8-K0001365916FALSE00013659162023-08-042023-08-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

____________________

Date of report (Date of earliest event reported): August 4, 2023

Amyris, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-34885 | 55-0856151 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 5885 Hollis Street, Suite 100, | Emeryville, | CA | 94608 |

| (Address of Principal Executive Offices) | (Zip Code) |

| | | | | | | | | | | |

| | (510) | 450-0761 | |

| | (Registrant’s telephone number, including area code) | |

| | | | | | | | |

| | | |

| | (Former name or former address, if changed since last report.) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions (see General Instruction A.2 below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

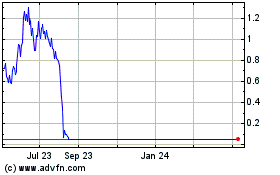

| Common Stock, $0.0001 par value per share | AMRS | The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

The information set forth below under Item 1.03 of this Current Report on Form 8-K regarding the DIP Credit Agreement is incorporated herein by reference.

Item 1.03 Bankruptcy or Receivership.

Voluntary Petitions for Bankruptcy

On August 9, 2023 (the “Petition Date”), Amyris, Inc. (the “Company” or the “Debtor”) and certain of its direct and indirect subsidiaries (collectively, the “Company Parties” or the “Debtors”) filed voluntary petitions for relief under Chapter 11 of Title 11 of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”), thereby commencing Chapter 11 cases for the Company Parties (the “Chapter 11 Cases”). On the Petition Date, the Company Parties filed a motion with the Bankruptcy Court seeking to jointly administer the Chapter 11 Cases under the caption “In re: Amyris, et al.” Certain of the Company’s subsidiaries were not included in the Chapter 11 filing.

The Company Parties will continue to operate their business as “debtors in possession” under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code and orders of the Bankruptcy Court. The Company Parties are seeking approval of various “first day” motions with the Bankruptcy Court, requesting customary relief intended to enable them to continue their ordinary course operations and facilitate an orderly transition of their operations into Chapter 11. In addition, the Company Parties filed with the Bankruptcy Court a motion seeking approval (“Interim DIP Order”) of debtor-in-possession financing (“DIP Financing”) in the form of the DIP Credit Agreement (as defined and described below).

The Company cannot be certain that holders of the Company’s common stock (the “Common Stock”) will receive any payment or other distribution on account of those shares following the Chapter 11 Cases.

DIP Credit Agreement

The Company Parties have sought an order authorizing Amyris, Inc., Amyris Clean Beauty, Inc., and Aprinnova, LLC, in their capacity as borrowers (collectively, the “Borrowers”), to obtain postpetition financing, and for each of the other Debtors and certain other non-Debtor subsidiaries (the “Guarantors”) to guarantee unconditionally on a joint and several basis, the Borrowers’ obligations in connection with a senior secured superpriority multiple-draw term loan facility (the “DIP Facility”) in the aggregate principal amount of up to $190 million (the “DIP Loans”), subject to and in accordance with the terms and conditions set forth in that certain Senior Secured Super Priority Debtor In Possession Loan Agreement, dated as of August 9, 2023 (the “DIP Credit Agreement”), by and among the Borrowers, the Guarantors, Euagore, LLC, an affiliate of Foris Ventures, LLC (together with the other lenders from time to time party thereto, the “DIP Lenders”), and Euagore, LLC, as Administrative Agent. The proceeds of the proposed DIP Facility may be used for, among other things, postpetition working capital for the Company and its subsidiaries, payment of costs to administer the Chapter 11 Cases, payment of expenses and fees of the transactions contemplated by the Chapter 11 Cases and payment of other costs, in each case, subject to an approved budget and such other purposes permitted under the DIP Credit Agreement and the Interim DIP Order.

The DIP Credit Agreement is subject to approval by the Bankruptcy Court. The Company Parties have requested authorization from the Bankruptcy Court, upon entry of the Interim DIP Order, for no more than two draws prior to the entry of a final order approving the DIP Financing (the “Final DIP Order”), in the aggregate principal amount of up to $70 million and upon entry of the Final DIP Order, multiple additional draws in the aggregate principal amount not to exceed $120 million. The Company Parties have requested a hearing on or before August 11, 2023 to consider entry of the Interim DIP Order. The Company Parties anticipate that the DIP Credit Agreement will become effective promptly following entry of the Interim DIP Order by the Bankruptcy Court.

| | | | | |

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information set forth under Item 1.03 of this Current Report on Form 8-K regarding the DIP Credit Agreement is incorporated herein by reference.

| | | | | |

| Item 2.04 | Triggering Events that Accelerate or Increase a Direct Financial Obligation or an Obligation Under an Off- Balance Sheet Arrangement. |

The commencement of the Chapter 11 Cases described in Item 1.03 above constitutes an event of default that accelerated the Company’s obligations under the following debt instruments (together, the “Debt Instruments”):

•Amended and Restated Loan and Security Agreement, dated as of October 28, 2019, by and among the Company, certain other Company Parties and Foris Ventures, LLC, as amended;

•Indenture, dated as of November 15, 2021, by and between the Company and U.S. Bank National Association, as trustee;

•Loan and Security Agreement dated as of September 27, 2022, by and among the Company, certain other Company Parties and Foris Ventures, LLC, as amended;

•Loan and Security Agreement dated as of October 11, 2022, by and among the Company, certain other Company Parties and DSM Finance B.V., as amended;

•Loan and Security Agreement, dated as of March 10, 2023, by and among the Company, certain other Company Parties and Perrara Ventures, LLC, as amended;

•Loan and Security Agreement, dated as of June 5, 2023, by and among the Company, certain other Company Parties and Anesma Group, LLC;

•Loan and Security Agreement, dated as of June 29, 2023, by and among the Company, certain other Company Parties and Anjo Ventures, LLC; and

•Loan and Security Agreement, dated as of August 2, 2023, by and among the Company, certain other Company Parties and Muirisc, LLC;

each as amended, restated, supplemented or otherwise modified from time to time.

The Debt Instruments provide that as a result of the Chapter 11 Cases, the principal and interest due thereunder shall be immediately due and payable. Any efforts to enforce such payment obligations under the Debt Instruments are automatically stayed as a result of the Chapter 11 Cases, and the creditors’ rights of enforcement in respect of the Debt Instruments are subject to the applicable provisions of the Bankruptcy Code.

Item 2.05 Costs Associated With Exit or Disposal Activities

On August 7, 2023, the Company announced the termination or separation of approximately 260 employees, effective August 8, 2023. The Company previously terminated or separated approximately 148 employees on June 26, 2023. The combined total represents an approximate 30% reduction in force to maintain an organization of approximately 1,090 employees to continue operations in connection with the Chapter 11 Cases.

In connection with the reduction in force effective August 8, 2023, the impacted employees will be provided severance benefits, including cash severance payments and reimbursement of medical insurance premiums. The Company expects to record a one-time charge of approximately $6.8 million related to the reduction in its workforce, consisting primarily of one-time severance payments upon termination of the employees. The Company expects that the majority of these charges will be incurred in the third quarter of 2023.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Appointment of Chief Restructuring Officer

On August 8, 2023, the Company appointed Philip Gund as the Company’s Chief Restructuring Officer (“CRO”), with the appointment effective as of August 9, 2023.

Mr. Gund is Senior Managing Director at Ankura Consulting Group. Prior to his current position, he was a founding principal of Marotta Gund Budd & Dzera LLC (“MGBD”). Prior to forming MGBD, Mr. Gund was a principal at Zolfo Cooper LLC where he provided consulting services to companies, creditors, investors, and directors in troubled situations. He has 34 years of experience working with troubled companies and their creditors, investors, and court-appointed officials. Mr. Gund has served as Chief Executive Officer, Chief Restructuring Officer, and Chief Financial Officer in crisis and interim management situations.

