Pound Falls As May Says Rejecting Brexit Deal Likely To Trigger No-deal Scenario

29 November 2018 - 6:51PM

RTTF2

The pound dropped against its major counterparts in the European

session on Thursday, after U.K. Prime Minister Theresa May remarked

that the U.K. will leave the European Union in March 2019 and the

MPs should determine whether to proceed with the Brexit deal.

Speaking to the British parliament, May said that if parliament

voted down the deal, the government would take obvious steps and

make preparations for a no-deal scenario.

May said that it is impossible to renegotiate a deal involving

removal of the backstop from the withdrawal agreement in the event

of losing Parliamentary vote on December 11.

"The European Union has made clear that there is no deal without

a backstop."

"In the no-deal scenario, we would do everything we could not to

erect a hard border - but there would be a decision from the

European Union and the Irish Government," she told MPs.

Meanwhile, European stocks tracked U.S. shares higher after

Federal Reserve Chairman Jerome Powell said that U.S. interest

rates were just below neutral, implying that the Fed's three-year

tightening cycle is drawing to a close.

Investors also remained hopeful for a de-escalation in trade

tensions between the U.S. and China at the G20 summit, though a

substantive breakthrough is unlikely.

The pound traded mixed against its major counterparts in the

Asian session. While it held steady against the franc and the euro,

it fell against the yen. Against the greenback, it rose.

The pound weakened to 1.2755 against the greenback, marking a

0.7 percent slide from a 3-day high of 1.2850 touched at 12:15 am

ET. Next key support for the pound is seen around the 1.26

level.

The pound lost 0.6 percent to hit more than a 2-month low of

1.2678 against the franc, reversing from a high of 1.2750 seen at

2:00 am ET. The pair was valued at 1.2738 when it ended deals on

Wednesday. The pound is poised to find support around the 1.25

region.

Preliminary figures from the State Secretariat for Economic

Affairs showed that Switzerland's economy shrunk in the third

quarter, defying expectations for further growth.

Gross domestic product decreased 0.2 percent from the second

quarter, when the economy expanded 0.7 percent. Economists had

forecast 0.4 percent growth.

The U.K. currency depreciated 0.9 percent to a 6-day low of

144.52 against the Japanese yen, after rising to 145.81 at 5:15 pm

ET. At yesterday's close, the pair was worth 145.76. Continuation

of the pound's downtrend is likely to take it to a support around

the 142.00 region.

Data from the Ministry of Economy, Trade and Industry showed

that Japan retail sales climbed a seasonally adjusted 1.2 percent

on month in October.

That exceeded expectations for an increase of 0.4 percent

following the 0.2 percent decline in September.

The pound slipped to 0.8912 against the euro, a weekly low. This

represented a 0.6 percent fall from a high of 0.8858 hit at 5:00 pm

ET. The euro-pound pair was valued at 0.8862 at yesterday's close.

The pound is seen finding support around the 0.91 mark.

Data from the Federal Employment Agency showed that Germany's

unemployment rate unexpectedly fell to a record low in November and

the number of unemployed decreased more than expected.

The seasonally adjusted jobless rate dropped to 5 percent from

5.1 percent in October. Economists had expected the rate to remain

unchanged.

Looking ahead, at 8:00 am ET, German preliminary CPI for

November is scheduled for release.

U.S. weekly jobless claims for the week ended November 24,

pending home sales and personal income and spending data for

October will be out in the New York session.

The Federal Reserve releases minutes from the November 7-8

meeting at 2:00 pm ET.

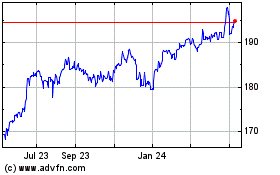

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Mar 2024 to Apr 2024

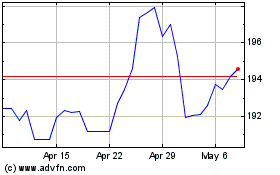

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Apr 2023 to Apr 2024