Quantum Genomics (Euronext Growth - FR0011648971

- ALQGC), a biopharmaceutical company specializing in

developing a new drug class that directly targets the brain to

treat difficult-to-treat/treatment-resistant hypertension and heart

failure, announced today it has successfully increased its capital

by removing subscription rights as part of a package to benefit a

category of persons in the sense of article L.225-138 of the French

code of commerce which allowed the Company to raise around 15.6 M€

(The “

Deal”).

For the purposes of this structuring operation

involving a sum of 15.6 M€, 6,408,779 new shares have been issued

with a unit price of 2.44 €, including share premium, with a

discount of 15,0 % compared to the last stock market price,

corresponding to a discount of 23.8% compared to the

volume-weighted average price of the last 20 trading sessions.

In parallel, the pharmaceutical company Gulf

Pharmaceutical Industries Julphar has agreed to a subscription of

capital increase to the sum of $2.0 M, or about 1.87 M€, thus

strengthening its partnership with Quantum Genomics as part of the

marketing and production of Firibastat in the Middle East, Africa,

certain member countries of the Commonwealth of Independent States

and Turkey.

Jean-Philippe Milon, CEO of Quantum

Genomics, stated: “We thank those shareholders who are

renewing their confidence in us as well as new French and

international institutional investors, and our partner Julphar who

have purchased a stake in Quantum Genomics at the time of this

capital increase. This operation will allow us to pursue the

development of firibastat and to diversify our portfolio of

products through an exploration of new therapeutic indications

based on the BAPAI platform.”

Raising capital for a major

project

The company plans to use the proceeds of the

Deal to fund: (i) the continued development of firibastat and (ii)

the exploration of new therapeutic indications based on the BAPAI

platform.

Main terms of the Deal

The Deal consisted of removing the subscriptions

rights of the company’s existing shareholders, through

institutional investors both in France and internationally, as part

of a new share offering (the “New Shares”) to

benefit a category of persons in the sense of articles L.225.138 of

the French code of commerce, through an accelerated bookbuild.

The issue price of the New Shares was set at

2.44 € per share, equating to a discount of 15.0 % in relation to

the closing price of a Quantum Genomics share on April 26, 2022,

and 23.8% in relation to the volume-weighted average price of a

Quantum Genomics share on the Paris Euronext Growth market for the

last 20 trading sessions of the stock market prior to being set

(i.e. from March 28, 2022 to April 26, 2022 inclusive), in

accordance with the 16th resolution as voted for at the mixed

general assembly of the Company on June 24, 2021.

The New Shares will be submitted to all

statutory requirements and will be assimilated into the original

shares once the Deal is definitively completed. The New Shares will

carry current rights and will be listed on the Paris Euronext

Growth market under the same ISIN code FR0011648971 - ALQGC. The

settlement and delivery of new common shares and their listing on

the Paris Euronext Growth market are scheduled for April 29,

2022.Subscription from the pharmaceutical company

Julphar

In parallel with the Operation, the

pharmaceutical company has today agreed to a subscription of

capital increase of $2.0 M, or about 1.87 M€, at a price of 2.44

Euro per share, which equates to the subscription price of the New

Shares issued for the purposes of the Operation. Julphar’s

subscribed shares are subject to a mandatory lock-up agreement of

one year.

The settlement and delivery of Julphar’s

subscribed shares and their listing on the Paris Euronext Growth

market are scheduled for April 29, 2022. They will be submitted to

all statutory requirements and will be assimilated into the

original shares. Julphar’s subscribed shares will carry current

rights and will be listed on the Paris Euronext Growth market under

the same ISIN code FR0011648971 - ALQGC.

A strengthened shareholder

structure

The share capital of the Company will then

comprise 33,852,067shares.

Otium Capital becomes the first shareholder of

Quantum Genomics, with 14.7% of the capital. This strong

reinforcement from this historical shareholder is a true sign of

confidence in the Company’s potential, its development plan and its

capabilities to reach its goals.

Therefore, following the capital increase, the

Company’s capital allocation has changed as follows:

|

Shareholding beforeoperation |

Number ofshares |

Percentage |

|

Shareholding afteroperation* |

|

Number ofshares |

Percentage |

|

Téthys |

993,161 |

3.6 |

% |

|

Téthys |

|

993,161 |

2.9 |

% |

| Otium

Capital |

888,888 |

3.3 |

% |

|

Otium

Capital |

|

4,987,248 |

14.7 |

% |

|

Institutional investors |

5,405,810 |

19.7 |

% |

|

Institutional investors |

|

7,716,229 |

22.8 |

% |

|

Management |

1,740,983 |

6.3 |

% |

|

Management |

|

1,740,983 |

5.2 |

% |

|

Public |

18,414,446 |

67.1 |

% |

|

Public |

|

18,414,446 |

54.4 |

% |

|

Total |

27,443,288 |

100.0 |

% |

|

Total |

|

33,852,067 |

100.0 |

% |

| |

|

|

|

|

|

|

|

|

|

| *informations

before Julphar’s investment |

|

|

|

|

|

|

As an example, a shareholder with 1.00% of the

Company’s capital before the Deal would henceforth hold a stake of

0.81% *.

