SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

SCHEDULE 13D

Rule 13d-101

INFORMATION

TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO §

240.13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment

No. 23)

| Agilysys,

Inc. |

(Name

of Issuer)

|

| Common

Stock, without par value |

| (Title

of Class of Securities) |

|

00847J105 |

| (CUSIP

Number) |

Howard

M. Berkower, Esq.

McCarter

& English, LLP

825 Eighth Avenue, 31st Floor

New York,

New York 10019

(212)

609-6800 |

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications)

|

| February 14, 2024 |

| (Date

of Event Which Requires Filing of this Statement) |

If the filing person has previously

filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule

because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box. o

Note: Schedules filed in paper

format shall include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7 for

other parties to whom copies are to be sent.

*The remainder of this cover page

shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and

for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder

of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of

1934 (the “Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other

provisions of the Act (however, see the Notes).

| CUSIP NO.: 00847J105 |

| |

|

| 1. |

NAME

OF REPORTING PERSONS

|

| |

MAK

Capital One L.L.C.

|

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

x (b) o |

| |

|

| 3. |

SEC USE ONLY |

| |

|

| 4. |

SOURCE OF FUNDS

|

| |

|

| 5. |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

o |

| |

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

| |

|

| |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

| |

|

| 7. |

SOLE VOTING POWER |

| |

0 |

| |

|

| 8. |

SHARED VOTING POWER |

| |

2,060,458

|

| 9. |

SOLE DISPOSITIVE POWER |

| |

0 |

| |

|

| 10. |

SHARED DISPOSITIVE POWER |

| |

2,060,458

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY

EACH REPORTING PERSON |

| |

2,060,458

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES o |

| |

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) |

| |

7.5%a

|

| 14. |

TYPE

OF REPORTING PERSON

OO |

a

This calculation is based upon 27,363,750 shares of the common stock, without par value, of

Agilysys, Inc., a Delaware corporation (the “Issuer”), outstanding as of February 1, 2024, as set forth in a prospectus supplement

dated February 14, 2024 to the Issuer’s shelf registration statement on Form S-3ASR which became effective upon filing with the Securities

and Exchange Commission on September 15, 2023.

| CUSIP NO.: 00847J105 |

| |

|

| 1. |

NAME

OF REPORTING PERSONS

|

| |

Michael A. Kaufman

|

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

x (b) o |

| |

|

| 3. |

SEC USE ONLY |

| |

|

| 4. |

SOURCE OF FUNDS

|

| |

|

| 5. |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

o |

| |

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

| |

United States

|

| |

|

| 7. |

SOLE VOTING POWER |

| |

9,580 |

| |

|

| 8. |

SHARED VOTING POWER |

| |

2,398,534

|

| 9. |

SOLE DISPOSITIVE POWER |

| |

9,580 |

| |

|

| 10. |

SHARED DISPOSITIVE POWER |

| |

2,398,534

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY

REPORTING PERSON |

| |

2,408,114

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES o |

| |

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) |

| |

8.8%a

|

| 14. |

TYPE

OF REPORTING PERSON

IN |

a

This calculation is based upon 27,363,750 shares of the common stock, without par value, of

Agilysys, Inc., a Delaware corporation (the “Issuer”), outstanding as of February 1, 2024, as set forth in a prospectus supplement

dated February 14, 2024 to the Issuer’s shelf registration statement on Form S-3ASR which became effective upon filing with the Securities

and Exchange Commission on September 15, 2023.

| CUSIP NO.: 00847J105 |

| |

|

| 1. |

NAME

OF REPORTING PERSONS

|

| |

MAK Capital Fund LP

|

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

x (b) o |

| |

|

| 3. |

SEC USE ONLY |

| |

|

| 4. |

SOURCE OF FUNDS

|

| |

|

| 5. |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

o |

| |

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

| |

|

| |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

| |

|

| 7. |

SOLE VOTING POWER |

| |

0 |

| |

|

| 8. |

SHARED VOTING POWER |

| |

2,060,458

|

| 9. |

SOLE DISPOSITIVE POWER |

| |

0 |

| |

|

| 10. |

SHARED DISPOSITIVE POWER |

| |

2,060,458

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY

EACH REPORTING PERSON |

| |

2,060,458

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES o |

| |

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) |

| |

7.5%a

|

| 14. |

TYPE

OF REPORTING PERSON

PN |

a

This calculation is based upon 27,363,750 shares of the common stock, without par value, of