The Company appointed Mr. Gund as CRO with compensation to be paid at the rate and upon the terms and conditions of that certain Engagement Letter, dated as of August 9, 2023, by and among and the Company and Mr. Gund (the “CRO Agreement”). As further set forth in the CRO Agreement, Mr. Gund has the authority as CRO to perform the ordinary course duties associated with that office such as advising the Company and its subsidiaries on matters relating to their debts, finances and liquidity, cash management and funding, business planning and restructuring strategy, the management of critical relationships and retention of experts, and such other duties as may be necessary or advisable in the course of the Chapter 11 Cases. Mr. Gund will report to the Restructuring Committee of the Board of Directors.

There are no additional, and no anticipated additional, compensatory arrangements between the Company and Mr. Gund in connection with his performance as the Company’s CRO beyond such fees paid pursuant to the CRO Agreement. Other than as described above, there are no arrangements or understandings between Mr. Gund and any other person pursuant to which he was appointed to serve as CRO. Additionally, in connection with this appointment, the Company also entered into an indemnification agreement with Mr. Gund that is in substantially the same form as those entered into with other directors and executive officers of the Company.

Mr. Gund is not a party to any transaction with the Company that would require disclosure under Item 404(a) of Regulation S-K, and there are no arrangements or understandings between Mr. Gund and any other persons pursuant to which he was appointed as CRO of the Company.

Appointment of Independent Director

On August 4, 2023, the Board appointed M Freddie Reiss as a Class III director, with the appointment effective as of August 9, 2023, and with a term expiring at the 2025 annual meeting of stockholders. The Board determined that Mr. Reiss qualifies as an independent director pursuant to the listing standards of the Nasdaq Stock Market. Mr. Reiss will be a member of the Restructuring Committee of the Board.

Mr. Reiss retired from his role as Senior Managing Director in the Corporate Finance/Restructuring practice of FTI Consulting, Inc. in 2013. Mr. Reiss has over 30 years of experience in strategic planning, cash management, liquidation analysis, covenant negotiations, forensic accounting and valuation. He specializes in advising on bankruptcies, reorganizations, business restructuring and in providing expert witness testimony for underperforming companies. Prior to joining FTI Consulting, Mr. Reiss was a partner and west region leader at PricewaterhouseCoopers, LLP, where he co-founded the Business Restructuring Services practice. Mr. Reiss is a recognized expert in the field of financial restructuring. Mr. Reiss holds an M.B.A. from City College of New York’s Baruch College and a B.B.A. from City College of New York’s Bernard Baruch School of Business. He is a Certified Public Accountant in New York and California. Mr. Reiss currently serves as an independent director of both Woodbridge Wind-Down Entity LLC, and its parent, Woodbridge Liquidation Trust, on which he is also the Chair of the Audit Committee, and both Blackrock TCP Capital Corp., on which he is also Chair of the Audit Committee, member of the Governance and Compensation Committee and a member of the Joint Transactions Committee, and Blackrock Direct Lending Corp., on which is also the Chair of Audit Committee and a member of the Joint Transactions Committee Member. Since April 2023, he has been serving as an independent director for Peer Street, Inc. He is also on the Board of Trustees for the Baruch College Fund, and was chairman of the audit committee and independent board member for Contech Engineered Solutions and Managing Member and director of Variant Holdings LLC.

Mr. Reiss will receive an advance monthly fee of $50,000 per month as compensation for his services.

Additionally, in connection with this appointment, the Company also entered into an indemnification agreement with Mr. Reiss that is in substantially the same form as those entered into with other directors and executive officers of the Company.

Mr. Reiss is not a party to any transaction with the Company that would require disclosure under Item 404(a) of Regulation S-K, and there are no arrangements or understandings between Mr. Reiss and any other persons pursuant to which he was appointed as director of the Company.

Item 7.01 Regulation FD Disclosure

Press Release

On August 9, 2023, the Company issued a press release announcing, among other things, the commencement of the Chapter 11 Cases. A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K.

As described in the press release, through the Chapter 11 Cases, the Company seeks to implement both an operational and balance sheet restructuring, address liquidity challenges, and preserve and maximize value. The Company intends to centralize its going-forward operations on its core technology and ingredients businesses and plans to exit certain of its consumer brands businesses.

Nasdaq Delisting Notice

The Company expects to receive a notice from The Nasdaq Stock Market (“Nasdaq”) that the Common Stock is no longer suitable for listing pursuant to Nasdaq Listing Rule 5110(b) as a result of the Chapter 11 Cases. If the Company receives such notice, the Company does not intend to appeal Nasdaq’s determination and, therefore, it is expected that its Common Stock will be delisted. The delisting of the Common Stock would not affect the Company’s operations or business and does not presently change its reporting requirements under the rules of the Securities and Exchange Commission (the “SEC”).

The information in this Item 7.01 of the Form 8-K, including Exhibit 99.1, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Cautionary Statements Regarding Trading in the Company’s Securities

The Company’s securityholders are cautioned that trading in the Company’s Common Stock during the pendency of the Chapter 11 Cases is highly speculative and poses substantial risks. Trading prices for the Company’s Common Stock may bear little or no relationship to the actual recovery, if any, by holders thereof in the Company’s Chapter 11 Cases. Accordingly, the Company urges extreme caution with respect to existing and future investments in its Common Stock.

Cautionary Statements Regarding Forward-Looking Statements

This Current Report on Form 8-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements contained in this Current Report on Form 8-K include, but are not limited to, statements regarding the process and potential outcomes of the Company’s Chapter 11 Cases, the Company’s ability to continue to operate as usual during the Chapter 11 Cases, the Company’s ability to improve its cost structure, capital structure, and liquidity position, and the ability of the DIP Financing to provide sufficient liquidity for the Company’s obligations during the Chapter 11 Cases. These statements are based on management’s current expectations, and actual results and future events may differ materially due to risks and uncertainties, including, without limitation, risks inherent in the bankruptcy process, including the outcome of the Chapter 11 Cases; the Company’s financial projections and cost estimates; the Company’s ability to raise additional funds during the Chapter 11 Cases; the Company’s ability to sell any of its assets; the impact of the Chapter 11 Cases on the listing of the Company’s Common Stock on the Nasdaq Stock Market; and the effect of the Chapter 11 Cases on the Company’s business prospects, financial results and business operations. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. These and other factors that may affect the Company’s future business prospects, results and operations are identified and described in more detail in the Company’s filings with the SEC, including the Company’s most recent Annual Report filed on Form 10-K and the subsequently filed Quarterly Report(s) on Form 10-Q. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this Form 8-K. Except as required by applicable law, the Company does not intend to update any of the

forward-looking statements to conform these statements to actual results, later events or circumstances or to reflect the occurrence of unanticipated events.

