false

0001584754

0001584754

2024-01-24

2024-01-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event

reported): January 24, 2024

AKOUSTIS

TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-38029 |

|

33-1229046 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

9805 Northcross Center Court, Suite A

Huntersville, NC 28078

(Address of principal executive offices, including

zip code)

704-997-5735

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see General Instruction A.2. below):

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of Each Class: |

|

Trading Symbol: |

|

Name of each exchange on which registered: |

| Common Stock, $0.001 par value |

|

AKTS |

|

The Nasdaq Stock Market LLC

(Nasdaq Capital Market) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.b-2 of this chapter)

Emerging

Growth Company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On

January 24, 2024, Akoustis Technologies, Inc. (the “Company”) filed a preliminary prospectus supplement (the “Preliminary

Prospectus Supplement”) to its effective shelf registration statement on Form S-3 (No. 333-262540) pursuant to Rule 424(b) under

the Securities Act of 1933, as amended (the “Securities Act”), relating to an underwritten public offering (the “Offering”)

of shares of the Company’s common stock. The Preliminary Prospectus Supplement contains select preliminary unaudited estimated financial

results for the fiscal quarter ended December 31, 2023. Such preliminary estimated results are furnished in the excerpt from the Preliminary

Prospectus Supplement attached hereto as Exhibit 99.1.

Item 7.01 Regulation FD Disclosure.

A copy of the press release

announcing the launch of the Offering is included herewith as Exhibit 99.2 and is incorporated by reference.

The

information under Items 2.02 and 7.01 and in Exhibits 99.1 and 99.2 to this Current Report on Form 8-K are being furnished and shall

not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), or incorporated by reference in any filing under the Securities

Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Akoustis Technologies,

Inc.

|

| |

|

| Date: January 24, 2024 |

By: |

/s/ Kenneth E. Boller |

| |

Name: |

Kenneth E. Boller |

| |

Title: |

Chief Financial Officer |

2

Exhibit 99.1

Selected Preliminary Financial Results for

Second Quarter of Fiscal 2024

Below is a summary of certain

preliminary estimates regarding our financial results for the quarter ended December 31, 2023. This preliminary financial information

is based upon our estimates and is subject to completion of our financial closing procedures. Moreover, this preliminary financial information

has been prepared solely on the basis of information that is currently available to, and that is the responsibility of, management. Our

independent registered public accounting firm has not audited or reviewed, and does not express an opinion with respect to, this information.

This preliminary financial information is not a comprehensive statement of our financial results for the quarter ended December 31, 2023,

and remains subject to, among other things, the completion of our financial closing procedures, final adjustments, completion of our internal

review and review by our independent registered public accounting firm of our financial statements for the quarter ended December 31,

2023, which may materially impact the results and expectations set forth below.

We expect revenue for the

three months ended December 31, 2023 to be in the range of approximately $6.9 million to $7.1 million. We recorded revenue of approximately

$5.9 million for the three months ended December 31, 2022.

As of December 31, 2023, we

had approximately $12.9 million of cash and cash equivalents.

Exhibit 99.2

Akoustis Announces Proposed Public Offering

of Common Stock

Charlotte, NC, January 24, 2024 (GLOBE NEWSWIRE)

- Akoustis Technologies, Inc. (Nasdaq: AKTS) (“Akoustis” or the “Company”), an integrated device manufacturer

(IDM) of patented bulk acoustic wave (BAW) high-band RF filters for mobile and other wireless applications, announced today that it intends

to offer and sell shares of its common stock in an underwritten public offering.

Akoustis expects to grant the underwriters a

30-day option to purchase additional shares of common stock sold in the offering solely to cover over-allotments. The offering

is subject to market and other conditions, and there can be no assurance as to whether or when such offering may be completed, or as

to the actual size or terms of such offering. Certain of the Company’s directors, officers and other employees have indicated

an intent to purchase shares of common stock in the offering.

Roth Capital Partners is acting as sole manager for the offering.