Agilysys, Inc., a Delaware corporation (the “Issuer”), outstanding as of February 1, 2024, as set forth in a prospectus supplement

dated February 14, 2024 to the Issuer’s shelf registration statement on Form S-3ASR which became effective upon filing with the Securities

and Exchange Commission on September 15, 2023.

| CUSIP NO.: 00847J105 |

| |

|

| 1. |

NAME

OF REPORTING PERSONS

|

| |

MAK

Capital Distressed Debt Fund I, LP

|

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

x (b) o |

| |

|

| 3. |

SEC USE ONLY |

| |

|

| 4. |

SOURCE OF FUNDS

|

| |

|

| 5. |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

o |

| |

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

| |

|

|

NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

| |

|

| 7. |

SOLE VOTING POWER |

| |

0 |

| |

|

| 8. |

SHARED VOTING POWER |

| |

0

|

| 9. |

SOLE DISPOSITIVE POWER |

| |

0 |

| |

|

| 10. |

SHARED DISPOSITIVE POWER |

| |

0

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY

EACH REPORTING PERSON |

| |

0

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES o |

| |

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) |

| |

0.0%a

|

| 14. |

TYPE

OF REPORTING PERSON

PN |

a

This calculation is based upon 27,363,750 shares of the common stock, without par value, of

Agilysys, Inc., a Delaware corporation (the “Issuer”), outstanding as of February 1, 2024, as set forth in a prospectus supplement

dated February 14, 2024 to the Issuer’s shelf registration statement on Form S-3ASR which became effective upon filing with the Securities

and Exchange Commission on September 15, 2023.

This

statement is filed with respect to the shares of the common stock, without par value (the “Common Stock”), of Agilysys,

Inc., a Delaware corporation (the “Issuer”), beneficially owned by the Reporting Persons (as defined below) and amends

and supplements the Schedule 13D initially filed with the Securities and Exchange Commission (the “SEC”) on July 1,

2008, as amended, including most recently amended by Amendment No. 22 thereto filed with the SEC on January 16, 2024 (“Amendment

22,” and collectively as so amended through Amendment 22, the “Schedule 13D”). Except as set forth

herein, the Schedule 13D is unmodified.

The

names of the persons filing this statement on Schedule 13D are: MAK Capital One L.L.C., a Delaware limited liability company (“MAK

Capital”), MAK Capital Fund LP, a Bermuda Islands limited partnership (“MAK Fund”), MAK Capital Distressed

Debt Fund I, LP, a Delaware limited partnership (“MAK CDD Fund” and together with MAK Fund, the “Selling

Stockholders”) and Michael A. Kaufman, a United States citizen (“Mr. Kaufman” and, collectively with MAK

Capital, MAK Fund and MAK CDD Fund, the “Reporting Persons”).

| ITEM 4. |

PURPOSE OF

TRANSACTION |

On

February 14, 2024, MAK Capital, the Selling Stockholders, the Issuer and BTIG, LLC, as underwriter (the “Underwriter”),

entered into an underwriting agreement (the “Underwriting Agreement”) pursuant to which the Selling Stockholders agreed

to sell 867,729 shares of Common Stock to the Underwriter at a price of $82.59 per share. The shares of Common Stock were sold for the

Selling Stockholders for portfolio management purposes.

| ITEM 5. |

INTEREST IN

SECURITIES OF THE ISSUER |

Item

5 (a) is amended as follows:

The ownership percentages

are calculated based on 27,363,750 shares of Common Stock outstanding as of February 1, 2024, as set forth in a prospectus supplement

dated February 14, 2024 to the Issuer’s shelf registration statement on Form S-3ASR which became effective upon filing with the

Securities and Exchange Commission on September 15, 2023.

