- Q4 2022 revenue of $2.0 million and income from grants of $0.4

million.

- Full year 2022 revenue of $7.8 million and income from grants

of $1.5 million.

- Net loss in Q4 of $47.6 million or $(0.92) per share, including

an impairment charge of $38.9 million. Adjusted net loss in

Q4 of $13.2 million or $(0.26) per share.

- Company holds unrestricted cash reserves of $32.9 million as of

December 31, 2022.

- After official ratification from the European Commission of the

European Union for funding of €782.1 million under the Important

Projects of Common European Interest (“IPCEI”) Hydrogen –

Technology for Advent’s Green HiPo project, Advent has been working

with the Greek State to establish the mechanism and timing schedule

for the funding facility.

- Commissioning of new Hood Park R&D and manufacturing

facility in Boston, Massachusetts. This facility will enable Advent

to scale-up and deliver on the increasing global demand for its

electrochemical products.

Advent Technologies Holdings, Inc. (NASDAQ: ADN) (“Advent” or

the “Company”), an innovation-driven leader in the fuel cell and

hydrogen technology space, today announced its consolidated

financial results for the three months and year ended December 31,

2022. All amounts are in U.S. dollars unless otherwise noted and

have been prepared in accordance with U.S. generally accepted

accounting principles (“GAAP”).

Q4 2022 Financial Highlights (All comparisons are to Q4

2021, unless otherwise stated)

- Revenue of $2.0 million and income from grants of $0.4 million.

The total of $2.4 million is down 22% year-over-year, due to a

decline in orders for the Company’s stationary fuel cell systems

primarily driven by a change in tower ownership by certain

Philippines telecom operators.

- Full year 2022 revenue of $7.8 million and income from grants

of $1.5 million. The total of $9.3 million is an increase of 18%

year-over-year, primarily due to a full year of results from the

Company’s fuel cell systems businesses, compared to a partial year

post-acquisition in 2021.

- Operating expenses of $11.7 million, a year-over-year decrease

of $4.6 million, primarily due to a reduction in incentive and

stock-based compensation expenses.

- Net loss in Q4 of $47.6 million or $(0.92) per share. Adjusted

net loss of $13.2 million or $(0.26) per share. Adjusted net loss

excludes a $2.1 million gain from the change in the fair value of

outstanding warrants, a $2.4 million gain from an acquisition

purchase price adjustment, and a $38.9 million goodwill and

intangible asset impairment charge.

- Asset impairment charge primarily relates to goodwill from the

Company’s stationary fuel cell systems business in Denmark,

Germany, and the Philippines, which was acquired in August

2021.

- Unrestricted cash reserves were $32.9 million as of December

31, 2022, a decrease of $9.5 million from September 30, 2022. In

the fourth quarter of 2022, the Company received $0.4 million in

tenant improvement allowances for the Hood Park R&D and

manufacturing facility in Charlestown, MA, which is net of

additional spending for the build-out of the facility.

“Advent continued to make progress in the last quarter, despite

global recession and inflationary pressures. Subsequent to

ratification by the EU for Advent’s IPCEI Green HiPo project, we

have been working with the Greek State on the mechanism and timing

schedule for the funding facility. It is our goal to finalize these

discussions as soon as possible and proceed with the roll-out of

the program,” said Dr. Vasilis Gregoriou, Chairman and CEO of

Advent Technologies. “With our focus on operational efficiency and

the drive for growth, we have now commissioned our new R&D and

manufacturing facility at Hood Park, Massachusetts. This will

operate alongside our planned facility in Western Macedonia,

Greece, by virtue of Green HiPo, allowing for both facilities to

efficiently target different geographies and specialized markets.

We remain confident that we are on a path for growth, and we look

forward to keeping you apprised of future developments.”

Business Updates

Green HiPo Project: After official ratification from the

European Commission of the European Union for funding of €782.1

million under the IPCEI Hydrogen – Technology for Advent’s Green

HiPo project, Advent has been working with the Greek State to

establish the mechanism and timing schedule for the funding

facility. These meetings have included visits by Greek State

officials to the Company’s research and production facilities in

Patras, Greece. The next steps towards implementation of Advent’s

Green HiPo Project have been discussed and highlight the Company’s

intention to create approximately 600 direct jobs for qualified

scientific and technical personnel and up to 4,600 indirect jobs

over a period of six years. Green HiPo will be based in Western

Macedonia, Greece, and will involve the development, design, and

manufacture of HT-PEM fuel cells and electrolysers for the

production of power and green hydrogen, respectively.

