false

0001859199

0001859199

2024-09-08

2024-09-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the

Securities Exchange

Act of 1934

Date of Report (date

of earliest event reported): September 8, 2024

reAlpha Tech Corp.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-41839 |

|

86-3425507 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

6515 Longshore Loop,

Suite 100, Dublin, OH 43017

(Address of principal

executive offices and zip code)

(707) 732-5742

(Registrant’s

telephone number, including area code)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

AIRE |

|

The Nasdaq Stock Market LLC |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

Acquisition of Debt Does Deals, LLC (d/b/a

Be My Neighbor)

On September 8, 2024 (the

“Closing Date”), reAlpha Tech Corp. (the “Company”) entered into a Membership Interest Purchase Agreement (the

“Acquisition Agreement”), with Debt Does Deals, LLC (d/b/a Be My Neighbor), a Texas limited liability company (“Be My

Neighbor”), Christopher Bradley Griffith and Isabel Williams (each, a “Seller,” and collectively, the “Sellers”),

pursuant to which the Company acquired from the Sellers 100% of the membership interests of Be My Neighbor, a mortgage brokerage company,

that were outstanding immediately prior to the execution of the Acquisition Agreement (the “Acquisition”).

In exchange for all of the

membership interests of Be My Neighbor outstanding immediately prior to the execution of the Acquisition Agreement, and pursuant to the

terms and subject to the conditions of the Acquisition Agreement, the Company agreed to pay the Sellers an aggregate purchase price of

up to $6,000,000, subject to the adjustments described below to each of the Earn-Out Payments (as defined below) provided in the Acquisition

Agreement, consisting of: (i) $1,500,000 in cash paid on the Closing Date, with each Seller receiving a cash amount in proportion to each

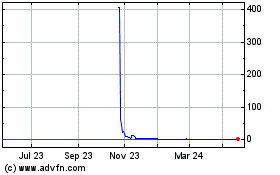

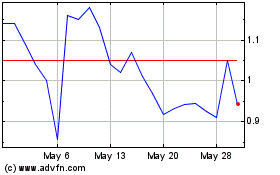

of their membership interest percentage in Be My Neighbor; (ii) $1,500,000 in restricted shares of the Company’s common stock, par

value $0.001 per share (the “Common Stock”), or 1,146,837 shares of restricted Common Stock at a price of $1.31 per share,

calculated based on the volume weighted average price of the Common Stock as reported on the Nasdaq Capital Market for the seven (7) consecutive

trading days ending on the trading day immediately prior to the Closing Date, to be issued within 90 days from the Closing Date and with

each Seller receiving an amount of shares of Common Stock in proportion to each of their membership interest percentage in Be My Neighbor

(the “Buyer Shares”); and (iii) up to an aggregate of $3,000,000 in potential earn-out payments, payable in three tranches

of up to $500,000, $1,000,000 and $1,500,000, respectively, in cash or restricted shares of Common Stock, at the Company’s sole

discretion, each of which is calculated based on a formula set forth in the Acquisition Agreement and subject to the achievement of certain

financial metrics by Be My Neighbor for three successive measurement periods of 12 months, with the first measurement period ending 12

months after the Closing Date (collectively, the “Earn-Out Payments,” and each, an “Earn-Out Payment”). Specifically,

each Earn-Out Payment will be payable in full if Be My Neighbor achieves certain revenue and earnings before interest, taxes, depreciation

and amortization (“EBITDA”) thresholds for each of the measurement periods, each of which is payable within 120 days of the

end of a measurement period. If Be My Neighbor does not meet the revenue and EBITDA threshold in a measurement period, a pro-rated amount

of the Earn-Out Payment for such measurement period will be paid to Be My Neighbor based on the actual revenue and EBITDA achieved and

in accordance with the formula set forth in the Acquisition Agreement. Further, if Be My Neighbor exceeds such revenue and EBITDA thresholds

during any measurement period, the Earn-Out Payment for such measurement period will not be capped and will be increased accordingly based

on the formula set forth in the Acquisition Agreement.

The Buyer Shares, and any

shares of Common Stock issued as payment for an Earn-Out Payment (collectively, the “Shares”), if any, will be subject to

a restrictive period of 180 days following the date of their respective issuances, during which period each Seller will not be able to

dispose, assign, sell and/or transfer such Shares. The aggregate amount of Shares issuable under the Acquisition Agreement, for purposes

of complying with Nasdaq Listing Rule 5635(a), may in no case exceed 19.99% of the Company’s issued and outstanding shares of Common

Stock immediately prior to the execution of the Acquisition Agreement, or 8,880,383 shares of Common Stock (the “Cap Amount”),

subject to stockholder approval of any shares exceeding such amount. In the event the Shares issuable thereunder exceed the Cap Amount,

the Company will pay the Sellers cash in lieu of such excess shares of Common Stock, based on a formula set forth in the Acquisition Agreement.

Following the closing of the

Acquisition, the Sellers are required to indemnify the Company and its affiliates for any liability, damages, losses, costs and/or expenses

arising out of breaches by the Sellers of their respective covenants and certain other matters specified in the Acquisition Agreement,

subject to certain limitations and exclusions as identified therein. The Company also has the right to set-off any amount owed to the

Sellers in connection with the Acquisition Agreement, including Earn-Out Payments, against the obligations and liabilities of the Sellers

or Be My Neighbor to the Company under the Acquisition Agreement The Acquisition Agreement also contains representations and warranties,

covenants, conditions, and no-solicitation and non-compete provisions, in each case, customary for transactions of this type.

The foregoing description

of the Acquisition Agreement in this Current Report on Form 8-K (this “Form 8-K”) does not purport to be a complete description

of the rights and obligations of the parties thereunder and is qualified in its entirety by reference to the full text of the Acquisition

Agreement, a copy of which is attached hereto as Exhibit 2.1 and incorporated herein by reference.

Item 2.01 Completion of Acquisition or Disposition of Assets.

The

information included in Item 1.01 of this Form 8-K is incorporated by reference into this Item 2.01 to the extent required.

Item 3.02 Unregistered Sales of Equity Securities.

The

information included in Item 1.01 of this Form 8-K is incorporated by reference into this Item 3.02 to the extent required. The Shares

issuable under the Acquisition Agreement, when issued, will be issued pursuant to an exemption from registration provided by Section 4(a)(2)

and/or Rule 506 of Regulation D of the Securities Act of 1933, as amended (the “Securities Act”) because such issuances will

not involve a public offering, the recipient will take the securities for investment and not resale, the Company took appropriate measures

to restrict transfer, and the recipients are sophisticated investors. The Shares are subject to transfer restrictions, and the book-entry

records evidencing the Shares contain an appropriate legend stating that such securities have not been registered under the Securities

Act and may not be offered or sold absent registration or pursuant to an exemption therefrom. The securities were not registered under

the Securities Act and such securities may not be offered or sold in the United States absent registration or an exemption from registration

under the Securities Act and any applicable state securities laws.

On

August 28, 2024, pursuant to agreements entered into with certain service providers, the Company issued an aggregate of 83,000 shares

of Common Stock for the services rendered to the Company, which were issued pursuant to an exemption from registration provided by Section

4(a)(2) and/or Rule 506 of Regulation D of the Securities Act because such issuances did not involve a public offering, the recipient

took the securities for investment and not resale, the Company took appropriate measures to restrict transfer, and the recipients are

sophisticated investors. The securities are subject to transfer restrictions, and the book-entry records evidencing the securities contain

an appropriate legend stating that such securities have not been registered under the Securities Act and may not be offered or sold absent

registration or pursuant to an exemption therefrom. The securities were not registered under the Securities Act and such securities may

not be offered or sold in the United States absent registration or an exemption from registration under the Securities Act and any applicable

state securities laws.