Akoustis intends to use the net proceeds

from the proposed offering to fund operations and the growth of its business, including for capital expenditures, working capital,

research and development, the commercialization of its technology, potential strategic transactions and for other general corporate

purposes.

A shelf registration statement relating to

the shares of common stock to be issued in the proposed offering was previously filed with the Securities and Exchange Commission

(the “SEC”) and is currently effective. A preliminary prospectus supplement and accompanying prospectus describing

the terms of the proposed offering will be filed with the SEC. The shares of common stock may be offered only by means of a

prospectus, including a prospectus supplement, forming a part of the effective registration statement. Copies of the

preliminary prospectus supplement and the accompanying prospectus relating to the securities being offered may be obtained, when

available, from Roth Capital Partners, LLC, 888 San Clemente, Suite 400, Newport Beach, CA 92660, by telephone at (800) 678-9147 or

by email at rothecm@roth.com. Electronic copies of the preliminary prospectus supplement and accompanying prospectus will also be

available on the SEC’s website at http://www.sec.gov.

This press release does not constitute an offer

to sell, or the solicitation of an offer to buy, the shares of common stock, nor will there be any sale of the shares of common stock

in any state or other jurisdiction in which such offer, solicitation or sale is not permitted.

About Akoustis Technologies, Inc.

Akoustis® (http://www.akoustis.com/)

is a high-tech BAW RF filter solutions company that is pioneering next-generation materials science and MEMS wafer manufacturing

to address the market requirements for improved RF filters — targeting higher bandwidth, higher operating frequencies and higher

output power compared to legacy polycrystalline BAW technology. The Company utilizes its proprietary and patented XBAW® manufacturing

process to produce bulk acoustic wave RF filters for mobile and other wireless markets, which facilitate signal acquisition

and accelerate band performance between the antenna and digital back end. Superior performance is driven by the significant advances of

poly-crystal, single-crystal, and other high purity piezoelectric materials and the resonator-filter process technology which enables

optimal trade-offs between critical power, frequency and bandwidth performance specifications.

Akoustis plans to service the fast growing multi-billion-dollar RF

filter market using its integrated device manufacturer (IDM) business model. The Company owns and operates a 125,000 sq. ft.

ISO-9001:2015 registered commercial wafer-manufacturing facility located in Canandaigua, NY, which includes a class 100 / class 1000

cleanroom facility — tooled for 150-mm diameter wafers — for the design, development, fabrication and packaging

of RF filters, MEMS and other semiconductor devices. Akoustis Technologies, Inc. is headquartered in the Piedmont technology

corridor near Charlotte, North Carolina.

Forward-Looking Statements

This document includes “forward-looking

statements” within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, each

as amended, that are intended to be covered by the “safe harbor” created by those sections. These forward-looking statements

include, but are not limited to, statements regarding the proposed public offering of common stock and the intended use of the net proceeds

of such public offering. Forward-looking statements include all statements that are not historical facts and typically are identified

by use of terms such as “may,” “might,” “would,” “will,” “should,” “could,”

“project,” “expect,” “plan,” “strategy,” “anticipate,” “attempt,”

“develop,” “help,” “believe,” “think,” “estimate,” “predict,”

“intend,” “forecast,” “seek,” “potential,” “possible,” “continue,”

“future,” and similar words (including the negative of any of the foregoing), although some forward-looking statements are

expressed differently. Forward-looking statements are neither historical facts nor assurances of future results, performance, events or

circumstances. Instead, these forward-looking statements are based on management’s current beliefs, expectations and assumptions,

and are subject to risks and uncertainties. Factors that could cause actual results to differ materially from those currently anticipated

include, without limitation, risks relating to our inability to obtain adequate financing and sustain our status as a going concern; our

limited operating history; our inability to generate revenues or achieve profitability; the results of our research and development activities;

our inability to achieve acceptance of our products in the market; the failure of our common stock to meet the minimum requirements for

continued listing on the Nasdaq Capital Market; the possibility that the anticipated benefits from business acquisitions will not be realized

in full or at all or may take longer to realize than expected; the possibility that costs or difficulties related to the integration of

