Australian Dollar Climbs Against Majors

14 February 2024 - 9:58PM

RTTF2

The Australian dollar was higher against its major counterparts

in the New York session on Wednesday, as U.S. stocks rebounded

following a sell-off in the previous session.

Hotter-than-expected inflation data released on Tuesday raised

expectations that the Federal Reserve is not likely to cut rates

before the policy meeting in June.

Investors scaled back expectations for interest rate cuts from

the Fed and now expect three 25-basis-point cuts this year.

U.S. economic reports on weekly jobless claims, retail sales,

industrial production and import and export prices are due this

week.

Survey results from NAB showed that Australia's business

conditions weakened in January and confidence remained weak despite

a marginal improvement.

The business conditions index dropped 2 points to 6 in January.

All three components namely trading, profitability and employment

conditions weakened from the previous month.

The aussie edged up to 0.6487 against the greenback and 0.8787

against the loonie, off its early lows of 0.6446 and 0.8749,

respectively. The currency is poised to find resistance around 0.68

against the greenback and 0.91 against the loonie.

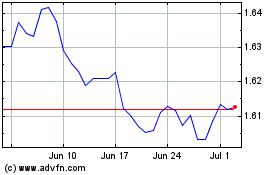

The aussie rose to 1.6512 against the euro and 1.0662 against

the kiwi, from its early lows of 1.6606 and 1.0637, respectively.

The aussie is seen finding resistance around 1.61 against the euro

and 1.09 against the kiwi.

The aussie touched a 2-day high of 97.66 against the yen, up

from a previous 5-day low of 97.06. If the aussie rises further, it

is likely to test resistance around the 100.00 region.

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024