UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 15, 2023

Anzu Special Acquisition Corp I

(Exact name of registrant as specified in its

charter)

|

Delaware

(State or other jurisdiction

of incorporation) |

|

001-40133

(Commission

File Number) |

|

86-1369123

(IRS Employer

Identification No.) |

|

12610

Race Track Road, Suite 250

Tampa,

FL

(Address of principal executive

offices) |

|

33626

(Zip Code) |

Registrant’s

telephone number, including area code: (202) 742-5870

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| x |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbols |

|

Name

of each exchange on

which registered |

| |

|

|

|

|

| Units,

each consisting of one share of Class A Common Stock and one-third of one redeemable Warrant |

|

ANZUU |

|

The

Nasdaq Stock Market LLC |

| Class

A Common Stock, par value $0.0001 per share |

|

ANZU |

|

The

Nasdaq Stock Market LLC |

| Redeemable Warrants, each whole Warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share |

|

ANZUW |

|

The

Nasdaq Stock Market LLC |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01. Other Events.

As previously disclosed, Anzu Special Acquisition

Corp I (“Anzu”) entered into a Business Combination Agreement (as it may be amended and/or restated from time to time, the

“Business Combination Agreement”) with Envoy Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of Anzu

(“Merger Sub”) and Envoy Medical Corporation, a Minnesota corporation (“Envoy”) pursuant to which, and subject

to certain conditions, Merger Sub will merge with and into Envoy, with Envoy surviving the merger as a wholly owned subsidiary of Anzu

(the “Merger” and, together with the other transactions contemplated by the Business Combination Agreement and any other agreement

executed and delivered in connection therewith, the “Proposed Business Combination”).

Attached hereto as Exhibit 99.1 and incorporated

by reference herein is an updated investor presentation, which provides an overview of Envoy and certain information regarding the Proposed

Business Combination and supersedes the investor presentation included as Exhibit 99.1 to the Form 8-K filed by Anzu with the Securities

and Exchange Commission (“SEC”) on February 22, 2023.

Forward-Looking Statements

This Current Report on Form 8-K includes “forward-looking

statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform

Act of 1995. Forward-Looking statements may be identified by the use of words such as “estimate,” “plan,” “project,”

“forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,”

“seek,” “target” or other similar expressions that predict or indicate future events or trends or that are not

statements of historical matters, but the absence of these words does not mean that a statement is not forward-looking. Such statements

may include, but are not limited to, statements regarding the expectations of Envoy or Anzu concerning the outlook for their business,

productivity, plans and goals for future operational improvements and capital investments, operational performance, future market conditions

or economic performance and developments in the capital and credit markets, as well as any information concerning possible or assumed

future operations of Envoy. Forward-looking statements also include statements regarding the expected benefits of the Proposed Business

Combination. The forward-looking statements contained in this Current Report on Form 8-K reflect Anzu’s current views about future

events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause its

actual results to differ significantly from those expressed in any forward-looking statement. Anzu does not guarantee that the transactions

and events described will happen as described (or that they will happen at all). In particular, there can be no assurance that the Proposed

Business Combination will close on the expected timeline or at all. These forward-looking statements are subject to a number of risks

and uncertainties, including, but not limited to, the ability to meet the conditions of the Proposed Business Combination, including approval

by stockholders of Anzu; the occurrence of any event, change or other circumstances that could give risk to the termination of the Business

Combination Agreement or any other agreement described in the Registration Statement (as defined below); the combined company’s

performance following the Proposed Business Combination; changes in the market price of shares of the combined company’s Class A

Common Stock after the Proposed Business Combination, which may be affected by factors different from those currently affecting the price

of shares of Anzu Class A Common Stock; the combined company’s success in retaining or recruiting, or changes required in, its officers,

key employees or directors following the Proposed Business Combination; unpredictability in the medical device industry, the regulatory

process to approve medical devices, and the clinical development process of Envoy products; competition in the medical device industry,

and the failure to introduce new products and services in a timely manner or at competitive prices to compete successfully against competitors;

disruptions in relationships with Envoy’s suppliers, or disruptions in Envoy’s own production capabilities for some of the

key components and materials of its products; changes in the need for capital and the availability of financing and capital to fund these

needs; Envoy’s ability to realize some or all of the anticipated benefits of the Proposed Business Combination; changes in interest

rates or rates of inflation; legal, regulatory and other proceedings could be costly and time-consuming to defend; changes in applicable

laws or regulations, or the application thereof on Envoy; a loss of any of Envoy’s key intellectual property rights or failure to

adequately protect intellectual property rights; if Anzu’s stockholders fail to properly demand redemption rights, they will not

be entitled to convert their Anzu Class A Common Stock into a pro rata portion of the funds held in the Trust Account; the Anzu Board

did not obtain a third-party fairness opinion in determining whether to proceed with the Proposed Business Combination; the financial

and other interests of the Anzu Board may have influenced the Anzu Board’s decision to approve the Proposed Business Combination;

the combined company’s ability to maintain the listing of its securities on Nasdaq following the Proposed Business Combination;

the effects of catastrophic events, including war, terrorism and other international conflicts; and other risks and uncertainties set

forth in the section entitled “Risk Factors” and “Cautionary Note Regarding Forward Looking Statements” in the

Registration Statement (as defined below) and in other reports Anzu files with the SEC. If any of these risks materialize or Anzu’s

assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. While

forward-looking statements reflect Anzu’s good faith beliefs, they are not guarantees of future performance. Anzu disclaims any

obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information,

data or methods, future events or other changes after the date of this Current Report on Form 8-K, except as required by applicable law.

