Reserve Bank Of India Slows Rate Hikes On Weaker Growth Outlook

07 December 2022 - 5:51PM

RTTF2

India's central bank raised its benchmark interest rates for the

fifth policy meeting in a row on Wednesday due to sticky core

inflation, but geared down the pace of tightening given the

softness in economic growth outlook.

The Monetary Policy Committee of the Reserve Bank of India voted

5-1 to hike its key interest rate, the repo, by 35 basis points to

6.25 percent with immediate effect, Governor Shaktikanta Das

said.

The central bank had previously raised the repo rate by a more

aggressive 50 basis points at each of the previous three

consecutive meetings. The RBI has raised rates by a cumulative 225

basis points since May.

The bank adjusted the standing deposit facility to 6.00 percent

and marginal standing facility rate and the Bank Rate to 6.50

percent.

Governor Das said the RBI will keep a close eye on inflation

dynamics and stands ready to act as may be necessary.

"Our actions will be nimble and in the best interest of the

economy," Das said after the bi-monthly meeting.

With headline inflation set to ease further and growth entering

a softer patch, the central bank will call a halt to tightening in

February, Capital Economics' economist Shilan Shah said.

The MPC also voted 4-2 to remain focused on withdrawal of

accommodation to ensure that inflation remains within the target

going forward, while supporting growth.

Despite hostile international environment, the Indian economy

remains resilient, drawing strength from its macroeconomic

fundamentals, Das noted.

The central bank lowered the economic growth projection for the

current financial year 2022-23 to 6.8 percent from 7.0 percent.

Also, the latest outlook was bleaker than the 6.9 percent

estimated by the World Bank on Tuesday. The Washington-based lender

forecast 6.6 percent expansion for the next financial year.

In the September quarter, India's economy had expanded 6.3

percent, which was much weaker than the 13.5 percent growth logged

in the June quarter.

The inflation trajectory largely evolved in line with the

projections, Das observed. The MPC is more concerned about the high

and sticky core inflation and exposure of food inflation to global

factors, he said.

Consumer price inflation weakened to 6.77 percent in October

from a five-month high of 7.41 percent in September.

RBI maintained its consumer price inflation forecast at 6.7

percent for the current year. Over the next twelve months,

inflation is projected to stay above the 4 percent target.

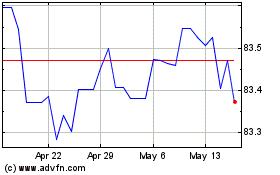

US Dollar vs INR (FX:USDINR)

Forex Chart

From Feb 2025 to Mar 2025

US Dollar vs INR (FX:USDINR)

Forex Chart

From Mar 2024 to Mar 2025