As filed with the Securities and Exchange Commission on July 13, 2022

Registration No. 333-258018

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Post-Effective

Amendment No. 2

to

FORM S-1 on FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PLAYSTUDIOS, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 7372 | | 88-1802794 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

10150 Covington Cross Drive

Las Vegas, Nevada 89144

Tel: (725) 877-7000

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

| | | | | | | | |

| Andrew Pascal | |

| Chief Executive Officer | |

| PLAYSTUDIOS, Inc. | |

| 10150 Covington Cross Drive | |

| Las Vegas, Nevada 89144 | |

| (725) 877-7000 | |

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

| | | | | | | | |

| Copies to: | | Copies to: |

| Joel Agena | | Rachel Paris |

| General Counsel | | DLA Piper LLP (US) |

| PLAYSTUDIOS, Inc. | | 2000 University Avenue |

| 10150 Covington Cross Drive | | East Palo Alto, CA 94303 |

| Las Vegas, Nevada 89144 | | (650) 833-2234 |

| (725) 877-7000 | | |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box: ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box: ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☒ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | | | | | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

On July 19, 2021, PLAYSTUDIOS, Inc. (the “Company”) filed a registration statement on Form S-1 (File No. 333-258018) with the Securities and Exchange Commission (the “SEC”), which was declared effective by the SEC on July 30, 2021, and which was amended by the Post-Effective Amendment No. 1 to Form S-1 which was declared effective on March 23, 2022. The registration statement covered (a) (i) up to 7,174,964 shares of the Company’s Class A common stock, par value $0.0001 per share (“Class A common stock”), that were issuable upon exercise of the warrants originally issued in the initial public offering of Acies Acquisition Corp. (the “Public Warrants”), of which 1,792,463 Public Warrants were subsequently tendered to the Company for a cash price of $1.00 per Public Warrant in connection with a tender offer launched by the Company on April 1, 2022 which expired at midnight Eastern time at the end of the day on May 13, 2022, and (ii) up to 3,821,667 shares of Company's Class A common stock that were issuable upon exercise of the warrants originally issued in a private placement in connection with the initial public offering of Acies Acquisition Corp. (the “Private Placement Warrants”), both at an exercise price of $11.50 per share of Class A common stock, and (b) the offer and sale, from time to time, by the selling securityholders named in the registration statement or their permitted transferees of up to 107,495,199 shares of common stock, of which approximately 12 million shares of Class A common stock were subsequently sold. The shares of Class A common stock registered included up to 10,693,624 shares of Class A common stock issuable as Earnout Shares (as defined herein) and 1,444,962 shares of Class A common stock issuable upon the exercise of 1,444,962 options to purchase shares of Class A common stock (the “Class A Option Shares”) and 3,821,667 Private Placement Warrants, and also included 21,348,205 shares of Class A common stock issuable upon conversion of: (i) 16,130,300 shares of our Class B common stock, par value $0.0001 per share (the “Class B common stock” and, together with the Class A common stock, our “common stock”), issued to Andrew S. Pascal, our Chairman of the Board and Chief Executive Officer, (ii) 3,026,112 shares of Class B common stock issuable as Earnout Shares and (iii) 2,191,793 shares of Class B common stock issuable upon the exercise of 2,191,793 options to purchase shares of Class B common stock (the “Class B Option Shares”, and together with the Class A Option Shares, the “Option Shares”).

This Post-Effective Amendment No. 2 to Form S-1 on Form S-3 (the “Post-Effective Amendment No. 2”) is being filed by us to convert the initial registration statement into a registration statement on Form S-3 because we are eligible to use Form S-3. This Post-Effective Amendment No. 2 contains an updated prospectus related to the offering and sale of the shares of outstanding Class A common stock covered by the registration statement. This Post-Effective Amendment No. 2 amends and restates the information contained in the registration statement under the sections contained herein.

For the purposes of this Post-Effective Amendment No. 2, references to the “Company,” the “Registrant,” “we,” “our,” “us” and similar terms means PLAYSTUDIOS, Inc. and its subsidiaries.

All filing fees payable in connection with the registration of the shares of Class A common stock covered by the registration statement were paid by the Registrant at the time of the initial filing of the registration statement. No additional securities are registered hereby.

The information in this preliminary prospectus is not complete and may be changed. Neither we nor the selling securityholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION — DATED JULY 13, 2022

PRELIMINARY PROSPECTUS

PLAYSTUDIOS, Inc.

Up to 95,237,463 Shares of Class A Common Stock

Up to 9,204,168 Shares of Class A Common Stock Issuable Upon Exercise of Warrants

Up to 3,821,667 Warrants

This prospectus relates to the issuance by us of up to an aggregate of 9,204,168 shares of our Class A common stock, $0.0001 par value per share (the “Class A common stock”), which consists of (i) up to 5,382,501 shares of our Class A common stock that are issuable upon the exercise of 5,382,501 warrants (the “Public Warrants”) originally issued in the initial public offering of Acies Acquisition Corp. (“Acies”) by the holders thereof and (ii) up to 3,821,667 shares of our Class A common stock that are issuable upon the exercise of 3,821,667 warrants originally issued in a private placement in connection with the initial public offering of Acies (the “Private Placement Warrants”, and together with the Public Warrants, the “Warrants”). We will receive the proceeds from any exercise of any Warrants for cash.

This prospectus also relates to the offer and sale from time to time by the selling Securityholders named in this prospectus (the “Selling Securityholders”) of (i) up to 95,237,463 shares of our Class A common stock, including up to 10,693,624 shares of Class A common stock issuable as Earnout Shares (as defined herein) and 1,444,962 shares of our Class A common stock issuable upon the exercise of 1,444,962 options to purchase shares of our Class A common stock (the “Class A Option Shares”) and (ii) up to 3,821,667 Private Placement Warrants. The shares of our Class A common stock being registered include 21,348,205 shares of Class A common stock issuable upon conversion of: (i) 16,130,300 shares of our Class B common stock, par value $0.0001 per share (the “Class B common stock” and, together with the Class A common stock, our “common stock”), issued to Andrew S. Pascal, our Chairman of the Board and Chief Executive Officer, or certain affiliates of Mr. Pascal, (ii) 3,026,112 shares of Class B common stock issuable as Earnout Shares, and (iii) 2,191,793 shares of Class B common stock issuable upon the exercise of 2,191,793 options to purchase shares of Class B common stock (the “Class B Option Shares”, and together with the Class A Option Shares, the “Option Shares”). We will not receive any proceeds from the sale of shares of common stock or Private Placement Warrants by the Selling Securityholders pursuant to this prospectus.

The rights of the holders of Class A common stock and Class B common stock are identical, except with respect to voting and conversion. Each share of Class A common stock is entitled to one vote per share. Each share of Class B common stock is entitled to twenty votes per share and is convertible into one share of Class A common stock. Outstanding shares of Class B common stock, all of which are held by Mr. Pascal and certain of his affiliates, represent approximately 74.5% of the voting power of our outstanding capital stock as of July 12, 2022.

We are registering the securities for resale pursuant to the Selling Securityholders’ registration rights under certain agreements between us and the Selling Securityholders. Our registration of the securities covered by this prospectus does not mean that the Selling Securityholders will offer or sell any of the shares of Class A common stock or Private Placement Warrants. The Selling Securityholders may offer, sell or distribute all or a portion of their shares of Class A common stock or Private Placement Warrants publicly or through private transactions at prevailing market prices or at negotiated prices. We provide more information about how the Selling Securityholders may sell the shares of Class A common stock or Private Placement Warrants in the section titled “Plan of Distribution.”