You should not place undue reliance on any forward-looking statements, which are based only on information currently available to Anzu.

Additional Information and Where to Find It

In connection with the Proposed Business Combination,

Anzu has filed with the SEC a registration statement on Form S-4 (File No. 333-271920) (the “Registration Statement”) that

was declared effective by the SEC on September 14, 2023. The Registration Statement includes a proxy statement in connection with Anzu's

solicitation of proxies for the vote by Anzu's stockholders with respect to the Proposed Business Combination and other matters as may

be described in the Registration Statement, as well as a prospectus relating to the offer and sale of the securities to be issued in connection

with the Proposed Business Combination. On September 14, 2023, Anzu commenced the mailing of the definitive proxy statement/prospectus

to its stockholders as of September 5, 2023, the record date established for voting on the Proposed Business Combination and other matters

described in the Registration Statement. Anzu also plans to file other relevant documents with the SEC regarding the Proposed Business

Combination. This Current Report on Form 8-K is not a substitute for the Registration Statement, the definitive proxy statement/prospectus

or any other document that Anzu will send to its stockholders in connection with the Proposed Business Combination. INVESTORS AND SECURITY

HOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS, THIS CURRENT REPORT ON FORM 8-K AND OTHER RELEVANT DOCUMENTS FILED WITH THE

SEC IF AND WHEN THEY BECOME AVAILABLE CAREFULLY AND IN THEIR ENTIRETY, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

Copies of the Registration Statement, the definitive

proxy statement/prospectus and other documents filed by Anzu or Envoy with the SEC may be obtained free of charge at the SEC’s website

at www.sec.gov.

Participants in the Solicitation

Anzu, Envoy and their respective directors, executive

officers, other members of management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies

of Anzu’s stockholders in connection with the Proposed Business Combination. Information regarding the persons who may, under SEC

rules, be deemed participants in the solicitation of Anzu’s stockholders in connection with the Proposed Business Combination and

a description of their direct and indirect interests are contained in the Registration Statement. Information regarding Anzu’s directors

and executive officers can be found in its Annual Report on Form 10-K filed with the SEC on April 3, 2023. These documents can be obtained

free of charge at the SEC’s website at www.sec.gov.

No Offer or Solicitation

This Current Report on Form 8-K relates to the

Proposed Business Combination and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities

or the solicitation of any vote in any jurisdiction pursuant to the Proposed Business Combination or otherwise, nor shall there be any

sale, issuance or transfer or securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made

except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, or an exemption therefrom, and otherwise

in accordance with applicable law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

