditors3 (in particular the European Investment

Bank or "EIB"), which is anticipated in the first quarter of

2024.

Should a final agreement with the EIB not materialize, CARMAT's

financing needs for the next 12 months would amount to c. €50

million, and the Company could fund its activities until February

22, 2024 without any further financing.

Assuming the conditional agreement in principle with the EIB is

implemented, this financing need would be reduced to €35 million,

and the Company's cash runway would, without any further new

financing, be extended to mid-May 2024.

CARMAT anticipates to reach an agreement with its financial

creditors by the end of the first quarter of 2024 and carries on

working very actively to secure additional financing in the

short-term, to enable the Company to further extend its cash

runway.

Terms of the Offering

The Company's Chief Executive Officer decided on Sunday, January

28, 2024, to issue 3,759,399 new ordinary shares at a unit price of

€3.99 (including issue premium), representing a total capital

increase of €15,000,002.01 (including issue premium). This capital

increase was increased by a further 382,071 new ordinary shares

(together with the new shares issued in connection with the initial

Offer, the "New Shares"), representing an additional amount

of €1,524,463.29 (including share premium), following the partial

exercise of the overallotment option granted by the Company to the

Lead Manager and Bookrunner.

The New Shares were the subject of a global offering (the

"Offering") comprising (a) a public offering in France,

primarily aimed at individuals (the "Public Offering"), and

(b) a global placement aimed at institutional investors (the

"Global Placement").

The New Shares were allocated as follows:

- 2,314,819 New Shares were allocated to subscriptions under the

Global Offering, of which 814,534 to investors who had given a

subscription commitment and 352,173 to guarantors (representing a

servicing rate of around 24% of the amount of their initial

commitments); and

- 1,826,651 New Shares were allocated to subscriptions under the

Public Offering.

In return for their guarantee commitments, the guarantors

received a fee equal to €0.32 million (corresponding to 5% of their

total commitment and 2% of the amount effectively called).

In accordance with Article 6 of EU Delegated Regulation

2016/1052 of March 8, 2016, Invest Securities, in its capacity as

stabilizing agent, reports that no stabilization operation has been

implemented, and that the stabilization period was terminated

today.

Breakdown of share capital and voting rights following the

Offer

To the best of the Company's knowledge, its shareholder

structure before and after the completion of the Offer will be as

follows:

Shareholders

Before the Offer

After the Offer

After the Offer on a diluted

basis (2)

Number of

shares

% of

capital

% of voting

rights (1)

Nombre

d’actions

Number of

shares

% of

capital

% of voting

rights (1)

% du

capital

Number of

shares

Lohas SARL

2,946,954

11.9%

10.2%

3,322,893

11.5%

10.0%

3,322,893

10.6%

9.3%

Matra Défense SAS

2,670,640

10.8%

12.6%

2,670,640

9.2%

11.0%

2,670,640

8.5%

10.3%

Sante Holdings SRL

2,518,344

10.2%

12.6%

2,894,283

10.0%

12.2%

2,894,283

9.2%

11.3%

Corely Belgium SPRL

880,000

3.6%

5.8%

880,000

3.0%

5.0%

880,000

2.8%

4.7%

Bratya SPRL

99,490

0.4%

0.7%

99,490

0.3%

0.6%

99,490

0.3%

0.6%

Pr. Alain Carpentier &

Famille

491,583

2.0%

3.4%

491,583

1.7%

3.0%

491,583

1.6%

2.8%

ARSF A. Carpentier

115,000

0.5%

0.8%

115,000

0.4%

0.7%

115,000

0.4%

0.6%

Therabel Invest

679,050

2.7%

2.3%

741,706

2.6%

2.2%

747,706

2.4%

2.1%

Cornovum

458,715

1.9%

1.6%

458,715

1.6%

1.4%

458,715

1.5%

1.3%

Stéphane Piat

174,165

0.7%

1.6%

174,165

0.6%

1.4%

1,182,608

3.8%

3.5%

Auto-Détention

6,474

0.0%

0.0%

6,474

0.0%

0.0%

6,474

0.0%

0.0%

Flottant

13,747,621

55.5%

48.4%

17,074,557

59.0%

52.4%

18,566,021

59.1%

53.6%

TOTAL

24,788,036

100.0%

100.0%

28,929,506

100.0%

100.0%

31,435,413

100.0%

100.0%

(1)

Percentage of exercisable voting

rights out of 28,966,063 theoretical voting rights at 12/31/2023,

the difference between the percentage of capital and voting rights

being explained mainly by the existence of double voting

rights.

(2)

At the date of the Prospectus,

there were 2,439,907 bonus shares not yet definitively allocated

and 66,000 warrants outstanding. This diluted basis does not take

into account the number of shares likely to be issued in connection

with the equitization of the EIB loan, which cannot be precisely

determined as it will depend in particular on future trends in

CARMAT's share price4.