We are an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), and are subject to reduced public company reporting requirements. This prospectus complies with the requirements that apply to an issuer that is an emerging growth company.

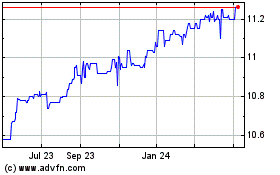

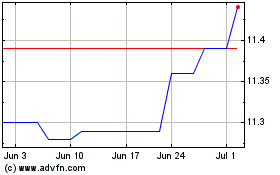

Our Class A common stock is currently listed on The Nasdaq Global Market (“Nasdaq”) under the symbol “MYPS”, and our Public Warrants are currently listed on the Nasdaq under the symbol “MYPSW”. On July 12, 2022, the closing price of our Class A common stock was $3.99 and the closing price for our Public Warrants was $0.77.

See the section titled “Risk Factors” beginning on page 12 of this prospectus to read about factors you should consider before buying our securities. Neither the United States Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2022.

TABLE OF CONTENTS

This prospectus is part of a registration statement that we have filed with the SEC pursuant to which the Selling Securityholders named herein may, from time to time, offer and sell or otherwise dispose of the securities covered by this prospectus. Neither we nor the Selling Securityholders have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any prospectus supplements or free writing prospectuses we have prepared. Neither we nor the Selling Securityholders take responsibility for, or can provide assurance as to the reliability of, any other information that others may give you. You should not assume that the information in this prospectus or any applicable prospectus supplement or free writing prospectus is accurate as of any date other than the date of the applicable document, regardless of the time of delivery of this prospectus or any other document or the sale of any Class A common stock or Warrants. Since the date of this prospectus or any prospectus supplement or free writing prospectus, or any documents incorporated by reference herein and therein, our business, financial condition, results of operations and prospects may have changed. It is important for you to read and consider all information contained in this prospectus or any prospectus supplement or free writing prospectus, including the documents incorporated by reference herein and therein, in making any investment decision. You should also read and consider the information in the documents to which we have referred you under the sections titled “Where You Can Find More Information” and “Incorporation of Certain Information by Reference” in this prospectus.

We are not, and the Selling Securityholders are not, making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted.

ABOUT THIS PROSPECTUS

On June 21, 2021 (the “Closing Date”), Acies consummated a business combination (the “Business Combination”) with PlayStudios, Inc., a Delaware corporation (“Old PLAYSTUDIOS”), pursuant to the Agreement and Plan of Merger, dated as of February 1, 2021 (the “Merger Agreement”), by and among Acies, Catalyst Merger Sub I, Inc., a Delaware corporation and a direct wholly owned subsidiary of Acies (“First Merger Sub”), Catalyst Merger Sub II, LLC, a Delaware limited liability company and a direct wholly owned subsidiary of Acies (“Second Merger Sub”), and Old PLAYSTUDIOS. In connection with the closing of the Business Combination (the “Closing”), Old PLAYSTUDIOS merged with First Merger Sub with Old PLAYSTUDIOS surviving the member (the “First Merger”). Immediately thereafter, and as part of an integrated transaction with the First Merger, Old PLAYSTUDIOS then merged with Second Merger Sub, with Second Merger Sub surviving the merger. As part of the Closing, Acies changed its name to PLAYSTUDIOS, Inc and Second Merger Sub changed its name to PLAYSTUDIOS US, LLC. PLAYSTUDIOS, Inc. is continuing the existing business operations of Old PLAYSTUDIOS as a publicly traded company.

Unless the context indicates otherwise, references in this prospectus to the “Company,” “PLAYSTUDIOS,” “we,” “us,” “our” and similar terms refer to PLAYSTUDIOS, Inc. (f/k/a Acies Acquisition Corp.) and its consolidated subsidiaries. References to “Acies” refer to our predecessor company prior to the consummation of the Business Combination.

This prospectus is part of a registration statement that we filed with the SEC using the “shelf” registration process. Under this shelf registration process, the Selling Securityholders may, from time to time, sell the securities offered by them described in this prospectus. We will not receive any proceeds from the sale by such Selling Securityholders of the securities offered by them described in this prospectus. This prospectus also relates to the issuance by us of the shares of Class A common stock issuable upon the exercise of the Warrants. We will not receive any proceeds from the sale of shares of Class A common stock underlying the Warrants pursuant to this prospectus, except with respect to amounts received by us upon the exercise of the Warrants for cash.

This prospectus contains or incorporates by reference summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described in the sections titled “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This prospectus and any accompanying prospectus supplement and the documents incorporated by referenced herein and therein contain forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We have based these forward-looking statements on our current expectations and projections about future events. All statements, other than statements of present or historical fact included in this prospectus, about our future financial performance, strategy, expansion plans, future operations, future operating results, estimated revenues, losses, projected costs, prospects, plans and objectives of management are forward-looking statements. Any statements that refer to projections, forecasts, or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “continue,” “goal,” “project,” or the negative of such terms or other similar expressions.

Forward-looking statements in this prospectus include, but are not limited to, statements about:

•our business strategy and market opportunity;

•our future financial performance, including our expectations regarding our revenue, cost of revenue, gross profit or gross margin, operating expenses (including changes in sales and marketing, research and development, and general and administrative expenses) and profitability;

•market acceptance of our games;

•our ability to raise financing in the future and the global credit and financial markets;

•factors relating to our business, operations, financial performance, and our subsidiaries, including:

◦changes in the competitive and regulated industries in which we operate, variations in operating performance across competitors, and changes in laws and regulations affecting our business;

◦our ability to implement business plans, forecasts and other expectations, and identify and realize additional opportunities; and

◦the impact of the COVID-19 pandemic (including existing and possible future variants);

•our ability to maintain relationships with our platforms, such as the Apple App Store, Google Play Store, Amazon Appstore, and Facebook;

•the accounting for our outstanding warrants to purchase shares of Class A common stock;

•our ability to develop, maintain, and improve our internal control over financial reporting;

•our ability to maintain, protect and enhance our intellectual property rights;

•our ability to successfully defend litigation brought against us;

•our ability to successfully close and integrate acquisitions to contribute to our growth objectives;

•our success in retaining or recruiting, or changes required in, our officers, key employees or directors; and

•the impact of the COVID-19 pandemic (including existing and possible future variants as well as vaccinations) on our business.

These forward-looking statements are based on our current plans, estimates, and projections in light of information currently available to us, and are subject to known and unknown risks, uncertainties, and assumptions about us, including those described under the section titled “Risk Factors” in this prospectus, that may cause our actual results, levels of activity, performance, or achievements to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by such forward-looking statements. In addition, the risks described under the section titled “Risk Factors” are not exhaustive. New risk factors emerge from time to time, and it is not possible to predict all such risk factors, nor can we assess the impact of all such risk factors on our business or the extent to which any risk factor or combination of risk factors may cause actual results to differ materially from those contained in any forward-looking statements. Forward-looking statements are also not guarantees of performance. You should not put undue reliance on any forward-looking statements, which speak only as of the date hereof. Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this prospectus whether as a result of new information, future events, or otherwise. Additional cautionary statements or discussions of risks and uncertainties that could affect our results or the achievement of the expectations described in forward-looking statements may also be contained in any accompanying prospectus supplement.