New Hood Park R&D and Manufacturing Facility: In March 2023,

Advent announced that it had opened its new R&D and

manufacturing facility at Hood Park in Boston, Massachusetts.

Located at the heart of one of Boston’s newest innovation and

R&D communities, the Hood Park facility will enable Advent to

scale-up and deliver on the increasing global demand for

electrochemical components in the clean energy sector by including

state-of-the-art coating machines to support the seamless

transition from prototypes to production runs for advanced

membranes and electrodes; a fully analytical facility dedicated to

quality control, performance analysis, and improving product

lifetime; fuel cell test stations for statistical process control

and development of next-generation membrane electrode assembly

(“MEA”) materials, and, a mechanical engineering lab for developing

automated processes for MEAs. One of the products to be

manufactured at Hood Park is the ion-pair Advent MEA which is

currently being developed within the framework of L’Innovator, the

Company’s joint development program with the U.S. Department of

Energy. Advent intends that its proprietary fuel cell products,

such as Serene and Honey Badger 50™, will use the ion-pair Advent

MEAs beginning in 2024. The Company expects the introduction of the

ion-pair Advent MEA will significantly reduce the cost of our

Serene flagship product suite and thus expand the immediately

addressable market. Furthermore, the expected system increase in

power density and lifetime will highly differentiate Advent’s fuel

cells in the heavy-duty mobility industry.

Joint Development Agreement with Hyundai Motor Company

(“Hyundai”): On March 22, 2023, Advent and Hyundai announced a

successful technology assessment. The assessment evaluated Advent’s

proprietary MEA technology for supplying Hyundai’s high-temperature

fuel cell needs, and following its success, the two companies have

entered into a Joint Development Agreement (“JDA”). The agreement

solidifies the interest of one of the world leaders in fuel cell

technology to further develop the HT-PEM technology in

collaboration with Advent. The first step of the JDA focuses on the

MEA. Advent’s goal is to provide its MEAs and its HT-PEM fuel cell

development expertise to co-develop with automotive manufacturers

the next generation of fuel cells for heavy-duty mobility. The

HT-PEM fuel cell technology is highly differentiated compared with

the current LT-PEM technology because it allows a vehicle to

operate with efuel such as eMethanol, biofuels, and low-purity

hydrogen; it allows higher impurity in the hydrogen or air intake,

a case which is very common in practice and has repeatedly hampered

LT-PEM deployments in real-world conditions; it has built-in

resilience, as the HT-PEM fuel cell does not rely on water for

conductivity, therefore eliminating the problems of operating in

extreme heat, cold, or humid conditions; and it has a higher

efficiency resulting from the high-temperature operation, which

allows for optimized cooling, a critical performance parameter for

heavy-duty trucks and aircraft. Based on the aforementioned, Advent

will pursue strategic joint development agreements to achieve its

goal of supplying key MEA components and technology to the mobility

market.

Vantage Towers Greece (“Vantage Towers”): On December 19,

2022, Advent launched a proof of concept (“PoC”) project with

Vantage Towers to replace diesel generators with fuel cells.

Vantage Towers Greece is the largest and only independent tower

infrastructure company in Greece, operating more than 5,250 towers

for Vodafone Greece and Wind Hellas. By replacing diesel generators

with fuel cells at non-permanent sites that are not connected to

the power grid, they can be supplied with environmentally friendly

electricity. Under the PoC, Vantage Towers Greece, a subsidiary of

Vantage Towers Group, one of Europe’s leading tower companies, will

explore the applicability of Advent’s Serene biomethanol-powered

fuel cell systems as back-up and primary power sources for its

telecom towers. This new collaboration is particularly aligned with

the overall strategy of Vantage Towers, which aims to drive

sustainable digitalization in Europe by reducing carbon emissions

across its network by using clean energy solutions. Following the

successful completion of the PoC project in Greece, Advent and

Vantage Towers could consider wider deployments. Advent has already

installed approximately 1,000 methanol-powered Serene fuel cell

systems worldwide, primarily used as a back-up power source for the

telecommunications sector.

