U.S. Dollar Advances After PMI Data, Fed Bullard's Comments

24 October 2016 - 9:25PM

RTTF2

The U.S. dollar climbed against its most counterparts in New

York deals on Monday, as the U.S. manufacturing activity expanded

more than expected in October and the St Louis Federal Reserve

President James Bullard reiterated the call for an interest rate

hike in this year.

Data from IHS Markit showed that U.S. preliminary manufacturing

PMI rebounded to 53.2 in October, from a three-month low of 51.5 in

September. The rate of improvement was the highest since October

2015.

Speaking on economy and monetary policy at the Association for

University Business and Economic Research in Arkansas, St. Louis

Fed President James Bullard said that a single 25 basis point hike

in the benchmark interest rate would get the monetary authority

very close to the level recommended by a so-called Taylor-type

policy rule.

The greenback strengthened to a 1-week high of 104.24 against

the Japanese yen, from a low of 103.72 hit 2:45 am ET.

The greenback rose back to 1.0877 against the euro, off its

early low of 1.0900.

The greenback reversed from an early low of 1.2249 against the

pound, with the pair rising back to 1.2210.

If the greenback extends rise, it may find resistance around

106.00 against the yen, 1.07 against the euro and 1.20 against the

pound.

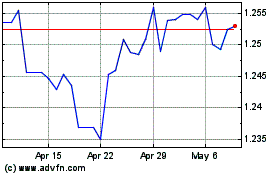

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Apr 2024 to May 2024

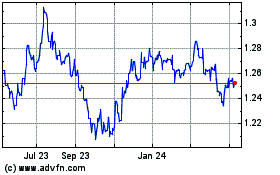

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From May 2023 to May 2024