acquired businesses’ operations will be greater than expected and the possibility of disruptions to our business during integration

efforts and strain on management time and resources; the impact of a pandemic or epidemic or a natural disaster, including the COVID-19

pandemic, the Russian-Ukrainian and Middle East conflicts and other sources of volatility on our operations, financial condition and the

worldwide economy, including its impact on our ability to access the capital markets; increases in prices for raw materials, labor, and

fuel caused by rising inflation; general economic conditions, including upturns and downturns in the industry; shortages in supplies needed

to manufacture our products, or needed by our customers to manufacture devices incorporating our products; our limited number of patents;

failure to obtain, maintain, and enforce our intellectual property rights; claims of infringement, misappropriation or misuse of third

party intellectual property, including the lawsuit filed by Qorvo, Inc. in October 2021, that, regardless of merit, has resulted in significant

expense our inability to attract and retain qualified personnel; our reliance on third parties

to complete certain processes in connection with the manufacture of our products; product quality and defects; existing or increased competition;

our ability to successfully manufacture, market and sell products based on our technologies; our ability to meet the required specifications

of customers and achieve qualification of our products for commercial manufacturing in a timely manner; our inability to successfully

scale our New York wafer fabrication facility and related operations while maintaining quality control and assurance and avoiding delays

in output; the rate and degree of market acceptance of any of our products; our ability to achieve design wins from current and future

customers; contracting with customers and other parties with greater bargaining power and agreeing to terms and conditions that may adversely

affect our business; risks related to doing business in foreign countries, including China; any security breaches, cyber-attacks or other

disruptions compromising our proprietary information and exposing us to liability; our failure to innovate or adapt to new or emerging

technologies, including in relation to our competitors; our failure to comply with regulatory requirements; results of any arbitration

or litigation that may arise; stock volatility and illiquidity; dilution caused by any future issuance of common stock or securities that

are convertible into or exercisable for common stock; our failure to implement our business plans or strategies; and our ability to maintain

effective internal control over financial reporting. These and other risks and uncertainties are described in more detail in the Risk

Factors and Management’s Discussion and Analysis of Financial Condition and Results of Operations sections of the Company’s

most recent Annual Report on Form 10-K and in subsequently filed Quarterly Reports on Form 10-Q. Considering these risks, uncertainties

and assumptions, the forward-looking statements regarding future events and circumstances discussed in this document may not occur, and

actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. You should

not rely upon forward-looking statements as predictions of future events. The forward-looking statements included in this document speak

only as of the date hereof and, except as required by law, we undertake no obligation to update publicly or privately any forward-looking

statements, whether written or oral, for any reason after the date of this document to conform these statements to new information, actual

results or to changes in our expectations.

Contact:

Kenneth Boller

Akoustis Technologies

Chief Financial Officer

(704) 274-3598

kboller@akoustis.com

v3.23.4

Cover

|

Jan. 24, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 24, 2024

|

| Entity File Number |

001-38029

|

| Entity Registrant Name |

AKOUSTIS

TECHNOLOGIES, INC.

|

| Entity Central Index Key |

0001584754

|

| Entity Tax Identification Number |

33-1229046

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

9805 Northcross Center Court

|

| Entity Address, Address Line Two |

Suite A

|

| Entity Address, City or Town |

Huntersville

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

28078

|

| City Area Code |

704

|

| Local Phone Number |

997-5735

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

AKTS

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

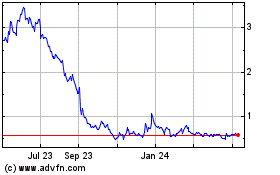

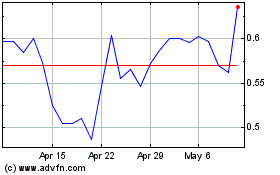

Akoustis Technologies (NASDAQ:AKTS)

Historical Stock Chart

From Apr 2024 to May 2024

Akoustis Technologies (NASDAQ:AKTS)

Historical Stock Chart

From May 2023 to May 2024