Stocks Steady as Investors Remain Cautious Ahead of Trump Inauguration -- 2nd Update

18 January 2017 - 11:52PM

Dow Jones News

By Jon Sindreu

Global markets were broadly flat Wednesday, a further sign of

the caution in financial markets ahead of earnings reports by large

U.S. banks and President-elect Donald Trump's inauguration later

this week.

U.S. futures pointed to the S&P 500 index remaining

unchanged, ahead of a session in which financial giants Goldman

Sachs Group Inc. and Citigroup Inc. will report on their

fourth-quarter earnings.

Goldman Sachs futures were up 0.1%, while Citigroup's fell

0.34%. Goldman shares have edged close to the all-time high they

reached in October 2007 and investors widely forecast profits to

increase from a year ago, but a lower-than-expected figure could

dent market optimism.

Corporate profits will be key to determine whether the U.S.

stock market is overvalued after the recent rally, analysts

say.

The Stoxx Europe 600 remained mostly unchanged in early European

trade and later edged down 0.2%. The biggest loser was the media

sector, which was sandbagged by Pearson PLC's 26% drop, after the

London-based publisher warned of lower future dividends on the back

of lower profit expectations.

Despite Pearson's drag, the FTSE 100 gained 0.1%. Asian shares

were mixed, but the main developed index, the Japanese Nikkei,

closed 0.4% higher.

Financial markets have struck a prudent tone ahead of Mr. Trump

taking office Friday, with investors appearing to have some second

thoughts about the risk-driven trades that have dominated since the

U.S. election on Nov. 8. While Mr. Trump's rhetoric against free

trade has long scared many analysts, markets initially focused on

his plans to slash taxes and regulations and boost infrastructure

spending.

Investors are now waiting for further clarity on such policies,

as well as corporate earnings, to decide whether growth and

inflation will come through, or whether markets got ahead of

themselves after the election.

"A lot of the indicators we follow are now pointing at the

market being overstretched," said Andrew Pease, global head of

strategy at London-based Russell Investments. "The U.S. economy's

fine, but markets have fully priced that in already."

In currencies, the pound fell 0.8% against the U.S. dollar to

$1.2299 after its 3% surge Tuesday, the biggest daily rise in eight

years. Sterling was bolstered by U.K. Prime Minister Theresa May

pledging to subject the final Brexit deal to a parliamentary

vote.

Nevertheless, many analysts said that Mrs. May's announcement

that Britain is set to leave the European single market will end up

weighing on sterling at the first sign of weak economic data.

"Enjoy the party but make sure you dance close to the door,"

said Antje Praefcke, an analyst at German lender Commerzbank

AG.

The WSJ Dollar Index, which tracks the currency against a basket

of 16 others, rose 0.4%. On Tuesday, it hit a one-month low after

Mr. Trump described the currency as "too strong" in an interview

with The Wall Street Journal.

Comments by Federal Reserve Bank of San Francisco President John

Williams, who argued that gradual interest-rate increases would

leave the economy unharmed, helped the dollar to recover.

Bond yields in the U.S. and Europe rose to reflect investors'

belief that monetary policy is unlikely to become much looser.

After falling to 2.327% on Tuesday, the lowest closing since late

November, yields on 10-year Treasurys recovered to 2.360%.

Haven assets, which had been propped up as investors became

jittery ahead of Mr. Trump's inauguration, also changed direction.

Gold was broadly flat Wednesday and the Japanese yen retreated

against all major currencies.

Traders will closely monitor Wednesday evening's speech by Fed

Chairwoman Janet Yellen to gauge whether interest rates are likely

to rise at a faster or slower pace than they are currently

expecting. Further signs of tighter-than-expected policy in the

U.S. could depress Treasurys again, boosting the dollar.

"Markets have traveled on hope, now they are going to have to

deal with the facts," said Neil Dwane, global strategist at Allianz

Global Investors.

Write to Jon Sindreu at jon.sindreu@wsj.com

(END) Dow Jones Newswires

January 18, 2017 07:37 ET (12:37 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

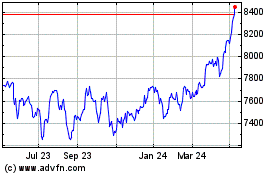

FTSE 100

Index Chart

From Apr 2024 to May 2024

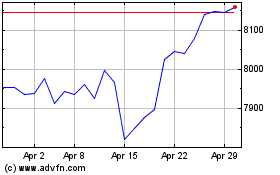

FTSE 100

Index Chart

From May 2023 to May 2024