| |

(a) |

As of February 16, 2024: |

| |

(i) |

MAK Capital holds 2,060,458

shares of Common Stock, representing 7.5% of the outstanding shares of Common Stock; |

| |

(ii) |

Mr. Kaufman holds 2,408,114

shares Common Stock, representing 8.8% of the outstanding shares of Common Stock; |

| |

(iii) |

MAK Fund holds 2,060,458

shares of Common Stock, representing 7.5% of the outstanding shares of Common Stock; and |

| |

(iv) |

MAK CDD Fund holds 0 shares

of Common Stock, representing 0.0% of the outstanding shares of Common Stock. |

Each of MAK Fund and

MAK CDD Fund shares voting power and investment power with MAK Capital and Mr. Kaufman.

The information contained

in rows 7 to 11 on each of the cover pages is incorporated by reference in its entirety.

Item

5(c) is amended as follows:

The transactions effected

by the Reporting Persons are set forth on Schedule A hereto which is incorporated herein by reference in its entirety.

| ITEM

6. |

Contracts,

Arrangements, Understandings or Relationships With respect to the Securities of the Issuer. |

On November 3, 2023, the Issuer, acting

through its board of directors, in accordance with Section 10(c) of its Certificate of Designation of 5.25% Series A Convertible Preferred

Stock (“Convertible Preferred Shares”) of which 1,735,457 shares were then outstanding and all of which were held

by the MAK Fund and MAK CDD, delivered a notice of mandatory conversion irrevocably exercising its right to cause the mandatory conversion

of the Convertible Preferred Shares (“Mandatory Conversion”) into an equal number of shares of Common Stock (such

shares, the “Conversion Shares”). Mr. Kaufman did not vote on or participate in the deliberations of the Issuer’s

board of directors with respect to whether to exercise the Issuer’s right to exercise the mandatory conversion. The conversion

was effective November 24, 2023 and the scheduled settlement was November 28, 2023.

On August 1,

2023, MAK Capital adopted a trading plan (the “2023 Trading Plan”) with BTIG, LLC intended to satisfy the affirmative

defense set forth in Rule 10b5-1(c)(1) promulgated under the Securities Exchange Act of 1934, as amended, to sell up to 867,728 shares

of Common Stock in accordance with Rule 144 promulgated under the Securities Act of 1933, as amended; provided that no sales of shares

of Common Stock under the plan could commence until the Issuer irrevocably exercised the Mandatory Conversion. The 2023 Trading Plan

was terminated on January 19, 2024, after 867,728 Conversion Shares were sold thereunder.

On January

25, 2024, MAK Capital adopted another trading plan with BTIG, LLC (the “2024 Trading Plan”) also intended to

satisfy the affirmative defense set forth in Rule 10b5-1(c)(1) promulgated under the Securities Exchange Act of 1934, as amended, to

sell up to 867,728 shares of Common Stock, whether Conversion Shares or other shares of Common Stock owned by the Selling

Stockholders, in accordance with Rule 144 promulgated under the Securities Act of 1933, as amended. No trading is permitted to occur

under the 2024 Trading Plan until April 25, 2024 and the 2024 Trading Plan will terminate on November 1, 2024. A form

of the trading 2024 Trading Plan is Exhibit 1 hereto and is incorporated herein by reference.

On February 14, 2024,

MAK Capital, the Selling Stockholders, the Issuer and the Underwriter entered into an underwriting agreement (the “Underwriting

Agreement”) pursuant to which the Selling Stockholders agreed to sell 867,729 shares of Common Stock to the Underwriter at

a price of $82.59 per share. The shares of Common Stock sold pursuant to the Underwriting Agreement are Conversion Shares and were sold

by the Selling Stockholders for portfolio management purposes. The closing date of the transactions contemplated by the Underwriting

is February 20, 2024. The Underwriting Agreement is Exhibit 2 hereto and is incorporated herein by reference.

| ITEM 7. |

MATERIALS TO BE FILED

AS EXHIBITS. |

Exhibit

1 – Form of Rule 10b5-1 Transaction Plan dated January 25, 2024 between MAK Capital One L.L.C. and BTIG, LLC.

