U.S. Dollar Rises As Falling Jobless Claims Ease Concerns Over Recession

08 August 2024 - 11:08PM

RTTF2

The U.S. dollar advanced against its most major counterparts in

the New York session on Thursday, as lower-than-expected jobless

claims helped ease concerns about a potential recession.

Data from the Labor Department showed that initial jobless

claims fell to 233,000, a decrease of 17,000 from the previous

week's revised level of to 250,000.

Economists had expected jobless claims to edge down to 240,000

from the 249,000 originally reported for the previous week.

U.S. stocks climbed as soft labor market data allayed concerns

over an economic downturn.

The dollar index rose 0.17 percent to 103.36.

The greenback climbed to 6-day highs of 0.8673 against the franc

and 1.0881 against the euro, from an early low of 0.8559 and a

2-day low of 1.0945, respectively. The currency is likely to locate

resistance around 0.94 against the franc and 1.06 against the

euro.

The greenback edged up to 147.54 against the yen and 1.3765

against the loonie, off its early lows of 145.42 and 1.3726,

respectively. Next key resistance for the currency is seen around

152.00 against the yen and 1.39 against the loonie.

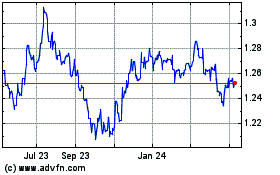

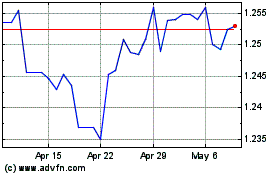

In contrast, the greenback fell to 1.2734 against the pound,

reversing from an early more than 5-week high of 1.2664. The

currency is seen finding support around the 1.31 level.

The greenback dropped to a 2-week low of 0.6579 against the

aussie, down from an early 2-day high of 0.6507. The currency is

poised to challenge support around the 0.69 level.

The greenback eased to 0.6006 against the kiwi, off an early

high of 0.5977. The currency may locate support around the 0.63

level.

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Dec 2024 to Jan 2025

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Jan 2024 to Jan 2025