Item 9.01 Financial Statements and Exhibits.

| | | | | |

| Exhibit Number | Description |

| 10.1 | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | AMYRIS, INC. | |

| | | | |

| | | | |

| Date: August 10, 2023 | By: | /s/ Han Kieftenbeld | |

| | | Han Kieftenbeld | |

| | Interim Chief Executive Officer and Chief Financial Officer |

SENIOR SECURED SUPER PRIORITY DEBTOR IN POSSESSION LOAN AGREEMENT

Dated as of August 9, 2023

by and among

AMYRIS, INC., AMYRIS CLEAN BEAUTY, INC.,

and APRINNOVA, LLC,

as Borrowers

THE SUBSIDIARIES OF THE BORROWERS PARTY HERETO,

as Guarantors,

EUAGORE, LLC,

as Administrative Agent,

and

THE LENDERS PARTY HERETO

3.8 Administrative Agent Remedies 26

TABLE OF CONTENTS

(continued)

Page

TABLE OF CONTENTS

(continued)

Page

TABLE OF CONTENTS

(continued)

Page

TABLE OF CONTENTS

(continued)

Page

EXHIBITS

Exhibit A Initial Budget

Exhibit B Names, Locations and Other Information

Exhibit C Intellectual Property

Exhibit D Financial Accounts

Exhibit E Interim Order

Exhibit F Form of Joinder Agreement

SCHEDULES

Schedule 1 Borrowers; Guarantors

Schedule 1A Indebtedness

Schedule 1B Investments

Schedule 1C Liens

Schedule 2.1 Commitments

Schedule 5.5 Actions Before Governmental Authorities

Schedule 5.6 Laws

Schedule 5.8 Tax Matters

Schedule 5.9(b) Intellectual Property Infringement

Schedule 5.9(c) Intellectual Property Sufficiency

Schedule 5.9(f) Intellectual Property Litigation

Schedule 5.12(a) Capitalization

Schedule 5.12(b) Subsidiaries

Schedule 5.13 Non-GAAP Financial Statements

Schedule 5.14(a) Real Property

Schedule 5.19 Insurance Policies

SENIOR SECURED SUPER PRIORITY DEBTOR IN POSSESSION LOAN AGREEMENT

This SENIOR SECURED SUPER PRIORITY DEBTOR IN POSSESSION LOAN AGREEMENT (as the same may be amended, restated, supplemented and/or otherwise modified from time to time, this “Agreement”) is made as of August 9, 2023 and is entered into by and among AMYRIS, INC., a Delaware corporation (the “Parent”), and each of the Subsidiaries of the Parent set out in Part 1 of Schedule 1 to this Agreement (together with the Parent, each, a “Borrower” and collectively, the “Borrowers”), the Subsidiaries of the Parent set out in Part 2 of Schedule 1 to this Agreement (and such other Subsidiaries of the Parent that are guarantors, each, a “Guarantor” and collectively, the “Guarantors” and, together with the Borrowers, each. an “Obligor” and collectively, the “Obligors”), each lender from time to time party hereto (each, a “Lender” and collectively, the “Lenders”) and Euagore, LLC, in its capacity as Administrative Agent (the “Administrative Agent”).

WHEREAS, on August 9, 2023 (the “Petition Date”), the Parent and certain of the Parent’s Subsidiaries (each, a “Debtor” and collectively, the “Debtors”) filed voluntary petitions with the Bankruptcy Court initiating their respective cases that are pending under chapter 11 of the Bankruptcy Code (each case of the Parent and each other Debtor, a “Case” and collectively, the “Cases”) and have continued in the possession of their assets and the management of their business pursuant to Section 1107 and 1108 of the Bankruptcy Code;

WHEREAS, the Borrowers have requested that the Lenders provide a superpriority multiple-draw senior secured debtor-in-possession term loan credit facility in an aggregate principal amount not to exceed $190,000,000 (the “DIP Facility”), with all of the Borrowers’ obligations under the DIP Facility to be guaranteed by each Guarantor, and the Lenders are willing to extend such credit to the Borrowers on the terms and subject to the conditions set forth herein;

WHEREAS, the relative priority of the DIP Facility with respect to the Collateral granted as security for the payment and performance of the Secured Obligations shall be as set forth in the Interim Order and the Final Order, in each case, upon entry thereof by the Bankruptcy Court, and in the Security Documents;

WHEREAS, all of the claims and the Liens granted under the DIP Orders and the Loan Documents to the Administrative Agent, the Lenders and the other Secured Parties in respect of the DIP Facility shall be subject to the Carve-Out;

WHEREAS, the Borrowers and the Guarantors are engaged in related businesses, and each Guarantor will derive substantial direct and indirect benefit from the making of the extensions of credit to the Borrowers under this Agreement; and

WHEREAS, in connection with the execution and delivery of this Agreement and the other Loan Documents and entry of the Interim Order and the Final Order, the Guarantors, as applicable, agree to guarantee the Obligations, and the Borrowers and each Guarantor agree to secure all of the Obligations by granting to the Administrative Agent, for the benefit of the Secured Parties, a lien and security interest in respect of, and on, substantially all of each their respective assets, on and subject to the terms and priorities set forth in the Interim Order and the Final Order and the Loan Documents.

NOW, THEREFORE, in consideration of the foregoing and the agreements, provisions and covenants herein contained, the parties to this Agreement agree as follows:

SECTION 1.DEFINITIONS AND RULES OF CONSTRUCTION

Unless otherwise defined herein, in this Agreement (including the Recitals) the following capitalized terms have the following meanings:

“Acceptable Confirmation Order” means an order of the Bankruptcy Court confirming an Acceptable Plan of Reorganization, in form and substance satisfactory to the Required Lenders and the Administrative Agent (solely with respect to its own treatment) in their sole respective discretion (as the same may be amended, supplemented, or modified from time to time after entry thereof with the consent of the Required Lenders and the Administrative Agent (solely with respect to its own treatment) in their respective sole discretion).

“Acceptable Disclosure Statement” means the disclosure statement relating to an Acceptable Plan of Reorganization in form and substance acceptable to the Required Lenders and the Administrative Agent (solely with respect to its own treatment).

“Acceptable Disclosure Statement Order” means an order of the Bankruptcy Court approving an Acceptable Disclosure Statement, in form and substance satisfactory to the Required Lenders and the Administrative Agent in their sole respective discretion (as the same may be amended, supplemented, or modified from time to time after entry thereof with the consent of the Required Lenders and the Administrative Agent in their sole respective discretion).

“Acceptable Plan of Reorganization” means a Chapter 11 Plan for each of the Cases, in form and substance satisfactory to the Required Lenders and the Administrative Agent (solely with respect to its own treatment) in their sole respective discretion, that, upon the consummation thereof, provides for the termination of all unused Commitments hereunder and the indefeasible payment in full in cash of all of the Secured Obligations under the Loan Documents.

“Acceptable Plan Support Agreement” means a plan support agreement that contemplates the consummation of an Acceptable Plan of Reorganization in compliance with all Milestones relating to such Acceptable Plan of Reorganization and in form and substance satisfactory to the Required Lenders and the Administrative Agent (solely with respect to its own treatment) in their sole respective discretion.

“Account Control Agreement(s)” means any agreement entered into by and among the Administrative Agent, any Obligor and a third party bank or other institution (including a Securities Intermediary) in which any Obligor maintains a Deposit Account or an account holding Investment Property and which grants the Administrative Agent a perfected security interest in the subject account or accounts.

“Adequate Protection Liens” has the meaning specified therefor in the DIP Orders.

“Adequate Protection Obligations” has the meaning specified therefor in the DIP Orders.

“Administrative Agent” has the meaning set forth in the preamble to this Agreement and is defined as the “DIP Agent” in the DIP Orders.

“Advance” means any loan made or advanced by the Lenders under this Agreement.

“Advance Date” means the funding date of any Advance.

“Advance Request” means a request for an Advance submitted by the Parent to the Administrative Agent (on behalf of the Lenders) in form and substance satisfactory to the Administrative Agent.

“Affiliate” means, with respect to any specified Person, any other Person directly or indirectly controlling or controlled by or under direct or indirect common control with such specified Person. For purposes of this definition, “control” (including, with correlative meanings, the terms “controlling”,

“controlled by” and under “common control with”), as used with respect to any Person, shall mean the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of such Person, whether through the ownership of voting securities, by agreement or otherwise.

“Agreement” has the meaning give to it in the preamble to this Agreement.