Exhibit

2 – Underwriting Agreement, dated February 14, 2024, among BTIG, LLC, Agilysys, Inc., MAK Capital Fund LP, MAK Capital Distressed

Debt Fund I, LP and MAK Capital One L.L.C., which is incorporated by reference to Exhibit 1.1 to Agilysys, Inc.’s Current Report

on Form 8-K filed on February 15, 2024.

SIGNATURES

After reasonable

inquiry and to the best of my knowledge and belief, the undersigned each certify that the information with respect to it set forth

in this statement is true, complete and correct.

Date: February 16, 2024

| |

|

|

| MAK CAPITAL ONE L.L.C. |

| |

|

| By: |

/s/ Michael A. Kaufman |

|

| |

Michael A. Kaufman, |

| |

Managing Member |

| |

|

| MAK CAPITAL FUND LP |

| |

| By: MAK GP LLC, general partner |

| |

|

| By: |

/s/ Michael A. Kaufman |

|

| |

Michael A. Kaufman, |

| |

Managing Member |

| |

|

| MAK CAPITAL DISTRESSED DEBT

FUND I, LP |

| |

| By: MAK

DDF-1 GP, LLC, general partner |

| |

|

| By: |

/s/ Michael A. Kaufman |

|

| |

Michael A. Kaufman, |

| |

Managing Member |

| |

|

| |

|

| By: |

/s/ Michael A. Kaufman |

|

| |

MICHAEL A. KAUFMAN |

SCHEDULE A

RECENT TRANSACTIONS

The following transactions

on the open market in the shares of Common Stock were effected by the Reporting Persons since January 15, 2024, the date immediately

prior to the date of the Reporting Persons’ last amendment of this Schedule 13D (with the reported price per share being a weighted

average):

| Date

Sold |

Shares

Sold |

Price

Per share |

| 1/16/2024 |

13,356 |

$ 75.0790 |

| 1/17/2024 |

32,958 |

$ 75.3912 |

| 1/18/2024 |

87,500 |

$ 77.6264 |

| 1/19/2024 |

14,426 |

$ 81.6909 |

| Date

Sold |

MAK

Fund Sold |

MAK

CDD Fund Sold |

| 1/16/2024 |

11,072 |

2,284 |

| 1/17/2024 |

27,322 |

5,636 |

| 1/18/2024 |

72,538 |

14,962 |

| 1/19/2024 |

11,959 |

2,467 |

The following transaction

pursuant to the Underwriting Agreement in the shares of Common Stock were effected by the Reporting Persons since January 15, 2024, the

date immediately prior to the date of the Reporting Persons’ last amendment of this Schedule 13D (with the reported price per share

being pursuant to the Underwriting Agreement):

| Date Sold |

Shares

Sold |

Price

Per share |

| 2/14/2024 |

867,729 |

$ 82.59 |

| Date Sold |

MAK

Fund Sold |

MAK

CDD Fund Sold |

| 2/14/2024 |

718,605 |

149,124 |

Exhibit

1

FORM OF RULE

10B5-1 TRANSACTION PLAN

This Rule 10b5-1 Transaction Plan

(the “Plan”) is entered into as of January 25, 2024, between ,(the “Client”) and BTIG, LLC,

a Delaware limited liability company (“Broker”).

RECITALS

WHEREAS, the Client wishes to establish

a trading plan that satisfies the affirmative defense set forth in Rule 10b5-1(c)(1) (“Rule 10b5-1”) under

the Securities Exchange Act of 1934, as amended (the “Exchange Act”); and

WHEREAS, Client hereby authorizes

Broker to execute transaction(s) on behalf of Client in accordance with this Plan in order to permit the transactions in securities

(the “Securities”), including, as designated in Exhibit A, attached hereto.1

Capitalized terms used herein but

not defined have the meaning given to them in Exhibit A.

