- Multiplication of cement sales volumes by more than 3.5

compared with H1 2022: 7,338 tons sold in H1 2023

- Order book of over 250,000 tons to date, +30,000 tons since

January 1st, 2023

- A key international milestone was reached with the signature

of the first licensing contract in Saudi Arabia with the Shurfah

Group

- Industrial deployment in line with plan, marked by H2

commissioning in summer

- Solid financial structure in line with budget: equity of

€71.2 million and cash of €32.8 million (including

investments)

- Confirmation of short- and medium-term financial targets in

a context favourable to decarbonization of the sector

Regulatory News:

Hoffmann Green Cement Technologies (ISIN: FR0013451044, Mnemo:

ALHGR) ("Hoffmann Green Cement" or the "Company"), an industrial

player committed to the decarbonation of the construction sector

that designs and markets innovative clinker-free cements, announces

its results for the first half of 2023. The Company's Supervisory

Board met on September 15, 2023 and reviewed the accounts to June

30, 2023 approved by the Management Board.

Key elements of the Company’s consolidated half-year

accounts

€ thousands - IFRS

At June 30, 2023

At June 30, 2022

Revenue

1,676

544

EBITDA

-3,648

-3,519

Recurring operating profit/loss (EBIT)

-5,133

-4,720

Financial profit/loss

270

-1,454

Tax

1,259

1,586

Net profit/loss

-3,606

-4,558

€ thousands - IFRS

At June 30, 2023

At June 30, 2022

Cash and cash equivalents

32,760

52,775

Shareholders' equity

71,245

76,895

Julien Blanchard and David Hoffmann, Co-founders of Hoffmann

Green Cement Technologies, said: "In the first half of 2023,

Hoffmann Green was able to significantly increased its cement sales

volumes. Thanks to the daily work of all our teams, we are

accelerating the marketing of our innovative clinker-free cement in

a construction market in demand of truly carbon-free solutions.

Considering the seasonality of our sales, we intend to intensify

the transformation of our order book into sales during the second

half of 2023. We are therefore confident of achieving our 2023

revenue target of marketing 24,000 tons of cement, representing

revenue of more than €4.5 million.

At the same time, the Company continued to deploy its industrial

roadmap, with the commissioning of H2, which allow Hoffmann to

significantly increase its production capacity. Finally, Hoffmann

Green recently reached an important stage in its international

development roadmap with the signature of a structuring partnership

with the Shurfah Group, a major construction player in Saudi

Arabia, to support the decarbonization of the Saudi construction

sector.

In the medium term, with the strong sales momentum, the

deployment of our industrial plan in line with schedule and budget,

and a solid financial structure, we confirm that we will achieve

all our financial targets in a context of tightening regulations

(RE 2020, France's Environmental Regulation 2020) that are

increasingly restrictive for traditional cement manufacturers and,

on the contrary, favorable for Hoffmann Green."

H1 2023 achievements: strong growth in sales volumes,

stronger order book thanks to partnerships in France and abroad,

industrial deployment and CSR awards

Multiplication by more than 3.5 in cement sales volumes and

continued growth in the order book:

- Cement sales volumes up +251.6% year-on-year to 7,338 tons, in

line with the Company's 2023 target of 24,000 tons, with

historically higher sales in the second half of the year. Sales

mainly concerned H-UKR technology;

- Order book at over 250,000 tons, up 30,000 tons thanks to the

signing of 11 structuring partnerships and order commitments with

major players in the sector: VM Matériaux (H-IONA bags), Belin

Promotion, Groupe Alkern, OGIC, GCC (partnership extended), BSS,

Groupe Minier, Iribarren, Vendée Habitat, Domofrance and Marne

Béton.

Accelerated international expansion :

- 22-year licensing agreement in Saudi Arabia with the Shurfah

Group to build several vertical H2 units to support the

decarbonization of the country's construction sector. In return for

the industrial and technological transfer and this exclusivity,

Hoffmann Green will receive an entry fee from Shurfah, as well as

fixed and variable annual royalties based on revenue generated by

the selling of Hoffmann cements in Saudi Arabia;

- Signature of a partnership with the Eloy group to develop

carbon-free construction in Belgium, in particular for pilot

ready-mix concrete and prefabrication applications.

Continued implementation of industrial strategy, with budget

in line with plan:

- Commissioning of H2, the world's first vertical cement plant,

since June 30, 2023. Built entirely from Hoffmann cements, the

plant enables production capacity to be increased by 250,000 tons

of cement per year, in line with the Group's ambitions and growing

demand. The investment of €22.4 million is in line with

forecasts;

- Commissioning of Hoffmann Green's R&D concrete plant since

the beginning of April 2023. Equipped with solar trackers and

ultra-modern water treatment systems, this 4.0 plant combines

modernity and eco-responsibility, like all the Company's equipment.

