Turkish Lira At 2-day High Vs U.S. Dollar After Turkey Lifts Lending, Repo Rates

24 November 2016 - 6:15PM

RTTF2

The Turkish Lira climbed against the U.S. dollar in the European

session on Thursday, after Turkey's central bank unexpectedly hiked

the key lending rate and the one-week repo rate amid the

deterioration in economic activity and risks to the inflation

outlook.

The Monetary Policy Committee, led by Governor Murat Cetinkaya,

raised the key lending rate, known as the Marginal Funding Rate, to

8.5 percent from 8.25 percent. The one-week repo rate was increased

to 8 percent from 7.5 percent.

The borrowing rate was left unchanged at 7.25 percent.

Economists had expected the central bank to leave all rates

unchanged.

The Lira climbed to a 2-day high of 3.3685 against the

greenback, off its early record low of 3.4212. If the Lira extends

rise, 2.9 is possibly seen as its next resistance level.

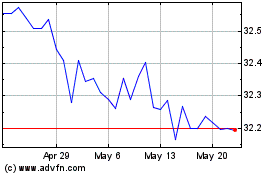

US Dollar vs TRY (FX:USDTRY)

Forex Chart

From Apr 2024 to May 2024

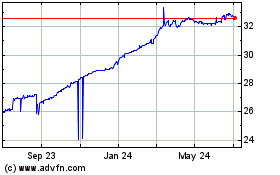

US Dollar vs TRY (FX:USDTRY)

Forex Chart

From May 2023 to May 2024