Antin Infrastructure Partners: Implementation of a liquidity contract with BNP Paribas Exane

24 March 2022 - 4:50PM

Business Wire

Regulatory News:

Antin (Paris:ANTIN) entered into a liquidity contract with BNP

Paribas Exane, starting on 25 March 2022, for a period of one year

and tacitly renewable unless otherwise advised.

This contract aims at improving Antin’s shares trading on the

regulated market of Euronext Paris. The contract is compliant with

the legal framework in force for liquidity contracts, as well as

with the Code of Conduct (Charte de Déontologie) issued by the

French Association representing Financial Markets Professionals

(Association Française des Marchés Financiers), which is recognised

by the AMF.

Total resources of €2,000,000 (2 million euros) have been

allocated to the liquidity account.

Operations under the liquidity contract will be suspended under

the conditions set out in article 5 of AMF Decision No. 2021-01 of

22 June 2021.

The liquidity contract may be terminated at any time and without

prior notice by Antin, at any time by BNP Paribas Exane subject to

one month’s notice.

This liquidity contract was entered into as part of the

execution of the share repurchase program approved by the Combined

Shareholders’ Meeting held on 14 September 2021.

Use of share authorisation for the liquidity contract

In its 6th resolution, the Combined Shareholders’ Meeting held

on 14 September 2021 authorised a program for Antin to buy back its

own shares capped at 10% of the share capital (or 5% of the share

capital with a view to hold shares for subsequent exchange or

payment as consideration for external growth transactions) (the

“Share Repurchase Program”)(1). This authorisation was granted for

18 months. The maximum repurchase price under this authorisation is

200% of the price of the IPO, i.e. €48 per share(2). In accordance

with applicable regulations and market practices permitted by the

AMF, the objectives of the Share Repurchase Program are as

follows:

- to enable an investment service provider to maintain the

liquidity of the shares of the Company within the framework of a

liquidity contract in compliance with market practices approved by

the AMF;

- to allocate shares as part of Antin’s stock purchase option

plans, free share plans, profit sharing program and any Group

savings plan or other allocations of shares to employees or

corporate officers of the Company and its affiliates and carry out

all hedging operations related to these transactions;

- to deliver shares on the occasion of the exercise of rights

attached to securities giving access to the Company’s share capital

and carry out all hedging operations related to these

transactions;

- to retain them pending a delivery of shares (as an exchange,

payment or other consideration) in the context of acquisitions,

mergers, spin-offs or asset contributions;

- to cancel all or part of the shares thus purchased; and

- to pursue any other purpose that has been or may be authorised

by legislation or regulations in force, or by any market practice

that may be admitted by the AMF, it being specified that in such a

case, Antin would inform its Shareholders by means of a press

release.

About Antin Infrastructure Partners

Antin Infrastructure Partners is a leading private equity firm

focused on infrastructure. With €22.7bn in Assets Under Management

across its Flagship, Mid Cap and NextGen investment strategies,

Antin targets investments in the energy and environment, telecom,

transport and social infrastructure sectors. With a presence in

Paris, London, New York, Singapore and Luxembourg, Antin employs

over 160 professionals dedicated to growing, improving and

transforming infrastructure businesses while delivering long term

value to portfolio companies and investors. Majority owned by its

partners, Antin is listed on compartment A of the regulated market

of Euronext Paris (Ticker: ANTIN ISIN: FR0014005AL0).

(1) When shares are bought back for the purpose of maintaining

the liquidity of the shares of the Company, the number of shares

taken into account in order to calculate the cap of 10% of the

Company’s share capital corresponds to the number of shares

purchased less the number of shares sold during the authorisation

period. (2) Subject to (i) a maximum total amount that may be

invested in the Share Repurchase Program of €300,000,000 and (ii)

adjustments required to take into account transactions on the share

capital (including capitalisation of reserves or free grant of

shares, stock-split or reverse stock-split).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220323005970/en/

Media Contacts

Antin Infrastructure Partners Nicolle Graugnard,

Communication Director Email: nicolle.graugnard@antin-ip.com

Shareholder Relations

Contacts

Antin Infrastructure Partners Ludmilla Binet, Head of

Shareholder Relations Email: ludmilla.binet@antin-ip.com

Brunswick Email: antinip@brunswickgroup.com Tristan

Roquet Montegon +33 (0) 6 37 00 52 57 Gabriel Jabès +33

(0) 6 40 87 08 14

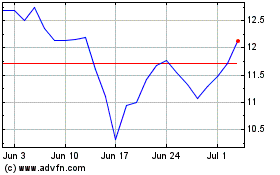

Antin Infrastructure Par... (EU:ANTIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

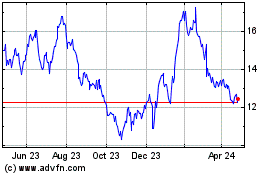

Antin Infrastructure Par... (EU:ANTIN)

Historical Stock Chart

From Apr 2023 to Apr 2024