VGP Trading Update

09 November 2023 - 5:00PM

VGP Trading Update

Regulated Information – Inside Information

9 November 2023, 7:00 am, Antwerp,

Belgium: VGP NV (‘VGP’ or ‘the Group’) today published its

trading update for the first ten months of 2023, reporting solid

growth, enhanced liquidity and exciting new development

prospects.

- €54.3 million of new and renewed leases signed

year-to-date (of which € 18.1 million during the past 4 months)

bringing the annualised committed leases for the

year to date to €341.2 million1 (+ € 38 million

compared to 31 December 2022, which is +13% YTD and +17% y-o-y).

Recently we have benefited from a strong rise in demand in our

portfolio.

- 24 projects under construction representing

790,000 m² (of which 16 projects totalling 402,000 m² started up

during the year) and €55.5 million in

additional annual rent once fully built and let. The

pipeline under construction is 87.14% pre-let.

Currently VGP expects to start up construction of up to 251,000 m2

before year-end. Construction prices remain in decline.

- 18 projects delivered during the year

representing 426,000 m², or € 22.3 million in additional annual

rent (of which 5 projects totalling 109,000 m² delivered during the

2H 2023), currently 99% let and a further 292,000 m² estimated for

delivery in the remainder of 2023, currently 96,5% let.

- 1,240,000 m² of new development land acquired

during the year (of which 539,000 m² during 2H 2023) and

875,000 m² of development land deployed to support the new

developments started up during the year. Total secured development

land bank stands at 9 million m² at the end of October 2023

representing a development potential of over 4.2 million m². As

anticipated previously, VGP has been able to secure a number of

iconic sites, amongst others the former

R&D site of Stellantis at Vélizy-Villacoublay (14 km from Paris

Eiffel tower, with direct ring road access) which has already been

acquired.

- Property portfolio2 virtually fully let with occupancy

at 99% as of 31 October 2023 (compared to 99 % as at 30

June 2023). Of the € 341.2 million committed annualized rental

income, € 296.6 has become cash generative, an increase of 24%

versus December 2022. Another € 33.1 million of rental income is

expected to start within the next twelve months.

- Solid liquidity position as evidenced by:

- Cash distribution relating to VGP Park München joint

venture with Allianz Real Estate received in Q3 in amount

of € 50 million. Additional profit distribution

from the First, Second and Third Joint Venture expected in Q4 in

amount of € 30-40 million;

- Successful first closing of Deka resulting in gross proceeds of

€ 461 million;

- Workstreams well advanced to broaden the Joint Venture model

substantially further with existing and new partners;

- Repaid bond of € 225 million at maturity in

September ’23;

- Reiteration of VGP’s investment grade rating by

Fitch with stable outlook.

- Photovoltaic capacity grew exponentially to

173MWp operational or under construction and with a further 95MWp

being planned. Once built, the renewable energy production will

exceed our annual tenant electricity consumption. This contributed

to the four-star GRESB developer rating, the

second highest among peers in the European logistics segment

[FOR FULL TRADING UPDATE SEE ATTACHMENT]

CONTACT DETAILS FOR INVESTORS AND MEDIA

ENQUIRIES

|

Investor Relations |

Tel: +32 (0)3 289 1433investor.relations@vgpparks.eu |

|

Karen Huybrechts(Head of Marketing) |

Tel: +32 (0)3 289 1432 |

Forward-looking statements:

This press release may contain forward-looking statements. Such

statements reflect the current views of management regarding future

events, and involve known and unknown risks, uncertainties and

other factors that may cause actual results to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements. VGP is

providing the information in this press release as of this date and

does not undertake any obligation to update any forward-looking

statements contained in this press release considering new

information, future events or otherwise. The information in this

announcement does not constitute an offer to sell or an invitation

to buy securities in VGP or an invitation or inducement to engage

in any other investment activities. VGP disclaims any liability for

statements made or published by third parties and does not

undertake any obligation to correct inaccurate data, information,

conclusions or opinions published by third parties in relation to

this or any other press release issued by VGP.

ABOUT VGP

VGP is a pan-European owner, manager and

developer of high-quality logistics and semi industrial real estate

as well as a provider of renewable energy solutions. VGP operates a

fully integrated business model with capabilities and longstanding

expertise across the value chain. Founded in 1998 as a Belgian

family-owned real estate developer in the Czech Republic, VGP with

a staff of circa 371 FTEs today operates in 17 European countries

directly and through several 50:50 joint ventures. As of June 2023,

the Gross Asset Value of VGP, including the joint ventures at 100%,

amounted to € 6.76 billion and the company had a Net Asset Value

(EPRA NTA) of € 2.2 billion. VGP is listed on Euronext Brussels

(ISIN: BE0003878957).

For more information, please visit:

http://www.vgpparks.eu/en

1 Including Joint Ventures at

100%. As at 31 October 2023 the annualized committed leases of the

Joint Ventures stood at €225.9 million.

2 Including Joint Ventures at

100%.

- 9 Nov 2023_VGP - Trading update (ENG)_Final

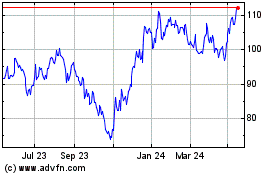

VGP NV (EU:VGP)

Historical Stock Chart

From Jan 2025 to Feb 2025

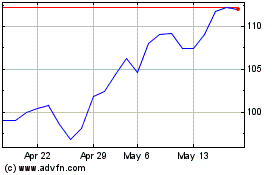

VGP NV (EU:VGP)

Historical Stock Chart

From Feb 2024 to Feb 2025