A-Mark Precious Metals, Inc. (NASDAQ:

AMRK) (A-Mark), a leading fully integrated precious metals

platform, has entered into a non-binding letter of intent with AMS

Holding, LLC (AMS), a leading collector platform for the marketing

and sales of vintage and modern coins, providing for three

transactions, including the proposed acquisition of LPM Group

Limited (LPM), one of Asia’s largest precious metals dealers.

The proposed transactions are subject to the

preparation and execution of definitive agreements and are expected

to close simultaneously in February 2024, subject to the receipt of

customary closing conditions and required third party consents or

approvals, including the consent of the lenders under A-Mark’s

Trading Credit Facility.

LPM Overview and Financial &

Operational Highlights

Established in 2012, LPM is one of the largest

precious metals wholesalers in Asia. Headquartered at the heart of

Hong Kong's Central Financial District, LPM boasts the city's

largest numismatics showroom. LPM offers a wide selection of

products through its retail store and 24/7 online trading platform,

including recently released silver coins, gold bullion, certified

coins, and the latest collectible numismatic issues.

The company’s global customer base spans sovereign and private

mints, manufacturers and fabricators, investors, collectors,

e-commerce customers, and other retail customers.

LPM three-year average financial and operational

highlights include*:

- Net sales of $393.2 million

- 108,000 ounces of gold sold

- 6.3 million ounces of silver

sold

- 27,000 wholesale and retail

customers

- 26,000 orders processed

*The results of LPM have been provided to A-Mark by AMS, have

been subject to year over year fluctuation, and are subject to

A-Mark’s continuing diligence.

“Acquiring LPM will be an important step in

growing A-Mark’s international presence, specifically in Asia,”

said A-Mark CEO Greg Roberts. “Having established a relationship

with AMS through supplier agreements, the timing was opportune to

integrate LPM into our portfolio and extend A-Mark’s global reach.

With access to A-Mark’s inventory and resources, we expect that LPM

will be able to secure larger purchase orders while providing

customers with a broader set of product offerings. Our strategy is

to expand LPM’s direct-to-consumer business through our proven

e-commerce expertise, while offering its global customer base a

broader portfolio of products and ancillary services such as

storage and fulfillment.”

LPM Transaction DetailsThe

letter of intent provides that A-Mark will acquire 100% of the

issued and outstanding equity interests of LPM Group Limited (LPM)

from AMS for total upfront consideration of $41.5 million,

consisting of $37.5 million in cash, subject to certain closing

adjustments, and $4.0 million of A-Mark common stock. The letter of

intent further provides that LPM will have a tangible net worth of

$11.5 million inclusive of net cash and precious metals

inventories. The letter of intent also contemplates that AMS will

have the potential to earn up to an additional $37.5 million in

cash based on achievement of certain Earnings before Interest,

Taxes, Depreciation, and Amortization (EBITDA) targets for 2024,

2025 and 2026.

LPM CEO Charlie Chang, who is expected to sign a

consulting agreement with A-Mark in connection with the

transaction, commented: “Since our founding, LPM has been focused

on developing strong relationships with both wholesale and retail

customers across Asia. Joining forces with A-Mark, I am eager to

capitalize on A-Mark's extensive resources and capabilities to

deepen our presence and expand our footprint within the retail and

wholesale precious metals market in Asia.”

Pinehurst Coin Exchange Asset Purchase

of ModernCoinMartUnder the letter of intent, A-Mark

affiliate, Pinehurst Coin Exchange, Inc. (Pinehurst), one of the

nation’s largest distributors of modern certified coins of which

A-Mark owns 49.0%, will acquire all the assets of ModernCoinMart

(MCM) from AMS for $5.5 million, subject to certain closing

adjustments. MCM is one of the fastest growing dealers in the U.S.

and ships to many international destinations. As part of the asset

purchase, Pinehurst will acquire $3.0 million of inventory, along

with MCM’s customer list, brand name, and related intellectual

property.

Pinehurst CEO Vince Wade commented: “Since its

inception in 2004, ModernCoinMart has established a formidable

e-commerce presence and cultivated a loyal customer base. In our

pursuit of expanding our direct-to-consumer business, we are

confident that MCM’s adept use of eBay, coupled with the appealing

collectability of its modern bullion coins, will not only retain

existing customers but also attract new ones. We believe that the

combination of effective online strategies and enticing product

offerings positions MCM and Pinehurst for continued success in

capturing market share and engaging a broader audience.”