As of the date of this Form

8-K, there are 44,424,130 shares of Common Stock issued and outstanding.

Item 8.01 Other Events.

On

September 9, 2024, the Company issued a press release announcing the transaction described in Item 1.01 of this Form 8-K. A copy of the

press release is attached as Exhibit 99.1 and is incorporated herein by reference.

The

information set forth and incorporated into this Item 8.01 of this Form 8-K, including Exhibit 99.1, is being furnished pursuant to Item

8.01 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference

into any of the Company’s filings under the Securities Act or the Exchange Act, whether made before or after the date hereof and

regardless of any general incorporation language in such filings, except to the extent expressly set forth by specific reference in such

a filing.

Item 9.01 Financial Statements and Exhibits.

(a) Financial statements

of businesses acquired.

The

Company has determined that the Acquisition will not constitute an acquisition of a significant amount of assets (as defined in Instruction

4 of Item 2.01) and, as such, financial statements contemplated by Item 9.01 of Form 8-K are not required to be reported by Form 8-K with

respect to the Acquisition.

(b) Pro forma financial

information.

The

Company has determined that the Acquisition will not constitute an acquisition of a significant amount of assets (as defined in Instruction

4 of Item 2.01) and, as such, pro forma financial information contemplated by Item 9.01 of Form 8-K is not required to be reported by

Form 8-K with respect to the Acquisition.

(d) Exhibits

| + | Certain schedules and exhibits to this agreement have been omitted

pursuant to Item 601(a)(5) of Regulation S-K. A copy of any omitted schedule and/or exhibit will be furnished to

the SEC upon request. |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| Date: September 9, 2024 |

reAlpha Tech Corp. |

| |

|

|

| |

By: |

/s/ Giri Devanur |

| |

|

Giri Devanur |

| |

|

Chief Executive Officer |

4

Exhibit 2.1

MEMBERSHIP INTERESTS PURCHASE AGREEMENT

This MEMBERSHIP INTERESTS

PURCHASE AGREEMENT (this “Agreement”) is entered into and made effective as of September 8, 2024, by and among: (i)

reAlpha Tech Corp., a Delaware corporation with its principal place of business at 6515 Longshore Loop, Dublin, Ohio 43017 (the “Buyer”),

(ii) Debt Does Deals, LLC d/b/a Be My Neighbor, a Texas limited liability company with its principal place of business at 305 W. Woodard

St., Suite 220, Denison, Texas 75020 (the “Company”), and (iii) Christopher Bradley Griffith, an individual residing

at ___________ (“Griffith”) and Isabel Williams, an individual residing at ______________ (“Williams”),

as the selling members of the Company (each individually referred to herein as a “Seller” and, collectively, as the

“Sellers”).

W I T N E S S E T H:

WHEREAS, the Company engages

in the business of providing mortgage brokerage services (the “Business”);

WHEREAS, the Sellers are the

legal and beneficial owners of all of the issued and outstanding membership interests of the Company (collectively, the “Interests”);

WHEREAS, Griffith owns fifty-one

percent (51%) of the Interests, and Williams owns forty-nine percent (49%) of the Interests (each, an “Allocated Share”);

WHEREAS, the Sellers desire

to sell and transfer to the Buyer, and the Buyer desires to purchase from the Sellers, all of the Interests, all as more specifically

provided herein.

NOW, THEREFORE, in consideration

of the foregoing recitals and the mutual covenants and agreements contained herein, the parties hereto, intending to be legally bound,

hereby agree as follows:

Article I

SALE OF THE INTERESTS AND TERMS OF PAYMENT

Section 1.01 Purchase

and Sale.

Upon the terms and conditions

contained in this Agreement, at the Closing, the Sellers shall sell, assign, transfer, convey, and deliver to the Buyer, and the Buyer

shall purchase and acquire from the Sellers, free and clear of any Encumbrances (as defined in Section 2.02), all of the issued and outstanding

Interests, with each Seller selling such Seller’s Allocated Share of the Interests.

Section 1.02 Purchase

Price Consideration.

(a) The

aggregate purchase price payable by the Buyer to the Sellers for the Interests shall be SIX MILLION and 00/100 DOLLARS ($6,000,000.00)

(the “Purchase Price”), consisting of:

| (i) | One million five hundred

thousand and 00/100 DOLLARS ($1,500,000.00) shall be payable in cash at the Closing (the “Cash Portion”) by

wire transfer of immediately available funds to an account or accounts specified in writing by the Sellers, with each Seller receiving

its Allocated Share of the Cash Portion. |

| (ii) | One million five hundred

thousand and 00/100 DOLLARS ($1,500,000.00) worth of shares of the Buyer’s common stock (the “Buyer Shares”),

par value $0.001 per share (the “Common Stock”), valued per share at the Closing 7-Day VWAP (as defined in Section

1.04 below), to be issued by the Buyer to the Sellers within ninety (90) days from the Closing, with each Seller receiving a number

of Buyer Shares (rounded up to the nearest whole Buyer Share) based on such Seller’s Allocated Share, subject to the terms and

conditions set forth in Exhibit A. The Buyer Shares will be issued in reliance upon the exemption from securities

registration afforded by Rule 506 of Regulation D of the Securities Act of 1933, as amended (the “Securities Act”),

and they shall be subject to applicable restrictions under federal securities Laws (as defined in Section 3.05). |

| (iii) | THREE MILLION and 00/100 DOLLARS ($3,000,000.00) shall be

payable in cash or shares of Common Stock, at the sole discretion of the Buyer, to the Sellers (the “Total Earnout”),

with each Seller receiving its Allocated Share of the Total Earnout, if, when, and to the extent payable in accordance with the terms

and conditions set forth in Exhibit B. |

(b) The

payment of the Purchase Price to the Sellers shall be in full satisfaction of all rights of the Sellers pertaining to their rights in

and to the Interests. Effective as of the Closing, (i) the Company shall be a wholly-owned subsidiary of the Buyer, and the Buyer

shall own 100% of the issued and outstanding membership interests of the Company, (ii) there will be no holders of Interests in,

or other equity securities of, the Company, other than the Buyer, and (iii) there will be no holders of Interest-Related Rights (as

defined in Section 3.03(b)) in the Company, other than the Buyer.

(c) Notwithstanding

anything to the contrary contained in this Agreement, under no circumstances shall the aggregate number of Buyer Shares and shares of

Common Stock issuable pursuant to Section 1.02(a)(iii), if any (collectively, the “Shares”), issuable under this Agreement

in connection with the Buyer’s purchase of the Interests, and any other shares of Common Stock to be issued by the Buyer, if any,

which could be aggregated with the Shares in connection with the purchase of the Interests under Nasdaq Listing Rule 5635(a), exceed 19.99%

of the Buyer’s issued and outstanding shares of Common Stock immediately before consummation of this Agreement and any other transactions

being consummated by the Buyer in connection with the purchase of the Interests (the “Cap Amount”), unless the Buyer

has obtained either (i) its stockholders’ approval of the issuance of more shares of Common Stock than the Cap Amount, pursuant

to Nasdaq Listing Rule 5635(a), or (ii) a waiver from Nasdaq (as defined in Section 1.04) of the Buyer’s compliance with Nasdaq

Listing Rule 5635(a). To the extent that the issuance of shares of Common Stock under this Agreement would cause the Shares issuable herein

to exceed the Cap Amount, the Buyer, in lieu of issuing such shares of Common Stock, shall pay the Sellers in cash an amount equal to

(x) the aggregate number of Shares that exceed the Cap Amount times (y) the 7-Day Closing VWAP or VWAP, as applicable, of the Common Stock

as reported on Nasdaq.

