Filed

Pursuant to Rule 424(b)(3)

Registration No. 333-259484

PROSPECTUS

SUPPLEMENT NO. 7

(To

Prospectus Dated June 6, 2022)

(Prospectus

Supplement No. 1 Dated June 30, 2022)

(Prospectus

Supplement No. 2 Dated July 11, 2022)

(Prospectus

Supplement No. 3 Dated August 2, 2022)

(Prospectus

Supplement No. 4 Dated August 11, 2022)

(Prospectus

Supplement No. 5 Dated August 22, 2022)

(Prospectus

Supplement No. 6 Dated August 26, 2022)

Up

to 13,426,181 Shares of Common Stock

This

Prospectus Supplement No.7 (this “Prospectus Supplement”) updates and supplements the prospectus dated June 6, 2022, as

supplemented by Prospectus Supplement No. 1 dated June 30, 2022 and as further supplemented by Prospectus Supplement No. 2 dated July

11, 2022; Prospectus Supplement No. 3 dated August 2, 2022; Prospectus Supplement No. 4 dated August 11, 2022; Prospectus Supplement

No. 5 dated August 22, 2022, and Prospectus Supplement No. 6 dated August 26, 2022 (the “Prospectus”), which forms a part

of our Registration Statement on Form S-1, as amended by that Post-Effective Amendment No. 1 on Form S-1 (“Post-Effective Amendment”),

which Post-Effective Amendment was declared effective by the Securities and Exchange Commission on June 6, 2022 (Registration No. 333-259484).

This Prospectus Supplement is being filed to update and supplement the information in the Prospectus with the information contained in

our Report on Form 8-K, filed with the Securities and Exchange Commission on September 30, 2022 (the “Form 8-K”). Accordingly,

we have attached the Form 8-K to this Prospectus Supplement.

The

Prospectus and this Prospectus Supplement relate to the offer and sale from time to time by 3i, LP, a Delaware limited partnership (“3i,

LP”), or their permitted transferees that may be identified in the Prospectus by prospectus supplement (the “Selling Stockholders”)

of up to 13,426,181 shares of Common Stock consisting of:

| |

● |

up

to 2,180,497 shares of Common Stock issued upon conversion of 20,000 shares of our Series A Preferred Stock originally issued in

a private placement to 3i, LP, based upon an initial conversion price of $9.906 and stated par value of $1,080 (which stated par

value includes a one-time dividend equal to an 8% increase in the original stated par value of $1,000). See the section titled “Business

- The Private Placement (PIPE Financing);” |

| |

● |

up

to 2,018,958 shares of Common Stock issuable upon exercise of the PIPE Warrant based upon an exercise price of $9.906; and |

| |

● |

up

to 9,226,726 additional shares of Common Stock that may be issuable upon conversion of our Preferred Stock using the Floor Price

of $1.9812. See the section titled, “Description of Our Capital Stock — The Series A Preferred Stock.” This

amount also includes 505,740 shares allocated to the exercise of the PIPE Warrant to comply with our obligation to register 125%

of the number of shares of our Common Stock issuable upon the exercise of the PIPE Warrant. See the section titled, “Description

of Our Capital Stock — PIPE Warrant.” |

The

shares of Common Stock covered by the Prospectus and this Prospectus Supplement were registered pursuant to the terms of a registration

rights agreement between us and 3i, LP. We will not receive any proceeds from the sale of shares of Common Stock offered for resale by

the Selling Stockholders, although we may receive up to $20 million in gross proceeds if the Selling Stockholders exercise the PIPE Warrant

in full.

We

are an “emerging growth company” and a “smaller reporting company” as defined under U.S. federal securities laws

and, as such, have elected to comply with reduced public company reporting requirements. The Prospectus, together with this Prospectus

Supplement, complies with the requirements that apply to an issuer that is an emerging growth company and a smaller reporting company.

We are incorporated in Delaware.

This

Prospectus Supplement should be read in conjunction with the Prospectus. If there is any inconsistency between the information in the

Prospectus and this Prospectus Supplement, you should rely on the information in this Prospectus Supplement.

Our Common Stock is listed on the

NASDAQ Global Market under the symbol “ALLR.” On September 30, 2022, the last reported sale price of our Common Stock was

$1.10 per share. As of September 30, 2022, we had 10,260,157 shares of Common Stock issued and outstanding.

Since

December 2021 pursuant to a series of exercise of conversion by 3i, LP, we issued 2,184,333 shares of Common Stock to 3i, LP upon the

conversion of 4,774 shares of Series A Preferred Stock. As of September 30, 2022, we had 15,226 shares of Series A Preferred Stock issued

and outstanding.