Financing horizon and liquidity

risk

The post-deal cash of 23.6 M€ million allows the

Company to finance its operations until the 2nd quarter of

2023.

Abstention agreement

For the purposes of the Deal, Quantum Genomics

has made an abstention agreement for a duration of 90 days from the

settlement and payment date of the Operation, subject to the usual

exceptions, thus preventing Quantum Genomics from issuing new

shares during the above-mentioned period.

Lock-up agreement

For the purposes of the Deal, the Management of

Quantum Genomics has entered into a lock-up agreement concerning

their Quantum Genomics shares for a duration of 180 days from the

settlement and payment date of the Deal, subject to the usual

exceptions.

In addition, the pharmaceutical company Julphar

made a commitment to retain the Quantum Genomics shares subscribed

for one year from the settlement date of the Deal, subject to the

usual exceptions.

Gilbert Dupont (Société Générale Group)

is the sole lead arranger and bookrunner for this

Deal.

The legal practice Orsay Avocats

(Frédéric Lerner - Pierre Hesnault) acted as legal counsel for this

Private Placement.

WARNINGS

The offering of New Shares in Quantum Genomics

as part of the Operation will not result in a prospectus being

submitted for the approval of the Autorité des Marchés

Financiers.

This press release does not constitute an offer

of stock market securities or any kind of invitation to purchase or

subscribe for securities in the United States or any other

country.

The Quantum Genomics securities that are the

subject of this press release have not been registered under the

U.S. Securities Act of 1933, as amended, (the “U.S.

Securities Act”), and Quantum Genomics does not intend to

pursue a public offer of its securities in the United States. Stock

market securities can only be offered, subscribed for or sold in

the United States further to registration in accordance with the

U.S Securities Act or if there is an exemption to the mandatory

registration.

Distribution of this press release may, in some

countries, be subject to specific regulations. Persons in

possession of this press release must inform themselves of any

local restrictions and comply with them.

Any decision to subscribe for or purchase shares

in Quantum Genomics should be made solely on the basis of public

information about Quantum Genomics. Gilbert Dupont is not

responsible for this information.

Detailed information about Quantum Genomics, in

particular about its business, results and risk factors, are

available in the annual financial report on the financial year

ending 31 December 2020 published in 2021 and in the half-yearly

financial report of 30 June 2021. These documents as well as other

regulated information and press releases can be consulted on the

Company’s website (https://www.quantum-genomics.com).

About Quantum Genomics

Quantum Genomics is a biopharmaceutical company

specializing in the development of a new class cardiovascular drugs

based on the Brain Aminopeptidase A Inhibition (BAPAI) mechanism.

It is the only company in the world to pursue this innovative

approach directly targeting the brain, founded upon more than

twenty years of research work by Paris-Descartes University and the

INSERM/CNRS laboratory led by Dr. Catherine Llorens-Cortès at the

Collège de France. Quantum Genomics thus aims to develop innovative

treatments for complicated or even treatment-resistant hypertension

(in approximately 30% of patients it is poorly controlled or

treatment failure occurs), and heart failure (one in two patients

diagnosed dies within five years).

Based in Paris and New York, the company is

listed on the Euronext Growth market in Paris (FR0011648971 -

ALQGC) and is registered on the US OTCQX market (symbol:

QNNTF).

Find out more at www.quantum-genomics.com, or on

our Twitter and Linkedin accounts

|

Contacts |

|

Quantum Genomics |

|

contact@quantum-genomics.com |

|

Edifice Communication (EUROPE) |

|

Financial and media communication

quantum-genomics@edifice-communication.com |

|

|

|

LifeSci (USA) |

|

Mike TattoryMedia communication+1 (646) 751-4362 -

mtattory@lifescipublicrelations.com |

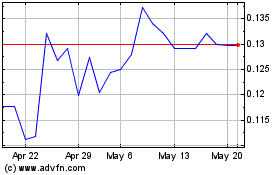

Quantum Genomics (EU:ALQGC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Quantum Genomics (EU:ALQGC)

Historical Stock Chart

From Nov 2023 to Nov 2024