Collaboration with Alfa Laval: On January 10, 2023,

Advent announced a collaboration with Alfa Laval, a global provider

of heat transfer, separation, and fluid handling products, on a

project to explore applications of Advent’s methanol-powered HT-PEM

fuel cells in the marine industry. Funded by the Danish Energy

Technology Development and Demonstration Program, the project is a

joint effort between Advent, Alfa Laval and a group of Danish

shipowners. The project will focus on testing Advent’s

methanol-powered HT-PEM fuel cells as a source of marine auxiliary

power. During the course of the project, the fuel cell system will

undergo a risk assessment by a leading international classification

society. At the same time, the project aims to integrate the next

generation of Advent’s fuel cells. These fuel cells will be based

on Advent’s next-generation MEA. Aiming to meet the ever-growing

power requirements of the maritime industry, Advent’s

next-generation fuel cells are expected to demonstrate a

significant increase in lifetime, efficiency, and electrical

output.

Marine Fuel Cell Solution for Superyachts: On February 9,

2023, Advent announced a new marine collaboration with a globally

renowned energy technology company, offering sustainable solutions

across the entire energy value chain. Advent and its partner will

work together to develop a 50kW–500kW marine fuel cell solution for

a range of superyachts, which will provide a sustainable and

reliable source of auxiliary power and offer improved power

density. This marine fuel cell solution is initially expected to be

used as a hybrid power source, enabling clean electricity

generation instead of using conventional diesel engines and

generators for procedures such as anchoring and maneuvering. As

part of the agreement, Advent’s partner has placed an initial order

for 20 of Advent’s methanol-powered Serene fuel cell systems.

Following the completion of this project, the two parties will

explore the potential of developing similar solutions for a wider

range of business applications beyond marine, such as industrial

power solutions.

Honey Badger Fuel Cell for U.S. Department of Defense:

Advent continued with the development efforts of the Honey Badger

50™, the portable power generator for the Defense market, funded by

the U.S. Department of Defense. The Company expects the production

version to be finalized in 2023, and our goal is to receive

production orders in 2024 increasing to higher volumes in 2025. We

consider the Department of Defense programs a very important part

of our innovation portfolio, as they demand performance under

extreme conditions and prove the resilience of the HT-PEM

technology. The portable fuel cell application market is also a

potential target for growth, where we intend to seek synergies with

established market leaders that require a fuel cell product

suite.

Conference Call

The Company will host a conference call on Friday, March 31,

2023, at 9:00 AM ET to discuss its results.

To access the call please dial (888) 660-6182 from the United

States, or (929) 203-0891 from outside the U.S. The conference call

I.D. number is 3273042. Participants should dial in 5 to 10 minutes

before the scheduled time.

A replay of the call can also be accessed via phone through

April 14, 2023, by dialing (800) 770-2030 from the U.S., or (647)

362-9199 from outside the U.S. The conference I.D. number is

3273042.

About Advent Technologies Holdings, Inc.

Advent Technologies Holdings, Inc. is a U.S. corporation that

develops, manufactures, and assembles complete fuel cell systems,

and the critical components for fuel cells in the renewable energy

sector. Advent is headquartered in Boston, Massachusetts, with

offices in California, Greece, Denmark, Germany, and the

Philippines. With more than 150 patents issued, pending, or

licensed worldwide for fuel cell technology, Advent holds the IP

for next-generation HT-PEM that enable various fuels to function at

high temperatures and under extreme conditions – offering a

flexible option for the automotive, aviation, defense, oil and gas,

marine, and power generation sectors. For more information, please

visit www.advent.energy.

Cautionary Note Regarding Forward-Looking Statements

This press release includes forward-looking statements. These

forward-looking statements generally can be identified by the use

of words such as “anticipate,” “expect,” “plan,” “could,” “may,”

“will,” “believe,” “estimate,” “forecast,” “goal,” “project,” and

other words of similar meaning. Each forward-looking statement

contained in this press release is subject to risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied by such statement. Applicable risks

and uncertainties include, among others, the Company’s ability to

maintain the listing of the Company’s common stock on Nasdaq;

future financial performance; public securities’ potential

liquidity and trading; impact from the outcome of any known and

unknown litigation; ability to forecast and maintain an adequate

rate of revenue growth and appropriately plan its expenses;

expectations regarding future expenditures; future mix of revenue

and effect on gross margins; attraction and retention of qualified

directors, officers, employees, and key personnel; ability to

compete effectively in a competitive industry; ability to protect

and enhance our corporate reputation and brand; expectations

concerning our relationships and actions with our technology

partners and other third parties; impact from future regulatory,

judicial and legislative changes to the industry; ability to locate

and acquire complementary technologies or services and integrate

those into the Company’s business; future arrangements with, or

investments in, other entities or associations; and intense

competition and competitive pressure from other companies worldwide

in the industries in which the Company will operate; and the risks

identified under the heading “Risk Factors” in our Annual Report on

Form 10-K filed with the Securities and Exchange Commission on

March 31, 2022, as well as the other information we file with the

SEC. We caution investors not to place considerable reliance on the

forward-looking statements contained in this press release. You are

encouraged to read our filings with the SEC, available at

www.sec.gov, for a discussion of these and other risks and

uncertainties. The forward-looking statements in this press release

speak only as of the date of this document, and we undertake no

obligation to update or revise any of these statements. Our

business is subject to substantial risks and uncertainties,

including those referenced above. Investors, potential investors,

and others should give careful consideration to these risks and

uncertainties.

