RELX 2021 Profit, Revenue Rose; Declares GBP500 Million Share Buyback

10 February 2022 - 6:46PM

Dow Jones News

By Joe Hoppe

RELX PLC on Thursday posted a higher pretax profit and revenue

for 2021 and declared a 500 million-pound ($676.8 million) share

buyback program.

The information-and-analytics group made a pretax profit of

GBP1.80 billion for the year, up from GBP1.48 billion a year

earlier.

Adjusted pretax profit--one of the company's preferred

metrics--rose 15% on a constant-currency basis to GBP2.08 billion,

benefiting from lower adjusted net-interest expenses.

Revenue increased to GBP7.24 billion from GBP7.11 billion,

driven by electronic revenue growth.

The board declared a dividend of 49.8 pence a share, up from 47

pence a year prior, and the company intends to make up to GBP500

million of share buybacks in 2022.

RELX said it expects full-year underlying growth rates in

revenue and adjusted operating profit, as well as constant currency

growth in adjusted earnings per share, to remain above historical

trends.

"RELX delivered strong underlying revenue and profit growth in

2021. We believe that this improved growth trajectory is a

reflection of our ongoing strategy of focusing on the organic

development of increasingly sophisticated analytics and decision

tools that deliver enhanced value to our customers across market

segments," Chief Executive Officer Erik Engstrom said.

Write to Joe Hoppe at joseph.hoppe@wsj.com

(END) Dow Jones Newswires

February 10, 2022 02:31 ET (07:31 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

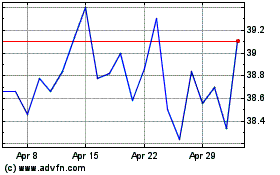

RELX (EU:REN)

Historical Stock Chart

From Dec 2024 to Jan 2025

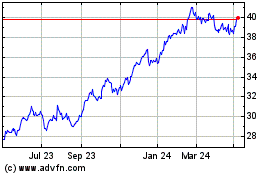

RELX (EU:REN)

Historical Stock Chart

From Jan 2024 to Jan 2025

Real-Time news about RELX Plc (Euronext): 0 recent articles

More RELX Plc News Articles