“All Assets Bidding Procedures” has the meaning set forth in Section 7.25(d).

“All Assets Bidding Procedures Motion” has the meaning set forth in Section 7.25(d).

“All Assets Bidding Procedures Order” has the meaning set forth in Section 7.25(d).

“All Asset Sale Transaction” means one or more transactions (or series of related transactions) to effectuate the sale of all or substantially all of the Borrowers’ consolidated assets, free and clear of liabilities (subject to customary exceptions) pursuant to the Cases which transactions shall be in form and substance acceptable to the Required Lenders and the Administrative Agent (solely with respect to its own treatment) in their sole respective discretion.

“Amyris Assets” means the Consumer Brands Business and the Other Amyris Assets.

“Anesma Loan Agreement” means that certain Loan and Security Agreement dated as of June 5, 2023, by and among Anesma Group, LLC, the Parent and certain Subsidiaries of the Parent, as amended, restated, supplemented or otherwise modified from time to time.

“Anjo Loan Agreement” means that certain Loan and Security Agreement dated as of June 29, 2023, by and among Anjo Ventures, LLC, the Parent and certain Subsidiaries of the Parent, as amended, restated, supplemented or otherwise modified from time to time.

“Anti-Terrorism Order” means Executive Order No. 13,224 as of September 24, 2001, Blocking Property and Prohibiting Transactions with Persons Who Commit, Threaten to Commit or Support Terrorism, 66 U.S. Fed. Reg. 49,079 (2001), as amended.

“Approved Bankruptcy Court Order” shall mean (a) each of the DIP Orders, as such order is amended and in effect from time to time in accordance with this Agreement, (b) any other order entered by the Bankruptcy Court regarding, relating to or impacting (i) any rights or remedies of any Secured Party, (ii) the Loan Documents (including the Obligors’ obligations thereunder), (iii) the Collateral, any Liens thereon or any DIP Superpriority Claims (including, without limitation, any sale or other disposition of Collateral or the priority of any such Liens or DIP Superpriority Claims), (iv) use of cash collateral, (v) debtor-in-possession financing, (vi) adequate protection or otherwise relating to any Prepetition Obligation or (vii) any Chapter 11 Plan, in the case of each of the foregoing clauses (i) through (vii), that (x) is in form and substance satisfactory to the Required Lenders and the Administrative Agent (solely with respect to its own treatment) in their sole respective discretion, (y) has not been vacated, reversed or stayed and (z) has not been amended or modified in a manner adverse to the rights of the Lenders except as agreed in writing by the Required Lenders and the Administrative Agent (solely with respect to its own treatment) in their sole respective discretion, and (c) any other order entered by the Bankruptcy Court that (i) is in form and substance satisfactory to the Required Lenders and the Administrative Agent (solely with respect to its own treatment) in their sole respective discretion, (ii) has not been vacated, reversed or stayed and (iii) has not been amended or modified except in a manner satisfactory to the Required Lenders and the Administrative Agent (solely with respect to its own treatment) in their sole respective discretion.

“Approved Budget” has the meaning given to it in Section 7.1(g)

“Assignee” has the meaning set forth in Section 10.13.

“Available Commitment” means, at any time, an amount equal to the aggregate Commitments minus the aggregate initial principal amount of all Advances made immediately prior to such time.

“Avoidance Actions Proceeds” has the meaning given to it in the definition of “DIP Superpriority Claims”.

“Bankruptcy Code” shall mean Title 11, U.S.C., as now or hereafter in effect, or any successor thereto.

“Bankruptcy Court” shall mean the United States Bankruptcy Court for the District of Delaware or any other court having jurisdiction over the Cases from time to time.

“Bankruptcy Law” means each of (i) the Bankruptcy Code, (ii) any domestic or foreign law relating to liquidation, conservatorship, bankruptcy, assignment for the benefit of creditors, moratorium, rearrangement, administration, insolvency, reorganization, debt adjustment, receivership or similar debtor relief from time to time in effect and affecting the rights of creditors generally (including without limitation any plan of arrangement provisions of applicable corporation statutes), and (iii) any order made by a court of competent jurisdiction in respect of any of the foregoing.

“Board of Directors” means with respect to (a) any corporation, the board of directors of the corporation or any committee thereof duly authorized to act on behalf of such board, (b) a partnership, the board of directors or managing member or members, as applicable, of the general partner of the partnership, (c) a limited liability company, the managing member or members or any controlling committee or board of directors of such company or the sole member or the managing member thereof, and (d) any other Person, the board or committee of such Person serving a similar function.

“Borrowers” has the meaning given to it in the preamble to this Agreement.

“Borrower Products” means all products, software, service offerings, technical data or technology currently being designed, manufactured or sold by any Obligor or which any Obligor intends to sell, license, or distribute in the future including any products or service offerings under development, collectively, together with all products, software, service offerings, technical data or technology that have been sold, licensed or distributed by any Obligor since their respective incorporations.

“Budget” means the Initial Budget, as amended, modified, supplemented or replaced from time to time in accordance with Section 7.1(g); provided that the Budget will not include entity level operating cash flows in respect of subsidiaries of the Parent but will include any projected transfers by any Subsidiary of the Parent to any Non-Debtor Subsidiary; provided; further, that all transfers by the Parent or any Subsidiary of the Parent to any Subsidiary of the Parent shall be documented in a separate Post-Petition Global Note and shall be made in accordance with the Budget.

“Business Day” means any day other than Saturday, Sunday and any other day on which banking institutions in the State of California are closed for business.

“Capital Stock” means: (i) in the case of a corporation, corporate stock or shares; (ii) in the case of an association or business entity other than a corporation, any and all shares, interests, participations, rights or other equivalents (however designated) of corporate stock; (iii) in the case of a partnership or limited liability company, partnership or membership interests (whether general or limited); and (iv) any other interest or participation that confers on a Person the right to receive a share of the profits and losses of, or distributions of assets of, the issuing Person, but excluding from all of the foregoing any debt securities convertible into Capital Stock, whether or not such debt securities include any right of participation with Capital Stock.

“Carve-Out” has the meaning specified therefor in the DIP Orders.

“Carve-Out Account” has the meaning set forth in Section 7.15(c)(i).

“Carve-Out Cap” has the meaning specified therefor in the DIP Orders.

“Cases” has the meaning given to it in the recitals to this Agreement.

“Cash” means all cash and liquid funds.

“Cash Collateral” has the meaning set forth in Section 7.15(b).

“Cash Equivalents” means, as of any date of determination, any of the following: (i) marketable securities (a) issued or directly and unconditionally guaranteed as to interest and principal by the United States Government, or (b) issued by any agency of the United States, the obligations of which are backed by the full faith and credit of the United States, in each case maturing within one year after such date; (ii) marketable direct obligations issued by any state of the United States of America or any political subdivision of any such state or any public instrumentality thereof, in each case maturing within one year after such date and having, at the time of the acquisition thereof, a rating of at least A-1 from Standard & Poor’s Corporation or at least P-1 from Moody’s Investors Service; (iii) commercial paper maturing no more than one year from the date of creation thereof and having, at the time of the acquisition thereof, a rating of at least A-1 from Standard & Poor’s Corporation or at least P-1 from Moody’s Investors Service; (iv) certificates of deposit or bankers’ acceptances maturing within one year after such date and issued or accepted by the Administrative Agent or by any commercial bank organized under the laws of the United States of America or any state thereof or the District of Columbia that (a) is at least “adequately capitalized” (as defined in the regulations of its primary federal banking regulator), and (b) has Tier 1 capital (as defined in such regulations) of not less than $100,000,000; and (v) shares of any money market mutual fund that (a) has substantially all of its assets invested continuously in the types of investments referred to in clauses (i) and (ii) above, (b) has net assets of not less than $500,000,000, and (c) has the highest rating obtainable from either Standard & Poor’s Corporation or Moody’s Investors Service.