| Dated: September 15, 2023 |

Anzu Special Acquisition Corp I |

| |

|

| |

|

|

| |

By: |

/s/ Dr. Whitney Haring-Smith |

| |

|

Dr. Whitney Haring-Smith |

| |

|

Chief Executive Officer |

Exhibit 99.1

ENVOY MEDICAL | 1 Investor Presentation Hear for Life September 2023

ENVOY MEDICAL | 2 Forward - Looking Statements This "Presentation" includes “forward - looking statements” within the meaning of the “safe harbor” provisions of the United State s Private Securities Litigation Reform Act of 1995. Forward - Looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “see k,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters, but the absence of these words does not mean that a statement is not forward - looking. These forward - looki ng statements include, but are not limited to, statements regarding the expectations of Envoy Medical Corporation ("Envoy Medical" or "Envoy" or the "Company") or Anzu Special Acquisition Corp I ("Anzu") concerning the out look for their business, productivity, plans and goals for future operational improvements and capital investments, operational performance, future market conditions or economic performance and developments in the capita l a nd credit markets, as well as any information concerning possible or assumed future operations of Envoy. Forward - looking statements also include statements regarding the expected benefits of the potential busines s combination between Anzu and Envoy (the "Proposed Business Combination"). These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of management of Anzu , Envoy Medical Corporation and Anzu SPAC GP I LLC (the "Sponsor") and are not predictions of actual performance. These forward - looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to p red ict and will differ from assumptions. Many actual events and circumstances are beyond the control of Anzu , Envoy Medical Corporation and the Sponsor. These forward - looking statements are subject to a number of risks and uncertainties, including, but not limited to the ability to meet the conditions of the Proposed Business Combination, including approval by stockholders of Anzu; the occurrence of any event, change or other circumstances that coul d g ive risk to the termination of the Business Combination Agreement or any other agreement described in the Registration Statement; the combined company's performance following the Proposed Business Combination; chan ges in the market price of shares of the combined company's Class A Common Stock after the Proposed Business Combination, which may be affected by factors different from those currently affecting the price of shares of Anzu Class A Common Stock; the Combined Company's success in retaining or recruiting, or changes required in, its officers, key employees or directors following the Proposed Business Combination; unpredictability i n t he medical device industry, the regulatory process to approve medical devices, and the clinical development process of Envoy products; competition in the medical device industry, and the failure to introduce new products and services in a timely manner or at competitive prices to compete successfully against competitors; disruptions in relationships with Envoy's suppliers, or disruptions in Envoy's own production capabilities for s ome of the key components and materials of its products; changes in the need for capital and the availability of financing and capital to fund these needs; Envoy's ability to realize some or all of the anticipated benefits of the Proposed Business Combination; changes in interest rates or rates of inflation; legal, regulatory and other proceedings could be costly and time - consuming to defend; changes in applicable laws or regulations, or the application th ereof on Envoy; a loss of any of Envoy's key intellectual property rights or failure to adequately protect intellectual property rights; if Anzu's stockholders fail to properly demand redemption rights, they will not be enti tle d to convert their Anzu Class A Common Stock into a pro rata portion of the funds held in the Trust Account; the Anzu Board did not obtain a third - party fairness opinion in determining whether to proceed with the Proposed Busine ss Combination; the financial and other interests of the Anzu Board may have influenced the Anzu Board's decision to approve the Proposed Business Combination; the combined company's ability to maintain the listing of it s securities on Nasdaq following the Proposed Business Combination; the effects of catastrophic events, including war, terrorism and other international conflicts; and other risks and uncertainties set forth in the sectio ns entitled “Risk Factors” and “Cautionary Note Regarding Forward - Looking Statements” in The Registration Statement (as defined below), and in other reports Anzu files with the SEC. If any of these risks materialize or Anzu’s , Envoy Medical Corporation’s or the Sponsor’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward - looking statements. There may be additional risks that Anzu , Envoy Medical Corporation or the Sponsor does not presently know or that it currently believes are immaterial that could also cause actual results to differ from those contained in the forward - looking statements. In addition, f orward - looking statements reflect Anzu’s , Envoy Medical Corporation’s or the Sponsor’s expectations, plans or forecasts of future events and views as of the date of this Presentation. While Anzu , Envoy Medical Corporation or the Sponsor may elect to update these forward - looking statements at some point in the future, Anzu , Envoy Medical Corporation and the Sponsor specifically disclaim any obligation to do so. These forward - looking statements should not be relied upon as represe nting Anzu’s , Envoy Medical Corporation’s or the Sponsor’s assessments as of any date subsequent to the date of this Presentation. Accordingly, undue reliance should not be placed upon th e forward - looking statements. No representations or warranties expressed or implied are given in, or in respect of, this Presentation. Industry and market dat a used in this Presentation have been obtained from third - party industry publication and sources as well as from research reports prepared for other purposes. Envoy Medical Corporation has not independently verified the data con tained from these sources and cannot assure you of the data’s accuracy or completeness. This data is subject to change. Recipients of this Presentation are not to constitute its contents, or any prior or subsequent com mun ications from or with Envoy Medical Corporation or their respective representatives as investment, legal or tax advice. In addition, this Presentation does not purport to be all - inclusive or to contain all of the information th at may be required to make a full analysis of Envoy Medical Corporation. Recipients of this Presentation should each make their own evaluation of Envoy Medical Corporation and of the relevance and adequacy of the information and s hou ld make such other investigations as they deem necessary. Market, ranking and industry data used throughout this Presentation, including statements regarding market size, are based on in dustry sources and the good faith estimates of Envoy’s management. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. While Envoy is not a war e of any misstatements regarding the industry data presented herein, its estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the headings “Risk Fact ors ” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations of Envoy Medical Corporation” in the Registration Statement. Investments in any securities described herein have not been approved or disapproved by the SEC or any other regulatory autho rit y nor has any authority passed upon or endorsed the merits of the offering or the accuracy or adequacy of the information contained herein. Any representation to the contrary is a criminal offense. DISCLAIMERS

