Antin’s Management of ESG Risks Recognized as Strong by Sustainalytics

20 July 2022 - 2:00AM

Business Wire

Antin placed in top ~1% of Asset Management

and Custody Services in inaugural Sustainalytics ESG rating

Regulatory News:

Antin Infrastructure Partners (Paris:ANTIN) announces today that

it has received an inaugural Environmental, Social and Governance

(ESG) Risk Rating of 13.8 from Sustainalytics, a global leader in

ESG research and data, based on a scale from 0-100, from lowest to

highest risk.

Antin has been included in the “low risk” category, reflecting

Antin’s strong performance across a broad range of ESG metrics, and

was ranked:

- In the top ~7% out of the 14,870 companies rated worldwide to

date

- In the top ~6% out of the 920 companies rated in the

“diversified Financials” industry

- In the top ~1% out of the 434 companies rated in the “Asset

Management and Custody Services” sector

Sustainalytics evaluated the robustness of programmes,

practices, and policies implemented by Antin to manage six ESG

issues considered material to the firm’s business: Corporate

Governance, Product Governance, Human Capital, Data Privacy and

Security, Business Ethics and ESG Integration.

Sustainalytics evaluated Antin’s overall management of these

material ESG issues as strong.

Antin integrates sustainability across all operations, both as a

company and as an investor. As a responsible company, Antin strives

to improve the ESG impacts of its corporate activities. As a

responsible investor, it actively incorporates ESG matters at all

stages of the investment cycle.

Melanie Biessy, COO & Senior Partner of Antin declared: “We

are proud of being rated among the top companies in our field in

our inaugural rating by Sustainalytics. ESG has been a strategic

priority since Antin’s inception. This strong rating is a testimony

to our unique culture and dedication to sustainability.”

The full ESG Risk Rating Report from Sustainalytics can be

accessed here.

About Antin Infrastructure Partners

Antin Infrastructure Partners is a leading private equity firm

focused on infrastructure. With over €22bn in Assets Under

Management across its Flagship, Mid Cap and NextGen investment

strategies, Antin targets investments in the energy and

environment, telecom, transport and social infrastructure sectors.

With offices in Paris, London, New York, Singapore and Luxembourg,

Antin employs over 175 professionals dedicated to growing,

improving and transforming infrastructure businesses while

delivering long-term value to portfolio companies and investors.

Majority owned by its partners, Antin is listed on compartment A of

the regulated market of Euronext Paris (Ticker: ANTIN ISIN:

FR0014005AL0)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220719005958/en/

Media Nicolle Graugnard,

Communication Director Email: nicolle.graugnard@antin-ip.com

Shareholder Relations

Ludmilla Binet, Head of Shareholder Relations Email:

ludmilla.binet@antin-ip.com

Brunswick Email:

antinip@brunswickgroup.com Tristan Roquet Montegon: +33 (0) 6 37 00

52 57 Gabriel Jabès: +33 (0) 6 40 87 08 14

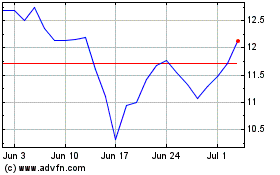

Antin Infrastructure Par... (EU:ANTIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

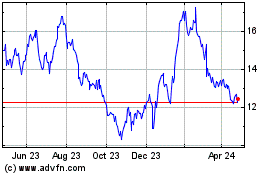

Antin Infrastructure Par... (EU:ANTIN)

Historical Stock Chart

From Apr 2023 to Apr 2024