(d) No

fractional shares or scrip representing fractional shares shall be issued under this Agreement. As to any fraction of a share which a

Seller would otherwise be entitled to receive in accordance with the terms of this Agreement, the Buyer shall, at its election, either

pay a cash adjustment in respect of such final fraction in an amount equal to such fraction multiplied by the 7-Day Closing VWAP or round

up to the next whole share.

Section 1.03 Review

Periods.

The mechanics, timing, and

responsibilities of calculating the Total Earnout for each review period, including, but not limited to, the permitted disputes and resolutions

thereof, shall be set forth in Exhibit B, together with the agreed-upon targets for the Company’s actual earnings

before interest, taxes, depreciation, and amortization (the “EBITDA”) and the Company’s revenue for each of the

three years following the Closing Date. Exhibit B further sets forth the effect on the Total Earnout should the Company

exceed the targets set forth therein and should it fall short thereof.

Section 1.04 Lockup;

Securities Definitions.

Each Seller hereby agrees

that it shall not offer, pledge, sell, contract to sell, sell any option or contract to purchase, grant any option, right, or warrant

to purchase, or otherwise transfer or dispose of, directly or indirectly, any of the Shares or enter into any swap, hedging or other arrangement

that transfers to another, in whole or in part, any of the economic consequences of ownership of any of the Shares held by such Seller

for one hundred and eighty (180) days following the issuance date of such Shares. Each Seller further agrees to execute and deliver such

other agreements as may be reasonably requested by the Buyer that are consistent with the foregoing or that are necessary to give further

effect thereto.

For purposes of this Agreement,

“VWAP” shall mean, for any date, the price determined by the first of the following clauses that applies: (a) if the

Common Stock is then listed or quoted on a Trading Market, the volume weighted average price of the Common Stock for such date (or the

nearest preceding date) on the Trading Market on which the Common Stock is then listed or quoted as reported by Bloomberg (based on a

Trading Day from 9:30 a.m. (New York City time) to 4:02 p.m. (New York City time)), (b) if the Common Stock is quoted for trading

on the OTCQB or OTCQX, as applicable, and if the OTCQB or OTCQX is not a Trading Market, the volume weighted average price of the Common

Stock for such date (or the nearest preceding date) on OTCQB or OTCQX as applicable, or (c) if the Common Stock is not then listed

or quoted for trading on OTCQB or OTCQX and if prices for the Common Stock are then reported in The Pink Open Market (or a similar organization

or agency succeeding to its functions of reporting prices), the most recent bid price per share of the Common Stock so reported.

“Closing 7-Day VWAP”

shall mean the VWAP for seven (7) consecutive trading days ending on the trading day immediately prior to the Closing Date (as defined

in Section 1.05 below).

“Trading Day”

shall mean a day on which the principal Trading Market is open for trading, and “Trading Market” shall mean any of the following

markets or exchanges on which the Buyer Shares are listed or quoted for trading on the date in question: the NYSE American, the Nasdaq

Capital Market (“Nasdaq”), the Nasdaq Global Market, the Nasdaq Global Select Market, the New York Stock Exchange,

OTCQB or OTCQX (or any successors to any of the foregoing).

Section 1.05 Closing.

The closing of the transactions

contemplated by this Agreement (the “Closing”) shall take place simultaneously with the execution of this Agreement

on the date of this Agreement remotely by electronic exchange of documents and signatures (the “Closing Date”).

Article II

REPRESENTATIONS AND WARRANTIES CONCERNING THE SELLERS

Each Seller, jointly and severally,

represents and warrants to the Buyer that the following statements are correct and complete as of the date hereof:

Section 2.01 Authority.

The Seller has full legal

power, authority, and capacity to execute and deliver this Agreement and all other documents, instruments, and writings required to be

delivered by the Seller at the Closing under this Agreement or otherwise required in connection with this Agreement (the “Related

Documents”) to which the Seller is a party and to consummate the transactions contemplated hereby and thereby. This Agreement

and each Related Document to which the Seller is a party have been duly and validly executed and delivered by the Seller and constitute

valid and binding obligations of the Seller, enforceable against the Seller in accordance with their terms, subject to applicable bankruptcy,

insolvency, or other Laws affecting the rights of creditors generally, and to equitable principles. No further action on the part of the

Seller is or will be required in connection with the consummation of the transactions under this Agreement.

Section 2.02 Title

to Interests.

(a) The

Seller lawfully owns beneficially and of record its Allocated Share of the Interests that are set forth in the Recitals and has good and

marketable title to its Interests, free and clear of any pledges, security interests, mortgages, deeds of trust, liens, charges, encumbrances,

equities, claims, adverse claims, options, rights of first refusal, rights of way, conditional sales, grants of power to confess judgment,

or limitations whatsoever (“Encumbrances”). There are no claims, actions, or proceedings of any kind pending or threatened

in writing by or against the Seller or the Company concerning its Interests. At the Closing, the Seller will transfer, assign, and deliver

to the Buyer good title to its Allocated Share of the Interests, free and clear of any Encumbrances.

(b) The

Interests were issued in compliance with applicable Laws. The Interests were not issued in violation of the organizational documents of

the Company or any other agreement, arrangement, or commitment to which the Seller or the Company is a party and are not subject to or

in violation of any preemptive or similar rights of any individual, a partnership (general or limited), a joint venture, a limited liability

company, a corporation, a trust, an unincorporated organization or Governmental Authority (“Person”).

(c) Other

than the organizational documents of the Company, there are no voting trusts, proxies or other agreements or understandings in effect

with respect to the voting or transfer of any of the Interests.

(d) The

Interests were never certificated, and the execution and delivery of this Agreement by the Sellers and execution and delivery of the assignment

of membership interest, in the form attached hereto as Exhibit C (the “Assignment Agreement”), shall

evidence the delivery by each Seller of its Allocated Share of the Interest to the Buyer.

Section 2.03 Consents

Required.

No consent, approval or authorization

of or by, registration, declaration or filing with, or notification to any Governmental Authority or any other Person is required in connection

with the execution, delivery, and performance by the Seller of this Agreement or the Related Documents to which the Seller is or will

be a party or the consummation by the Seller of the transactions contemplated hereby or thereby. “Governmental Authority”

means any national, federal, state, provincial, county, municipal, or local government, foreign, or domestic, or the government of any

political subdivision of any of the foregoing, or any entity, authority, agency, ministry, or other similar body exercising executive,

legislative, judicial, regulatory, or administrative authority or functions of or pertaining to government, including any authority or

other quasi-governmental entity established to perform any of such functions.

Section 2.04 Investment

Representations.

(a) Each

Seller is an “accredited investor” as defined in Rule 501 of Regulation D promulgated under the Securities Act. Each Seller

has such knowledge and experience in financial or business matters that it is capable of evaluating the merits and risks of receiving

the Buyer Shares in connection with the sale of the Interests.

(b) The

Buyer Shares will be acquired for investment for each Seller’s own account, not as a nominee or agent, and not with a view to the

resale or distribution of any part thereof, and each Seller has no present intention of selling, granting any participation in, or otherwise

distributing the same. Each Seller does not presently have any contract, undertaking, agreement, or arrangement with any Person to sell,

transfer, or grant participations to such Person or to any third party with respect to any of the Buyer Shares.

