HOPSCOTCH GROUPE : 2022 Annual results

31 March 2023 - 3:32AM

HOPSCOTCH GROUPE : 2022 Annual results

Press ReleaseParis, March 30,

2023Annuel Turnover section

HOPSCOTCH GROUPERecord year in

2022Current Operating

Income: 34%

growth Net

Income Group

Share:

5.8 million

euroDividends are

back

HOPSCOTCH Groupe (Euronext

FR0000065278), a communications consulting group and a major player

in Digital, Public Relations, Influence and Events, today

presented its turnover and gross margin, consolidated at 31

December 2022.

|

M€ |

2022 |

2021 |

|

Turnover |

246.809 |

153.679 |

|

Gross Margin (1) |

86.148 |

66.993 |

|

Current Operating Income |

+9.042 |

+6.753 |

|

Operating Income |

+9.359 |

+8.783 |

|

Net Income Group

Share |

+5.578 |

+3.995 |

|

Self-financing capacity (2) |

+10.224 |

+4.391 |

(1) Gross Margin is determined by revenue minus

operational external purchases.(2) Assimilated to

EBITDA / after neutralization of the IFRS 16 effect

Strong rebound of operationsAs

previously communicated, the group's activity recorded a record

level thanks to the continued rebound of events, but also thanks to

continued growth in the Public Relations and digital businesses, as

well as internationally with Sopexa. The integration in the second

half of the year of the sports activities acquired and consolidated

in the second half of the year is supporting growth with a gross

margin of €2.2 million.With operating conditions well under

control, the group is once again knowing favorable margins: current

operating income of 9.0 million euros for a gross margin of 86.1

million euros, i.e. nearly 11%. This performance is now organic,

and should not be compared with the previous year, which still

benefited from significant support measures and tax exemptions

(more than €2 million).After financial expenses and corporate

taxes, consolidated net income reached €6.1 million, of which €5.6

million were attributable to the Group.

Solid financial structureCash

flow, at €44 million at the end of the year, remained stable

compared to last year. The positive cash flow from operations

(€10.2 million) was used in particular for loan repayments (€4.2

million), payment of corporate income tax (€2.8 million) and an

unfavorable change in working capital at the close (€3.0 million).

Cash was also used to buy back treasury shares (€1.2 million).Bank

loans amounted to €27.8 million. The share of the EMP amounted to

€19.1 million. The consolidated financial position net of debt

amounted to €16.3 million, an improvement of €2,2 million compared

to 2021.With a largely positive financial net position and

shareholders' equity of €28 million, a dividend of €0.50 per share

will be proposed to the General Meeting, to be paid on Monday July

10, 2023.

2023 projectionsWith the

dimension reached today, the ambition is to form the first

worldwide communication consulting group, born and rase in Europe,

able to compete in an innovative way with the biggest

networks.Already present in more than 30 countries of the world,

and rich of as many different nationalities, Hopscotch is in

discussions with Vero Group which operates the same businesses in 6

countries of South East Asia, and employs 200 people.Hopscotch is

also strengthening its position in sectorial verticals such as

luxury, mobility, health, or food and lifestyle.Thanks to its solid

financial structure, the group will continue its strategy of

external growth turned towards the international market, and

towards the reinforcement in promising sectors such as

tourism.Finally, the group is constantly reinforcing its CSR

conviction and knowledge: multi-labeled, including EcoVadis

Platinum label (less than 1% of the companies evaluated), Hopscotch

devotes increasing resources to develop its capacities in these

fields.

HOPSCOTCH Groupe will publish its Q1 2023

revenues on May 4th, 2023, after the market close.

________Shareholder

contact

Pierre-Franck MOLEY – General Manager - Tel.

(+33) 01 41 34 20 56 - pfmoley@hopscotchgroupe.com

Press contact

Anne Vernois – Senior Advisor - Tél. 06 20 60 20 83 –

avernois-projets@hopscotchgroupe.com

________

About HOPSCOTCH HOPSCOTCH is an

international communications group founded in France, directed by

its founders and its managers, all guided by a business vision

carried forward by the complementarity of expertise. The credo of

HOPSCOTCH? “Global PR”, created around a unique mix of digital,

event management, influence, public relations and marketing

services.HOPSCOTCH brings together, at its Paris Hub, in Lyon, in

Lille, in Marseille and internationally more than 800 expert

collaborators in all the communication skills: influence, events,

activation, digitalization, internal communications, public

affairs, marketing services…Convinced that the value of an

enterprise or organization resides in the care given to its capital

of human relations, HOPSCOTCH structures its expertise around its

own brand “Hopscotch” (Events / PR / Travel / Décideurs / Congrès /

Luxe / Sport), and specialized agencies: Alizeum, heaven, Human to

Human, Le Public Système Cinéma, Le Public Système PR, Sagarmatha,

Sopexa, Sport&Co and Uniteam.HOPSCOTCH today has an integrated

international network, with 35 offices spread over 5 continents,

allowing a capacity for intervention anywhere in the world.

Quoted on Euronext Growth Paris (Code ISIN :

ALHOP FR 00000 6527 8), in 2022 the group represents a turnover of

€246.9 million and a gross margin of €86.1 million.

Follow us : www.hopscotchgroupe.com et sur LinkedIn / Twitter /

Instagram @HOPSCOTCHgroupe

- CP HOPSCOTCH Groupe_2022 annual results

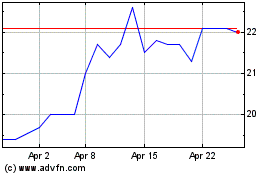

Hopscotch Groupe (EU:ALHOP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hopscotch Groupe (EU:ALHOP)

Historical Stock Chart

From Apr 2023 to Apr 2024