AGREEMENT

NOW, THEREFORE, the Client and Broker

hereby agree as follows:

| A. | Client appoints Broker to

execute the orders specified in the Plan pursuant to the terms and conditions set forth below under ordinary principles of best

execution. Broker hereby accepts such appointment. |

| B. | Broker shall commence transactions

in Securities pursuant to the Plan beginning on the Plan Commencement Date, as set forth on Exhibit A. |

| C. | Broker will execute transactions

in Securities as set forth in Exhibit A for the account of Client. Unless otherwise specified in Exhibit A,

orders filled under the Plan shall be executed on a “Not Held” basis. Not Held orders are market or limit orders that

give the trader the right to use his or her discretion in the price and time of filling the order. Broker has the discretion,

not obligation, to execute 10b5-1 orders during pre-opening or after hours. |

| D. | The Aggregate Share Number

provided on Exhibit A, and the limit prices, if applicable, shall be adjusted automatically on a proportionate basis

to take into account any stock split, reverse stock split or stock dividend with respect to the Securities or any change in capitalization

with respect to the issuer of the Securities (the “Issuer”) that occurs during the term of the Plan. Cash dividends

shall have no impact on the limit prices set forth on Exhibit A. |

1 Note – for directors

and executive officers (as defined in Exchange Act Rule 16a-1(f)) of the issuer who want to rely on the Rule 10b5-1 affirmative

defense there is a mandatory cooling off period and such persons must wait to initiate any trades under the Plan until the later

of: (i) 90 days after adopting or modifying the plan; and (ii) the earlier of (x) two business days after the release of

financial results on Form 10-Q or Form 10-K for the fiscal quarter in which the Plan was adopted or (y) 120 days after adopting

the Plan. For all other parties, other than the issuer, the cooling off period is 30 days. The rules do not require a cooling

off period for issuers.

| E. | Client acknowledges and agrees

that Broker may elect not to execute transactions in Securities pursuant to the Plan at any time when: |

| 1. | Broker, in its sole discretion,

has determined that a market disruption, banking moratorium, outbreak or escalation of hostilities or other crisis or calamity

has occurred that could, in Broker’s judgment, impact offer, sales or delivery of Securities and Broker has so notified

Client promptly in writing (provided that Broker shall resume effecting trades in accordance with the Plan as soon as Broker determines

that is reasonably practical to do so and has so notified Client promptly in writing); or |

| 2. | Broker, in its sole discretion,

has determined that it is prohibited from doing so by a legal, regulatory, contractual or other restriction applicable to it or

its affiliates or to Client or Client’s affiliates and has so notified Client promptly in writing; or |

| 3. | Broker has received notice

from Client to terminate the Plan in accordance with Section III(C) below. |

| F. | If requested by Broker, Client

agrees to deposit in Client’s account with Broker or Broker’s clearing firm (i) prior to the Plan Commencement Date,

all Securities to be sold pursuant to the Plan (or, if an Aggregate Amount is specified in Exhibit A, Client’s

good faith estimate of the Securities to be so sold) and/or (ii) if applicable, prior to the Plan Commencement Date, any cash

necessary to make purchases of Securities. Client acknowledges and agrees that any failure to make such a deposit will result

in the Plan being terminated. |

| G. | Client hereby authorizes

Broker to serve as Client’s agent and attorney-in-fact in accordance with the terms of the Plan. |

| H. | Broker shall in no event exercise any option if, at the time of exercise, the exercise price

of such Option is equal to or higher than the market price of the Securities.2 |

| II. | Representations, Warranties

and Covenants |

| A. | As of the date hereof, Client

is not in possession of any material2 non-public

information with respect to the Issuer or the Securities. Client represents and warrants that the Plan is being entered into in

good faith and is not part of a plan or scheme to evade the prohibitions of Rule 10b5-1. |

| B. | While the Plan is in effect,

the Client will at all times act in good faith and will not take any action or omit to take any action intended to evade the prohibitions

of Rule 10b5-1. |

| C. | Client agrees not to communicate,

directly or indirectly, any material non-public information relating to the Securities or the Issuer to any employee of Broker

or its affiliates who is involved, directly or indirectly, in executing the Plan at any time while the Plan is in effect. Client

acknowledges that Broker and its affiliates may from time to time possess material non-public information relating to the Securities

or the Issuer and are under no obligation to disclose that information to Client. |

| D. | Client’s execution

of this Plan or any amendment hereto, as the case may be, and the purchases contemplated hereby does not and will not violate

or conflict with the Client’s certificate of incorporation or by-laws or, if applicable, any similar constituent document, or

any law, rule regulation or agreement binding on or applicable to the Client or any of its subsidiaries or any of its or their

property or assets. |

2 Delete if options are not relevant to the client transaction plan.

3“Material”

information for these purposes is any information to which an investor would reasonably attach importance in reaching a decision

to buy, sell or hold securities of the Issuer.

