PARROT: 2022 THIRD-QUARTER BUSINESS

17 November 2022 - 5:00PM

PARROT: 2022 THIRD-QUARTER BUSINESS

| |

PRESS RELEASEParis, November 17, 2022, 7am CET |

2022 THIRD-QUARTER BUSINESS

During the third quarter of 2022, the Parrot

Group, a European leader for professional civil drones, recorded

consolidated revenues of €21.4m, up 229% year-on-year based on its

reference scope1, presented with the 2021 full-year earnings. In

this third quarter of 2022, the strong growth of the activity

coupled with the cost structure of the period, allowed to reduce

the consolidated operating losses of the quarter to an amount

inferior to 1 M€.

|

|

Revenues (€m and % of revenues) |

Q3 2022 |

Q3 2021 |

Change |

FY 2021 |

|

A |

Parrot

Drones |

13.9 |

63% |

5.8 |

40% |

+137% |

20.9 |

38% |

|

B |

Of which, consumer products(2) |

0.5 |

2% |

5.0 |

35% |

- |

6.2 |

11% |

|

C |

Pix4D |

8.1 |

37% |

5.8 |

40% |

+38% |

26.2 |

48% |

|

D |

Parrot SA |

0.3 |

1% |

0.1 |

1% |

- |

0.3 |

1% |

|

E |

Intragroup eliminations |

-0.3 |

-1% |

-0.3 |

-2% |

- |

-0.8 |

-2% |

|

F |

SenseFly

(activity divested in October 2021) |

- |

- |

2.9 |

18% |

- |

7.7 |

14% |

|

|

CONSOLIDATED PARROT GROUP TOTAL |

21.9 |

100% |

14.5 |

100% |

+52% |

54.3 |

100% |

|

|

NEW SCOPE TOTAL (1)

(=A-B+C+D+E) |

21.4 |

98% |

6.5 |

73% |

+229% |

40.4 |

74% |

The figures reported by the Group for

the third quarter are unaudited and were presented to the Board of

Directors on November 16, 2022.(1) “New scope total” is a

performance indicator reflecting the impact of the strategy rolled

out since end-2018. It corresponds to the Parrot Group’s

consolidated revenues after deducting revenues from consumer

products (see 2) and revenues from the subsidiaries divested

(Micasense sold in January 2021, no revenues in 2021, and Sensefly

SA and Sensefly Inc, sold in October 2021). Note that intragroup

eliminations are not reallocated and therefore include a relatively

insignificant percentage for sales from the subsidiaries

divested.(2) Consumer products: consumer drones (all ranges),

legacy automotive products (car kit, plug & play) and connected

devices, for which sales were discontinued in 2021.

For several consecutive quarters, the Group has

seen the benefits of its strategy rolled out since the end of 2018,

focused on professional uses for equipment and solutions, and is

ramping up its growth, supported by a favorable geopolitical

context for the deployment of drone technologies. Consolidated

revenues for the first nine months of the year climbed to €52.4m,

up 35%, with 115% growth based on the reference scope1.

During this third quarter, the Group’s

activities were marked by:

- The 137% increase

in micro-drone revenues (+131% at constant exchange rates) to

€13.9m reflects the strong sales growth for ANAFI USA professional

micro-drones and the start of sales for the ANAFI Ai. The ANAFI USA

is benefiting from new orders from NATO countries (including the

United Kingdom, Spain and the United States) as well as the

continued deliveries for the French Defense Procurement Agency

(DGA). To date, 450 systems have already been delivered to the

French armed forces, representing just over half of the total

planned under the European call for tenders from February 2020,

which is due to end in 2024. More widely, Parrot is seeing

increased demand for its micro-drones, made possible by the gradual

integration of drone technologies on its core target markets

(inspection, surveillance, mapping), further strengthened by the

high level of security provided by its equipment.

- The 38% growth in

revenues from data analysis software (+23% at constant exchange

rates) to €8.1m for the third quarter of 2022. The business is

being supported by the acceleration in sales for the new business

solutions launched at the start of 2020, the international

development of the sales and marketing strategy, and the continued

increase in the number of users. Pix4D Mapper, the longstanding

solution, is continuing to build on its growth, while new

equipment, making it possible to further enhance the precision of

the data used, is responding to increasingly advanced use

cases.

