Strong revenue growth of 18% in H1 2022

02 September 2022 - 1:45AM

Strong revenue growth of 18% in H1 2022

PRESS RELEASE Loudéac, France, 1

September 2022

Strong revenue growth of 18% in H1

2022

-

Organic growth of

7%

-

Farming supplies up 19%, driven by external growth, price

rises and continued good sales momentum

-

Farming nutrition up 14% thanks to the aggressive strategy

to win back market share

-

Further sharp growth in the horse and landscape markets,

+17% and +22% respectively

WINFARM (ISIN: FR0014000P11 - ticker:

ALWF), No. 1 French distance-seller for the farming

industry, today announced its revenue for the first half

of 2022.

|

In millions of euros, unaudited |

H1 2022 |

H1 2021 |

Change |

Change at constant scope 1 |

|

Farming supplies |

55.2 |

46.5 |

+19% |

+6% |

|

Farming nutrition |

5.5 |

4.8 |

+14% |

+14% |

|

Other |

0.8 |

0.7 |

ns |

ns |

|

TOTAL |

61.5 |

52.0 |

+18% |

+7% |

WINFARM made consolidated H1 revenue of €61.5m,

up 18% compared to H1 2021 (+7% at constant scope).

The Farming Supplies business

(90% of H1 revenue), whose products are marketed under the Vital

Concept brand, made revenue of €55.2m, up 19% compared to H1 2021.

It benefited from the integration of the €6.3m contribution from

BTN de Haas (consolidated since July 2021). Organic revenue growth

reached 7% on a like-for-like basis. The positive sales trend over

the period was due to the price increases recorded by the Group to

offset higher purchase prices as well as continued good sales

momentum. Within this division, the Vital Concept nutrition

activity grew by more than 15% in H1, contributing to the

division's overall growth of 67%. Given the current period of

drought, farmers are likely to supplement livestock feed in the

coming months, thus boosting the outlook in the months ahead.

The horse and

landscape diversification markets enjoyed

continued good sales trends, up by 17% and 22% respectively.

The Farming Nutrition business

(9% of H1 revenue), marketed under the Alphatech brand, saw revenue

increase by a sharp 14% to €5.5m. The roll-out of a dynamic sales

plan underpinned by an increase in commercial resources and teams

began to show results, with a significant increase in sales in the

Middle East in particular, a priority area of development for the

Group.

EXCELLENT VISIBILITY FOR

2022

Despite pressure on raw material costs at the

start of the year, which affected the entire agricultural sector,

the Group showed a capacity to smoothly pass on the purchase price

increases recorded during the period while retaining its customer

portfolio. These positive trends together with continued strong

sales momentum offer good visibility on future performance, after a

successful first half of the year and a good start to the third

quarter.

In terms of growth drivers, WINFARM should also

benefit in the second half of the year from the acquisition of the

Kabelis Group companies, which were included in

the consolidation scope from 1 August 2022. After the integration

of Kabelis, the Group's Landscape and Green Space business should

generate full-year revenue of nearly €21 million. This

transformative acquisition will create a major player on one of

France's most promising markets, and a leader in Brittany, Normandy

and Pays-de-Loire.

The efforts already underway in the

Farming Nutrition business are expected to

continue during the second half of the year. The Group's ambition

in this activity is to widen the gap in relation to the competition

by enhancing product quality to meet the needs of an exacting

customer base.

Next publication: 2022

half-year results, 6 October 2022 after the market

closes.

About WINFARM

Founded in Loudéac, in the heart of Brittany, in

the early 1990s, WINFARM is now the French leader in distance

selling for the agricultural world. WINFARM offers farmers and

breeders comprehensive, unique and integrated solutions to help

them meet the new technological, economic, environmental and social

challenges of the next generation of agriculture. With a vast

catalogue of more than 15,500 product references (seeds,

phytosanitary, harvesting products, etc.), two-thirds of which are

own brands, WINFARM has more than 44,500 customers in France and

Belgium.

WINFARM generated revenue in 2021 of €108m. By

2025, WINFARM aims to achieve revenue of around €200m and an EBITDA

margin of about 6.5%.

The company is listed on Euronext Growth Paris

(ISIN: FR0014000P11 - ticker: ALWF) - Eligible for PEA PME equity

savings plans - Certified as an "Innovative Company" by

bpifrance.

For more information about the company:

www.winfarm-group.com

Contacts:

|

WINFARMinvestisseurs@winfarm-group.com |

|

|

ACTIFIN, financial communicationsBenjamin

LEHARI+33 (0)1 56 88 11 11winfarm@actifin.fr |

ACTIFIN, financial press relationsJennifer

JULLIA+33 (0) 1 56 88 11 19jjullia@actifin.fr |

1 Revenue excluding BTN de Haas

- WINFARM_PR_H1_2022_revenue_final_EN (1)

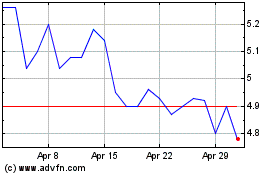

Winfarm (EU:ALWF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Winfarm (EU:ALWF)

Historical Stock Chart

From Apr 2023 to Apr 2024