Strategic Investment in AMS Holdings

The letter of intent further provides that a

proposed joint venture consisting of A-Mark, Pinehurst and Stack’s

Bowers Numismatics, LLC, an affiliate of A-Mark, will acquire a

common equity interest in AMS equivalent to 10% of the total, fully

diluted common equity interests in AMS. As part of the proposed

investment, A-Mark CEO Greg Roberts will join the AMS board of

directors.

AMS CEO Jim Hilt commented: “These transactions

underscore our strategic transformation as a platform that will

define the next era of collecting in our industry. Greg’s

leadership in turning A-Mark into a globally recognized fully

integrated platform make him and his team a perfect partner for AMS

and we look forward to the benefit of his expertise on our board.

This is a critical step in our evolution to accelerate our growth,

create industry impact, and drive value for collectors in our

markets.”

Transaction Advisors D.A.

Davidson & Co. is acting as financial advisor to A-Mark, and

Kramer Levin Naftalis & Frankel LLP and Frye & Hsieh LLP

are acting as legal advisors to A-Mark. Houlihan Lokey is acting as

financial advisor to AMS, and Ballard Spahr LLP is acting as legal

advisor to AMS.

Conference Call A-Mark will

hold a conference call today, February 6, 2024, at 4:30 p.m.

Eastern time (1:30 p.m. Pacific time) to discuss the proposed

transactions as well as the company’s financial results for the

fiscal second quarter ended December 31, 2023. A-Mark management

will host the presentation, followed by a question-and-answer

period.

A-Mark’s conference call can be accessed as

follows:

U.S. dial-in number: 1-888-506-0062International number:

1-973-528-0011Participant Access Code:

362228Webcast: https://www.webcaster4.com/Webcast/Page/2867/49671

Please call the conference telephone number 10

minutes before the start time. An operator will register your name

and organization. If you have any difficulty connecting with the

conference call, please contact A-Mark’s investor relations team at

1-949-574-3860.

A replay of the call will be available after

7:30 p.m. Eastern time on the same day through February 20,

2024.

Toll-free replay number: 1-877-481-4010International replay

number: 1-919-882-2331Participant Access Code: 49671

The call will also be broadcast live and

available for replay on the Investor Relations section of A-Mark’s

website at ir.amark.com/.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy any shares of common

stock of A-Mark. Any offer will be made only by means of a

prospectus supplement and accompanying prospectus forming a part of

an effective registration statement of A-Mark.

About A-Mark Precious

MetalsFounded in 1965, A-Mark Precious Metals, Inc. is a

leading fully integrated precious metals platform that offers an

array of gold, silver, platinum, palladium, and copper bullion,

numismatic coins, and related products to wholesale and retail

customers via a portfolio of channels. The company conducts its

operations through three complementary segments: Wholesale Sales

& Ancillary Services, Direct-to-Consumer, and Secured Lending.

The company’s global customer base spans sovereign and private

mints, manufacturers and fabricators, refiners, dealers, financial

institutions, industrial users, investors, collectors, e-commerce

customers, and other retail customers.

A-Mark’s Wholesale Sales & Ancillary

Services segment distributes and purchases precious metal products

from sovereign and private mints. As a U.S. Mint-authorized

purchaser of gold, silver, and platinum coins since 1986, A-Mark

purchases bullion products directly from the U.S. Mint for sale to

customers. A-Mark also has longstanding distributorships with other

sovereign mints, including Australia, Austria, Canada, China,

Mexico, South Africa, and the United Kingdom. The company sells

more than 200 different products to e-commerce retailers, coin and

bullion dealers, financial institutions, brokerages, and

collectors. In addition, A-Mark sells precious metal products to

industrial users, including metal refiners, manufacturers, and

electronic fabricators.

Through its A-M Global Logistics subsidiary,

A-Mark provides its customers with a range of complementary

services, including managed storage options for precious metals as

well as receiving, handling, inventorying, processing, packaging,

and shipping of precious metals and coins on a secure basis.