ENVOY MEDICAL | 3 Additional Information and Where to Find It In connection with the Proposed Business Combination, Anzu has filed with the SEC a registration statement on Form S - 4 (File No. 333 - 271920) (the “Registration Statement”) that was declared effective by the SEC on September 14, 2023. The Registration Statement includes a proxy statement in connection with Anzu's solicitation of proxies for the vot e b y Anzu's stockholders with respect to the Proposed Business Combination and other matters as may be described in the Registration Statement, as well as a prospectus relating to the offer and sale of the securities to be is sue d in connection with the Proposed Business Combination. On September 14, 2023, Anzu commenced the mailing of the definitive proxy statement/prospectus to its stockholders as of September 5, 2023, the record date establi she d for voting on the Proposed Business Combination and other matters described in the Registration Statement. Anzu also plans to file other relevant documents with the SEC regarding the Proposed Business Combination. This Pr ese ntation is not a substitute for the Registration Statement, the definitive proxy statement/prospectus or any other document that Anzu will send to its stockholders in connection with the Proposed Business C omb ination. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS, THIS PRESENTATION AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE CAR EFU LLY AND IN THEIR ENTIRETY, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Copies of the Registration Statement, the definitive proxy statement/prospectus and other documents filed by Anzu or Envoy Me dic al Corporation with the SEC may be obtained free of charge at the SEC's website at www.sec.gov. Participants in the Solicitation Anzu, Envoy Medical and their respective directors, executive officers, other members of management and employees, under SEC rul es, may be deemed to be participants in the solicitation of proxies of Anzu’s stockholders in connection with the Proposed Business Combination. Information regarding the persons who may, under SEC rules, be deemed part ici pants in the solicitation of Anzu’s stockholders in connection with the Proposed Business Combination and a description of their direct and indirect interests are contained in the Registration Statement. Information re garding Anzu’s directors and executive officers can be found in its Annual Report on Form 10 - K filed with the SEC on April 3, 2023. These documents can be obtained free of charge at the SEC’s website at www.sec.gov. No Offer or Solicitation This Presentation relates to the Proposed Business Combination and is neither an offer to purchase, nor a solicitation of an off er to sell, subscribe for or buy any securities or the solicitation of any vote in any jurisdiction pursuant to the Proposed Business Combination or otherwise, nor shall there be any sale, issuance or transfer or securities in any jur isd iction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom, and o the rwise in accordance with applicable law. Risk factors For a description of the risks relating to the Proposed Business Combination, please see the section entitled “Risk Factors” in the Registration Statement. DISCLAIMERS (CONTINUED)

ENVOY MEDICAL | 4 AGENDA 1 Market Opportunity 2 Clinical Strategy 3 Company Overview 4 Investment Opportunity

ENVOY MEDICAL | 5 ~2.8M U.S. ADULTS SUFFER MODERATE TO PROFOUND HEARING LOSS AND MAY BE CANDIDATES FOR COCHLEAR IMPLANTS 1 ~$84B and growing untapped potential cochlear implant U.S. market opportunity 3,4 Sources: (1) Goman , Adele M., and Frank R. Lin. "Prevalence of hearing loss by severity in the United States." American journal of public healt h 1 06.10 (2016): 1820 - 1822.; Goman , Adele M., Nicholas S. Reed, and Frank R. Lin. "Addressing estimated hearing loss in adults in 2060." JAMA Otolaryngology – Head & Neck Surge ry 143.7 (2017): 733 - 734 (2) Cochlear Limited Annual Report 2022 (3) S2N Market Model prepared for Envoy Medical Corporation (4) Assumes device price of ~$30,000 for 2.8M U.S. population of potential candidates for cochlear implants ~ 5% - 8% of the people that could benefit from an implantable hearing solution have received one 2

ENVOY MEDICAL | 6 ENVOY PLANS TO BRING FULLY IMPLANTED COCHLEAR IMPLANTS TO MARKET Breakthrough Technology Source: Cochlear.com Source: M edel.com Source: Advancedbionics.com FULLY IMPLANTED* *The image is not a photo of an Envoy Acclaim patient

ENVOY MEDICAL | 7 ENVOY ACCLAIM ® CURRENT ALTERNATIVES Completely internal Prominently visible Capable of 24/7 hearing without external component Requires externally worn component to work/hear Leverages the natural ear Relies on artificial microphone, bypasses ear Charge battery wirelessly every ~4+ days Short battery life, may require daily charging, changing No daily maintenance Daily maintenance Compatible with active lifestyle, waterproof Often removed for certain activities No magnets, designed to be MRI compatible* Relies on magnets, potential interference with MRI *MRI compatibility not yet determined

ENVOY MEDICAL | 8 ACCLAIM ® EXPECTS TO BE FIRST OF - ITS - KIND FULLY IMPLANTED COCHLEAR IMPLANT (FICI) DEVICE Novel Technology DISCREET • No need for externally worn components • Outer e ar will pick up the sound naturally. No external artificial microphone needed DEPENDABLE • Designed to allow t rue 24/7 hearing • Reliable in many environments and activities EASY • No expensive external sound processors to replace when lost or damaged • No frequent battery changes or charging. Rechargeable battery expected to last several days between charges and designed to last 8 - 12 years Breakthrough Device Designation

ENVOY MEDICAL | 9 MARKET OPPORTUNITY

ENVOY MEDICAL | 10 DISCREET AND IMPLANTABLE MEDICAL TECHNOLOGY CONTINUES TO INNOVATE MARKETS Sleep Apnea Fully Implanted Cochlear Implants Glucose Monitoring Pacemaker FDA Approves Inspire ® Upper Airway Stimulation (UAS) Therapy for Obstructive Sleep Apnea FDA Breakthrough Designation granted for Envoy’s fully implantable cochlear implants FDA approves first continuous glucose monitoring system with a fully implantable glucose sensor and compatible mobile app for adults with diabetes FDA approves the first leadless pacemaker to treat cardiac arrhythmias Source: Mayoclinic.org Source: senseonics.com Source: mddionline.com