Investing

in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described in the section titled

“Risk Factors” beginning on page 13 of the Prospectus, and under similar headings in any amendments or supplements

to the Prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities,

or passed upon the accuracy or adequacy of this Prospectus Supplement and the Prospectus. Any representation to the contrary is a criminal

offense.

Prospectus

Supplement dated September 30, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 27, 2022

ALLARITY THERAPEUTICS, INC.

(Exact name of registrant as specified in our charter)

| Delaware |

|

001-41160 |

|

87-2147982 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

210 Broadway, Suite 201

Cambridge, MA |

|

02139 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(401) 426-4664

(Registrant’s telephone number, including

area code)

Not applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| ☐ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

ALLR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

Second Amendment to License Agreement with

Novartis

On

September 27, 2022, Allarity Therapeutics Europe Aps (“Allarity Europe”), a wholly-owned subsidiary of Allarity Therapeutics,

Inc. (the “Company”), entered into a Second Amendment to License Agreement (the “Second

Amendment”) with Novartis Pharma AG, a company organized under the laws of Switzerland (“Novartis”), which amended the

terms of the License Agreement dated April 6, 2018 (the “Original Agreement”), as amended by that certain First Amendment

to License Agreement effective as of March 30, 2022 (“Amendment” and together with the Original Agreement, the “Agreement”)

and that certain Promissory Note dated April 6, 2018, which was re-issued by Allarity Therapeutics Denmark ApS (“Allarity

Denmark,” or “OV-SPV2”), a subsidiary of Allarity Europe, in favor of Novartis on March 30, 2022, to modify the terms

and timing of the Outstanding Milestone Payment (as defined in the Second Amendment). The Second Amendment became effective upon receipt

by Novartis of the first portion of the Outstanding Milestone Payment, which was made on or about September 28, 2022.

Under

Clause 7.2 of the Original Agreement, the Company agreed to pay Novartis a milestone payment in one lump sum (“Third Milestone Payment”)

upon submission of the first NDA with the FDA for a Licensed Product in the United States (the “Third Milestone”). The Second

Amendment restructured the terms of the Third Milestone Payment to an installment plan (with the final installment due in 2023), allowing

the Company more time to make the Third Milestone Payment.

In

addition, the Second Amendment amended (1) Clause 1.1 of the Agreement to include the definitions of Financing Transaction, Phase 1 Clinical

Trial and Phase 1b/2 Clinical Trial, (2) Clause 2.1 of the Agreement to clarify that the Company would not be permitted to sublicense

any rights granted to the Company prior to completion of a Phase II Clinical Trial without the prior written consent of Novartis, and

(3) Clause 7.3 to provide for the acceleration of certain milestone payments in the event the Company enters into a Financing Transaction

(as defined in the Second Amendment). If all milestones under the Second Amendment are achieved,

the Company may be obligated to pay Novartis up to a maximum of $26.5 million.

The

Original Agreement, First Amendment and the Note are filed as Exhibit 10.7 to our Registration Statement on Form S-4 filed with the Securities

and Exchange Commission (the “SEC”) on August 20, 2021, and Exhibits 10.1 and 10.2 to our Current Report on Form 8-K filed

with the SEC on April 18, 2022, respectively. The foregoing description of the Second Amendment does not purport to be complete and is

qualified in its entirety by reference to the Second Amendment, a copy of which is filed herewith as Exhibit 10.1 and is incorporated

herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The

information disclosed in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| † | In accordance with Item 601 of

Regulation S-K, certain portions of this exhibit will be omitted because they are not material and would likely cause competitive harm

to the registrant if disclosed. The registrant agrees to provide an unredacted

copy of the exhibit on a supplemental basis to the SEC or its staff upon request. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Allarity Therapeutics, Inc. |

| |

|

| |

By: |

/s/ James G. Cullem |

| |

|

James G. Cullem

Chief Executive Officer |

| |

|

|

| Dated: September 30, 2022 |

|

|

3

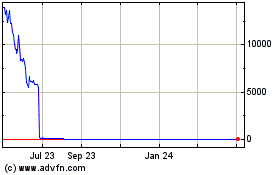

Allarity Therapeutics (NASDAQ:ALLR)

Historical Stock Chart

From Mar 2024 to Apr 2024

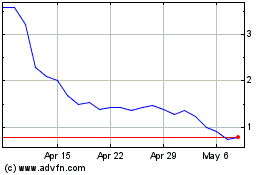

Allarity Therapeutics (NASDAQ:ALLR)

Historical Stock Chart

From Apr 2023 to Apr 2024