| E. | Client acknowledges that

Client is solely responsible for making any necessary disclosures and/or complying with any reporting requirements under and otherwise

complying with Sections 13 and 16 of the Exchange Act, Rule 144 and Regulation S-K of the Securities Act of 1933 (the “Securities

Act”) and other applicable laws, rules and regulations. Client acknowledges that neither Broker nor any of its affiliates

has advised it with respect to any legal, regulatory, tax, accounting or economic consequences arising from the Plan or any transactions

under the Plan. If applicable, Broker agrees to conduct all sales transactions in accordance with the manner of sale requirement

of Rule 144 under the Securities Act. |

| F. | While the Plan is in effect,

Client agrees not to enter into or alter any corresponding or hedging transaction or position with respect to the Securities covered

by the Plan (including, without limitation, with respect to any securities convertible or exchangeable into the Securities) and

agrees not to alter (except as provided in Section IV below) or deviate from, or attempt to exercise any influence over how, when

or whether transactions are executed pursuant to, the terms of the Plan. Notwithstanding anything to the contrary set forth in

this Plan, nothing in this Plan shall prevent Client from engaging in a business combination transaction with the Issuer, which

may include but is not limited to a tender or exchange offer, merger, acquisition, reorganization, recapitalization, acquisition

of all or substantially all of the assets, or a comparable transaction. |

| G. | While the Plan is in effect,

Client shall not (i) enter into a binding contract with respect to the purchase or sale of Securities with another broker, dealer

or financial institution (each, a “Financial Institution”), (ii) instruct another Financial Institution to

purchase or sell Securities or (iii) adopt a Plan for trading with respect to Securities other than the Plan. In addition, Client

represents that no such contract, instruction or plan is currently in effect. |

| H. | Broker shall maintain appropriate

policies and procedures designed to ensure that each person with trading authority under the Plan does not possess material non-public

information with respect to the Issuer or its Securities. Broker shall terminate or suspend the trading authority under the Plan

of any such person promptly upon learning that such person has become aware of material non-public information with respect to

the Issuer or its Securities. |

| I. | Client has obtained all necessary

and required authorizations, consents and approvals to enter into this Plan and the transactions that are the subject of this

Plan. |

| III. | Amendment, Termination

and Suspension |

| A. | The Plan may be modified

or amended only by a writing signed by Client and Broker and any modification or amendment by Client requires: |

| 1. | the effective date of the

modified or amended plan to be specified; and |

| 2. | a certificate signed by the

Client certifying that the representations and warranties in this Plan are true and correct at and as of the date of such certificate

as if made at and as of such date. |

| B. | Any modification to the Aggregate

Share Number, price or timing of the purchase or sale of the Securities under the Plan (or, with respect to any algorithm, computer

program or formula, any changes that impact amount, price or timing) will be treated as a termination of the Plan and an adoption

of a new trading plan and the Client will execute a new trading plan, which will provide for the same representations, warranties

and covenants as contained herein.4 |

4 Note – any modification to the Plan

resulting in a termination and the adoption of a new plan, will trigger the cooling off periods described in footnote 1.

