BIOCORP Reports Half-year Results as of June 30, 2023

05 September 2023 - 2:00AM

Business Wire

- Operating revenues up 21% to €4.1 million

- Net loss for the first half of the year at

€3.8 million

Regulatory News:

BIOCORP (FR0012788065 – ALCOR / Eligible PEA‐PME) (Paris:ALCOR),

a French company specialized in the design, development, and

manufacturing of innovative medical devices, presents its half-year

financial results as of June 30, 20231.

Éric Dessertenne, CEO of BIOCORP, commented: “The first half of

2023 has been very dynamic for Biocorp with the main event being

the conclusion of discussions with NOVO NORDISK, our commercial

partner of the Mallya platform since 2021. NOVO NORDISK began the

takeover of BIOCORP with the firm intention of preserving the

capacity for innovation, the investment effort and the

entrepreneurial spirit that have always driven us. Given NOVO

NORDISK's global presence, this transaction represents the best

opportunity to develop new connected devices and make them

available to the greatest possible number of patients suffering

from serious chronic diseases such as diabetes. Over the last few

weeks, the work undertaken by our respective teams has confirmed

this desire with great enthusiasm".

Half-year results as of June 30th, 2023

- Turnover for the first half of 2023 amounts to €4,112 K, up

36.5% from €3,011 K a year earlier.

- Sales of manufactured products for €1,297 K – 100% increase

compared to the first half of 2022. Contract manufacturing activity

remains flat.

- Sales of development services: €2,814 K – increase of 19%

compared to the first half of 2022.

- Operating expenses rose by 35% to €8,035 K (vs. €5,948 K in H1

2022) and are explained by the increase in salaries and expenses

related to the recruitments made last year to structure some

departments of the Company (regulatory, R&D, purchasing,

project management), an increase in component consumption, an

increase in certain overheads, and a provision for obsolete

component inventory.

- Taking these elements into account, the Gross Operating Profit

(EBITDA) is negative at (€3,080 K), compared to (€2,145 K) in the

first half of 2022, the operating result for the first six months

of the year came to a loss of €3,905 K compared with a loss of

€2,529 K in the first half of 2022.

- The half-year financial result shows a loss of (€119 K)

compared to (€39 K) a year earlier.

- Exceptional items were positive at €97 K on June 30, 2023,

compared to €156 K in the first half of 2022.

- For tax purposes, BIOCORP estimates that it will have acquired

a Research Tax Credit (CIR) of €129 K by June 30, 2023. CIR and CII

had been estimated at 99 K€ a year earlier.

- Considering the above elements, on June 30, 2023, the net

result is negative at (€3,798 K) compared to a loss of (€2,313 K)

in the first half of 2022. As a consequence, the amount of the

shareholders' equity as at June 30, 2023 is (€1,240 K).

In K€

June 30th, 2023

June 30th, 2022

December 31st, 2022

Sales

4,112

3,011

11,670

Other operating income

18

408

178

Total operating income

4,130

3,419

11,848

Gross operating profit (EBITDA)

-3,080

-2,145

43

Net operating income

-3,905

-2,529

-732

Net financial income

-119

-39

-61

Exceptional income

98

156

-117

Research Tax Credit & Innovation Tax

Credit

-129

-99

259

Net profit

-3,798

-2,313

-651

Cash at bank

2,582

590

2,666

Financial debts

8,786

4,197

5,776

- On June 30, 2023, cash at bank totaled €2,582 K (vs. €590 K in

H1 2022), including €3,000 K received from the issuance of deeply

subordinated bills (billets de trésorerie court terme) which are

due for redemption on September 22, 2023.

- Total financial debt as at 30 June 2023 amounts to €8,786 K

(vs. €4,197 K in H1 2022) and was composed of convertible bonds

(emprunts obligataires convertibles) subscribed by Vatel Capital

for €2,291 K, bank debt (dettes bancaires) for €3,080 K, short-term

commercial paper (concours bancaires court terme) for €3,002 K and

other financial debts (autres dettes financières) for €413 K.

Highlights of the first half of 2023

- Signature of an industrial partnership with the pharmaceutical

company HRA Pharma, a subsidiary of the world leader in

self-medication products Perrigo company plc, for the development

of an innovative medical device for the healing of skin

lesions.