ENVOY MEDICAL | 11 REVENUE GROWTH & SHAREHOLDER RETURN Implantable Device Market Opportunity Sources: (1) Inspire 2022 Annual Report (2) Cochlear Limited Annual Report 2022 2015 - 2022 Revenue 1 (in millions) Total Shareholder Return Since Listing 2 Inspire disrupted the sleep apnea market with the first implantable device Current incumbent market leader in cochlear implants generated material shareholder return since its IPO in 1995

ENVOY MEDICAL | 12 ENVOY MEDICAL | 12 Sources: (1) PitchBook Data, as of August 2023; Market share data shown are estimates based on publicly available information and are subject to cha ng e. (2) https://www.sonova.com/en/acquisition - advanced - bionics - completed (3) https://www.cochlear.com/au/en/corporate/media/media - releases/2022/2022 - 04 - 27 - cochlear - agrees - to - acquire - oticon - medical Cochlear Implant Market Opportunity ENVOY COULD DISRUPT A MULTI - $B COCHLEAR MARKET Market Trends • Miniaturization • Wireless Capabilities • Aging Population • MRI Compatibility • Lifestyle • 24/7 Hearing • Market Penetration & Candidacy Expansion • Cognitive Decline ~60% Other ~20% < 5% ~15% (ASX: COH) $1.2B Revenue ~$9.9B Market Cap 1 (SWX: SOON) $3.9B Revenue ~$15.8B Market Cap Acquired Advanced Bionics in 2010 1,2 (CSE: DEMANT) $2.9B Revenue ~$6.5B Market Cap Oticon Medical business pending sale to Cochlear Corporation 1,3 Totally implantable cochlear implant in a limited feasibility trial. Unlike Envoy’s Acclaim, no known US patients. Totally implantable cochlear implant in a limited feasibility trial. Unlike Envoy’s Acclaim, no known US patients.

ENVOY MEDICAL | 13 ENVOY MEDICAL | 13 Cochlear Implant Market Opportunity ENVOY COULD DISRUPT A MULTI - $B COCHLEAR MARKET US FDA approval for fully implanted middle ear device • x x x x Early Feasibility Study (EFS) • • • x x Breakthrough Device Designation from US FDA • x x x x Investigational Device Exemption (IDE) to implant US patients • x x x x US FDA approved for commercial sales x x x x x part of part of fully implanted cochlear device Source: Envoy Medical management (USA) (Europe) (Australia)

ENVOY MEDICAL | 14 Companies Description Revenue (USD) 1 Gross Margin (%) 1 Market Cap (USD) 1 (SWX: SOON) Sonova is one of the world's largest manufacturers and distributors of hearing aids. The company is based in Switzerland and distributes its products in more than 100 countries through its internal sales team and independent retailers. It also sells cochlear implants through its advanced bionics subsidiary. ~$3.9B TTM Total As of 31 March 2023 71% ~ $15.8B (ASX: COH) Cochlear is the leading cochlear implant device manufacturer with around 60% global market share. Developed markets contribute 80% of group revenue where cochlear implants are the standard of care for children with severe to profound hearing loss. The company also actively targets the growing cohort of seniors in developed markets. Main products include cochlear implants, bone - anchored hearing aids, and associated sound processors. ~$1.2B TTM Total As of 30 - June - 2022 ~ $9.9B (CSE: DEMANT) Demant is a Denmark - based manufacturer and distributor of hearing solutions, such as hearing aid devices and audio diagnostic equipment. More than 80% of the company's sales come from North America and Europe. ~$2.9B TTM Total As of 30 - June - 2022 75% ~ $6.5B 75% Source: (1) PitchBook Data as of August 2023 Cochlear implant focused companies trading at higher multiples MULTI - $B MARKET CAP INCUMBENTS WITH ATTRACTIVE GROSS MARGINS expects to be brought public at equity rollover value of 1 - 3% of any of the incumbents

ENVOY MEDICAL | 15 CLINICAL STRATEGY

ENVOY MEDICAL | 16 1 5 6 6 6 6 6 6 6 7 7 7 8 8 8 10 13 29 31 No other known hearing loss focused FDA breakthrough device designation 2 Alzheimer’s Heart failure Cancer Spinal cord injury Hearing loss Autism spectrum disorder Stroke Diabetes Breast cancer Degenerative disc Liver cancer Critical limb ischemia Parkinson’s Coronary artery disease Epilepsy Hypertension Kidney disease Pancreatic cancer Respiratory failure Source: (1) Envoy Medical Receives FDA Breakthrough Device Designation for its Fully Implanted Acclaim® Cochlear Implant (2) STAT Database of FDA - Designated Breakthrough Devices (as of December 2022) NO OTHER KNOWN HEARING - FOCUSED FDA BREAKTHROUGH DESIGNATED DEVICE Acclaim is focused on breakthrough to “improve the hearing of adults diagnosed with moderate to profound sensorineural hearing loss." 1 TOP DISEASES

ENVOY MEDICAL | 17 EARLY EXPERIENCE WITH A NOVEL FULLY IMPLANTED COCHLEAR IMPLANT ACIA 2023 – Dallas – Presentation Dr. Colin L. Driscoll, M.D. ǀ Mayo Clinic Sources: American Cochlear Implant Alliance (ACIA) conference session in Dallas, TX on June 6, 2023