| C. | The Plan shall terminate

on the Plan Termination Date. |

| D. | The Plan may be terminated

by Client at any time upon prior written notice sent to Broker by certified mail, courier or by e-mail and confirmed by telephone,

as specified in Section 5(D), below. Client agrees that Client shall not terminate the Plan except upon consultation with Client’s

own legal advisors. Notwithstanding the Plan termination as provided in this paragraph, any transactions that are in process,

including transactions that are executed on the date of the termination notice but occur prior to Broker receiving such notice

and any transactions that have not fully settled as of such termination notice date shall continue until completion in accordance

with the terms of this Plan. |

| E. | The Plan may be terminated

upon (i) the commencement of any voluntary or involuntary case or other proceeding against the Client seeking liquidation, reorganization

or other relief under any bankruptcy, insolvency or similar law or seeking the appointment of a trustee, receiver or other similar

official, or the taking of any corporate action by the Client to authorize or commence any of the foregoing; or (ii) the public

announcement of a tender or exchange offer for the Securities or of a merger, acquisition, recapitalization or other similar business

combination or transaction as a result of which the Securities would be exchanged for or converted into cash, securities or other

property. |

| F. | The Plan shall be suspended

or, at Broker’s option, terminated, if Broker is prohibited from making transactions pursuant to the Plan by a legal, regulatory,

contractual or other restriction applicable to it or its affiliates or to Client or Client’s affiliates and Broker so notifies

Client promptly in writing. |

| G. | Client acknowledges that

terminations or modifications or amendments to this Plan or other similar trading plans may affect Client’s ability to rely

on Rule 10b5-1. |

| H. | Client agrees and understands

that Broker shall execute the Plan in accordance with its terms and shall not be required to suspend, terminate or modify this

Plan unless Broker receives notice from the Client in accordance with this Section III. |

| IV. | Indemnification; Limitation

of Liability |

| A. | Client agrees to indemnify

and hold harmless Broker and its members, officers, employees and affiliates (each, an “Indemnified Person”)

from and against all claims, losses, damages and liabilities (including, without limitation, any legal or other expenses reasonably

incurred in connection with defending or investigating any such action or claim) (collectively, the “Losses”)

arising out of or relating to the Plan, including, without limitation, (i) any breach by Client of the Plan (including Client’s

representations and warranties hereunder), (ii) any violation by Client of applicable laws or regulations, including violations

by Client of Rule 10b5-1, Rule 14e-3 of the Exchange Act, or any other federal, state or foreign securities laws or regulations

prohibiting trading while aware of material nonpublic information, or (iii) any regulatory investigation or inquiry relating to

transactions made pursuant to the Plan; excluding, in each case, any Losses arising out of or relating to fraud, willful misconduct,

gross negligence or breaches of the Plan by any Indemnified Person. This indemnification shall survive termination of the Plan. |

| B. | Notwithstanding any other

provision hereof, Broker shall not be liable to Client for (i) special, indirect, punitive, exemplary or consequential damages,

or incidental losses or damages of any kind, even if advised of the possibility of such losses or damages or if such losses or

damages could have been reasonably foreseen or (ii) any failure to perform or to cease performance or any delay in performance

that results from a cause or circumstance that is beyond its reasonable control, including but not limited to failure of electronic

or mechanical equipment, strikes, failure of common carrier or utility systems, severe weather, market disruptions or other causes

commonly known as “acts of God”. |

| A. | Proceeds from each transaction in Securities effected under the Plan

will be delivered to Client’s account less any commission, commission equivalent, mark-up or differential and other expenses

of sale to be paid to Broker or any other executing broker or clearing firm involved in the transaction, including, but not limited

to execution, margin, funding, exercise and assignment fees related to the sale of Listed Options5

provided that any commission hereunder shall be as set forth in Exhibit A. |

| B. | Client and Broker acknowledge

and agree that the Plan is a “securities contract,” as such term is defined in Section 741(7) of Title 11 of the United

States Code (the “Bankruptcy Code”), entitled to all of the protections given such contracts under the Bankruptcy

Code. |

| C. | Client acknowledges and agrees

that, if applicable, the Plan shall be subject to the terms and conditions of Client’s account agreement with Broker or

Broker’s clearing firm (the “account agreement”) and, in the event of any inconsistency, the account

agreement shall prevail. Subject to the preceding sentence, the Plan constitutes the entire agreement between Client and Broker

with respect to the Plan and supersedes any prior agreements or understandings with regard to the Plan. |

| D. | All notices to Broker under

the Plan shall be given to Broker by certified mail, courier or by e-mail, and confirmed by telephone, as provided below: |

BTIG, LLC

600 Montgomery

Street, 6th Floor

San Francisco,

CA 94111

Attn: Matt Clark

and Nick Nolan

Telephone: (415)