Presentation of Non-GAAP Financial Measures

In addition to the results provided in accordance with U.S. GAAP

throughout this press release, the Company has provided non-GAAP

financial measures - Adjusted Net Income / (Loss) and Adjusted

EBITDA - which present results on a basis adjusted for certain

items. The Company uses these non-GAAP financial measures for

business planning purposes and in measuring its performance

relative to that of its competitors. The Company believes that

these non-GAAP financial measures are useful financial metrics to

assess its operating performance from period-to-period by excluding

certain items that the Company believes are not representative of

its core business. These non-GAAP financial measures are not

intended to replace, and should not be considered superior to, the

presentation of the Company’s financial results in accordance with

GAAP. The use of the terms Adjusted Net Income / (Loss) and

Adjusted EBITDA may differ from similar measures reported by other

companies and may not be comparable to other similarly titled

measures. These measures are reconciled from the respective

measures under GAAP in the appendix below.

ADVENT TECHNOLOGIES HOLDINGS,

INC.

CONSOLIDATED BALANCE

SHEETS

(Amounts in USD thousands,

except share and per share amounts)

As of

ASSETS

December 31, 2022

(Unaudited)

December 31, 2021

Current assets:

Cash and cash equivalents

$

32,869

$

79,764

Accounts receivable

979

3,139

Contract assets

52

1,617

Inventories

12,620

6,958

Prepaid expenses and Other current

assets

2,980

5,873

Total current assets

49,500

97,351

Non-current assets:

Goodwill

5,742

30,030

Intangibles, net

6,062

23,344

Property and equipment, net

17,938

8,585

Right-of-use assets

4,055

-

Other non-current assets

5,971

2,475

Deferred tax assets

-

1,246

Available for sale financial asset

320

-

Total non-current assets

40,088

65,680

Total assets

$

89,588

$

163,031

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Trade and other payables

$

4,680

$

4,837

Deferred income from grants, current

801

205

Contract liabilities

1,019

1,118

Other current liabilities

4,703

12,515

Operating lease liabilities

2,280

-

Income tax payable

183

196

Total current liabilities

13,666

18,871

Non-current liabilities:

Warrant liability

998

10,373

Deferred tax liabilities

-

2,500

Long-term operating lease liabilities

9,802

-

Defined benefit obligation

72

90

Deferred income from grants,

non-current

50

-

Other long-term liabilities

852

996

Total non-current liabilities

11,774

13,959

Total liabilities

25,440

32,830

Commitments and contingent

liabilities

Stockholders’ equity

Common stock ($0.0001 par value per share;

Shares authorized: 110,000,000 at December 31, 2022 and December

31, 2021; Issued and outstanding: 51,717,720 and 51,253,591 at

December 31, 2022 and December 31, 2021, respectively)

5

5

Preferred stock ($0.0001 par value per

share; Shares authorized: 1,000,000 at December 31, 2022 and

December 31, 2021; nil issued and outstanding at December 31, 2022

and December 31, 2021)

-

-

Additional paid-in capital

174,509

164,894

Accumulated other comprehensive loss

(2,604)

(1,273)

Accumulated deficit

(107,762)

(33,425)

Total stockholders’ equity

64,148

130,201

Total liabilities and stockholders’

equity

$

89,588

$

163,031

ADVENT TECHNOLOGIES HOLDINGS,

INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Amounts in USD thousands,

except share and per share amounts)

Three months ended December

31,

Years Ended December

31,

(Unaudited)

(Unaudited)

2022

2021

2022

2021

Revenue, net

$

1,957

$

2,903

$

7,837

$

7,069

Cost of revenues

(2,455)

(2,744)

(8,581)

(5,406)

Gross profit / (loss)

(498)

159

(744)

1,663

Income from grants

449

197

1,460

829

Research and development expenses

(2,458)

(1,980)

(9,796)

(3,541)