ENVOY MEDICAL | 18 ILLUSTRATIVE TRACK TO COMMERCIALIZATION Clinical Strategy 2024 – 2025* Pivotal Study ~40 - 50 patients Timeline not to scale * Estimates for 2023 and beyond are illustrative and are based on management's current assumptions, which are subject to change. Please see “Risk Factors” in the Registration Statement. Pivotal IDE Submission Q1 2024* First activation First patient implanted at Mayo Clinic Full EFS Enrollment 3 patients Q4 2022 FDA Breakthrough Granted 2019 Q3 2022 EFS IDE Accepted Planned Funding ~$30 - 40M to FDA approval (estimated) Q2 2023 Colin Driscoll, MD ACIA Presentation Commercialization & market acceptance / reimbursement 2026*

ENVOY MEDICAL | 19 EARLY FEASIBILITY STUDY & PIVOTAL TRIALS Clinical Strategy x Acclaim accepted into the FDA EFS program x Allows for rapid design changes on shorter review schedule x Expedited first - in - human trials x 3 patients implanted □ Approval to move to pivotal trials after successful completion of EFS* Early Feasibility Study (EFS) Pivotal Clinical Trial* □ Pathway to FDA approval (expected 2026) □ 40+ patients □ ~5 sites in the US □ May simultaneously seek CE mark approval in Europe Envoy prepared for immediate transition from EFS to Pivotal Traditional Feasibility Study Pivotal Clinical Trials Early Feasibility Study Early Feasibility Study (EFS) + FDA Breakthrough Device Designation may accelerate commercialization* Pivotal Clinical Trials COMMERCIALIZATION COMMERCIALIZATION TYPICAL APPROACH ENVOY APPROACH* *Future developments are illustrative and are based on management's current assumptions, which are subject to change. Please see “Risk Factors” in the Registration Statement.

ENVOY MEDICAL | 20 COMPANY OVERVIEW

ENVOY MEDICAL | 21 COMPANY & PRODUCT OVERVIEW Envoy Medical Corporation is a hearing health company focused on providing innovative technologies and solutions across the hearing loss spectrum. Our technologies are designed to shift the hearing industry paradigm and bring both providers and patients the fully implanted hearing devices they desire. Our products are designed to deliver: x Improved hearing x Improved quality of life x Reduction to healthcare costs over time x Dignity and independence Envoy Medical Corporation is dedicated to innovating and pushing hearing technology beyond the status quo to improve access, usability, compliance and ultimately quality of life. Acclaim ® A fully implanted cochlear implant (“FICI”), granted Breakthrough Device Designation by the FDA . The Acclaim represents a long - anticipated shift from partially implanted cochlear implants. The device leverages the natural anatomy of the ear rather than utilizing a microphone to capture sound. Sound vibrations enter through the ear and are processed into customized electronic signals. Envoy’s stimulator sends these electrical signals to the cochlea and hearing nerve resulting in the sensation of sound. Esteem ® The Esteem ® is the first and only currently FDA - approved, fully - implanted active middle ear implant (AMEI) . The Envoy Sensor converts the vibrations into electrical signals that are sent to the implanted Esteem Sound Processor . The Esteem Sound Processor receives, adjusts and intensifies the signals . The Esteem Driver directly transfers these signals to the inner ear where the hair cells are stimulated, causing you to hear . ~ 1 , 000 Esteems have been installed . Shared sensor technology for both products. Esteem sensor has been implanted in patients for over fifteen years. Who are we?

ENVOY MEDICAL | 22 ENVOY’S RECHARGEABLE BATTERY EXPECTED TO LAST SEVERAL DAYS BETWEEN CHARGES Rechargeable implanted batteries enhance quality of life Source: Boston Scientific Deep Brain Stimulation System Sleep Apnea Implant Therapy Source: LivaNova Cardiac C ontractility M odulation T herapy Source: Impulse Dynamics Cochlear Implant Remain fully mobile while charging with the wire free charging system Battery charging s ystem only worn while charging , a few hours every 4+ days** Envoy’s battery is similar to other medical devices with implanted, rechargeable batteries