Amount and percentage of the dilution immediately resulting

from the Offering

For guidance purposes, the impact of the Offering on the stake

of a shareholder holding 1% of the Company’s share capital prior to

the Offering and not subscribing to it, and on the portion of the

Company’s shareholders’ equity per share would be as follows (based

on 24,788,036 shares outstanding and unaudited shareholders’ equity

of -€17.54 million as of November 30, 2023):

Portion of capital

Portion of shareholders’

equity

per share

Non-diluted

basis

Diluted basis

Non-diluted

basis

Diluted basis

Before the Offering

1.00%

0.91%

-0.708

-0.597

After the issuance of 4,141,470

New Shares

0.86%

0.79%

-0.091

-0.044

* At the date of Prospectus, 2,439,907

bonus shares and 66,000 warrants were outstanding. This diluted

basis does not take into account the number of shares likely to be

issued in connection with the equitization of the EIB loan, which

cannot be precisely determined as it will depend in particular on

future trends in CARMAT's share price.

Lock-up commitment by the Company - No commitment to retain

shares

CARMAT continues its development and intends to keep open the

possibility of implementing other initiatives aimed at securing

additional financing and alleviating its cash flow constraints.

In this context, the Company has granted Invest Securities, the

Lead Manager and Bookrunner, a lock-up commitment until March 15,

2024, subject to certain customary exceptions, and the issuance by

the Company of securities in connection with the planned

“equitization” of the EIB loan.

It is specified that no lock-up commitment has been asked for in

the context of the Offering neither from the Company’s existing

shareholders nor from investors who have committed to subscribing

to the Offering.

Settlement and delivery of the New Shares

Settlement and delivery of the New Shares and their admission to

trading on the Euronext Growth multilateral trading facility in

Paris are scheduled on January 31, 2024.

The New Shares will be listed on the same line as the Company's

existing ordinary shares, will carry dividend rights and will be

immediately fungible with the Company's existing shares.

Availability of the prospectus

The Public Offer has been the subject of a prospectus approved

by the French Financial Markets Authority (Autorité des marchés

financiers - the “AMF”) on January 17, 2024 under number

24-005 (the “Prospectus”). This prospectus comprises: (i)

the Company’s 2022 universal registration document filed with the

AMF on April 21, 2023 under number D.23-0323 (the “2022

URD”); (ii) an amendment to the 2022 URD filed with the AMF on

January 17, 2024 under number D.23-0323-A1 (the

“Amendment”); (iii) a securities note (the “Note

d’Opération”); and (iv) a summary of the Prospectus included in

the Note d’Opération.

The Prospectus is available online on the CARMAT

(www.carmatsa.com) and AMF (www.amf-france.org) websites. The

approval of the Prospectus should not be taken as an endorsement by

the AMF of the securities offered.

Risk Factors

Investors are invited to carefully consider the risk factors

described in chapter 2 “Risk Factors” of the 2022 URD, and in

particular the “Funding risk”, “Risk of operational and financial

unviability”, “Risk associated with production quality” and “Risk

associated with the supply of materials and components” sections,

as updated in chapter 4 of the Amendment and chapter 3 “Risk

Factors associated with the Offering” of the Note d’Opération.

Partners in the transaction

INVEST SECURITIES

EuroLand Corporate

Lead Manager and Bookrunner

Advisor

***

About CARMAT

CARMAT is a French MedTech that designs, manufactures and

markets the Aeson® artificial heart. The Company’s ambition is to

make Aeson® the first alternative to a heart transplant, and thus

provide a therapeutic solution to people suffering from end-stage

biventricular heart failure, who are facing a well-known shortfall

in available human grafts. The world’s first physiological

artificial heart that is highly hemocompatible, pulsatile and

self-regulated, Aeson® could save, every year, the lives of

thousands of patients waiting for a heart transplant. The device

offers patients quality of life and mobility thanks to its

ergonomic and portable external power supply system that is

continuously connected to the implanted prosthesis. Aeson® is

commercially available as a bridge to transplant in the European

Union and other countries that recognize CE marking. Aeson® is also

currently being assessed within the framework of an Early

Feasibility Study (EFS) in the United States. Founded in 2008,

CARMAT is based in the Paris region, with its head offices located

in Vélizy-Villacoublay and its production site in Bois-d’Arcy. The

Company can rely on the talent and expertise of a multidisciplinary

team of circa 200 highly specialized people. CARMAT is listed on

the Euronext Growth market in Paris (Ticker: ALCAR / ISIN code:

FR0010907956).

For more information, please go to www.carmatsa.com and follow

us on LinkedIn.

Name: CARMAT ISIN code:

FR0010907956 Ticker: ALCAR

Disclaimer

This press release does not constitute an offer to sell nor a

solicitation of an offer to buy ordinary shares of Carmat, and does

not constitute an offer, solicitation or sale in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of any

such state or jurisdiction.