You should read this prospectus and any accompanying prospectus supplement, and the documents incorporated by referenced herein and therein completely, and with the understanding that our actual future results, levels of activity, and performance as well as other events and circumstances may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

| | |

| SUMMARY |

This summary highlights selected information appearing elsewhere or incorporated by reference in this prospectus. Because it is a summary, it may not contain all of the information that may be important to you. Before making your investment decision with respect to our securities, you should read this entire prospectus carefully, including the information set forth under the section titled “Risk Factors” in this prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein and therein. |

PLAYSTUDIOS — The Power of Play |

We are a developer and publisher of free-to-play casual games for mobile and social platforms each of which incorporate our unique playAWARDS loyalty program. Over our ten-year history, we developed a portfolio of free-to-play social casino games that are considered to be among the most innovative and unique in the genre. They include the award-winning POP! Slots, myVEGAS Slots, my KONAMI Slots, myVEGAS Blackjack, MyVEGAS Bingo, MGM Slots Live and Tetris. Our games are based on original content, real-world slot game content, as well as third-party licensed brands and are downloadable and playable for free on multiple social and mobile-based platforms, including the Apple App Store, Google Play Store, Amazon Appstore, and Facebook. Each of our games is powered by our proprietary playAWARDS program and incorporates loyalty points that are earned by players as they engage with our games. During the year ended December 31, 2021, these loyalty points could have been exchanged for real-world rewards from over 95 awards partners representing more than 265 hospitality, entertainment, and leisure brands across 17 countries and four continents. The rewards are provided by our collection of awards partners, all of whom provide their rewards at no cost to us, in exchange for product integration, marketing support, and participation in our loyalty program. The program is enabled by our playAWARDS platform which consists of a robust suite of tools that enable our awards partners to manage their rewards in real time, measure the value of our players’ engagement, and gain insight into the effectiveness and value they derive from the program. Through our self-service platform, awards partners can launch new rewards, make changes to existing offers, and in real time see how players are engaging with their brands. The platform tools also provide awards partners the ability to measure the off-line value our players generate as consumers and patrons of their real-world establishments. |

Background |

We were originally known as Acies Acquisition Corp. On the Closing Date, Acies consummated the Business Combination with Old PLAYSTUDIOS, pursuant to the Merger Agreement. In connection with the Closing, we changed our name from Acies to PLAYSTUDIOS, Inc. We are continuing the existing business operations of Old PLAYSTUDIOS as a publicly traded company. Upon the Closing, Acies’ ordinary shares, warrants and units ceased trading, and shares of our Class A common stock and Public Warrants began trading on the Nasdaq under the symbols “MYPS,” and “MYPSW,” respectively. |

Corporate Information |

Acies was incorporated on August 14, 2020 as a Cayman Islands exempted company and incorporated for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization, or similar business combination with one or more businesses. Acies completed its initial public offering in October 2020 (the “IPO”). On June 21, 2021, Acies consummated the Business Combination with Old PLAYSTUDIOS pursuant to the Merger Agreement. In connection with the Closing, we changed our name from Acies to PLAYSTUDIOS, Inc. Our principal executive office is located at 10150 Covington Cross Drive, Las Vegas, Nevada 89144. Our telephone number is (725) 877-7000. Our website address is www.playstudios.com. Information contained on our website or connected thereto does not constitute part of, and is not incorporated by reference into, this prospectus or the registration statement of which it forms a part. Additional information about us is included in documents incorporated by reference in this prospectus. See sections titled “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.” |

| | | | | | | | |

| THE OFFERING |

| Issuer | | PLAYSTUDIOS, Inc. |

| Issuance of Class A Common Stock | | |

| Shares of Class A Common Stock Offered by Us | | 9,204,168 shares of Class A common stock, consisting of 9,204,168 shares of Class A common stock that are issuable upon the exercise of 9,204,168 Warrants by the holders thereof. |

| Shares of Class A Common Stock Outstanding Prior to Exercise of All Warrants | | 111,966,389 shares |

| Shares of Class A Common Stock Outstanding Assuming Exercise of All Warrants | | 121,170,557 shares |

| Shares of Class B Common Stock Outstanding | | 16,130,300 shares (each share of our Class B common stock has twenty (20) votes per share and is convertible at the option of the holder to one share of Class A common stock; the outstanding shares of Class B common stock are not included in the number of outstanding shares of our Class A common stock). |

| Exercise Price of Warrants | | $11.50 per share, subject to adjustment as described herein. |

| Use of Proceeds | | We will receive up to an aggregate of approximately $105.8 million from the exercise of the Warrants, assuming the exercise in full of all of the Warrants for cash. We intend to use the proceeds from the exercise of the Warrants for general corporate purposes, which may include capital expenditures, investments, and working capital. In addition, from time to time in the past we have considered, and we continue to consider, acquisitions and strategic transactions, and we also may use such proceeds for such purposes. See “Use of Proceeds.” |

| Resale of Class A Common Stock and Private Placement Warrants | | |

| Shares of Class A Common Stock Offered by the Selling Securityholders | | 95,237,463 shares of Class A common stock (including up to 10,693,624 shares of Class A common stock issuable as Earnout Shares and 3,636,755 shares of Class A common stock issuable as Option Shares). This includes 16,130,300 outstanding shares of Class B Common Stock, 3,026,112 Earnout Shares of Class B common stock and 2,191,793 Class B Option Shares. |

| Private Placement Warrants Offered by the Selling Securityholders | | 3,821,667 Private Placement Warrants. |

| Use of Proceeds | | We will not receive any proceeds from the sale of shares of our Class A common stock or Private Placement Warrants by the Selling Securityholders. |

| Market for Class A Common Stock and Warrants | | Our Class A common stock is listed on the Nasdaq under the symbol “MYPS,” and our Public Warrants are listed on the Nasdaq under the symbol “MYPSW”. |

| Risk Factors | | See “Risk Factors” and other information included in this prospectus and any risk factors described in the documents we incorporate by reference for a discussion of factors you should consider before investing in our securities. |

The 111,966,389 outstanding shares of our Class A common stock and 16,130,300 outstanding shares of our Class B common stock is calculated as of July 8, 2022 and excludes:

•9,204,168 shares of our Class A common stock issuable from the exercise of Warrants outstanding as of July 8, 2022, each with an exercise price of $11.50 per share;

•11,973,888 Earnout Shares of our Class A common stock and 3,026,112 Earnout Shares of our Class B common stock, in each case, reserved for issuance upon an Earnout Triggering Event;

•11,559,424 shares of our Class A common stock and 2,191,793 shares of our Class B common stock issuable upon the exercise of stock options outstanding as of July 8, 2022 with a weighted average exercise price of $0.82 per share;

•7,299,827 shares of our Class A common stock issuable upon the vesting of restricted stock units outstanding as of July 8, 2022;

•15,272,970 shares of our common stock reserved for future issuance under our 2021 Equity Incentive Plan (the “2021 Plan”), as well as: (i) any automatic increases in the number of shares of common stock reserved for future issuance under our the 2021 Plan and (ii) upon the forfeiture, termination, expiration or reacquisition of any shares of common stock underlying outstanding stock awards granted under the PLAYSTUDIOS, Inc. 2011 Omnibus Stock and Incentive Plan, an equal number of shares of our common stock; and

•4,611,788 shares of Class A common stock reserved for future issuance under our 2021 Employee Stock Purchase Plan (the “2021 ESPP”), as well as any automatic increases in the number of shares of Class A common stock reserved for future issuance under the 2021 ESPP.

Unless the context otherwise requires or is otherwise indicated, the outstanding shares of Class A common stock described in this prospectus include the 900,000 shares of our Class A common stock held by the Sponsor that are subject to forfeiture if certain earnout conditions are not satisfied, as such shares are issued and outstanding as of July 8, 2022.