ENVOY MEDICAL | 23 KEY LEADERS – MANAGEMENT TEAM Executive Summary Brent Lucas, CEO Mr. Lucas has been the Chief Executive Officer of Envoy Medical Corporation for the last seven years and brings over 15 years of experience in the active implantables in the hearing health industry . He has served in various roles and gained a tremendous amount of specialized experience, working his way up from an intern to CEO. Mr. Lucas received his Bachelor’s Degree from the University of St. Thomas and JD from the Mitchell Hamline School of Law. Phil Segel , VP of Implant Technology and Training Mr. Segel has joined Envoy Medical Corporation as the VP of Implant Technology and Training. With over 35 years in the field of cochlear implantation, he brings expertise in the areas of clinical and surgical support, trending of clinical practice, product training and clinical research . As the interface between R & D and the field for Envoy Medical, M r. Segel will bring feedback from healthcare professionals working with auditory implantable devices, into the design and development workstream. Mr. Segel received his Bachelor’s Degree and Master’s in Audiology from Case Western Reserve University. Tom Hoegh , VP of R&D Mr. Hoegh has over 30 years of experience in the medical device industry, primarily in the development and on - market support of active implantable devices such as neuromodulation systems for spinal, sacral, deep brain, and hypoglossal nerve stimulation. Mr. Hoegh’s previous experiences consist of leading engineering teams at Nuvectra , ICU/Smiths Medical, Medtronic, and Apnex Medical. Mr. Hoegh received a dual Bachelor of Science degree in Mechanical Engineering and Chemistry from Valparaiso University and a Master of Science degree in Technology Management from the University of St. Thomas. David R. Wells , CFO Mr. Wells has 20 years of experience in the small - cap public company arena. Mr. Wells joined Envoy Medical, Inc. as its Chief Financial Officer in August, 2023. From 2014 to 2021 he was the CFO of ENDRA Life Sciences Inc. (NASDAQ: NDRA), a publicly traded clinical diagnostics technology company, where he directed ENDRA’s initial public offering (IPO) and subsequently raised an additional $55 million across multiple transactions. In December 2022, David joined the Board of Directors of HeartSciences (NASDAQ: HSCS), which is developing a cardiac device which seeks to bridge today’s “diagnostic gap” in cardiac care by providing effective front - line solutions that assist in the detection of heart disease in at - risk patien ts.

ENVOY MEDICAL | 24 KEY LEADERS – BOARD AND BOARD NOMINEES Executive Summary Glen Taylor Chairman Emeritus • Founder and chairman of Taylor Corporation, a global printing and communications company and one of the nation’s largest privately held companies • A member (and former chair) of the Board of Governors of the National Basketball Association • Served in the Minnesota State Senate from 1980 to 1990 and as Minority Leader from 1985 to 1988 • President of the YMCA, director of the Mankato Chamber of Commerce, director of the Greater Minnesota Corporation and the Minnesota Business Partnership, and served on the Minnesota State University Foundation Board of Directors • Attended Harvard Graduate School of Business and earned his BS at Minnesota State University in Mankato Janis Smith - Gomez Independent Director Nominee, Nominee for NomGov Committee Chair • Over 30 years of executive experience at Johnson & Johnson, Mars, Kraft and PepsiCo • Most recent role with J&J, Janis led the brand identity efforts to evolve the $27B medical devices business into a leading patient - centered, customer - focused, digitally powered MedTech innovator • Previously accountable P&L owner of businesses as large as $3B, managing budgets from $10M to $215M • On non - profit boards of New York Academy of Medicine and Black Public Media • Graduate of University of Chicago with an MBA in Marketing & Business Policy and a Bachelor’s degree in Business Susan Kantor Independent Director Nominee, Nominee for Audit Committee Chair • An Advisory Partner for PwC from 2011 to 2016, a Partner and CFO & Treasurer of PRTM Management Consultants from 1997 to 2011 • Previously a CFO at corporate strategy and operations consulting firms Monitor Group and BCG, as well as Parexel International, a CRO • Board member and Audit Committee chair of Anzu, Teknor Apex Company, a $1.2 billion dollar privately - held material science Company, Guest Services Inc., a privately - held hospitality company, and the International Council on Clean Transportation. • Ex - board director and the Audit Committee Chair for Lionbridge Technologies Inc. when it was a $550 million publicly - held company. Sold to private equity in 2016 • Bachelor’s degree from Grove City College in Accounting and Business Administration and her CPA in MA Mona Patel Independent Director Nominee • Over 30 years of experience in medical devices in marketing, market development, clinical education and mergers and acquisitions • Former VP of Marketing and Clinical Education at Boston Scientific in their neuromodulation division where she helped build the start - up into a market leader with ~$1B in sales • Introduced the first rechargeable spinal cord stimulator into a market and helped convert the market from non - rechargeables to rechargeables • Launched the first rechargeable in Deep Brain Stimulation for Parkinson’s • BSE in Mechanical Engineering from the University of Michigan and an M.B.A. from the Wharton School of Business Whitney Haring - Smith CEO of Anzu SPAC, Nominee for Compensation Committee Chair • Co - founding managing partner at Anzu Partners since March 2015 • Serves on the board of multiple private technology companies, including Sofregen (medical device company), and previously on the board of MultiMechanics (acquired by Siemens) and Axsun Technologies (acquired by Excelitas) • Formerly a BCG consultant from January 2011 to March 2015 in San Francisco, Hong Kong, Nigeria and United Kingdom • BS and MS from Yale University in Political Science and his PhD from Oxford University as a Rhodes Scholar Brent Lucas, CEO of Envoy Medical • Served as CEO of Envoy for the past seven years and brings over 15 years of experience in the active implantables in the hearing health industry • Served in various roles with Envoy and gained a tremendous amount of specialized experience, working his way up from an intern to CEO • Received his bachelor’s degree from the University of St. Thomas and Juris Doctor degree from the Mitchell Hamline School of Law Chuck Brynelsen Independent Director Nominee, Nominee for Board Chair • Most recently serving as Senior VP and President of Abbott Vascular from 2017 to 2021 • Since 2015 he has also been a Venture Partner of SpringRock Ventures, an investment firm that focuses on digital health, devices, services • Served on private companies boards of directors, including Alebra Technologies since 2010 and Neuspera Medical from 2022 to 2023 • Served as SVP and President of Medtronic Early Technologies from 2015 to 2016, as the Global President of Covidien Early Technologies from 2013 to 2015, and as the CEO of IntraPace from 2005 to 2012 • MBA from Kellogg School of Management at Northwestern University and his BA from Bradley University