(c) Each

Seller understands that the Buyer Shares, when issued, shall be “restricted securities” under the federal securities Laws

and that under such Laws and applicable regulations the Buyer Shares may be resold without registration under the Securities Act only

in certain limited circumstances. Each Seller represents that it is aware of the provisions of Rule 144 promulgated under the Securities

Act, which rules permit the limited resale of shares purchased in a private placement or shares owned by certain Persons subject to the

satisfaction of certain conditions, which may include the time and manner of sale, the holding period for the Buyer Shares, and requirements

relating to the Buyer which are outside of each Seller’s control, and which the Buyer is under no obligation and may not be able

to satisfy. Each Seller understands that such Buyer Shares are being offered and issued to it in reliance on specific exemptions from

the registration requirements of United States federal and state securities Laws and Buyer is relying in part upon the truth and accuracy

of, and each Seller’s compliance with, the representations, warranties, agreements, acknowledgements and understandings of each

Seller set forth in this Agreement in order to determine the availability of such exemptions and the eligibility of each Seller to acquire

such Buyer Shares.

(d) Each

Seller acknowledges that, as of the date hereof, it has been afforded: (i) the opportunity to ask such questions as it has deemed necessary

of, and to receive answers from, representatives of the Buyer concerning the terms and conditions of this Agreement and the transactions

contemplated hereby and the Buyer Shares, and the merits and risks of receiving the Buyer Shares; (ii) access to information about the

Buyer and its financial condition, results of operations, business, properties, management and prospects sufficient to enable it to evaluate

the transactions contemplated under this Agreement; (iii) the opportunity to obtain such additional information that the Buyer possesses

or can acquire without unreasonable effort or expense that is necessary to make an informed investment decision with respect to the investment;

and (iv) the opportunity to ask questions of management of the Buyer. Each Seller has sought such accounting, legal and Tax advice as

it has considered necessary to make an informed decision with respect to the terms set forth hereunder.

(e) Each

of the Sellers and, to their knowledge, the Company has not taken any of the actions set forth in, and is not subject to, the disqualification

provisions of Rule 506(d)(1) of the Securities Act.

(f) The

foregoing representations and warranties set forth under this Section 2.04 shall be true and correct as of the issuance date of any Buyer

Shares and the Closing Date.

Section 2.05 Full

Disclosure.

No representation or warranty

made by the Sellers in this Agreement, any Schedule, any Exhibit, or any certificate delivered, or to be delivered, by or on behalf of

the Sellers pursuant hereto contains or will contain any untrue statement of a material fact, or omits or will omit to state a material

fact necessary to make the statements contained herein or therein not misleading. There is no fact or circumstance that the Sellers have

not disclosed to the Buyer in writing that the Sellers presently believe have resulted, or could reasonably be expected to result, in

a Material Adverse Effect on the Company or could reasonably be expected to have a Material Adverse Effect on the ability of the Company

or the Sellers to perform their respective obligations under this Agreement. “Material Adverse Effect” means any change,

circumstance, occurrence, development, event, or effect having, or reasonably expected to have, individually or in the aggregate, a material

adverse effect on the prospects, condition, or operations of the business of a Person; provided, however, that the following shall

not be considered in determining whether a Material Adverse Effect has occurred (but, in the case of each of clauses (a), (b) and (c)

below, only to the extent such changes or effects do not have a disproportionate adverse impact on the Person as compared to other Persons

in the industry in which the Person conducts business): (a) changes in economic or political conditions or the financing, banking,

currency or capital markets in general; (b) changes in Laws or interpretations thereof or changes in accounting requirements or principles;

or (c) any hurricane, super storm, tornado, earthquake, flood, tsunami, natural disaster, act of God, epidemic, pandemic (including

that resulting from the COVID-19, SARS-CoV-2 virus or any mutation or variation thereof), or other comparable events or outbreak, or any

acts of terrorism, sabotage, military action, armed hostilities or war (whether or not declared) or any escalation or worsening thereof.

Article III

REPRESENTATIONS AND WARRANTIES

CONCERNING THE COMPANY

The Sellers, jointly and severally,

represent and warrant to the Buyer that the following statements are correct and complete as of the date of this Agreement and will be

correct and complete as of the Closing Date:

Section 3.01 Organization;

Qualification.

The Company is duly organized,

validly existing, and in good standing under the Laws of the jurisdiction of its formation, and it has all requisite power and authority

(corporate and otherwise) to own, lease, and operate its assets and properties and to carry on its Business as presently conducted. The

Company is duly licensed or qualified to transact business and is in good standing in each jurisdiction set forth on Schedule 3.01,

which together constitutes all jurisdictions in which the nature of the business transacted by it, including its ownership or leasing

of properties, requires such licensing or qualification. The Company has delivered to the Buyer true and complete copies of all such documents

establishing its legal existence or governing its internal affairs (collectively, the “Fundamental Documents”).

Section 3.02 Authority

Relative to this Agreement.

The Company has full limited

liability company power and authority to execute and deliver this Agreement and each Related Document to which it is a party and to consummate

the transactions contemplated hereby and thereby. The execution and delivery of this Agreement and each Related Document to which it is

a party and the consummation of the transactions contemplated hereby and thereby have been duly and validly authorized by requisite limited

liability company action taken by it, and no other proceedings by the Company are necessary to authorize this Agreement and each such

Related Document or to consummate the transactions contemplated hereby or thereby. This Agreement and each such Related Document have

been duly and validly executed and delivered by the Company and constitute the valid and binding obligations of the Company, enforceable

against it in accordance with their terms, subject to applicable bankruptcy, insolvency, or other Laws affecting the rights of creditors

generally, and to equitable principles. No further action on the part of the Company is or will be required in connection with the consummation

of the transactions under this Agreement.

Section 3.03 Capitalization.

(a) The

Interests (i) constitute 100% of the total issued and outstanding membership interests of the Company, (ii) have been duly authorized,

and (iii) are validly issued, fully paid, and non-assessable. No other membership interests or other equity securities of the Company

are authorized, issued, or outstanding.

(b) Other

than this Agreement (i) there is no subscription, option, warrant, call, right, agreement, or commitment, whether written or oral,

relating to the issuance, sale, delivery, or transfer (including any right of conversion or exchange under any outstanding security or

other instruments) by any the Company, or by any of the Sellers, of any membership interests or equity securities of the Company, (ii) there

are no written or oral outstanding contractual obligations of the Company to repurchase, redeem, or otherwise acquire any outstanding

Interests or other membership interests or equity securities of the Company, and (iii) there are no contracts, commitments, arrangements,

understandings, or restrictions to which the Company, or any of the Sellers or any other holder of the Company’s equity securities

is bound relating to any membership interests or other equity securities of the Company (collectively, the “Interest-Related

Rights”).

(c) Except

as set forth in Schedule 3.03(c), neither the Sellers, nor any officer, director, manager, employee, or member of the Company,

nor any relative or other Affiliate of any of the foregoing, have any interest in any property, real or personal, tangible or intangible,

used in or pertaining to the Business, and no such Person is indebted to the Company, nor is the Company indebted to any such Person.

For purposes of this Agreement, “Affiliate” means, with respect to any Person, any other Person that directly or indirectly,

through one or more intermediaries, controls or is controlled by or is under common control with the Person specified.

Section 3.04 Subsidiaries;

Investments.

The Company does not have

any equity or similar investment, directly or indirectly, in or with any subsidiary, corporation, company, partnership, association, joint

venture, or other Person.

Section 3.05 Consents

and Approvals; No Violation.