Post-period key factors2

- Completion on August 4, 2023 of the acquisition by Novo Nordisk

of a controlling interest in BIOCORP. The offer price is €35.00 per

share.

- In the context of such acquisition, all the convertible bonds

issued by Biocorp have been reimbursed in cash on August 4, 2023

for an amount of €2,263k and an intra-group loan agreement has been

entered into between Biocorp and Novo Nordisk for the purposes of

this reimbursement and financing of Biocorp’s working capital.

- On August 7, 2023, Novo Nordisk filed with the Autorité des

marchés financiers a draft simplified mandatory tender offer to

purchase the remaining shares of Biocorp at the aforementioned

price of €35.00 per share (the “Offer”), followed by a squeeze-out

of the Company in the event that the conditions required to

implement the squeeze-out are met at the end of the Offer.

Completion of the Offer is subject to a declaration of compliance

from the Autorité des marchés financiers.

- At the date hereof, the ownership of the BIOCORP's share

capital and voting rights is distributed as follows:

Shareholder

Number of shares

% of the share capital

Number of theoretical voting

rights

% of theoretical voting

rights

Novo Nordisk Region Europe A/S3

3,307,836

74.97%

3,307,836

74.68%

Jacques GARDETTE

3,200

0.07%

3,400

0.08%

Jacques GARDETTE family

1,000

0.02%

2,000

0.05%

Treasury shares

9,724

0.22%

9,724

0.22%

Public

1,090,526

24.72%

1,106,108

24.97%

Total

4,412,286

100%

4,429,068

100%

Prospects for the second half of 2023

- Favorable perspectives for the demand of our Mallya platform,

in comparison to the first half of 2023.

- Biocorp expects Mallya production capacities to increase by the

end of the year, thanks to the new assembly zone in the

manufacturing site of Issoire.

- Subject to completion of the Offer, the intentions of Novo

Nordisk with respect to Biocorp are detailed in the draft offeror

information notice. Novo Nordisk notably indicates that it intends

to pursue the main strategies being implemented by the Company and

to support its development as part of its integration into the Novo

Nordisk group.

The half-year financial report for 2023 will be made available

by October 31st on the Company's website, in the "Investors"

section.

ABOUT BIOCORP Recognized for its expertise in the

development and manufacture of medical devices and delivery

systems, BIOCORP has today acquired a leading position in the

connected medical device market thanks to Mallya. This smart sensor

for insulin injection pens allows reliable monitoring of injected

doses and thus offers better compliance in the treatment of

patients with diabetes. Available for sale from 2020, Mallya

spearheads BIOCORP's product portfolio of innovative connected

solutions. The company has 85 employees. BIOCORP is listed on

Euronext since July 2015 (FR0012788065 – ALCOR).

For more information, please visit www.biocorpsys.com.

1 The Board of Directors of BIOCORP, meeting on September 4,

2023, approved the accounts for the first half of 2023 (not audited

by the statutory auditors). 2 See press releases issued by Biocorp

on June 19, August 4 and August 7, 2023. 3 The shareholding of Novo

Nordisk Region Europe A/S includes 2,838,669 shares resulting from

the acquisition of the controlling block on August 4, 2023, and

469,167 additional shares acquired by Portzamparc on behalf of Novo

Nordisk Region Europe A/S, in accordance with article 231-38 IV of

the AMF General Regulation, since the filing of the draft Offer

with the Autorité des marchés financiers on August 7, 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230904784335/en/

CONTACTS BIOCORP Sylvaine Dessard Senior Director Marketing

& Communication rp@biocorp.fr + 33 (0)6 88 69 72 85

Bruno ARABIAN Press Officer barabian@ulysse-communication.com

+33 (0)6 87 88 46 26

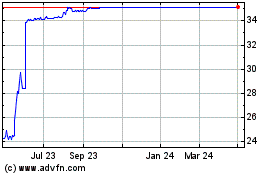

Biocorp (EU:ALCOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Biocorp (EU:ALCOR)

Historical Stock Chart

From Apr 2023 to Apr 2024