ENVOY MEDICAL | 25 Jannine “Jan” Larky , M.A. ǀ Stanford Ear Institute (Palo Alto, CA) Dr. Aniket Saoji , Ph.D. ǀ Mayo Clinical (Rochester, MN) Dr. Sarah Sydlowski , Ph.D. & Au.D . ǀ Cleveland Clinic (Cleveland, OH) Dr. Melissa Hall , Au.D. ǀ University of Florida (Gainesville, FL) Dr. Camille Dunn , Ph.D. ǀ University of Iowa (Iowa City, IA) KEY LEADERS – ADVISORY BOARD Executive Summary Dr. Colin L. Driscoll , M.D. ǀ Mayo Clinic (Rochester, MN) Dr. Elizabeth “Liz” Toh , M.D. ǀ Lahey Hospital & Medical Center (Boston, MA) Dr. Theodore “Ted” McRackan , MD ǀ Medical University of South Carolina (Charleston, South CA) Dr. Craig A. Buchman, M.D. ǀ Washington University School of Medicine in St. Louis (St. Louis, MO) Dr. John Kveton , M.D. ǀ Ear Nose and Throat Medical and Surgical Group, LLC (New Haven, CT) Dr. Jack Shohet , M.D. ǀ Shohet Ear Associates Medical Group, Inc. (Seal Beach, CA) Audiologists Surgeons Dave Fabry , Ph.D., CIO ǀ Starkey Hearing Technologies

ENVOY MEDICAL | 26 INVESTMENT OPPORTUNITY

ENVOY MEDICAL | 27 Consideration for Envoy Medical ▪ Envoy Medical shareholders are rolling 100% of their equity into the Propsed Business Combination ▪ Envoy Medical valued at $150M at closing , payable in shares of ANZU common stock with assumed value of $10.00 per share Sponsor committed long - term to Envoy Medical success ▪ Sponsor to forfeit significant Class B shares at Closing and all 12.5M of its private warrants ▪ Sponsor to vest half of Common shares retained only upon FDA approval for Acclaim cochlear implant ▪ Sponsor affiliates to make $10M+ cash investment in PIPE at closing TRANSACTION SUMMARY Business Combination between Anzu and Envoy Medical PLEASE READ THE REGISTRATION STATEMENT CAREFULLY AS YOU CONSIDER WHETHER OR NOT TO REDEEM PLEASE REFER TO THE REGISTRATION STATEMENT AND ASSOCIATED DOCUMENTS FOR ADDITIONAL DETAILS

ENVOY MEDICAL | 28 ANZU is supported by Anzu Partners, an investment firm focused on industrial technologies and life sciences ▪ Anzu Partners has a team of 60+ professionals, including 8+ PhDs working in the investment and portfolio support teams ▪ Anzu Partners’ prior investments in the medical device and life science space include, among others: ▪ Banyan Biomarkers (first FDA - approved blood test for concussion) ▪ Sofregen (FDA - approved vocal restoration injectable) ANZU IS A STRONG FIT FOR ENVOY Support and commitment from Anzu’s Sponsor Management teams of ANZU and Anzu Partners are committed to providing ongoing support to Envoy ▪ Anzu’s CEO, Whitney Haring - Smith, leads structured public investments for Anzu Partners affiliated funds and medical device investing ▪ Anzu’s CFO, Daniel Hirsch, has led multiple de - SPAC transactions, including Broadmark (BRMK) and Playa (PLYA) ▪ Anzu's Audit Chair, Susan Kantor, a former PwC Partner, expected to continue to serve as Audit Chair post - combination

ENVOY MEDICAL | 29 PLANNED PATH TO DEAL APPROVAL Indicative and Illustrative Approval Timeline Sep. 30, 2023: Deadline to close the Business Combination (unless extended) Filed S - 4/proxy statement for SEC review May 2023 April 2023 Business Combination Agreement signed September 2023 (Projected) S - 4 declared effective by SEC Business Combination Approved Q3 2023 (Projected) Contacts InvestorRelations@EnvoyMedical.com IR@anzuspac.com JPeterson@NorthlandCapitalMarkets.com Dave.McDonald@LakeStreetCM.com

ENVOY MEDICAL | 30 Thank You

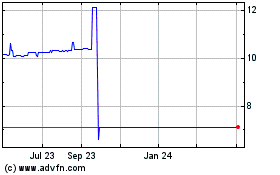

Anzu Special Acquisition... (NASDAQ:ANZUU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Anzu Special Acquisition... (NASDAQ:ANZUU)

Historical Stock Chart

From Apr 2023 to Apr 2024