Neither the execution and

delivery of this Agreement and the Related Documents by the Sellers, nor the sale by the Sellers of the Interests under this Agreement

nor the consummation of the other transactions contemplated by this Agreement and the Related Documents will (a) conflict with or

result in any breach of any provision of the Fundamental Documents of the Company; (b) require any consent, approval, authorization,

or permit of, or filing with, or notification to, any Governmental Authority other than those that are set out on Schedule 3.05;

(c) result in a default (or give rise to any right of termination, cancellation, or acceleration) under the terms of any note, mortgage,

indenture, deed of trust, real property lease, or other contract or agreement to which the Company is a party or by which the Company

is bound or subject; (d) result in the creation of any encumbrance, security interest, equity, or right of others upon any of the

properties or assets of the Company or under the terms, conditions, or provisions of any agreement to which the Company or its assets

may be bound or affected; or (e) violate any order, writ, injunction, decree, law, statute, rule, or regulation of any Governmental

Authority (“Law”) applicable to the Company or its assets.

Section 3.06 Financial

Statements.

(a) The

Company has delivered to the Buyer reviewed balance sheets of the Company as of December 31, 2023, and December 31, 2022, and the related

certified public accountant reviewed consolidated statements of operations and comprehensive loss, changes in members’ equity, and

cash flows for the 12-month periods then ended (collectively, the “Reviewed Financial Statements”) and the management-prepared

consolidated balance sheet of the Company as of June 30, 2024 (the “Latest Balance Sheet Date”) and the related management-prepared

statements of operations and comprehensive loss, changes in members’ equity, and cash flows for the period beginning on January

1, 2024, and ending on the Latest Balance Sheet Date (collectively, the “MP Financial Statements,” and, together with

the Audited Financial Statements, the “Financial Statements”).

(b) The

Financial Statements, including the related notes and schedules thereto, (i) have been prepared in accordance with the books and

records of the Company, which are true and complete in all material respects and which have been maintained in a manner consistent with

historical practice, (ii) present fairly, in accordance with GAAP, the financial condition and results of operations of the Company,

which such Financial Statements purport to present as of the dates thereof and for the periods indicated therein and (iii) have been

prepared on the consistent basis and in accordance with consistent policies, principles, and practices throughout the periods covered

thereby (except as may be indicated therein, in the notes thereto or as summarized in Schedule 3.06, and except, in the case

of the Reviewed Financial Statements, for the absence of footnotes and to standard year-end adjustments, none of which will be material).

As used herein, “GAAP” means generally accepted accounting principles in the United States, as consistently applied

by the Company.

(c) Since

the date of the Reviewed Financial Statements, there has been no change in (i) any accounting principle, procedure, or practice followed

by the Company or (ii) the method of applying any such principle, procedure, or practice.

Section 3.07 Undisclosed

Liabilities.

The Company does not have

any material Liabilities (for the purpose of this Section, “material” means Liabilities that, individually or in the aggregate,

exceed $5,000, that are not fully reflected or reserved against in the Reviewed Financial Statements, except those that have been incurred

in the ordinary course of business since the date thereof (none of which are material)). There is no basis for any claim against the Company

for any material Liability that is not fully reflected or reserved against in the Reviewed Financial Statements, other than obligations

incurred in the ordinary course of business since the date of the Reviewed Financial Statements (none of which are material). “Liabilities”

means liabilities or obligations, secured or unsecured, of any nature whatsoever, whether absolute, accrued, contingent, or otherwise,

and whether due or to become due.

Section 3.08 Absence

of Adverse Changes and Extraordinary Events.

Except as otherwise contemplated

by this Agreement, from the date of the Reviewed Financial Statements through the date hereof, (a) the Company has not entered into

any transactions other than in the ordinary course of business consistent with past practice, (b) there has not been any event that

has had or may have a material adverse effect on the Company, (c) the Business has been operated only in the ordinary course and

substantially in the manner that such business was heretofore conducted, (d) all vendors and contractors of the Company have been

promptly paid, and (e) each Seller has used that Seller’s commercially reasonable efforts to preserve the goodwill of the Company

and its relationships with its employees, customers, and suppliers.

Section 3.09 Insurance.

The Company maintains insurance

for its properties against loss or damage by fire or other casualty or any other such other insurance, including liability insurance,

as would usually be maintained by prudent companies similar in size and credit standing to the Company and engaged in the same or similar

business.

Section 3.10 Title

to Assets.

The Company has good and marketable

title to, or a valid leasehold or license interest in, all of its assets, properties, and interests in properties, real, personal or mixed

(a) reflected on the balance sheets included in the Reviewed Financial Statements, (b) acquired since the Latest Balance Sheet

Date, or (c) required for or used in the conduct of its business as currently conducted, except for inventory sold in the ordinary

course of business since the date of that balance sheet and accounts receivable and notes to the extent that they have been paid (collectively,

the “Assets”). All of the Assets that have an individual book value in excess of $5,000 are listed in Schedule 3.10.

All of the equipment, furniture, fixtures, and other personal property included in the Assets are in good operating condition and are

adequate for use in the ordinary course of the Company’s business consistent with past practice with no defects that could interfere

with the conduct of normal operations of such equipment, furniture, fixtures, and other personal property, except for damaged, worn, or

defective items that have been written off or written down to fair market value or for which adequate reserves have been established in

the Reviewed Financial Statements. All of the Assets are owned by the Company, free and clear of any Encumbrances, and no Assets are held

on a consignment or lease basis.

Section 3.11 Credit

Lines, Loans, Guarantees, Banks.

Schedule 3.11

describes all the loans and credit lines of the Company, including the identity of the lender, the loan amount and balance, terms, related

security interests, and the identity of any guarantors. Except as set out on Schedule 3.11, (a) the Company has no indebtedness

for borrowed money or other debt obligation, other than trade credit extended in the ordinary course of business by the suppliers and

vendors of the Company, (b) the Company has not guaranteed the Liabilities of any third party and (c) the Company is not obligated

to indemnify any third party. The full details of the Company’s bank accounts, including the names of all Persons authorized to

draw thereon or make withdrawals therefrom, and the balance of each such account as of the most recent statement date, are detailed in

Schedule 3.11.

Section 3.12 Labor

Matters.

Except as set forth in Schedule

3.12: (a) the Company is in full compliance with all applicable Laws concerning employment and employment practices, terms, and

conditions of employment and wages and hours, and they are not engaged in any unfair labor practice; (b) there is no unfair labor

practice complaint against the Company pending or, to the Knowledge (as defined below) of the Sellers, threatened before any Governmental

Authority; (c) there is no labor strike, dispute, slowdown, or stoppage actually pending or, to the Knowledge of the Sellers, threatened

against or affecting any of the Company; (d) no grievance nor any arbitration proceeding arising out of or under any collective bargaining

or other agreement is pending against any of the Company; and (e) the Company has not experienced any strike or work stoppage or

other industrial dispute involving their employees in the past five (5) years. “Knowledge” means, with respect to any

fact or matter, the actual knowledge of a Person, and such knowledge that they would be expected to discover after diligent inquiry concerning

the existence of the fact or matter in question.

Section 3.13 Employees;

Employee Benefit Arrangements.

(a) Schedule 3.13(a)

is a true and complete list of the names and positions of current employees of the Company (the “Employees”) and the

following compensation information for fiscal year 2023 for each Employee (as applicable): (i) annual base salary; (ii) annual

bonus; (iii) commissions; (iv) benefits; (v) severance; and (vi) all other items of compensation that are in fact

paid, provided, or made available to that Employee or that the Company is required to pay, provide, or make available to that Employee

under any written or oral agreement, plan or other understanding or arrangement. The Company has no outstanding Liabilities (including

any commission payments due) with respect to any Employee (or any dependent or beneficiary of any such Employee) that are not accrued

for in the Reviewed Financial Statements. Except as set out on Schedule 3.13(a), the employment of all Employees is “at

will,” and the Company may terminate the employment of each Employee at any time, for any reason or for no reason. Except as set

out on Schedule 3.13(a), the Company has not offered employment to any individual who is not an Employee. The Company has

delivered to the Buyer true and complete copies of employment agreements with the Employees listed on Schedule 3.13(a).