“Cash Management Order” shall mean an order of the Bankruptcy Court entered in the Cases, together with all extensions, modifications and amendments thereto, in form and substance acceptable to the Administrative Agent, which among other matters authorizes the Debtors to maintain their existing cash management and treasury arrangements or such other arrangements in accordance with the DIP Orders and as shall be reasonably acceptable to the Administrative Agent in all material respects.

“Cause” means (a) being convicted of, or pleading guilty or nolo contendere to, a felony (other than a traffic violation), (b) material breach of any obligations, (c) willful misconduct that results in material harm to the Debtors, (d) fraud with regard to the Debtors, (e) willful, material violation of any reasonable written rule, regulation or policy of the Debtors that results in material harm to the Debtors, or (f) willful and substantial failure to make reasonable attempts in good faith to substantially perform material duties (other than by reason of illness or disability) (it being understood that, for this purpose, the manner and level of performance shall not be determined based on the financial performance of the Debtors. To avoid doubt, no act or failure to act, shall be considered “willful,” unless done, or omitted to be done, in bad faith and without reasonable belief that an action or omission was in, or not opposed to, the best interest of the Debtors, and, in addition, conduct shall not be considered “willful” with respect to any action taken or not taken based on the advice of the Debtors’ inside or outside legal counsel.

“Change in Control” means:

(i) any “person” or “group” (as such terms are used in Sections 13(d) and 14(d) of the Securities Exchange Act of 1934 (the “Exchange Act’’) is or becomes the “beneficial owner” (as defined in Rules 13d-3 and l3d-5 under the Exchange Act, except that for purposes of this clause such person or group shall be deemed to have ‘‘beneficial ownership” of all securities that such person or group has the right to acquire, whether such right is exercisable immediately or only after the passage of time (such right, an “option right”)), directly or indirectly, of Capital Stock of the Parent representing more than 35.0% of the voting power of the total outstanding Capital Stock of the Parent (and taking into account all such securities that such person or group has the right to acquire (whether pursuant to an option right or otherwise));

(ii) during any period of twelve (12) consecutive months, a majority of the members of the Board of Directors of the Parent cease to be composed of individuals (a) who were members of that Board of Directors at the commencement of such period, (b) whose election or nomination to that Board of Directors was approved by individuals referred to in preceding clause (a) constituting at the time of such election or nomination at least a majority of that Board of Directors or (c) whose election or nomination

to that Board of Directors was approved by individuals referred to in preceding clauses (a) and (b) constituting at the time of such election or nomination at least a majority of that Board of Directors; or

(iii) any Person or two or more Persons acting in concert shall have acquired by contract or otherwise, or shall have entered into a contract that, upon consummation thereof, will result in its or their acquisition of the power to exercise, directly or indirectly, a controlling influence over the management or policies of the Parent, or control over the equity securities of the Parent entitled to vote for members of the Board of Directors of the Parent on a fully-diluted basis (and taking into account all such securities that such Person or Persons have the right to acquire (whether pursuant to an option right or otherwise)) representing 35.0% or more of the combined voting power of such securities, provided that commencement of the Cases shall not constitute a “Change of Control” hereunder.

“Chapter 11 Plan” means a chapter 11 plan of liquidation or reorganization in the Cases in form and substance satisfactory to the Required Lenders and the Administrative Agent in their sole discretion in all respects and consented to by the Required Lenders and the Administrative Agent, confirmed by an order (in form and substance satisfactory to the Required Lenders and the Administrative Agent (solely with respect to its own treatment) in their sole respective discretion) of the Bankruptcy Court under the Cases.

“Claims” has the meaning set forth in Section 10.10.

“Closing Date” has the meaning given to it in Section 4.

“Collateral” means (a) the property described in Section 3.3 and (b) the “DIP Collateral” as defined in the Interim Order (and, when applicable, the Final Order) and words of similar intent, and in any of the Security Documents, and shall include all present and after acquired assets and property, whether real, personal, tangible, intangible or mixed of the Obligors, wherever located, on which Liens are or are purported to be granted pursuant to the DIP Orders and/or the Security Documents to secure the payment and performance of the Secured Obligations.

“Collateral IP” means all Intellectual Property other than Excluded Intellectual Property.

“Commitment” means with respect to each Lender on any date, the commitment of such Lender on such date to make Advances, in each case in accordance with the terms of this Agreement, expressed as an amount representing the maximum principal of such Advance, or participation therein. The initial amount of such Lender’s Commitment is set forth on Schedule 2.1.

“Confidential Information” has the meaning set forth in Section 10.12.

“Contingent Obligation” means, as applied to any Person, any direct or indirect liability, contingent or otherwise, of that Person with respect to (i) any Indebtedness or other obligations of another Person, including any such obligation directly or indirectly guaranteed, endorsed, co-made or discounted or sold with recourse by that Person, or in respect of which that Person is otherwise directly or indirectly liable; (ii) any obligations with respect to undrawn letters of credit, corporate credit cards or merchant services issued for the account of that Person; and (iii) all obligations arising under any interest rate, currency or commodity swap agreement, interest rate cap agreement, interest rate collar agreement, or other agreement or arrangement designated to protect a Person against fluctuation in interest rates, currency exchange rates or commodity prices; provided, however, that the term “Contingent Obligation” shall not include endorsements for collection or deposit in the ordinary course of business. The amount of any Contingent Obligation shall be deemed to be an amount equal to the stated or determined amount of the primary obligation in respect of which such Contingent Obligation is made or, if not stated or determinable, the maximum reasonably anticipated liability in respect thereof as determined by such Person in good faith; provided, however, that such amount shall not in any event exceed the maximum amount of the Secured Obligations under the guarantee or other support arrangement.

“Consumer Brands” means Biossance, 4U by Tia, JVN, Rose Inc., Pipette, MenoLabs, Stripes, Costa Brazil, Onda, Purecane, Olika, EcoFabulous and Terasana.

“Consumer Brands Business” means, in the aggregate, the business, operations, and assets used in connection with the Consumer Brands (but excluding causes of actions, intercompany receivables, contracts unless assumed and assigned to the buyer with cure payments made by the buyer, privileged books and records, and employees, unless timely offers are made to employees of such businesses on terms of employment at least the same as the current terms of employment).

“Copyright License” means any written agreement granting (i) any right to exploit any Copyright, now owned or hereafter acquired by any Obligor or in which any Obligor now holds or hereafter acquires any interest, (ii) an immunity from suit under any Copyright, or (iii) an option to any of the foregoing.

“Copyrights” means all copyrights, whether registered or unregistered and published or unpublished, including copyrights in software, internet web sites, databases and the content thereof, held pursuant to the laws of the United States, any State thereof, or of any other country.

“Debt Transaction” means, with respect to Parent or any consolidated Subsidiary, any sale, issuance, placement, assumption or guaranty of funded Indebtedness (other than pursuant to this Agreement), whether or not evidenced by a promissory note or other written evidence of Indebtedness, other than Permitted Indebtedness.

“Debtor” or “Debtors” shall have the meaning given in the recitals to this Agreement.

“Default” means any event which, with the passage of time or notice or both, would, unless cured or waived hereunder, become an Event of Default.

“Deposit Accounts” means any “deposit accounts,” as such term is defined in the UCC, and includes any checking account, savings account, or certificate of deposit.

“DIP Orders” means collectively, the Interim Order and the Final Order.