Administrative and selling expenses

(9,258)

(14,318)

(35,915)

(41,877)

Amortization of intangibles

(651)

(717)

(2,764)

(1,185)

Credit loss – customer contracts

(1,116)

-

(1,116)

-

Gain from purchase price adjustment

2,370

-

2,370

-

Impairment loss - intangible assets and

goodwill

(38,922)

-

(38,922)

-

Operating loss

(50,084)

(16,659)

(85,427)

(44,111)

Fair value change of warrant liability

2,127

6,909

9,375

22,743

Finance income / (expenses), net

61

(24)

52

(51)

Foreign exchange gains / (losses), net

(40)

(42)

(91)

(43)

Other income / (expenses), net

4

(62)

(216)

16

Loss before income tax

(47,932)

(9,878)

(76,307)

(21,446)

Income taxes

307

872

1,970

923

Net loss

$

(47,625)

$

(9,006)

$

(74,337)

$

(20,523)

Net loss per share

Basic loss per share

(0.92)

(0.18)

(1.44)

(0.45)

Basic weighted average number of

shares

51,717,720

51,253,591

51,528,703

45,814,868

Diluted loss per share

(0.92)

(0.18)

(1.44)

(0.45)

Diluted weighted average number of

shares

51,717,720

51,253,591

51,528,703

45,814,868

ADVENT TECHNOLOGIES HOLDINGS,

INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Amounts in USD

thousands)

Years Ended December

31,

(Unaudited)

2022

2021

Net Cash used in Operating

Activities

$

(32,125)

$

(35,837)

Cash Flows from Investing

Activities:

Proceeds from sale of property and

equipment

0

7

Purchases of property and equipment

(11,527)

(3,920)

Purchases of intangible assets

(117)

(18)

Advances for the acquisition of property

and equipment

(2,557)

(2,200)

Acquisition of a subsidiary, net of cash

acquired

-

(19,425)

Acquisition of available for sale

financial assets

(316)

-

Net Cash used in Investing

Activities

$

(14,517)

$

(25,556)

Cash Flows from Financing

Activities:

Business Combination and PIPE financing,

net of issuance costs paid

-

141,121

Proceeds of issuance of common stock and

paid-in capital from warrants exercise

-

262

State loan proceeds

-

118

State refundable deposit repayment

(40)

-

Net Cash (used in) provided by

Financing Activities

$

(40)

$

141,501

Net (decrease) / increase in cash, cash

equivalents, restricted cash and restricted cash

equivalents

$

(46,682)

$

80,108

Effect of exchange rate changes on cash,

cash equivalents, restricted cash and restricted cash

equivalents

537

(860)

Cash, cash equivalents, restricted cash

and restricted cash equivalents at the beginning of year

79,764

516

Cash, cash equivalents, restricted cash

and restricted cash equivalents at the end of year

$

33,619

$

79,764

Supplemental Non-GAAP Measures and Reconciliations

In addition to providing measures prepared in accordance with

GAAP, we present certain supplemental non-GAAP measures. These

measures are EBITDA, Adjusted EBITDA and Adjusted Net Income /

(Loss), which we use to evaluate our operating performance, for

business planning purposes and to measure our performance relative

to that of our peers. These non-GAAP measures do not have any

standardized meaning prescribed by GAAP and therefore may differ

from similar measures presented by other companies and may not be

comparable to other similarly titled measures. We believe these

measures are useful in evaluating the operating performance of the

Company’s ongoing business. These measures should be considered in

addition to, and not as a substitute for net income, operating

expense and income, cash flows and other measures of financial

performance and liquidity reported in accordance with GAAP. The

calculation of these non-GAAP measures has been made on a

consistent basis for all periods presented.

EBITDA and Adjusted EBITDA

These supplemental non-GAAP measures are provided to assist

readers in determining our operating performance. We believe this

measure is useful in assessing performance and highlighting trends

on an overall basis. We also believe EBITDA and Adjusted EBITDA are

frequently used by securities analysts and investors when comparing

our results with those of other companies. EBITDA differs from the

most comparable GAAP measure, net income / (loss), primarily

because it does not include interest, income taxes, depreciation of

property, plant and equipment, and amortization of intangible

assets. Adjusted EBITDA adjusts EBITDA for one-time transaction

costs, asset impairment charges, changes in warrant liability, and

executive severance.

The following tables show a reconciliation of net income /

(loss) to EBITDA and Adjusted EBITDA for the three months and years

ended December 31, 2022 and 2021.