RISK FACTORS

An investment in our securities involves a high degree of risk. Before investing in our securities, in addition to the risks and uncertainties discussed under “Cautionary Note Regarding Forward-Looking Statements”, you should carefully consider the risk factors incorporated by reference into this prospectus in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as well as the risk factors and other information contained in any applicable prospectus supplement and any applicable free writing prospectus we file with the SEC. The market price of our securities could decline if one or more of these risks or uncertainties actually occur, causing you to lose all or part of your investment in our securities. See sections titled “Where You Can Find More Information” and “Incorporation of Certain Information by Reference” elsewhere in this prospectus. Additionally, the risks and uncertainties incorporated by reference in this prospectus or any prospectus supplement are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may become material and adversely affect our business.

USE OF PROCEEDS

All of the Class A common stock and Warrants offered by the Selling Securityholders pursuant to this prospectus will be sold by the Selling Securityholders for their respective accounts. We will not receive any of the proceeds from these sales.

We will receive up to an aggregate of approximately $105.8 million from the exercise of the Warrants, assuming the exercise in full of all of the Warrants for cash. We expect to use the proceeds from the exercise of the Warrants, if any, for general corporate purposes, which may include capital expenditures, investments and working capital. In addition, from time to time in the past we have considered, and we continue to consider, acquisitions and strategic transactions, and we also may use such proceeds for such purposes.

We will have broad discretion over the use of proceeds from the exercise of the Warrants. There is no assurance that the holders of the Warrants will elect to exercise any or all of such Warrants. To the extent that the Warrants are exercised on a “cashless basis,” the amount of cash we would receive from the exercise of the Warrants will decrease.

DIVIDEND POLICY

We have not paid any cash dividends on our common stock to date. The payment of cash dividends in the future will be dependent upon our revenues and earnings, capital requirements and general financial condition. The payment of any cash dividends will be within the discretion of our Board of Directors at such time. In addition, we are not currently contemplating and do not anticipate any stock dividends in the foreseeable future as it is currently expected that available cash resources will be utilized in connection with our ongoing operations and development projects.

SELLING SECURITYHOLDERS

The Selling Securityholders acquired the shares of our common stock from us in private offerings pursuant to exemptions from registration under Section 4(a)(2) of the Securities Act in connection with a private placement concurrent with the IPO and in connection with the Business Combination. Pursuant to the Registration Rights Agreement dated June 21, 2021 entered into in connection with the consummation of the Business Combination (the “Registration Rights Agreement”)

and the Subscription Agreements dated February 1, 2021 entered into in connection with the signing of the Merger Agreement (the “Subscription Agreements”), we agreed to file a registration statement with the SEC for the purposes of registering for resale the shares of our Class A common stock issued to the Selling Securityholders pursuant to the Subscription Agreements and Merger Agreement.

Except as set forth in the footnotes below, the following table sets forth, based on written representations from the Selling Securityholders, certain information as of July 8, 2022 regarding the beneficial ownership of our Class A common stock and Warrants by the Selling Securityholders and the shares of Class A common stock and Warrants being offered by the Selling Securityholders. The applicable percentage ownership of Class A common stock is based on approximately 111,966,389 shares of Class A common stock and 16,130,300 shares of Class B common stock outstanding as of July 8, 2022. Information with respect to shares of Class A common stock owned beneficially after the offering assumes the sale of all of the shares of Class A common stock offered (including the possible receipt of Earnout Shares and the vesting of the Sponsor Shares which are subject to forfeiture (the “Unvested Sponsor Shares”)) and no other purchases or sales of our Class A common stock. The Selling Securityholders may offer and sell some, all or none of their shares of Class A common stock.

We have determined beneficial ownership in accordance with the rules of the SEC. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the Selling Securityholders have sole voting and investment power with respect to all shares of common stock that they beneficially own, subject to applicable community property laws.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Shares of Class A Common Stock Beneficially Owned After the Offered Shares of Common Stock are Sold |

| Name of Selling Securityholder | | Shares of Class A Common Stock Beneficially Owned Prior to Offering | | Number of Shares of Class A Common Stock Being Offered | | Number | | Percent |

Andrew Pascal(1) | | 2,191,793 | | 2,191,793 | | — | | — |

Activision Publishing, Inc.(2) | | 12,677,398 | | 14,809,480 | | — | | — |

A-Fund, L.P.(3) | | 3,400,018 | | 3,940,064 | | — | | — |

| Alejandro Feely | | 25,000 | | 25,000 | | — | | — |

Alpine Oil Company(4) | | 125,000 | | 125,000 | | — | | — |

Andrew Zobler(5) | | 25,000 | | 25,000 | | — | | — |

| Anthony McDevitt. | | 25,000 | | 25,000 | | — | | — |

BlackRock, Inc.(6) | | 3,200,000 | | 3,200,000 | | — | | — |

| Blake Morrison | | 2,500 | | 2,500 | | — | | — |

| Brian Goldman | | 15,000 | | 15,000 | | — | | — |

Brisa Carleton(7) | | 68,702 | | 25,000 | | 43,702 | | * |

Chad Hansing(8) | | 243,921 | | 233,041 | | 10,880 | | — |

CHAH Revocable Trust(9) | | 2,503,579 | | 2,957,945 | | — | | — |

ClearBridge Small Cap CIF(10) | | 14,590 | | 14,590 | | — | | — |

ClearBridge Small Cap Fund(11) | | 1,120,800 | | 1,120,800 | | — | | — |

DreamStreet Holdings, LLC(12) | | 9,419,827 | | 12,029,517 | | — | | — |

Gordco LLC(13) | | 267,061 | | 355,295 | | — | | — |

Guardian Small Cap Core VIP Fund(14) | | 325,000 | | 325,000 | | — | | — |

Icon Ventures IV, L.P.(15) | | 4,794,359 | | 5,479,725 | | — | | — |

| James H. Dahl | | 650,000 | | 650,000 | | — | | — |

Jeffrey Scott(16) | | 3,000 | | 3,000 | | — | | — |

JM Cox Resources LP(17) | | 125,000 | | 125,000 | | — | | — |

J&H Investments, LLC(18) | | 771,157 | | 959,419 | | 50,000 | | * |

Joel Agena(19) | | 333,043 | | 233,043 | | 100,000 | | * |

Katie Bolich(20) | | 295,754 | | 233,041 | | 62,713 | | * |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Kenneth L. Criss | | 25,000 | | 25,000 | | — | | — |

KING FAMILY TRUST(21) | | 867,922 | | 1,154,674 | | — | | — |

Lanx Concentrated Fund I, LP(22) | | 35,000 | | 35,000 | | — | | — |

Lanx Offshore Partners, Ltd(23) | | 35,000 | | 35,000 | | — | | — |

Legend Capital Partners(24) | | 250,000 | | 250,000 | | — | | — |

| Melissa Danenberg | | 2,500 | | 2,500 | | — | | — |

MGM Resorts International(25) | | 16,647,124 | | 18,740,970 | | — | | — |

Michael Ashton Hudson ROTH IRA #1(26) | | 200,000 | | 200,000 | | — | | — |

Pascal Family Trust(27) | | 3,319,305 | | 3,329,427 | | 406,300 | | * |

Paul D. and Julie A. Mathews Family Trust(28) | | 5,116,655 | | 6,054,751 | | 51,000 | | * |