“DIP Superpriority Claims” means all allowed claims entitled to the benefits of Bankruptcy Code section 364(c)(1), having superpriority over any and all administrative expenses and claims, of any kind or nature whatsoever, including, without limitation, superpriority claims granted to the Administrative Agent and the other Secured Parties under the Interim Order and Final Order, and the administrative expenses of the kinds specified in or ordered pursuant to Bankruptcy Code sections 105, 326, 327, 328, 330, 331, 361, 362, 363, 364, 365, 503, 506, 507(a), 507(b), 546, 552, 726, 1113 and 1114, and any other provision of the Bankruptcy Code, which allowed claims shall for the purposes of section 1129(a)(9)(A) of the Bankruptcy Code be considered administrative expenses allowed under section 503(b) of the Bankruptcy Code and which shall be payable from and have recourse to all prepetition and postpetition property of the Debtors and all proceeds thereof, including, without limitation, subject to entry of the Final Order, any proceeds or property recovered in connection with the pursuit of claims or causes of action arising under chapter 5 of the Bankruptcy Code (the “Avoidance Actions Proceeds”), subject only to the payment of the Carve-Out.

“DIP Termination Date” means, unless otherwise agreed to by the Administrative Agent in its sole discretion, the earliest to occur of (i) the Maturity Date, (ii) the Plan Effective Date, (iii) the date of dismissal of the Cases or conversion of the Cases into cases under Chapter 7 of the Bankruptcy Code, (iv) the date of the Administrative Agent’s written notice to the Borrowers of the occurrence of an Event of Default under the Loan Documents, and (v) the date of the consummation of any sale or other disposition of all or substantially all of the Amyris Assets pursuant to section 363 of the Bankruptcy Code.

“Disbursements Variance” means, for any Measuring Period, the numerical amount by which total disbursements for such Measuring Period are greater than total disbursements, respectively, on a Line Item by Line Item Basis, for such Measuring Period as set out in the Budget for the then applicable week and on a cumulative basis for such Measuring Period; provided, however, the calculation of the Disbursements Variance shall not include any amounts in the Budget related to professional fees.

“Disbursements Variance Percentage” means, for any Measuring Period, on a Line Item by Line Item Basis, the percentage obtained by dividing (a) the Disbursements Variance for the then applicable

week and on a cumulative basis for such Measuring Period by (b) total disbursements for such Measuring Period as set out in the Budget for the then applicable week and on a cumulative basis.

“Disclosure Statement Hearing Order Deadline” has the meaning set forth in Section 7.25(d).

“Disqualified Stock” means, with respect to any Person, any Capital Stock that by its terms (or by the terms of any security into which it is convertible or for which it is exchangeable at the option of the holder) or upon the happening of any event:

(i) matures or is mandatorily redeemable pursuant to a sinking fund obligation or otherwise;

(ii) is convertible or exchangeable for Indebtedness or Disqualified Stock (excluding Capital Stock convertible or exchangeable solely at the option of the issuer or a Subsidiary; provided, that any such conversion or exchange will be deemed an incurrence of Indebtedness or Disqualified Stock, as applicable); or

(iii) is redeemable at the option of the holder thereof, in whole or in part.

“Dollars” and “$” means the lawful currency for the time being of the United States of America.

“Domestic Subsidiary” means any Subsidiary that is not a Foreign Subsidiary.

“DSM Loan Agreement” means that certain Loan and Security Agreement by and among DSM Finance B.V. and certain of the Obligors, dated as of October 11, 2022, as amended and restated by that certain Amendment and Restatement Agreement dated as of December 12, 2022, and as further amended, restated, supplemented or otherwise modified from time to time in accordance with this Agreement.

“Environmental Laws” means all applicable federal, state, local and foreign Laws, statutes, ordinances, codes, rules, legally binding standards and regulations, now or hereafter in effect, and in each case as amended or supplemented from time to time, and any applicable non-appealable judicial or administrative interpretation thereof, including any applicable legally binding judicial or administrative order, consent decree or judgment, imposing liability or standards of conduct for or relating to the regulation and protection of human health and safety (to the extent related to exposure to Hazardous Materials), the environment and natural resources (including ambient air, surface water, groundwater, wetlands, land surface or subsurface strata, wildlife, aquatic species and vegetation).

“Environmental Liabilities” means, with respect to any Person, all liabilities, obligations, costs, losses, damages, fine, penalties and expenses (including all fees, disbursements and expenses of counsel, experts and consultants), incurred as a result of or related to any claim, suit, action, investigation, proceeding or demand by any Person, whether based in contract, tort, implied or express warranty, strict liability, criminal or civil statute or common law, arising under or related to any Environmental Laws or permits, or in connection with any Release or threatened Release or presence of a Hazardous Material whether on, at, in, under, from or about or in the vicinity of any real or personal property.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended, and the regulations promulgated thereunder.

“ERISA Affiliate” means, with respect to each Obligor, any trade or business (whether or not incorporated) which, together with such Obligor, is treated as a single employer within the meaning of Sections 414(b) or (c) of the IRC (or, solely for purposes of Section 302 of ERISA or Sections 412 and 430 of the IRC, Section 414(m) or (o) of the IRC).

“ERISA Plan” means, at any time, an employee benefit plan, as defined in Section 3(3) of ERISA, which any Obligor or any of its Subsidiaries maintains, contributes to or has an obligation to contribute to on behalf of participants who are or were employed by any such Person (or, if such plan were terminated at such time, would under Section 4069 of ERISA be deemed to be an employee benefit plan of such Person).

“Event of Default” has the meaning set forth in Section 8.

“Exchange Act” means the Securities Exchange Act of 1934, as amended from time to time.

“Excluded Intellectual Property” means: United States intent-to-use trademark applications to the extent that, and solely during the period in which, the grant of a security interest therein would impair the validity or enforceability of such intent-to-use trademark applications under applicable federal law.

“Excluded Taxes” means any of the following Taxes imposed on or with respect to the Administrative Agent or any Lender or required to be withheld or deducted from a payment to the Administrative Agent or any Lender, (i) Taxes imposed on or measured by net income (however denominated), franchise Taxes, and branch profits Taxes, in each case, (a) imposed as a result of the Administrative Agent or any Lender being organized under the laws of, or having its principal office or, in the case of the Administrative Agent or any Lender, its applicable lending office located in, the jurisdiction imposing such Tax (or any political subdivision thereof) or (b) imposed as a result of a present or former connection between the Administrative Agent or any Lender and the jurisdiction imposing such Tax (other than connections arising from the Administrative Agent or any Lender having executed, delivered, become a party to, performed its obligations under, received payments under, received or perfected a security interest under, engaged in any other transaction pursuant to or enforced any Loan Document, or sold or assigned an interest in any Advance or Loan Document), (ii) in the case of the Administrative Agent or any Lender, U.S. federal withholding Taxes imposed on amounts payable to or for the account of the Administrative Agent or any Lender with respect to an applicable interest in any Advance or commitment pursuant to a law in effect on the date on which (a) the Administrative Agent or any Lender acquires such interest in any Advance or commitment or (b) the Administrative Agent or any Lender changes its lending office, except, in each case, to the extent that, pursuant to Section 7.10, amounts with respect to such Taxes were payable either to the Administrative Agent or any Lender’s assignor immediately before the Administrative Agent or any Lender became a party hereto or to the Administrative Agent or any Lender immediately before it changed its lending office, and (iii) if, upon prior written request therefor, the Administrative Agent or any Lender fails to provide the Obligors with a duly executed IRS Form W-9 or appropriate IRS From W-8.

“Exit Premium” has the meaning set forth in Section 2.8.

“Financial Statements” has the meaning set forth in Section 7.1.