248-5525

E-Mail: btigcorporateservices@btig.com

With a copy to:

BTIG, LLC

600 Montgomery

Street, 6th Floor

San Francisco,

CA 94111

Attn: Chief Compliance

Officer

Telephone: (415)

248-2200

E-mail: compliance@btig.com

5 Delete if options are not part of this transaction plan.

All

notices to Client under the Plan shall be given to Client by certified mail, courier or by e-mail, and confirmed by telephone,

as provided below:

MAK Capital One

LLC

590 Madison Ave.,

31st floor[Address]

New York, NY 10022

Attn: David Smith

and Jordan Sperling

(212) 486-3291

– David Smith

(212) 486-3215

– Jordan Sperling

DSmith@makcap.com

JSperling@makcap.com

| E. | Client’s rights and

obligations under the Plan may not be assigned or delegated without the written permission of Broker. Broker’s rights and

obligations may not be assigned or delegated without the written permission of Client. |

| F. | The Plan may be signed in

any number of counterparts, each of which shall be an original, with the same effect as if the signatures thereto and hereto were

upon the same instrument. |

| G. | If any provision of the Plan

is or becomes inconsistent with any applicable present or future law, rule or regulation, that provision will be deemed modified

or, if necessary, rescinded in order to comply with the relevant law, rule or regulation. All other provisions of the Plan will

continue and remain in full force and effect. |

| H. | This Plan shall be governed

by and construed in accordance with the internal laws of the State of New York and may be modified or amended only by a writing

signed by the parties hereto. |

IN WITNESS

WHEREOF, the undersigned have signed this Plan.

| |

|

|

BTIG, LLC |

| |

|

|

|

|

| By: |

|

|

By: |

|

| |

Name: |

|

|

Name: |

| |

Title: |

|

|

Title: |

EXHIBIT

A

Transaction

Details

Client Name: MAK Capital

One LLC

Issuer Name: Agilysys,

Inc (AGYS)

Plan Commencement Date: April

25, 2024 or soon after as possible

Plan Termination Date: November

1, 2024

1. List the Security and the

class of security subject to the Plan:

AGYS common shares

2. Name of principal market

or exchange for the Securities (the “Exchange”): NASDAQ

| 3. Type of transaction(s) subject

to the Plan: |

o Exercise of Call Options |

o Sale of Common Stock |

| |

|

|

| |

o Purchase |

o Derivative |

| 4. Please indicate if the Plan covers: |

x Stock |

o Options |

o Stock and Options |

| 5. Please indicate what type of Options, if any: |

o Cash |

o Cashless |

o Listed |

| 6. Please indicate if you are: |

Section 16 Insider: |

o Yes |

o No |

| |

Rule 144 Affiliate: |

o Yes |

o No |

7. Aggregate amount of the

Securities covered by the Plan (specified in terms of number of shares or other securities or a specified dollar value of securities

(after deducting commissions)) (the “Aggregate Share Number” or “Aggregate Amount”, as applicable); If Listed Option sale, include amount of Security to

underlie Listed Options:6) :

867,728 shares

8.

| · | Plan Start Date: Trading will commence on the first permitted day following the mandatory cooling off

period. |

| · | Total shares to be sold: the lesser of 867,728 shares or the maximum allowable under Rule 144. |

| · | Trades will be conducted under a Rule 10b5-1 plan. Trades will be done within the constraints of Rule 144 while the rule remains applicable over the course of the program. |

9. [insert any other trading or plan instructions]

6 Delete if options are not part of this transaction plan.

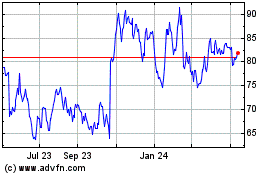

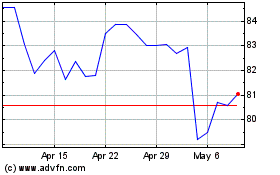

Agilysys (NASDAQ:AGYS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Agilysys (NASDAQ:AGYS)

Historical Stock Chart

From Apr 2023 to Apr 2024