It will enable the internal development of R&D activities such

as testing of future technologies and the development of certain

concrete formulations specific to Hoffmann Green's customers. Its

investment amounts to €2.0 million;

- Rehabilitation and commissioning during the summer of the site

of its subsidiary Hoffmann Microtech, acquired in June 2022. The

work made it possible to internalize the industrial process of

grinding blast furnace slag, one of the raw materials used in H-UKR

and H-IONA cements. The investment budget is €2.5 million.

Awards recognizing the Company's CSR commitments and

innovation policy:

- Awarded the Paulownias Prize by the Collège des Directeurs du

Développement Durable (C3D), which recognizes the managers of

tomorrow's companies who are committed to sustainable

development;

- Laureate of the "Waste and Circular Economy Showcase" at the

14ème National Forum organized by the PEXE network in partnership

with ADEME at the French Ministry of the Economy, Finance and

Industrial and Digital Sovereignty;

- Laureate of the French Tech 2030 program, an ambitious new

support program operated by La Mission French Tech alongside the

Secrétariat général pour l'investissement (SGPI) and

Bpifrance;

- Member of the World Cement Association (WCA), the world's

largest independent organization working on behalf of the cement

industry.

2023 half-year results

The Company's revenue amounted to €1.7 million, corresponding

mainly to cement sales of €1.6 million and the invoicing of carbon

credits in the amount of €0.1 million. During the first half of

2023, the Company pursued its commercial development with a +251.6%

year-on-year increase in cement sales volumes (7,388 tonnes in H1

2023 vs. 2,087 tonnes in H1 2022).

EBITDA was stable year-on-year (-€0.1 million). At the end of

June 2023, it stood at -€3.6 million, compared to -€3.5 million at

the end of June 2022. The year-on-year decrease in operating

expenses (+€0.2 million), due to tight control of certification

costs, was offset by the rise in personnel costs (-€0.3 million).

The Company's workforce increased from 41 at the end of June 2022

to 56 at the end of June 2023. The sales, R&D, technical and

operating teams have been strengthened in accordance with the

Company's development plan.

Operating income before non-recurring items for H1 2023 came to

-€5.1 million. Change over one year (-€0.4 million) is explained by

the evolution of EBITDA and higher depreciation charges.

Financial result was +€0.3 million, up significantly compared

with the previous year (+€1.7 million). As a reminder, the

Financial Result at the end of June 2022 (-€1.5 million) was marked

by the fall in value of the Company's UCITS linked to the effects

of the war in Ukraine on the financial markets.

After taking into account tax income of €1.3 million, net income

at the end of June 2023 was €3.6 million, compared with €4.6

million at June 30, 2022.

Solid financial structure in line with budget

At June 30, 2023, the Company had a solid balance sheet, with

shareholders' equity of €71.2 million.

Available cash amounted to €21 million (and €32.8 million

including investments), in line with the Company's development

plan.

The change in cash and cash equivalents over the first half of

2023 (-€9.2 million) is explained by operating cash flows (-€3.8

million), investment cash flows (-€3.5 million) linked to the

completion of work on the H2 production unit, the construction of

the concrete plant and work to upgrade Hoffmann Microtech's

production site, as well as loan repayments (-€1.9 million).

The Company's financial statements to June 30, 2023 will be

disclosed in the Company's half-yearly financial report, which will

be made available to shareholders on the Company's website by

October 30, 2023 at the latest, in accordance with legal and

regulatory requirements.

Strategy and outlook: short and medium-term financial targets

confirmed

In H2 2023, the Company will continue to execute its

strategic plan, with a particular focus on :

- Market a volume of 24,000 tons of cement by 2023, equivalent to

13,000 truckloads of concrete. This represents sales in excess of

€4.5 million. Given the seasonal nature of its sales, which are

higher in the second half of the year, the Company is confident of

achieving this target;

- Pursue its industrial deployment through the H3 project, for

which construction of the plant is scheduled to start in the first

half of 2024, for delivery in 2025. This schedule is in line with

the Company's industrial ambitions by 2026;

- Continue to sign contracts with strategic partners in France

and abroad;

- Develop the marketing of its carbon credits;

- Develop a fifth technology.

Confirmation of 2026 targets: revenue of €130 million and

EBITDA margin of 40%.