“Final Order” means a final order of the Bankruptcy Court in substantially the form of the Interim Order, with only such modifications thereto as are reasonably necessary to convert the Interim Order to a final order and such other modification as are satisfactory in form and substance to the Parent, the Required Lenders and the Administrative Agent in their respective sole discretion.

“Final Order Entry Date” means the date on which the Final Order is entered by the Bankruptcy Court.

“First Foris Loan Agreement” means that certain Amended and Restated Loan Agreement dated as of October 28, 2019 by and among Foris Ventures, LLC, the Parent and certain Subsidiaries of the Parent, as, as amended by that certain Omnibus Amendment Agreement, dated as of June 5, 2023, and as further amended, restated, supplemented or otherwise modified from time to time.

“First Initial Advance” has the meaning set forth in Section 2.1(a).

“Foreign Subsidiary” means any Subsidiary other than a Subsidiary organized or formed under the laws of any state within the United States or the District of Columbia.

“Foris Liens” means first priority security interests in and Liens on Prepetition Collateral.

“Foris Prepetition Secured Lenders” means each of (a) Foris Ventures, LLC as lender under the First Foris Loan Agreement, (b) Foris Ventures, LLC as lender under the Second Foris Loan Agreement,

(c) Perrara Ventures, LLC as lender under the Perrara Loan Agreement, (d) Anesma Group, LLC as lender under the Anesma Loan Agreement, (e) Anjo Ventures, LLC as lender under the Anjo Loan Agreement, and (f) Muirisc, LLC as lender under the Muirisc Loan Agreement.

“Foris Prepetition Obligations” means the Secured Obligations, as defined in the Foris Prepetition Secured Loan Agreements.

“Foris Prepetition Secured Loan Agreements” means the First Foris Loan Agreement, the Second Foris Loan Agreement, the Perrara Loan Agreement, the Anesma Loan Agreement, the Anjo Loan Agreement, the Muirisc Loan Agreement and any other loan agreement made between any Affiliate of a Foris Prepetition Secured Lender, the Parent and any Subsidiary of the Parent before the Petition Date.

“GAAP” means generally accepted accounting principles in the United States of America, as in effect from time to time; provided, that the definitions set forth in this Agreement and any financial calculations required by the Loan Documents shall be computed to exclude any change to lease accounting rules from those in effect pursuant to Financial Accounting Standards Board Accounting Standards Codification 840 (Leases) and other related lease accounting guidance as in effect on the date hereof.

“Governmental Approval” means any consent, authorization, approval, order, license, franchise, permit, certificate, accreditation, registration, filing or notice, of, issued by, from or to, or other act by or in respect of, any Governmental Authority.

“Governmental Authority” means any nation or government, any state or other political subdivision thereof, and any agency, department or other entity exercising executive, legislative, judicial, regulatory or administrative functions of or pertaining to government.

“Group Members” means the Obligors and their respective Subsidiaries and “Group Member” means any of them.

“Hazardous Material” means hazardous waste, hazardous substance, pollutant, contaminant, toxic substance, oil, hazardous material, chemical or other similar substance to the extent each of the foregoing is regulated by any Environmental Law.

“Indebtedness” means indebtedness of any kind including, without limitation (i) all indebtedness for borrowed money or the deferred purchase price of property or services, including reimbursement and other obligations with respect to surety bonds and letters of credit, (ii) all obligations evidenced by notes, bonds, debentures or similar instruments, (iii) all capital lease obligations, (iv) all Contingent Obligations, and (v) Disqualified Stock.

“Indemnified Taxes” means (i) Taxes, other than Excluded Taxes, imposed on or with respect to any payment made by or on account of any obligation of any Obligor under any Loan Document and (ii) to the extent not otherwise described in (i), Other Taxes.

“Independent Director” means, in relation to any Debtor, an independent director to the to the Board of Directors of such Debtor or any Restructuring Committee of such Debtor.

“Initial Advances” has the meaning set forth in Section 2.1(a).

“Initial Budget” means the weekly budget in form and substance satisfactory to the Administrative Agent commencing with the week during which the Petition Date occurs and continuing through the first sixty (60) days of the Cases, containing line items of sufficient detail to reflect the consolidated operating cash flow of the Debtors and each Non-Debtor Subsidiary for such period, a copy of which is attached as Exhibit A.

“Intellectual Property” means all of each Obligors’ (i) rights anywhere in the world in and to Copyrights; Trademarks; Patents; Licenses; trade secrets, confidential and proprietary information,

including know-how, manufacturing and production processes and techniques, research and development information, databases and data, customer and supplier lists and information; inventions; mask works; domain names and social media identifiers; all other intellectual and industrial property rights of any type; and the rights to sue for past, present and future infringement, misappropriation or other violation of any of the foregoing and any harm to the goodwill associated therewith, and (ii) all tangible embodiments of the foregoing.

“Interim Order” means an interim order of the Bankruptcy Court (and as the same may be amended, supplemented, or modified from time to time after entry thereof with the consent of the Required Lenders and the Administrative Agent in their sole discretion) in the form attached as Exhibit E, with changes to such form as are satisfactory to the Required Lenders and the Administrative Agent (solely with respect to its own treatment), in their sole respective discretion, approving the Loan Documents and related matters.

“Interim Order Entry Date” means the date on which the Interim Order is entered by the Bankruptcy Court.

“Investigation” means any investigation of the claims, liens and defenses against any Prepetition Lender.

“Investment” means any beneficial ownership (including stock, partnership or limited liability company interests) of or in any Person, or any loan, advance or capital contribution to any Person or the acquisition of all, or substantially all, of the assets or a business line or division of another Person or the purchase of any assets of another Person for greater than the fair market value of such assets to solely the extent of the amount in excess of the fair market value.

“IP Security Agreement” means each certain Intellectual Property Security Agreement entered into between an Obligor and Administrative Agent in accordance with this Agreement.

“IRC” means the Internal Revenue Code of 1986, as amended, and any successor thereto (unless otherwise specified therein).

“IRS” means the Internal Revenue Service, or any successor thereto.

“Joinder Agreements” means for each Subsidiary that is required to be a Subsidiary Guarantor, a completed and executed Joinder Agreement in substantially the form attached hereto as Exhibit F.

“Laws” means any federal, state, local and foreign statute, law, treaty, judicial decision, regulation, guidance, guideline, ordinance, rule, judgment, order, decree, code, injunction, permit, concession, grant, franchise, governmental (or quasi-governmental) agreement, governmental (or quasi-governmental) restriction or determination of an arbitrator, court or other Governmental Authority (whether or not having the force of law), whether now or hereafter in effect.

“Leland Property” means the commercial scale production facility located in Leland, North Carolina.

“Lender” has the meaning set forth in the preamble to this Agreement and is defined as the “DIP Lenders” in the DIP Orders.

“Lender Advisors” shall mean Goodwin Procter LLP, CR3 Partners and each other advisor, consultant, expert and local or special counsel to the Lenders.

“License” means any Copyright License, Patent License, Trademark License or other license of rights or interests.

“Lien” means any mortgage, deed of trust, pledge, hypothecation, assignment for security, security interest, encumbrance, levy, lien or charge of any kind, whether voluntarily incurred or arising by

operation of law or otherwise, against any property, any conditional sale or other title retention agreement, and any lease in the nature of a security interest; provided, that for the avoidance of doubt, licenses, strain escrows and similar provisions in collaboration agreements, research and development agreements that do not create or purport to create a security interest, encumbrance, levy, lien or charge of any kind shall not be deemed to be Liens for purposes of this Agreement.

“Line Item by Line Item Basis” means each line of the Budget (excluding any amounts in the Budget related to professional fees for the Debtors and any statutory creditors’ committee); provided, however, that for line items labeled “Other AP Disbursements,” “InterCo disbursements,” and “Aged Brazil payables,” “Line Item by Line Item Basis” shall refer to the line items set forth in the supporting schedules provided to the Secured Parties in connection with the Budget.