Paul Mathews(29) | | 620,438 | | 609,892 | | 10,546 | | * |

PGP 2021 Irrevocable Trust(30) | | 1,898,734 | | 1,898,734 | | — | | — |

Samuel H. Kennedy(31) | | 25,000 | | 25,000 | | — | | — |

Scott Peterson(32) | | 586,373 | | 135,945 | | 450,428 | | * |

SJP 2021 Irrevocable Trust(33) | | 1,898,734 | | 1,898,734 | | — | | — |

SMALLCAP World Fund, Inc.(34) | | 4,500,000 | | 4,500,000 | | — | | — |

Tech Opportunities, LLC(35) | | 326,000 | | 326,000 | | — | | — |

The Bolich Family Trust(36) | | 853,208 | | 1,006,650 | | 20,000 | | * |

The Fetters Family Trust(37) | | 867,922 | | 1,154,674 | | — | | — |

The Judy K. Mencher Trust 2014(38) | | 567,099 | | 662,473 | | — | | — |

The Lanx Fund, LP(39) | | 35,000 | | 35,000 | | — | | — |

Venture Lending & Leasing VI, LLC(40) | | 3,524,892 | | 4,028,786 | | — | | — |

Zachary Elias Leonsis(41) | | 25,000 | | 25,000 | | — | | — |

| TOTAL | | 84,849,408 | | 95,237,463 | | 1,205,569 | | * |

| | | | | | | | |

*Less than one percent.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Private Placement Warrants Beneficially Owned After the Offered Private Placement Warrants are Sold |

| Name of Selling Securityholder | | Number of Private Placement Warrants Beneficially Owned Prior to Offering | | Number of Private Placement Warrants Being Offered | | Number | | Percent |

Gordco LLC(13) | | 377,279 | | 377,279 | | — | | — |

J&H Investments, LLC(18) | | 1,018,782 | | 1,018,782 | | — | | — |

KING FAMILY TRUST(21) | | 1,212,803 | | 1,212,803 | | — | | — |

The Fetters Family Trust(37) | | 1,212,803 | | 1,212,803 | | — | | — |

| TOTAL | | 3,821,667 | | 3,821,667 | | — | | — |

| | | | | | | | |

(1)Shares listed as beneficially owned consist of 2,191,793 Class B Option Shares. Shares offered hereby consist of 2,191,793 Class B Option Shares. Shares listed as beneficially owned and shares offered hereby do not include shares held by DreamStreet Holdings, LLC and Pascal Family Trust. Mr. Pascal is the manager of DreamStreet Holdings, LLC and the trustee of Pascal Family Trust.

(2)Shares offered hereby consist of 12,677,398 shares of Class A common stock and up to 2,132,082 Earnout Shares. Activision Entertainment Holdings, Inc., a Delaware corporation, which is the holder of all the issued and outstanding shares of Activision Publishing, Inc., may therefore be deemed to beneficially own the securities offered hereby. Activision Blizzard, Inc., a Delaware corporation, which is the holder of all the issued and outstanding shares of

Activision Entertainment Holdings, Inc., may therefore be deemed to beneficially own the securities offered hereby. A representative of Activision Publishing, Inc. was on the Board of Directors of PLAYSTUDIOS, Inc. prior to its business combination with Acies Acquisition Corp.

(3)Shares offered hereby consist of 3,400,018 shares of Class A common stock and up to 540,046 Earnout Shares. Jason Krikorian is a member of our Board of Directors of the Company. A-Fund Investment Management, L.P. is the general partner of A-Fund, L.P. A-Fund International, Ltd. is the general partner of A-Fund Management, L.P. F. Hurst Lin and Matthew C. Bonner are the directors of A-Fund International, Ltd. and share voting and dispositive control with respect to the shares held by A-Fund, L.P. Mr. Krikorian disclaims beneficial ownership of such shares except with respect to his pecuniary interests.

(4)James Kelly Cox is trustee, director and beneficial owner of Alpine Oil Company.

(5)Andrew Zobler was an independent director of Acies Acquisition Corp., the predecessor company to PLAYSTUDIOS.

(6)The registered holders of the referenced shares to be registered are the following funds and accounts under management by subsidiaries of BlackRock, Inc.: BlackRock Global Allocation Fund, Inc.; BlackRock Global Allocation V.I. Fund of BlackRock Variable Series Funds, Inc.; BlackRock Global Allocation Portfolio of BlackRock Series Fund, Inc.; BlackRock Capital Allocation Trust; BlackRock Strategic Income Opportunities Portfolio of BlackRock Funds V; Master Total Return Portfolio of Master Bond LLC; and BlackRock Global Long/Short Credit Fund of BlackRock Funds IV. BlackRock, Inc. is the ultimate parent holding company of such subsidiaries. On behalf of such subsidiaries, the applicable portfolio managers, as managing directors (or in other capacities) of such entities, and/or the applicable investment committee members of such funds and accounts, have voting and investment power over the shares held by the funds and accounts which are the registered holders of the referenced shares. Such portfolio managers and/or investment committee members expressly disclaim beneficial ownership of all shares held by such funds and accounts. The address of such funds and accounts, such subsidiaries and such portfolio managers and/or investment committee members is 55 East 52nd Street, New York, NY 10055. Shares shown include only the securities being registered for resale and may not incorporate all shares deemed to be beneficially held by the registered holders or BlackRock, Inc.

(7)Brisa Carleton was an independent director of Acies Acquisition Corp., the predecessor company to PLAYSTUDIOS.

(8)Shares listed as beneficially owned consist of 10,880 shares of Class A common stock and 233,041 Class A Option Shares. Shares offered hereby consist of 233,041 Class A Option Shares.

(9)Shares listed as beneficially owned consist of 2,503,579 shares of Class A common stock. Shares offered hereby consist of 2,503,579 shares of Class A common stock and up to 454,366 Earnout Shares. Chad and Audrey Hansing are Trustees and beneficial owners of CHAH Revocable Trust. Chad Hansing was a Co-Founder of Old PLAYSTUDIOS and is a current employee of the Company.

(10)ClearBridge Investments, LLC is discretionary manager of the ClearBridge Small Cap CIF and has both dispositive and voting power over the securities offered hereby. The portfolio managers employed by ClearBridge to manage this account and who exercise these powers are Albert Grosman and Brian Lund.

(11)ClearBridge Investments, LLC is discretionary manager of the ClearBridge Small Cap Fund and has both dispositive and voting power over the securities offered hereby. The portfolio managers employed by ClearBridge to manage this account and who exercise these powers are Albert Grosman and Brian Lund.

(12)Shares listed as beneficially owned consist of 9,419,827 shares of Class B common stock. Shares offered hereby consist of 9,419,827 shares of Class A common stock issuable upon conversion of Class B common stock and up to 2,609,690 Earnout Shares. Andrew Pascal is the beneficial owner of DreamStreet Holdings, LLC and is the Co-Founder and Chief Executive Officer of the Company.

(13)Shares offered hereby consist of 267,061 shares of Class A common stock and up to 88,234 Unvested Sponsor Shares. Christopher Grove and Kimberly Harvey are the beneficial owners of Gordco LLC.

(14)ClearBridge Investments, LLC is discretionary manager of the Guardian Small Cap Core VIP Fund and has both dispositive and voting power over the securities offered hereby. The portfolio managers employed by ClearBridge to manage this account and who exercise these powers are Albert Grosman and Brian Lund.

(15)Shares offered hereby consist of 4,794,359 shares of Class A common stock and up to 685,366 Earnout Shares. Joseph Horowitz is a member of our Board of Directors of the Company. Icon Management Associates IV, LLC is the general partner of Icon Ventures IV, L.P. Joseph Horowitz, Thomas Mawhinney, and Jeb Miller are the managing members of Icon Management Associates IV, LLC and share voting and dispositive control with respect to the shares held by Icon Ventures IV, L.P.

(16)ClearBridge Investments, LLC is discretionary manager of the Jeffrey Scott account and has both dispositive and voting power securities offered hereby. The portfolio managers employed by ClearBridge to manage this account and who exercise these powers are Albert Grosman and Brian Lund.

(17)James Kelly Cox is trustee, president and beneficial owner of JM Cox Resources LP.