Despite the current economic climate, the Company considers that

it is well positioned and has strengthened its model in relation to

the decarbonization challenges facing the construction sector.

Unlike traditional cement manufacturers, the Company is

energy-efficient thanks to its clinker-free cold production

process, which requires little electricity. This is an asset for

its development in France and Europe in the current energy crisis.

What's more, from 2025 onwards, with the application of its second,

more restrictive threshold, France's Environmental Regulation 2020

(RE2020) will force construction players to use more low-carbon

cements, which will encourage the development of Hoffmann

cements.

In this context, Hoffmann Green has confirmed its target of

selling 550,000 tons of cement a year from three production sites

in France by 2026, representing revenue of around €120 million and

a 3% share of the French market.

At the same time, on an international scale, as already

undertaken in Switzerland and more recently in Saudi Arabia, the

Company aims to expand through licensing agreements with partners

responsible for financing, building and operating Hoffmann Green

vertical production units in their geographical territory, and for

marketing the Company's technologies. The Company aims to have 4

units operational by 2026, generating sales of around €10 million.

Construction of the first plant is due to start next year in Saudi

Arabia.

Overall, the Company expects to achieve an EBITDA margin of

around 40% by 2026, with the intermediate milestones of positive

EBITDA from 2024 and positive EBITDA from 2025.

ABOUT HOFFMANN GREEN CEMENT TECHNOLOGIES

Founded in 2014 and based in Bournezeau (Vendée, Western

France), Hoffmann Green Cement Technologies designs, produces and

distributes innovative extremely low-carbon cements – with a carbon

footprint 5 times lower than traditional cement – that present, at

equivalent dosage and with no alteration to the concrete

manufacturing process, superior performances than traditional

cement.

Hoffmann Green has two production units powered by a fleet of

solar trackers on the Bournezeau site: a 4.0 plant and H2, the

world's first vertical cement plant, which was inaugurated in May

2023. A third plant will be built at the major port of Dunkirk in

2024-2025, bringing total production capacity to 550,000 tonnes a

year, or 3% of the French market. The Group has developed a genuine

technological breakthrough based on the modification of cement

composition and the creation of a cold manufacturing process, 0%

clinker and low energy consumption, making it a leading and unique

player in the cement market, which has not changed for 200

years.

Within the context of the climate emergency and energy price

inflation, Hoffmann Green Cement is thus actively participating in

the energy transition by producing a clean cement that consumes 10

to 15 times less energy than a Portland cement, by working to

create eco-responsible buildings and by encouraging the circular

economy and the preservation of natural resources. Thanks to its

unrivaled technological know-how that is constantly improving,

driven by effective and cutting-edge teams, Hoffmann Green Cement

Technologies addresses all construction sector markets, both in

France and abroad.

Hoffmann Green was chosen as one of the 20 French green

start-ups in 2022 as part of the French Tech Green20 programme, run

by Mission French Tech in partnership with the French Ministry for

Ecological Transition. In June 2023, the company was selected as

part of French Tech 2030, an ambitious new support programme run by

La Mission French Tech alongside the General Secretariat for

Investment (SGPI) and Bpifrance.

The company is continuing to expand internationally, signing

contracts in the UK, Belgium, Switzerland and recently Saudi

Arabia.

For further information, please go to:

www.ciments-hoffmann.com/

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230917100909/en/

Hoffmann Green

- Jérôme Caron

- Chief Financial Officer

- finances@ciments-hoffmann.fr

- +33 2 51 460 600

NewCap Investor Relations

- Pierre Laurent

- Thomas Grojean

- Quentin Massé

- ciments-hoffmann@newcap.eu

- +33 1 44 71 94 94

NewCap Media Relations

- Nicolas Merigeau

- Antoine Pacquier

- ciments-hoffmann@newcap.eu

- +33 1 44 71 94 98

Hoffmann Green Cement Technologies | Telephone: +33 2 51 460

600 | Email: finances@ciments-hoffmann.fr

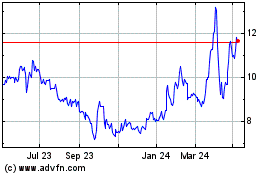

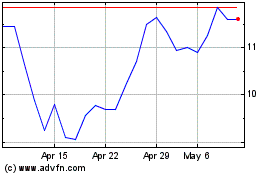

Hoffmann Green Cement Te... (EU:ALHGR)

Historical Stock Chart

From Apr 2024 to May 2024

Hoffmann Green Cement Te... (EU:ALHGR)

Historical Stock Chart

From May 2023 to May 2024