Outlook for 2022

Realigned and driven by professional solutions

at the forefront of innovation, Parrot is continuing to move

forward with confidence as it rolls out its strategy focused on

professional micro-drones and solutions, while remaining vigilant

concerning the international environment.

The Group is continuing to allocate its

resources to an ambitious R&D roadmap. Supported by its

advances in the field of artificial intelligence and the growing

integration between hardware and software, Parrot aims to continue

facilitating the adoption of drone technologies and offer new use

cases that are aligned with the needs of professionals, businesses

and institutions, focused on (i) 3D Mapping, Geomatics and

Inspection, (ii) Defense and Security, and (iii) Precision

Farming.

To secure its production capacity over the

medium and long term, and respond to the growing interest in its

micro-drones, Parrot has further strengthened its coordination

between R&D, procurement and production tracking. The increase

in the resources allocated to these operations is being combined

with an agile sourcing management approach. These transformational

initiatives could limit the company’s performance.

Looking beyond the disruption linked to the

economic and geopolitical environment, which is difficult to

predict, the Group plans to move forward with its roadmap for

revenue growth on its “new scope” and capitalize on the

opportunities opened up by the growing adoption of drone

technologies in businesses and the public sector. The Group will

continue to closely monitor the allocation of its cash, and will be

ready to respond and adapt to potential changes in the

conditions.

Change in revenues over nine

months

|

|

Revenues (€m and % of revenues) |

2022 9 months |

2021 9 months |

Change |

FY 2021 |

|

A |

Parrot

Drones |

29.2 |

56% |

14.1 |

36% |

108% |

20.9 |

38% |

|

B |

Of which, consumer products(2) |

1.0 |

2% |

7.1 |

18% |

-87% |

6.2 |

11% |

|

C |

Pix4D |

23.2 |

44% |

17.5 |

45% |

32% |

26.2 |

48% |

|

D |

Parrot SA |

0.5 |

1% |

0.3 |

1% |

102% |

0.3 |

1% |

|

E |

Intragroup eliminations |

(0.5) |

-1% |

-0.8 |

-2% |

-32% |

-0.8 |

-2% |

|

F |

SenseFly

(activity divested in October 2021) |

- |

0% |

7.7 |

20% |

-100% |

7.7 |

14% |

|

|

CONSOLIDATED PARROT GROUP TOTAL |

52.4 |

100% |

38.8 |

100% |

35% |

54.3 |

100% |

|

|

NEW SCOPE TOTAL (1)

(=A-B+C+D+E) |

51.5 |

98% |

24.0 |

62% |

115% |

40.4 |

74% |

Next financial date

- 2022 full-year earnings: Thursday

March 16, 2023

ABOUT PARROT

Parrot is Europe's leading commercial UAV group.

With a strong international presence, the Group designs, develops

and markets a complementary range of micro-UAV equipment and image

analysis software dedicated to companies, large groups and

government organizations. Its offer is mainly centred on three

vertical markets: (i) Inspection, 3D mapping and Geomatics, (ii)

Defence and security, and Precision agriculture.

Its ANAFI range of micro UAVs, recognized for

their performance, robustness and ease of use, features an open

source architecture and meets the highest safety standards. Its

software suite for mobile and drone mapping is based on advanced

expertise in photogrammetry and offers solutions tailored to the

specificities of the verticals it addresses.

The Parrot Group, founded in 1994 by Henri

Seydoux, designs and develops its products in Europe, mainly in

Paris, where its headquarters are located, and in Switzerland.

Today, it has over 500 employees worldwide and carries out the vast

majority of its sales internationally. Parrot has been listed on

Euronext Paris since 2006 (FR0004038263 - PARRO). For more

information:www.parrot.com, www.pix4d.com

CONTACTS

|

Investors, analysts, financial medias Marie

Calleux - T. : +33(0) 1 48 03 60 60parrot@calyptus.net |

Tech

& consumer mediasJean Miflin - T. : +33(0) 1 48

03 60 60jean.miflin@parrot.com |

- Parrot_CP_T3-2022_1117_EN

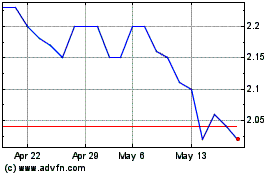

Parrot (EU:PARRO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Parrot (EU:PARRO)

Historical Stock Chart

From Nov 2023 to Nov 2024