(18)Shares offered hereby consist of 771,157 shares of Class A common stock and up to 238,262 Unvested Sponsor Shares. J&H Investments, LLC is co-owned 50/50 by The JM 2021 Irrevocable Trust and The HM 2021 Irrevocable Trust. Jim Murren is the trustee of The JM 2021 Irrevocable Trust and Heather Murren is the trustee of The HM 2021 Irrevocable Trust. Jim Murren and Heather Murren share voting and dispositive power with respect to the securities held by J&H Investments, LLC.

(19)Shares listed as beneficially owned consist of 100,000 shares of Class A common stock and 233,043 Class A Option Shares. Shares offered hereby consist of 233,043 Class A Option Shares. Joel Agena is the General Counsel and Secretary of the Company.

(20)Shares listed as beneficially owned consist of 62,713 shares of Class A common stock and 233,041 Class A Option Shares. Shares offered hereby consist of 233,041 Class A Option Shares.

(21)Shares offered hereby consist of 867,922 shares of Class A common stock and up to 286,752 Unvested Sponsor Shares. Edward King is trustee and beneficial owner of the KING FAMILY TRUST. Edward King was the Co-CEO of Acies Acquisition Corp., the predecessor company to PLAYSTUDIOS.

(22)The Selling Securityholder is managed by Lanx Management, LLC. Brian Goldman is the natural person who has voting or investment control over the shares held by Lanx Management, LLC, and thus has voting or investment control over the securities offered hereby.

(23)The Selling Securityholder is managed by Lanx Management, LLC. Brian Goldman is the natural person who has voting or investment control over the shares held by Lanx Management, LLC, and thus has voting or investment control over the securities offered hereby.

(24)DeWitt C. Thompson is Managing Partner of Legend Capital Partners, and has sole and dispositive power with respect to the securities held by Legend Capital Partners.

(25)Shares offered hereby consist of 16,647,124 shares of Class A common stock and up to 2,093,846 Earnout Shares. Steve Zanella, the Chief Commercial Officer of MGM Resorts International, serves as a director of the Company. His position is not subject to any contractual right. MGM Resorts International is also party to the Marketing Agreement. The Selling Securityholder is a public company listed on the New York Stock Exchange and is not a controlled company.

(26)Ashton Hudson is the beneficiary of the Michael Ashton Hudson ROTH IRA #1.

(27)Shares listed as beneficially owned consist of 406,300 shares of Class A Common Stock and 2,913,005 shares of Class A common stock issuable upon conversion of Class B common stock. Shares offered hereby consist of 2,913,005 shares of Class A common stock issuable upon conversion of Class B common stock and up to 416,422 Earnout Shares. Andrew Pascal is the beneficial owner of Pascal Family Trust and is the Co-Founder and Chief Executive Officer of the Company.

(28)Shares listed as beneficially owned consist of 5,116,555 shares of Class A common stock. Shares offered hereby consist of 5,065,655 shares of Class A common stock and up to 989,096 Earnout Shares. Paul D. and Julie A. Mathews are Trustees and beneficial owners of the Paul D. and Julie A. Mathews Family Trust. Paul D. Mathews was a Co-Founder of the Company and is a current employee of the Company.

(29)Shares listed as beneficially owned consist of 10,546 shares of Class A common stock and 609,892 Class A Option Shares. Shares offered hereby consist of 609,892 Class A Option Shares.

(30)Shares offered hereby consist of 1,898,734 shares of Class A common stock issuable upon conversion of Class B common stock. Andrew Pascal has voting power over the shares and is the Co-Founder and Chief Executive Officer of the Company.

(31)Samuel H. Kennedy was an independent director of Acies Acquisition Corp., the predecessor company to PLAYSTUDIOS.

(32)Shares listed as beneficially owned consist of 450,428 shares of Class A common stock and 135,945 Class A Option Shares. Shares offered hereby consist of 135,945 Class A Option Shares. Scott Peterson is the Chief Financial Officer of the Company.

(33)Shares offered hereby consist of 1,898,734 shares of Class A common stock issuable upon conversion of Class B common stock. Andrew Pascal has voting power over the shares and is the Co-Founder and Chief Executive Officer of the Company.

(34)Capital Research and Management Company (“CRMC”) is the investment adviser for SMALLCAP World Fund, Inc. (“SCWF”). For purposes of the reporting requirements of the Exchange Act, CRMC and Capital Research Global Investors (“CRGI”) may be deemed to be the beneficial owner of the shares of Class A common stock held by SCWF; however, each of CRMC and CRGI expressly disclaims that it is, in fact, the beneficial owner of such securities. Brady L. Enright, Julian N. Abdey, Jonathan Knowles, Gregory W. Wendt, Peter Eliot, Bradford F. Freer, Leo Hee, Roz Hongsaranagon, Harold H. La, Dimitrije Mitrinovic, Aidan O’Connell, Samir Parekh, Andraz Razen, Renaud H. Samyn, Arun Swaminathan, Thatcher Thompson, Michael Beckwith, and Shlok Melwani, as portfolio managers, have voting and investment powers over the shares held by SCWF. The address for SCWF is c/o Capital Research and Management Company, 333 S. Hope St., 55th Floor, Los Angeles, California 90071. SCWF acquired the securities being registered hereby in the ordinary course of its business.

(35)Hudson Bay Capital Management LP, the investment manager of Tech Opportunities, LLC, has voting and investment power over these securities. Sander Gerber is the managing member of Hudson Bay Capital GP LLC, which is the general partner of Hudson Bay Capital Management LP. Each of Tech Opportunities, LLC and Sander Gerber disclaims beneficial ownership over these securities.

(36)Shares listed as beneficially owned consist of 853,208 shares of Class A common stock. Shares offered hereby consist of 833,208 shares of Class A common stock and up to 173,442 Earnout Shares. Kathleen Connors Bolich and Bryan David Bolich are Trustees and beneficial owners The Bolich Family Trust. Kathleen Connors Bolich is a current employee of the Company.

(37)Shares offered hereby consist of 867,922 shares of Class A common stock and up to 286,752 Unvested Sponsor Shares. Daniel Fetters and Lisa Fetters are the trustees and beneficial owners of The Fetters Family Trust. Daniel Fetters was the Co-CEO of Acies Acquisition Corp., the predecessor company to PLAYSTUDIOS.

(38)Shares offered hereby consist of 567,099 shares of Class A common stock and up to 95,374 Earnout Shares. Judy Mencher is a director of the Company.

(39)The Selling Securityholder is managed by Lanx Management, LLC. Brian Goldman is the natural person who has voting or investment control over the shares held by Lanx Management, LLC, and thus has voting or investment control over the securities offered hereby.

(40)Shares offered hereby consist of 3,524,892 shares of Class A common stock and up to 503,894 Earnout Shares. Westech Investment Advisors LLC is the Managing Member of Venture Lending & Leasing VI, LLC. Ron Swenson, Sal Gutierrez, and Maurice Werdegar are the three directors of the Managing Member.

(41)Zachary Elias Leonsis was an independent director of Acies Acquisition Corp., the predecessor company to PLAYSTUDIOS.

DESCRIPTION OF OUR SECURITIES

The following summary of the material terms of our securities is not intended to be a complete summary of the rights and preferences of such securities. The descriptions below are qualified by reference to the actual text of the Certificate of Incorporation. We advise you to read our Certificate of Incorporation and Bylaws in their entirety for a complete description of the rights and preferences of our securities.

General

Authorized Capitalization

Authorized capital stock consists of shares of capital stock, par value $0.0001 per share, of which:

•2,000,000,000 shares are designated as Class A common stock;

•25,000,000 shares are designated as Class B common stock; and

•100,000,000 shares are designated as preferred stock.