(b) “Benefit

Arrangement” means any employee benefit plans, as defined in Section 3(3) of the United States Employee Retirement Income

Security Act of 1974, as amended (“ERISA”) or other applicable Law, or other pension, savings, retirement, benefit,

fringe benefit, compensation, deferred compensation, incentive, bonus, commission, profit-sharing, insurance, welfare, severance, change

of control, parachute, stock option, stock purchase, or other employee benefit plan, program or arrangement, whether or not subject to

any of the provisions of ERISA, whether or not funded and whether written or oral.

(c) Except

as referred to in Schedule 3.13(c), the Company has no Benefit Arrangements covering former or current employees of the Company,

or under which the Company has any Liability (each such Benefit Arrangement, a “Company Employee Plan”). The Company

has no commitment or obligation to create any additional Benefit Arrangements or to increase benefit levels, provide any new benefits

under, or otherwise change any Company Employee Plan, and no such creation, increase, or change has been proposed, made the subject of

written or oral representations to employees, or requested or demanded by employees under circumstances that make it reasonable to expect

that it will occur. Correct and complete copies of all Company Employee Plans are attached as part of Schedule 3.13(c).

(d) Each

Company Employee Plan is and has been administered in compliance with its terms and with the requirements of applicable Law and for the

exclusive benefit of the participants and beneficiaries of that Company Employee Plan. There is no pending or, to the Sellers’ Knowledge,

threatened legal action, arbitration, or other proceeding against the Company with respect to any Company Employee Plan, other than routine

claims for benefits, that could result in Liability to the Company or to the Buyer, and there is no basis for any such legal action or

proceeding. All required, declared, or discretionary (in accordance with historical practices) payments, premiums, contributions, reimbursements,

or accruals with respect to each Company Employee Plan for all periods ending prior to or as of the date hereof have been made or properly

accrued on the Financial Statements, including the balance sheets included in the Reviewed Financial Statements, or with respect to accruals

properly made after the date of the Reviewed Financial Statements, on the books and records of the Company. There is no unfunded actual

or potential Liability relating to any Company Employee Plan that is not reflected on the Financial Statements, including the balance

sheets included in the Reviewed Financial Statements, or with respect to accruals properly made after the date of the Reviewed Financial

Statements, on the books and records of the Company. Each Company Employee Plan that is a “group health plan” within the meaning

of Section 5000 of the Code has been maintained in compliance with Section 4980B of the Code and Title I, Subtitle B,

Part 6 of ERISA and no Tax payable on account of Section 4980B of the Code has been or is expected to be incurred as this law

is not applicable to the Company. If any Company Employee Plan is, or has features that constitute, a “nonqualified deferred compensation

plan” within the meaning of Treas. Reg. §1.409A-1(a), that Company Employee Plan has been operated in compliance with

Section 409A of the Code and applicable Treasury regulations thereunder and the Company has no any obligation to pay, reimburse,

or indemnify any service provider in any such Company Employee Plan for Taxes resulting from the service provider’s participation

in that Company Employee Plan. Except as may be required under COBRA or other Laws of general application, no Company Employee Plan obligates

the Company to provide any employee or former employee, or their spouses, family members or beneficiaries, any post-employment or post-retirement

health or life insurance, accident or other “welfare-type” benefits. The execution and delivery of this Agreement and the

consummation of the transactions contemplated hereby will not result in any payment (either of severance pay or otherwise) becoming due

under any Company Employee Plan, or from any of the Company, the Sellers, or the Buyer, to any current or former employee or self-employed

individual.

Section 3.14 Contracts;

Customers.

(a) Schedule 3.14(a)

sets out a list of all the written and oral contracts and commitments (including any (i) real property leases, (ii) customer

contracts and customer orders (including customer contact lists), (iii) partner and supplier contracts, (iv) powers of attorney,

and (v) indemnification agreements), (A) to which the Company is a party, (B) by which the Company is bound, or (C) under

which the Company has performed work, or had work performed for it, in the past twenty-four (24) months (collectively, the “Contracts”)

that are material to the Company (“Material Contracts”), including the following:

| (i) | each Contract of the Company involving aggregate consideration

in excess of $10,000 and which, in each case, cannot be cancelled by such Company without penalty or without more than thirty (30) days’

notice; |

| (ii) | all Contracts that provide for the indemnification by the Company of any Person or the assumption of any

Tax, environmental, or other Liability of any Person; |

| (iii) | all Contracts relating to Intellectual Property (as defined in Section 3.21), including all licenses,

sublicenses, settlements, coexistence agreements, covenants not to sue, and permissions; |

| (iv) | except for Contracts relating to trade receivables, all Contracts relating to indebtedness (including,

without limitation, guarantees) of the Company; and |

| (v) | all Contracts that limit or purport to limit the ability of the Company to compete in any line of business

or with any Person or in any geographic area or during any period of time |

(b) Each

Material Contract is valid and binding on the Company in accordance with its terms and is in full force and effect. None of the Company

or, to the Knowledge of the Sellers, any other party thereto is in breach of or default under (or is alleged to be in breach of or default

under) or has provided or received any notice of any intention to terminate, any Material Contract. Complete and correct copies of each

Material Contract (including all modifications, amendments, and supplements thereto and waivers thereunder) have been made available to

Buyer.

(c) (i) To

the Knowledge of the Sellers, the Company’s relationships with each of their customers is good, (ii) no problem or disagreement

exists between the Company and any customer, and (iii) no customer has notified the Company that it intends to, nor has any customer

threatened to, terminate, decrease, or otherwise modify its relationship and dealings with the Company, and the Sellers do not have any

reason to believe that any customer intends to take any such action, in each case whether as a result of the transactions contemplated

by this Agreement or otherwise.

Section 3.15 Legal

Proceedings, Etc.

There is no claim, action,

proceeding, or investigation pending, nor, to the Knowledge of the Sellers and/or the Company, is there any basis for or any threatened

claim, action, proceeding or investigation, against or relating to the Company or the Sellers before any Governmental Authority acting

in an investigative or adjudicative capacity, nor has any such claim, action, proceeding or investigation been pending or, to the Knowledge

of the Sellers and/or the Company, threatened in the past five (5) years, and the Company is not subject to any outstanding order, writ,

injunction, or decree.

Section 3.16 Taxes.

(a) (i)

All Tax Returns required to be filed by the Company on or before the date hereof have been filed by or on behalf of the Company. (ii) The

Company has paid in full, or provided for in the Reviewed Financial Statements, all Taxes required to be paid by it through the date hereof,

whether or not shown to be due on any Tax Returns. (iii) All accruals or reserves for Taxes reflected in the Reviewed Financial Statements

are adequate to cover Taxes accruing with respect to or payable by the Company through the date thereof, and the Company has not incurred

or accrued any Liability for Taxes subsequent to that date other than in the ordinary course of business. (iv) All Tax Returns filed

or required to be filed on or before the Closing by the Company are true, correct, and complete in all material respects. (v) No

Tax Return of the Company has been audited or is under audit by the relevant authorities, and the Company has not received any notice

that any such Tax Return is under examination or will be audited. (vi) No extension of the statute of limitations with respect to

any claim for Taxes has been granted by the Company. (vii) There are no liens or other Encumbrances for Taxes upon the assets of

the Company except liens for Taxes not yet due. (viii) The Company is not party to or bound by any Tax allocation or sharing agreement,

nor does it have any Liability for the Taxes of any Person other than itself under Treas. Reg. §1.1502-6 (or any similar provision

of state, local, or non-U.S. Law), as a transferee or successor, by contract or otherwise. (ix) The Company has withheld and paid

all Taxes required to have been withheld and paid in connection with any amounts paid or owing by the Company to any employee, independent

contractor, creditor, stockholder or other Person.