“Litigation” has the meaning set forth in Section 5.5.

“Loan Documents” means this Agreement, the Interim and Final Orders, each Post-Petition Global Note, the Notes (if any), the Account Control Agreements, the Joinder Agreements, all UCC financing statements, the IP Security Agreements, each Security Document, the Approved Budget, and any other documents executed or delivered in connection with the Secured Obligations or the transactions contemplated hereby, as the same may from time to time be amended, modified, supplemented or restated, and is defined as the “DIP Loan Documents” in the DIP Orders.

“Material Adverse Effect” means a material adverse effect upon: (i) the business, operations, properties, assets, or condition (financial or otherwise) of the Obligors ; or (ii) the ability of the Obligors to perform the Secured Obligations in accordance with the terms of the Loan Documents, or the ability of the Administrative Agent or any Lender to enforce any of its rights or remedies with respect to the Secured Obligations; or (iii) the Collateral or the Administrative Agent’s Liens on the Collateral or the priority of such Liens; provided that Material Adverse Effect shall expressly exclude (i) any matters publicly disclosed prior to the filing of the Cases, (ii) any matters disclosed on the Schedules or Exhibits hereto, (iii) any matters disclosed in any first day pleadings or declarations, and (iv) the effect of the filing of the Cases, the events and conditions related to, resulting from or leading up thereto and the effects thereon, and any action required to be taken under the Loan Documents or the DIP Orders.

“Maturity Date” means December 31, 2023.

“Maximum Rate” has the meaning set forth in Section 2.2.

“Measuring Period” means the weekly period most recently ended beginning with the week ending on August 18, 2023 and each successive weekly period thereafter.

“Milestone” has the meaning given to it in Section 7.25.

“Mortgage” means any mortgage, deed of trust or other agreement which conveys or evidences a Lien in favor of the Administrative Agent, for the benefit of the Secured Parties, on Real Estate of an Obligor, including any amendment, restatement, modification or supplement thereto.

“Multiemployer Plan” means a “multiemployer plan” as defined in Section 4001(a)(3) of ERISA, and to which any Obligor or any ERISA Affiliate is making, is obligated to make, has made or been obligated to make, contributions on behalf of participants who are or were employed by any of them.

“Muirisc Loan Agreement” means that certain Loan and Security Agreement dated on or about August 2, 2023, by and among Muirisc, LLC, the Parent and certain Subsidiaries of the Parent, as amended, restated, supplemented or otherwise modified from time to time.

“Net Proceeds” means the gross proceeds from the sale of any Amyris Assets less the direct costs and expenses incurred in connection with the marketing, negotiation, documentation, and closing of such sale, including, without limitation, any purchase price hold-backs, reasonable and documented legal fees and investment banking fees incurred in connection with such sale, taxes required to be paid, cure costs in

connection with any assumed and assigned and/or modified contracts, licenses and leases, and reasonable and documented out of pocket costs and expenses incurred in connection with such sale.

“Non-Debtor Subsidiary” means any Subsidiary of a Debtor which is not itself a Debtor.

“Note” means each promissory note issued hereunder in accordance with Section 2.6.

“Obligor” has the meaning given to it in the preamble to this Agreement.

“OFAC” has the meaning set forth in Section 5.22(b).

“Other Amyris Assets” means all of the assets of the Debtors and its Non-Debtor Subsidiaries other than the Consumer Brands Business.

“Other Taxes” means all present or future stamp, court or documentary, intangible, recording, filing or similar Taxes that arise from any payment made under, from the execution, delivery, performance, enforcement or registration of, from the receipt or perfection of a security interest under, or otherwise with respect to, any Loan Document.

“Parent” has the meaning set forth in the preamble to this Agreement.

“Patent License” means any written agreement in which any Obligor now holds or hereafter acquires any interest that (i) grants any right with respect to any invention or any Patent, (ii) agrees to refrain from asserting or grants immunity from suit under any Patent or invention, or (iii) grants an option to any of the foregoing.

“Patents” means all letters patent of, or rights corresponding thereto, in the United States or in any other country, all applications (including provisional, continuation (in-whole or in-part), and divisional applications) of the foregoing and any other pre-grant variations thereof, and all reissues, reexaminations, renewals, extensions and other post-grant variations thereof in the United States or any other country.

“Permitted Indebtedness” means (i) Indebtedness of the Obligors in favor of the Secured Parties under the Loan Documents or created pursuant to the DIP Orders; (ii) Indebtedness existing on the Closing Date which is disclosed in Schedule 1A; (iii) [reserved]; (iv) Indebtedness to trade creditors incurred in the ordinary course of business due within 90 days; (v) Indebtedness that also constitutes a Permitted Investment; (vi) [reserved]; (vii) [reserved]; (viii) [reserved]; (ix) [reserved]; (x) [reserved]; (xi) Contingent Obligations that are guarantees of Indebtedness described in clauses (i) through (x) or other obligations of others that do not otherwise constitute Indebtedness; (xii) extensions, refinancings and renewals of any items of Permitted Indebtedness under clause (iii) above with the prior written consent of the Administrative Agent.

“Permitted Intellectual Property Licenses” means (i) licenses of Intellectual Property rights granted by any Obligor that are in existence at the Closing Date and (ii) non-perpetual licenses of Intellectual Property rights granted by any Obligor in the ordinary course of business on arm’s length terms consisting of the licensing of technology, the development of technology or the providing of technical support which may include licenses with unlimited renewal options solely to the extent such options require mutual consent for renewal or are subject to financial or other conditions as to the ability of licensee to perform under the license; provided such license was not entered into during continuance of an Event of Default.

“Permitted Investment” means: (i) Investments existing on the Closing Date which are disclosed in Schedule 1B; (ii) (a) marketable direct obligations issued or unconditionally guaranteed by the United States of America or any agency or any State thereof maturing within one year from the date of acquisition thereof, (b) commercial paper maturing no more than one year from the date of creation thereof and currently having a rating of at least A-2 or P-2 from either Standard & Poor’s Corporation or Moody’s Investors Service, (c) certificates of deposit issued by any bank with assets of at least

$500,000,000 maturing no more than one year from the date of investment therein, and (d) money market accounts; (iii) [reserved]; (iv) Investments accepted in connection with Permitted Transfers; (v) Investments (including debt obligations) received in connection with the bankruptcy or reorganization of customers or suppliers and in settlement of delinquent obligations of, and other disputes with, customers or suppliers arising in the ordinary course of the Obligors’ business; (vi) Investments consisting of notes receivable of, or prepaid royalties and other credit extensions, to customers and suppliers in the ordinary course of business and consistent with past practice, provided, that this subparagraph (vi) shall not apply to Investments of any Obligor in any Subsidiary; (vii) [reserved]; (viii) [reserved]; (ix) Investments in existing Domestic Subsidiaries; (x) Investments in Subsidiary Guarantors in such amount as set forth in the Budget and with the prior written consent of the Administrative Agent (in its absolute discretion) in writing from time to time and which are evidenced by a Post-Petition Global Note and Pledged Equity; (xi) Investments in Foreign Subsidiaries that are not Subsidiary Guarantors which are required in the ordinary course of business to fund the day to day operations of the Foreign Subsidiaries in such amount as set forth in the Budget and approved by the Administrative Agent (in its absolute discretion) in writing from time to time and which are evidenced by a Post-Petition Global Note and Pledged Equity; (xii) Permitted Intellectual Property Licenses; and (xiii) additional Investments approved by the Bankruptcy Court in the Final Order.