A-Mark’s mint operations, which are conducted through its wholly

owned subsidiary Silver Towne Mint, enable the company to

offer customers a wide range of proprietary coin and bar offerings

and, during periods of market volatility when the availability of

silver bullion from sovereign mints is often product constrained,

preferred product access.A-Mark’s Direct-to-Consumer segment

operates as an omni-channel retailer of precious metals, providing

access to a multitude of products through its wholly owned

subsidiaries, JM Bullion and Goldline. JM Bullion is

a leading e-commerce retailer of precious metals and operates seven

separately branded, company-owned websites targeting specific

niches within the precious metals

market: JMBullion.com, ProvidentMetals.com, Silver.com, GoldPrice.org, SilverPrice.org, BGASC.com,

and BullionMax.com. JMB also owns CyberMetals.com, an

online platform where customers can purchase and sell fractional

shares of digital gold, silver, platinum, and palladium bars in a

range of denominations. Goldline markets precious metals directly

to the investor community through various channels, including

television, radio, and telephonic sales efforts. A-Mark also holds

minority ownership interests in four additional direct-to-consumer

brands.

The company operates its Secured Lending segment

through its wholly owned subsidiary, Collateral Finance Corporation

(CFC). Founded in 2005, CFC is a California licensed finance lender

that originates and acquires loans secured by bullion and

numismatic coins. Its customers include coin and precious metal

dealers, investors, and collectors.

A-Mark is headquartered in El Segundo, CA and

has additional offices and facilities in the neighboring Los

Angeles area as well as in Dallas, TX, Las Vegas, NV, Winchester,

IN, and Vienna, Austria. For more information,

visit www.amark.com.

A-Mark periodically provides information for

investors on its corporate website, www.amark.com, and its

investor relations website, ir.amark.com. This includes press

releases and other information about financial performance, reports

filed or furnished with the SEC, information on corporate

governance, and investor presentations.

Important Cautions Regarding

Forward-Looking StatementsStatements in this press release

that relate to future plans, objectives, expectations, performance,

events and the like are "forward-looking statements" within the

meaning of the Private Securities Litigation Reform Act of 1995 and

the Securities Exchange Act of 1934. These include statements

regarding the occurrence and the timing of the closing of the

transactions described in this release, and the anticipated

benefits to A-Mark and its affiliates of the transactions. Future

events, risks and uncertainties, individually or in the aggregate,

could cause actual results or circumstances to differ materially

from those expressed or implied in these statements. Factors that

could cause actual results to differ include the following:

With respect to all of the transactions: The

failure of the parties to agree on definitive transaction

documents; the failure of the parties to complete the contemplated

transactions within the currently expected timeline or at all; the

failure to obtain necessary third-party consents or approvals;

greater than anticipated costs incurred to consummate the

transactions; and the strategic, business, economic, financial,

political and governmental risks and other Risk Factors affecting

the businesses of the company and the industries in which it

operates, as described in in the company’s public filings with the

Securities and Exchange Commission.

With respect to the acquisition of LPM: The

inability to successfully integrate LPM with A-Mark’s other

business, as anticipated or at all; the inability to realize the

anticipated synergies between LPM and A-Mark’s other businesses;

the difficulties in managing a business located outside the United

States generally, and in particular in China and other Asian

jurisdictions; and LPM’s inability to expand its business in China

and other parts of Asia, as anticipated or at all.

With respect to the investment in AMS: The risks

associated with the conduct of the business of AMS generally; the

inability of the joint venture, as a minority holder, to exercise

control over AMS; and the inability of the joint venture to exit

its investment in AMS at a profit, at the time of its choosing or

at all.

Company Contact:Steve Reiner, Executive Vice

President, Capital Markets & Investor RelationsA-Mark Precious

Metals, Inc.1-310-587-1410sreiner@amark.com

Investor Relations Contacts:Matt Glover and

Greg BradburyGateway Group,

Inc.1-949-574-3860AMRK@gateway-grp.com

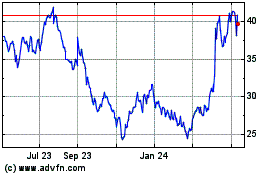

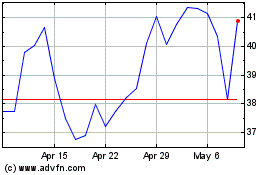

A Mark Precious Metals (NASDAQ:AMRK)

Historical Stock Chart

From Mar 2024 to Apr 2024

A Mark Precious Metals (NASDAQ:AMRK)

Historical Stock Chart

From Apr 2023 to Apr 2024