(b) “Tax”

and “Taxes” mean all taxes, charges, fees, levies, or other assessments, including, without limitation, income, gross

receipts, excise, property, sales, transfer, gains, use, value added, withholding, license, occupation, privileges, payroll, and franchise

taxes and stamp duties, imposed by any Governmental Authority; and those terms shall include any interest, penalties, or additions to

tax attributable to those assessments. “Tax Return” means any report, statement, return, or other information required

to be supplied by the Company to a taxing authority in connection with Taxes.

Section 3.17 Compliance

with Law.

The Company has conducted

its business in all material respects in compliance with, and it currently is in compliance with, all applicable Laws. The Company has

all permits, licenses, approvals, certificates, and other authorizations, and has made all notifications, registrations, certifications,

and filings with all Governmental Authorities, necessary or advisable for the operation of its business as currently conducted. There

is no action, case or proceeding pending or, to the Company’s Knowledge after due investigation, threatened by any Governmental

Authority with respect to (i) any alleged violation by the Company of any Law, or (ii) any alleged failure by the Company to

have any permit, license, approval, certification, or other authorization required in connection with the operation of the Business. No

notice of any violation of such Laws has been received by the Company, and the Company has not received any notice that the products manufactured

or sold or the services provided by the Company is not in compliance with, or do not meet the standards of, all applicable Laws.

Section 3.18 Full

Disclosure.

This Agreement, including

the representations and warranties contained in Article II and this Article III, the schedules, attachments, and exhibits attached

hereto, do not contain any untrue statement of material fact or omit to state any material fact necessary to make the statements contained

herein or therein, taken as a whole, in light of the circumstances in which they were made, not misleading.

Section 3.19 Broker’s

or Finder’s Fees.

None of the Sellers, nor the

Company, nor any Person acting on the Sellers’ or the Company’s behalf, has employed an agent, broker, Person or firm in connection

with the transactions contemplated by this Agreement. To the extent that any of the Sellers or the Company has incurred any Liability

for any brokerage fees, commissions, or finder’s fees in connection with the transactions contemplated by this Agreement, the Sellers,

and not the Company, will be solely responsible for the payment of that Liability.

Section 3.20 Related

Party Transactions; Guarantees.

Except as set out on Schedule 3.20,

there are no related party transactions between any of the Company, on the one hand, and the Sellers (or any spouse, other family member

or Affiliate of any Seller), on the other hand, in existence as of the Closing, and there are no Liabilities between any Seller (or any

spouse, other family member or Affiliate of any Seller) and the Company that will not, by their terms or otherwise, terminate at or before

the Closing. The Company has not guaranteed the Liabilities of the Sellers or any other Person.

Section 3.21 Intellectual

Property.

(a) “Intellectual

Property” means (i) any and all inventions, technology, patents, and reissuances, continuations, continuations-in-part,

divisions and reexaminations of those patents, (ii) trademarks, service marks, trade dress, logos, trade names, domain names, and

corporate names, including all goodwill associated therewith, (iii) copyrightable works and copyrights (including software, databases,

data, and related documentation), (iv) mask works, (v) trade secrets and confidential business information (including ideas,

research, and development, know-how, processes and techniques, technical data, designs, drawings, specifications, client, customer and

supplier lists, pricing and cost information, and business and marketing plans and proposals), and (vi) all registrations, applications,

renewals, and recordings of any of the preceding items listed in this sentence. Schedule 3.21 sets out each item of Intellectual

Property that is used in the conduct of the Business as currently conducted.

(b) The

Company either owns the entire right, title, and interest to, or holds an existing, valid, and enforceable license to use, all the Intellectual

Property used in or required for the Business as currently conducted (any such license and any required royalty payments are set out on

Schedule 3.21).

(c) There

are no actions instituted or, to the Knowledge of the Sellers, threatened by any third party pertaining to, or challenging, the Company’s

use of, or right to use, any Intellectual Property.

(d) Neither

the Intellectual Property of the Company nor the conduct of the Business infringes any Intellectual Property of any third party, nor has

the Company received any written assertion of any such infringement or any offer to license Intellectual Property under claim of use.

(e) To

the Knowledge of the Sellers, no third party is infringing upon any Intellectual Property of the Company.

(f) All

current and former employees and consultants of the Company has signed (i) non-disclosure agreements related to any of the Company’s

Intellectual Property rights, and (ii) agreements obligating them to assign to the Company Intellectual Property rights developed

by them in the course of their service to the Company, and those agreements are currently in full force and effect.

(g) The

Company has not violated or breached, nor is the Company in violation or in breach of, any confidentiality, non-competition, non-solicitation,

or similar obligation of the Company to any Person.

Section 3.22 Environmental

Matters.

(a) Except

as set forth on Schedule 3.22, to the Knowledge of the Sellers, (i) the business of the Company is being and has been conducted

in compliance in all material respects with all Environmental Laws, (ii) the real property operated by the Company (including, without

limitation, soil, groundwater or surface water on or under the properties and buildings thereon) (the “Affected Property”)

does not contain any Regulated Substance in violation of applicable Environmental Laws (the Company does not own any real property), (iii)

the Company has, and at all times has had, all permits, licenses and other approvals and authorizations required under applicable Environmental

Laws, if any, for the operation of the business of the Company, (iv) the Company has not received any notice from any Governmental

Authority that the Company or any of its Affiliates may be a potentially responsible party in connection with any waste disposal site

or facility used by or otherwise related to the Company, (v) no reports have been filed, or have been required to be filed, by the Company

concerning the release of any Regulated Substance in the violation of Environmental Laws or otherwise with respect to the violation of

any Environmental Laws on or at the properties used in the business of the Company, (vi) no Regulated Substance has been disposed of,

transferred, released or transported from the Affected Property, other than as permitted under applicable Environmental Law or pursuant

to appropriate regulations, permits or authorizations, (vii) there have been no environmental investigations, studies, audits, tests,

reviews, or other analyses conducted by or which are in the possession of the Company or any Affiliate of the Company relating to the

business of the Company, true and complete copies of which have not been delivered to the Buyer prior to the date hereof, (viii) there

are no underground storage tanks on, in or under any Affected Property and no underground storage tanks have been closed or removed from

any Affected Property, (ix) the Company has not presently incurred, and the Affected Property is not presently subject to, any liabilities

(fixed or contingent) relating to any suit, settlement, judgment or claim asserted a violation of Environmental Laws or arising under

any Environmental Law, and (x) there are no civil, criminal or administrative actions, suits, demands, claims, hearings, investigations

or other proceedings pending or threatened against the Company or any Affiliate of the Company with respect to the Business relating to

any violations, or alleged violations, of any Environmental Law, and neither the Company nor any Affiliate of the Company has received

any notices, demand letters or requests for information, arising out of, in connection with, or resulting from, a violation, or alleged

violation, of any Environmental Law, and neither the Company nor any Affiliate of the Company has been notified by any Governmental Authority

that it has, or may have, any liability pursuant to any Environmental Law. Schedule 3.22 includes a true and complete list of all

North American Industry Classification System (NAICS) Codes applicable to the Company. The sale of the Interests to the Buyer, and the

other transactions contemplated hereby, do not require any filing with, notice to, or approval or consent by, any Governmental Authority

under any Environmental Law, except as disclosed in Schedule 3.05.