With respect to Member States of the European Economic Area

other than France, no action has been taken or will be taken to

permit a public offering of the securities referred to in this

press release requiring the publication of a prospectus in any such

Member State. Therefore, such securities will only be offered in

any such Member State (i) to qualified investors as defined in

Regulation (EU) 2017/1129 of the European Parliament and European

Council of 14 June 2017, as amended (the “Prospectus

Regulation”) or (ii) in accordance with the other exemptions of

Article 1(4) of Prospectus Regulation.

This press release is an advertisement and not a prospectus

within the meaning of the Prospectus Regulation.

This press release and the information it contains are being

distributed to and are only intended for persons who are (x)

outside the United Kingdom or (y) in the United Kingdom who are

qualified investors (as defined in the Prospectus Regulation as it

forms part of domestic law by virtue of the European Union

(Withdrawal) Act 2018) and are (i) investment professionals falling

within Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005, as amended (the “Order”),

(ii) high net worth entities and other such persons falling within

Article 49(2)(a) to (d) of the Order (“high net worth companies”,

“unincorporated associations”, etc.) or (iii) other persons to whom

an invitation or inducement to participate in investment activity

(within the meaning of Section 21 of the Financial Services and

Market Act 2000) may otherwise lawfully be communicated or caused

to be communicated (all such persons in (y)(i), (y)(ii) and

(y)(iii) together being referred to as “Relevant Persons”).

Any invitation, offer or agreement to subscribe, purchase or

otherwise acquire securities to which this press release relates

will only be engaged with Relevant Persons. Any person who is not a

Relevant Person should not act or rely on this press release or any

of its contents.

This press release may not be distributed, directly or

indirectly, in or into the United States. This press release and

the information contained therein does not, and will not,

constitute an offer of securities for sale, nor the solicitation of

an offer to purchase, securities in the United States or any other

jurisdiction where restrictions may apply. Securities may not be

offered or sold in the United States absent registration or an

exemption from registration under the U.S. Securities Act of 1933,

as amended (the “Securities Act”). The securities of Carmat

have not been and will not be registered under the Securities Act,

and Carmat does not intend to conduct a public offering in the

United States.

MIFID II Product Governance/Target Market: solely for the

purposes of the requirements of Article 9.8 of the Delegated

Directive (EU) 2017/593 relating to the product approval process,

the target market assessment in respect of the shares of Carmat has

led to the conclusion in relation to the type of clients criteria

only that: (i) the type of clients to whom the shares are targeted

is eligible counterparties and professional clients and retail

clients, each as defined in Directive 2014/65/EU, as amended

(“MiFID II”); and (ii) all channels for distribution of the

shares of Carmat to eligible counterparties and professional

clients and retail clients are appropriate. Any person subsequently

offering, selling or recommending the shares of Carmat (a

“distributor”) should take into consideration the type of

clients assessment; however, a distributor subject to MiFID II is

responsible for undertaking its own target market assessment in

respect of the shares of Carmat and determining appropriate

distribution channels.

The distribution of this press release may be subject to legal

or regulatory restrictions in certain jurisdictions. Any person who

comes into possession of this press release must inform him or

herself of and comply with any such restrictions.

Any decision to subscribe for or purchase the shares or other

securities of Carmat must be made solely based on information

publicly available about Carmat. Such information is not the

responsibility of Invest Securities and has not been independently

verified by Invest Securities.”

______________________________ 1 For further details on this

agreement, please refer to the Company's press release dated

January 12, 2024. 2 For further details, please refer to the

statement on the Company's working capital, included in the

Prospectus for the offering approved by the Autorité des marchés

financiers (the "AMF") on January 17, 2024 under number 24-005 (the

"Prospectus"). 3 For further details, please refer to the

Prospectus and see the Company's press release dated January 12,

2024 on the conditional agreement in principle reached with the

European Investment Bank. 4 For further details of this potential

equitization, please refer to the Company’s press release dated

January 12, 2024. The attention of investors is drawn to the fact

that the implementation of the “equitization” mechanism

(extinguishment of liabilities through spread issues of shares to

be sold within a short period of time) on all or part of the

tranches of the loan (representing a maximum of €48 million

including interest) is likely to result in significant dilution and

downward pressure on the share price.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240128272091/en/

CARMAT Stéphane Piat Chief Executive Officer

Pascale d’Arbonneau Chief Financial Officer Tel.: +33 1

39 45 64 50 contact@carmatsas.com

Alize RP Press Relations

Caroline Carmagnol Tel.: +33 6 64 18 99 59

carmat@alizerp.com

NewCap Financial Communication & Investor

Relations

Dusan Oresansky Tel.: +33 1 44 71 94 92

carmat@newcap.eu

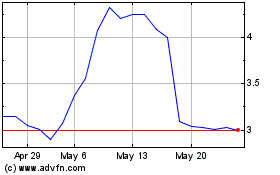

Carmat (EU:ALCAR)

Historical Stock Chart

From Dec 2024 to Jan 2025

Carmat (EU:ALCAR)

Historical Stock Chart

From Jan 2024 to Jan 2025