The Board of Directors is authorized, without stockholder approval, except as required by the listing standards of the Nasdaq, to issue additional shares of capital stock.

As of July 8, 2022, we have approximately 111,966,389 shares of Class A common stock outstanding and approximately 16,130,300 shares of Class B common stock outstanding. There are also 9,204,168 warrants consisting of 5,382,501 public warrants and 3,821,667 private placement warrants issued and outstanding.

Common Stock

We have two classes of authorized common stock, Class A common stock and Class B common stock. The rights of the holders of Class A common stock and Class B common stock are identical, except with respect to voting and conversion.

Dividend Rights

Subject to preferences that may be applicable to any preferred stock outstanding at the time, the holders of outstanding shares of common stock are entitled to receive ratably any dividends declared by the Board of Directors out of assets legally available. See the section titled “Dividend Policy” for additional information.

Voting Rights

Shares of Class A common stock are entitled to one vote per share. Shares of Class B common stock are entitled to 20 votes per share. The holders of Class A common stock and Class B common stock will generally vote together as a single class on all matters submitted to a vote of stockholders unless otherwise required by the DGCL or the Certificate of Incorporation.

The Certificate of Incorporation provides that prior to the Final Conversion Date (as defined below), we shall not, without the prior affirmative vote of the holders of at least a majority of the outstanding shares of Class B common stock, voting as a separate class, in addition to any other vote required by applicable law or the Certificate of Incorporation:

•directly or indirectly, whether by amendment, or through merger, recapitalization, consolidation or otherwise, amend, repeal, or adopt any provision of the Certificate of Incorporation inconsistent with, or otherwise alter, any provision of the Certificate of Incorporation that modifies the voting, conversion or other rights, powers, preferences, privileges, or restrictions of the shares of Class B common stock ;

•reclassify any outstanding shares of Class A common stock into shares having (i) rights as to dividends or liquidation that are senior to Class B common stock or (ii) the right to have more than one vote per share, except as required by law;

•decrease or increase the number of authorized shares of Class B common stock or issue any shares of Class B common stock (other than shares of Class B common stock issued by us pursuant to the exercise or conversion of options or warrants or settlements of other equity awards that, in each case, were outstanding as of the date of the Closing); or

•authorize, or issue any shares of, any class or series of capital stock having the right to more than one vote for each share thereof other than Class B common stock.

Additionally, the DGCL could require either holders of Class A common stock or Class B common stock to vote as separate classes in the following circumstances:

•if we were to seek to amend the Certificate of Incorporation to increase or decrease the par value of a class of capital stock, then that class would be required to vote separately to approve the proposed amendment; and

•if we were to seek to amend the Certificate of Incorporation in a manner that alters or changes the powers, preferences, or special rights of a class of capital stock in a manner that affected its holders adversely, then that class would be required to vote separately to approve the proposed amendment.

Liquidation Rights

If we are involved in a liquidation, dissolution, or are wound up, holders of our common stock are entitled to share ratably in all assets remaining after payment of liabilities and the liquidation preference of any then outstanding shares of preferred stock. The Certificate of Incorporation provides that any merger or consolidation of the Company with or into another entity must be approved by a majority of the outstanding shares of Class A common stock and Class B common stock, each voting as separate classes unless (i) the shares of our common stock are treated equally, identically and ratably, on a per share basis and (ii) such shares are converted on a pro rata basis into shares of the surviving entity or its parent in such transaction having substantially identical rights, powers and privileges to the shares of Class A common stock and Class B common stock, respectively, in effect immediately prior to such transaction.

No Preemptive or Similar Rights

Our common stock is not entitled to preemptive rights, and there are no redemption or sinking fund provisions applicable to our common stock.

Conversion Rights

Each share of Class B common stock will automatically convert into one share of Class A common stock on the Final Conversion Date, which is the earliest to occur of:

•the date specified by the holders of at least a majority the then outstanding shares of Class B common stock voting as a separate class;

•the date on which Andrew Pascal, the Pascal Family Trust and their respective permitted transferees collectively cease to beneficially own at least 20% of the number of shares of Class B common stock collectively held by such holders immediately following the Closing of the Business Combination; and

•the date that is nine months after the death or permanent and total disability of Andrew Pascal, provided that such date may be extended by a majority of the independent members of the Board of Directors to a date that is not longer than 18 months from the date of such death or disability, provided, however, that from the time of the death or permanent and total disability of Andrew Pascal, the voting power of such shares of Class B common stock shall only be exercised in accordance with an approved transition agreement or a person previously designated by Andrew Pascal and approved by a majority of the independent members of the Board of Directors.

In addition, a holder’s shares of Class B common stock will automatically convert into shares of Class A common stock upon (i) the affirmative written election of such stockholder, or (ii) any sale, assignment, transfer, conveyance, hypothecation, or other transfer or disposition, directly or indirectly, of such shares of Class B common stock or any legal or beneficial interest in such share, whether or not for value and whether voluntary or involuntary or by operation of law (including by merger, consolidation, or otherwise), including, without limitation the transfer of a share of Class B common stock to a broker or other nominee or the transfer of, or entering into a binding agreement with respect to, voting control over such share by proxy or otherwise, other than certain permitted transfers set forth in the Certificate of Incorporation.

Preferred Stock

Pursuant to the Certificate of Incorporation, the Board of Directors has the authority, without further action by the stockholders, to issue from time to time shares of preferred stock in one or more series. The Board of Directors may designate the rights, preferences, privileges and restrictions of the preferred stock, including dividend rights, conversion rights, voting rights, redemption rights, liquidation preference, sinking fund terms, and the number of shares constituting any series or the designation of any series. As of July 8, 2022, there were no shares of preferred stock outstanding.

The issuance of preferred stock could have the effect of restricting dividends on our common stock, diluting the voting power of our common stock, impairing the liquidation rights of our common stock, or delaying, deterring, or preventing a change in control. Such issuance could have the effect of decreasing the market price of our common stock. There are currently no plans to issue any shares of preferred stock.

Stock Options and Restricted Stock Units

As of July 8, 2022, there are 11,559,424 shares of our Class A common stock and 2,191,793 shares of our Class B common stock issuable upon the exercise of stock options, with a weighted average exercise price of $0.82 per share, and 7,299,827 shares of our Class A common stock subject to restricted stock units. There are 15,272,970 shares of our common stock reserved for future issuance under the 2021 Plan as well as: (i) any automatic increases in the number of shares of common stock reserved for future issuance under the 2021 Plan and (ii) upon the forfeiture, termination, expiration or reacquisition of any shares of common stock underlying outstanding stock awards granted under the PLAYSTUDIOS, Inc. 2011 Omnibus Stock and Incentive Plan, an equal number of shares of our common stock. In addition, there are 4,611,788 shares of Class A common stock reserved for future issuance under the 2021 ESPP, as well as any automatic increases in the number of shares of Class A common stock reserved for future issuance under the 2021 ESPP.

Warrants

As of July 8, 2022, there are 5,382,501 shares of our Class A common stock issuable upon the exercise of the Public Warrants, each with an exercise price of $11.50 per share, and 3,821,667 shares of our Class A common stock issuable upon the exercise of the Private Placement Warrants, each with an exercise price of $11.50 per share.

The Public Warrants will expire 5 years after the completion of the Business Combination, or earlier upon redemption or liquidation. The Private Placement Warrants are identical to the Public Warrants, except that the Private Placement Warrants and the shares of Class A common stock issuable upon exercise of the Private Placement Warrants were not transferable until after the completion of the Business Combination, subject to certain limited exceptions. Additionally, the Private Placement Warrants are non-redeemable so long as they are held by the initial holder or any of its permitted transferees. If the Private Placement Warrants are held by someone other than the initial holder or its permitted transferees, the Private Placement Warrants will be redeemable by the Company and exercisable by such holders on the same basis as the Public Warrants. The Private Placement Warrants may be exercised on a cashless basis so long as held by the Sponsor or certain permitted transferees.