(b) “Environmental

Laws” means any federal, state, and local law, statute, ordinance, rule, regulation, license, permit, authorization, approval,

consent, court order, judgment, decree, injunction, code, requirement, or agreement with any Governmental Authority, (x) relating to pollution

(or the cleanup thereof or the filing of information with respect thereto), human health, or the protection of air, surface water, ground

water, drinking water supply, land (including land surface or subsurface), plant and animal life, or any other natural resource, or (y) concerning

exposure to, or the use, storage, recycling, treatment, generation, transportation, processing, handling, labeling, production, or disposal

of Regulated Substances, in each case as amended and as now or hereafter in effect. The term Environmental Law includes, without limitation,

(i) the Comprehensive Environmental Response Compensation and Liability Act of 1980, the Water Pollution Control Act, the Clean Air Act,

the Clean Water Act, the Solid Waste Disposal Act (including the Resource Conservation and Recovery Act of 1976 and the Hazardous and

Solid Waste Amendments of 1984), the Toxic Substances Control Act, the Insecticide, Fungicide and Rodenticide Act, the Occupational Safety

and Health Act of 1970, each as amended and as now or hereafter in effect, and (ii) any common law or equitable doctrine (including, without

limitation, injunctive relief and tort doctrines such as negligence, nuisance, trespass, and strict liability) that may impose liability

or obligations for injuries or damages due to or threatened as a result of the presence of, exposure to, or ingestion of, any Regulated

Substance.

(c) “Regulated

Substances” means pollutants, contaminants, hazardous, or toxic substances, compounds, or related materials or chemicals, hazardous

materials, hazardous waste, flammable explosives, radon, radioactive materials, asbestos, urea formaldehyde foam insulation, polychlorinated

biphenyls, petroleum, and petroleum products (including, but not limited to, waste petroleum and petroleum products) as regulated under

applicable Environmental Laws.

Section 3.23 OFAC

and September 24, 2001 Executive Order.

Neither the Specially Designated

Nationals and Blocked Persons List maintained by the Office of Foreign Assets Control, Department of the Treasury (“OFAC”),

nor any similar list maintained by OFAC, nor the September 24, 2001 Executive Order Blocking Property and Prohibiting Transactions with

Persons who Commit, Threaten to Commit, or Support Terrorism, is applicable to the Company or the Sellers.

Section 3.24 Anti-Corruption

Laws.

Neither the Company, nor any

Seller, nor anyone acting on any of their behalf, has directly or indirectly: (a) made, offered to make, or promised to make any

payment or transfer of anything of value, directly or indirectly, to (i) anyone working in an official capacity for any Governmental

Authority, including any employee of any government-owned or controlled entity or public international organization, or (ii) any

political party, official of a political party, or candidate for political office, in order to obtain or retain business, or secure any

improper business advantage, except for the payment of fees required by Law to be paid to Governmental Authorities, (b) made any

unreported political contribution, (c) made or received any payment that was not legal to make or receive, (d) engaged in any

transaction or made or received any payment that was not properly recorded on its books, (e) created or used any “off-book”

bank or cash account or “slush fund”, or (f) engaged in any conduct constituting a violation of the United States Foreign

Corrupt Practices Act of 1977, as amended, or the United Kingdom Bribery Act 2010, as amended.

Section 3.25 Privacy.

The Company has not been accused

of any violation of any data protection or privacy Law, nor, to the Sellers’ Knowledge, are there facts that would reasonably form

the basis for such an accusation. The Company has implemented commercially reasonable technological measures to protect personal information

collected from individuals from loss, theft, and unauthorized access or disclosure.

Article IV

REPRESENTATIONS AND WARRANTIES OF THE BUYER

The Buyer represents and warrants

to the Sellers as of the date hereof as follows:

Section 4.01 Organization.

The Buyer is duly organized,

validly existing, and in good standing under the Laws of the jurisdiction of its formation, and it has all requisite power and authority

to own, lease, and operate its properties and to carry on its Business as now conducted.

Section 4.02 Authority

Relative to this Agreement.

The Buyer has full corporate

power and authority to execute and deliver this Agreement and each Related Document to which it is a party and to consummate the transactions

contemplated hereby and thereby. The execution and delivery of this Agreement and each Related Document to which the Buyer is a party

and the consummation of the transactions contemplated hereby and thereby have been duly and validly authorized by requisite corporate

action taken by the Buyer, and no other corporate proceedings by the Buyer are necessary to authorize this Agreement and each such Related

Document or to consummate the transactions contemplated hereby or thereby. This Agreement and each such Related Document have been duly

and validly executed and delivered by the Buyer and constitute the valid and binding obligations of the Buyer, enforceable against it

in accordance with their terms, subject to applicable bankruptcy, insolvency, or other Laws affecting the rights of creditors generally,

and to equitable principles. No further action on the part of the Buyer is or will be required in connection with the consummation of

the transactions under this Agreement.

Section 4.03 Consents

and Approvals; No Violation.

Neither the execution and

delivery by the Buyer of this Agreement and each Related Document to which it is a party, nor the purchase by the Buyer of the Interests

under this Agreement, nor the consummation of the other transactions contemplated by this Agreement and the Related Documents to which

it is a party will (a) conflict with or result in any breach of any provision of the Fundamental Documents of the Buyer, or (b) violate

any Laws applicable to the Buyer.

Section 4.04 Broker’s

or Finder’s Fees.

Neither the Buyer, nor any

Person acting on the Buyer’s behalf, has employed an agent, broker, Person, or firm acting on behalf of the Buyer in connection

with the transactions contemplated hereby. To the extent the Buyer has incurred any Liabilities for any brokerage fees, commissions, or

finder’s fees in connection with the transactions contemplated hereby, the Buyer will be solely responsible for the payment of those

Liabilities.

Article V

RESTRICTIVE COVENANTS

Section 5.01 Nondisclosure.

The Sellers shall not use

or disclose at any time after the Closing, except (x) to the extent such Seller is in the employ or in the service of either the Company

or the Buyer pursuant to such terms of a separate agreement or (y) with the prior written consent of an officer authorized to act in the

matter, any trade secrets, proprietary information, or other information that the Company or the Buyer considers confidential, including

formulas, designs, processes, suppliers, machines, improvements, inventions, operations, manufacturing, marketing, distributing, selling,

cost and pricing data, master files, supplier and vendor lists and client or customer lists utilized by the Company or by the Buyer or

any of their respective subsidiaries or Affiliates (collectively, the “Buyer Group”), or the skills, abilities, and

compensation of the Buyer Group’s employees and contractors, and all other similar information material to the conduct of the Business

or any other business of the Buyer Group, which is or was obtained or acquired by the Sellers while in the employ of, or while a member

of, the Company; provided, however, that this provision shall not preclude the Sellers from (i) using or disclosing information

that presently is known generally to the public or that subsequently comes into the public domain, other than by way of disclosure in

violation of this Agreement or in any other unauthorized fashion, or (ii) disclosure of that information as required by Law or court

order, provided further that (A) prior to that disclosure the Sellers give Buyer three (3) business days’ written notice

(or, if disclosure is required to be made in less than three (3) business days, then that notice shall be given as promptly as practicable

after determination that disclosure may be required) of the nature of the Law or order requiring disclosure and the disclosure to be made