Three months ended December

31,

Years Ended December

31,

EBITDA and Adjusted EBITDA

(Unaudited)

(Unaudited)

(in Millions of U.S. dollars)

2022

2021

$ change

2022

2021

$ change

Net loss

$

(47.63)

$

(9.00)

(38.63)

$

(74.34)

$

(20.52)

(53.82)

Depreciation of property and equipment

$

0.36

$

0.38

(0.02)

$

1.49

$

0.56

0.93

Amortization of intangibles

$

0.65

$

0.71

(0.06)

$

2.76

$

1.18

1.58

Finance income / (expenses), net

$

(0.06)

$

0.02

(0.08)

$

(0.05)

$

0.05

(0.10)

Other income / (expenses), net

$

0.00

$

0.06

(0.06)

$

0.22

$

(0.02)

0.24

Foreign exchange differences, net

$

0.04

$

0.04

-

$

0.09

$

0.04

0.05

Income taxes

$

(0.31)

$

(0.87)

0.56

$

(1.97)

$

(0.92)

(1.05)

EBITDA

$

(46.95)

$

(8.66)

(38.29)

$

(71.80)

$

(19.63)

(52.17)

Net change in warrant liability

$

(2.13)

$

(6.91)

4.78

$

(9.38)

$

(22.74)

13.36

Gain from purchase price adjustment

$

(2.37)

$

-

(2.37)

$

(2.37)

$

-

(2.37)

Impairment loss – intangible assets and

goodwill

$

38.92

$

-

38.92

$

38.92

$

-

38.92

One-Time Transaction Related Expenses

(1)

$

-

$

-

-

$

-

$

5.87

(5.87)

One-Time Transaction Related Expenses

(2)

$

-

$

-

-

$

-

$

0.89

(0.89)

Executive severance (3)

$

-

$

-

-

$

-

$

2.44

(2.44)

Adjusted EBITDA

$

(12.53)

$

(15.57)

3.04

$

(44.63)

$

(33.17)

(11.46)

(1) Bonus awarded after consummation of the Business Combination

effective February 4, 2021. (2) Transaction costs related to the

acquisition of SerEnergy/FES. (3) Former Financial Officer

resignation.

Adjusted Net Income / (Loss)

This supplemental non-GAAP measure is provided to assist readers

in determining our financial performance. We believe this measure

is useful in assessing performance and highlighting trends on an

overall basis. Adjusted Net Loss differs from the most comparable

GAAP measure, net income / (loss), primarily because it does not

include one-time transaction costs, asset impairment charges,

changes in warrant liability, and executive severance. The

following table shows a reconciliation of net income / (loss) for

the three months and years ended December 31, 2022 and 2021.

Three months ended December

31,

Years Ended December

31,

Adjusted Net Loss

(Unaudited)

(Unaudited)

(in Millions of U.S. dollars)

2022

2021

$ change

2022

2021

$ change

Net loss

$

(47.63)

$

(9.00)

(38.63)

$

(74.34)

$

(20.52)

(53.82)

Net change in warrant liability

$

(2.13)

$

(6.91)

4.78

$

(9.38)

$

(22.74)

13.36

Gain from purchase price adjustment

$

(2.37)

$

-

(2.37)

$

(2.37)

$

-

(2.37)

Impairment loss – intangible assets and

goodwill

$

38.92

$

-

38.92

$

38.92

$

-

38.92

One-Time Transaction Related Expenses

(1)

$

-

$

-

-

$

-

$

5.87

(5.87)

One-Time Transaction Related Expenses

(2)

$

-

$

-

-

$

-

$

0.89

(0.89)

Executive severance (3)

$

-

$

-

-

$

-

$

2.44

(2.44)

Adjusted Net Loss

$

(13.21)

$

(15.91)

2.70

$

(47.17)

$

(34.06)

(13.11)

(1) Bonus awarded after consummation of the Business Combination

effective February 4, 2021. (2) Transaction costs related to the

acquisition of SerEnergy/FES. (3) Former Financial Officer

resignation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230331005154/en/

Advent Technologies Holdings, Inc.

Naiem Hussain nhussain@advent.energy

Chris Kaskavelis press@advent.energy

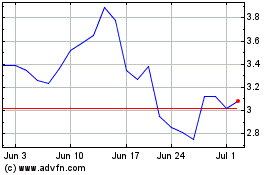

Advent Technologies (NASDAQ:ADN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Advent Technologies (NASDAQ:ADN)

Historical Stock Chart

From Nov 2023 to Nov 2024