The Company may redeem the outstanding Public Warrants in whole, but not in part, at a price of $0.01 per Public Warrant upon a minimum of 30 days’ prior written notice of redemption, if and only if the last sale price of the Company’s common stock equals or exceeds $18.00 per share for any 20-trading days within a 30-trading day period ending three business days before the Company sends the notice of redemption to the holders of the Public Warrants. If the Company calls the Public Warrants for redemption, management will have the option to require all holders that wish to exercise the Public Warrants to do so on a cashless basis. In no event will the Company be required to net cash settle the exercise of Public Warrants.

Anti-takeover Effects of the Certificate of Incorporation and the Bylaws

The Certificate of Incorporation and Bylaws contain provisions that could have the effect of delaying, deferring, or discouraging another party from acquiring control of us. These provisions and certain provisions of the DGCL, which are summarized below, could discourage takeovers, coercive or otherwise. These provisions are also designed, in part, to encourage persons seeking to acquire control of us to negotiate first with the Board of Directors. The Board of Directors believes that the benefits of increased protection of the potential ability to negotiate with an unfriendly or unsolicited acquirer outweigh the disadvantages of discouraging a proposal to acquire us.

Issuance of Undesignated Preferred Stock

As discussed above in the section titled “Preferred Stock,” the Board of Directors has the ability to designate and issue preferred stock with voting or other rights or preferences that could deter hostile takeovers or delay changes in our control or management.

Dual Class Stock

As described above, the Certificate of Incorporation provides for a dual class common stock structure which provides Andrew Pascal with the ability to control the outcome of matters requiring stockholder approval, even though he owns significantly less than a majority of the shares of outstanding common stock, including the election of directors and significant corporate transactions, such as a merger or other sale of our company or our assets.

Limits on Ability of Stockholders to Act by Written Consent or Call a Special Meeting

The Certificate of Incorporation provides that stockholders may not act by written consent after the first date on which the number of outstanding shares of Class B common stock represents less than a majority of the total voting power of the then outstanding shares of capital stock that would then be entitled to vote in the election of directors at an annual meeting of the stockholders (such date, the “Voting Threshold Date”). Prior to the Voting Threshold Date, stockholders may act by written consent only if the action is first recommended or approved by the Board of Directors. This limit on the ability of

stockholders to act by written consent may lengthen the amount of time required to take stockholder actions. As a result, the holders of a majority of common stock would not be able to amend the Bylaws or remove directors without holding a meeting of stockholders called in accordance with the Bylaws.

In addition, the Certificate of Incorporation provides that special meetings of the stockholders may be called only by the chairman of the board, the chief executive officer, or the Board of Directors acting pursuant to a resolution adopted by a majority of the Board of Directors. A stockholder may not call a special meeting, which may delay the ability of stockholders to force consideration of a proposal or for holders controlling a majority of the capital stock to take any action, including the removal of directors.

Advance Requirements for Advance Notification of Stockholder Nominations and Proposals

The Bylaws establish advance notice procedures with respect to stockholder proposals and the nomination of candidates for election as directors, other than nominations made by or at the direction of the Board of Directors or a committee thereof. These advance notice procedures may have the effect of precluding the conduct of certain business at a meeting if the proper procedures are not followed and may also discourage or deter a potential acquirer from conducting a solicitation of proxies to elect its own slate of directors or otherwise attempt to obtain control of the Company.

Election and Removal of Directors

The Certificate of Incorporation and Bylaws contain provisions that establish specific procedures for appointing and removing members of the Board of Directors. Under the Certificate of Incorporation and Bylaws, vacancies and newly created directorships on the Board of Directors may be filled only by a majority of the directors then serving on the Board of Directors. Under the Certificate of Incorporation and Bylaws, directors may be removed from office, with or without cause, by the affirmative vote of the holders of a majority of the total voting power of all of our outstanding securities generally entitled to vote in the election of directors, voting together as a single class.

No Cumulative Voting

The DGCL provides that stockholders are not entitled to the right to cumulate votes in the election of directors unless the Certificate of Incorporation provides otherwise. The Certificate of Incorporation and Bylaws do not expressly provide for cumulative voting. Without cumulative voting, a minority stockholder may not be able to gain as many seats on the Board of Directors as the stockholder would be able to gain if cumulative voting were permitted. The absence of cumulative voting makes it more difficult for a minority stockholder to gain a seat on the Board of Directors to influence the Board of Directors’ decision regarding a takeover.

Amendment of Certificate of Incorporation Provisions

Certain amendments to the Certificate of Incorporation will require the approval of two-thirds of the then outstanding voting power of our capital stock.

Delaware Anti-Takeover Statute

We are subject to the provisions of Section 203 of the DGCL regulating corporate takeovers. In general, Section 203 prohibits a publicly held Delaware corporation from engaging, under certain circumstances, in a business combination with an interested stockholder for a period of three years following the date the person became an interested stockholder unless:

•prior to the date of the transaction, the Board of Directors approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder;

•upon completion of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for purposes of determining the voting stock outstanding, but not the outstanding voting stock owned by the interested stockholder, (1) shares owned by persons who are directors and also officers and (2) shares owned by employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

•at or subsequent to the date of the transaction, the business combination is approved by the Board of Directors and authorized at an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least two-thirds of the outstanding voting stock that is not owned by the interested stockholder.

Generally, a business combination includes a merger, asset, stock sale, or other transaction resulting in a financial benefit to the interested stockholder. An interested stockholder is a person who, together with affiliates and associates, owns or, within three years prior to the determination of interested stockholder status, did own 15% or more of a corporation’s outstanding voting stock. The Board of Directors expects the existence of this provision to have an anti-takeover effect with respect to transactions the Board of Directors does not approve in advance. The Board of Directors also anticipates that

Section 203 may discourage attempts that might result in a premium over the market price for the shares of our Class A common stock held by our stockholders.

The provisions of the DGCL, the Certificate of Incorporation and Bylaws could have the effect of discouraging others from attempting hostile takeovers and as a consequence, they might also inhibit temporary fluctuations in the market price of our Class A common stock that often result from actual or rumored hostile takeover attempts. These provisions might also have the effect of preventing changes in our management. It is also possible that these provisions could make it more difficult to accomplish transactions that our stockholders might otherwise deem to be in their best interests.

Exclusive Forum

The Certificate of Incorporation provides that the sole and exclusive forum for (1) any derivative action or proceeding brought on our behalf, (2) any action asserting a claim of breach of a fiduciary duty owed by any of our directors, officers, or other employees to our company or our stockholders, (3) any action asserting a claim against us or any director or officer of our company arising pursuant to any provision of the DGCL, (4) any action to interpret, apply, enforce, or determine the validity of the Certificate of Incorporation or Bylaws, or (5) any other action asserting a claim that is governed by the internal affairs doctrine shall be a state or federal court located within the State of Delaware, in all cases subject to the court having jurisdiction over indispensable parties named as defendants. However, this exclusive forum provision would not apply to suits brought to enforce a duty or liability created by the Securities Act or Exchange Act or any claim for which the U.S. federal district courts have exclusive jurisdiction.

In addition, the Certificate of Incorporation provides that, unless we consent in writing to the selection of an alternative forum, the U.S. federal district courts will be the exclusive forum for resolving any complaint asserting a cause of action arising under the Securities Act, subject to and contingent upon a final adjudication in the State of Delaware of the enforceability of such exclusive forum provision.